With FANG stocks soaring all day without a specific catalyst, many investors were hoping that today’s panic bid in growth stocks was to frontrun Alphabet’s after hours results, which many expected would be another beat, sending the stock higher.

And to those who expected a beat, they were right, because moments ago Google Alphabet reported Q4 EPS of $12.77, beating exp. of $10.82 soundly, with revenue ex-TAC of $31.84BN also not only above the consensus forecast of $31.33BN, but also above the highest Wall Street forecast of $31.81BN.

The other Q4 core earnings highlights were all solid as well:

- paid clicks on Google properties +66%

- cost-per-click on Google properties -29%

- operating margin +21%

- operating income $8.20 billion

Additionally, ads on Google properties were up 21% and TAC as a share of ad sales was down from last year.

So far so good, and if this was it, the shares would have maintained their kneejerk spike higher and continued today’s levitation.

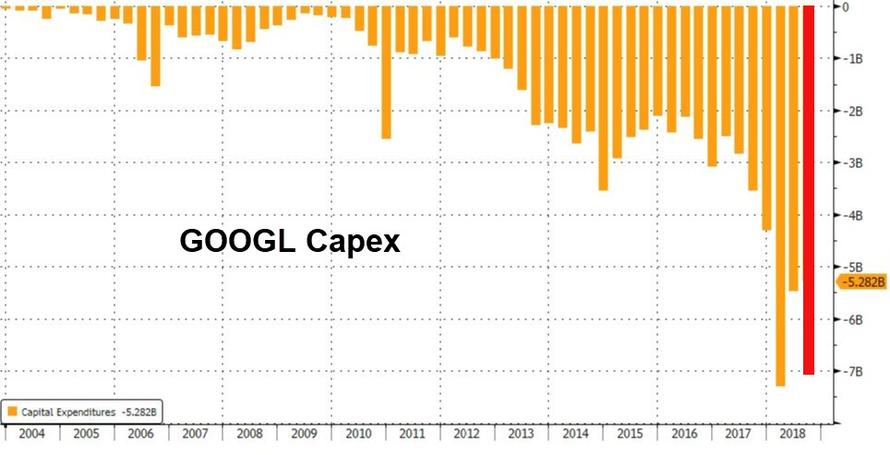

However, as in the case of Amazon, it was not meant to be, because after scanning the company’s top and bottom-line beats, traders shifted their attention to how much money Alphabet was spending to maintain its top line growth and margins, and it was here that a problem emerged, because Google CapEx exploded 80% higher from the $3.8BN a year ago to a whopping $6.85BN, while total CapEx surged to $7.1BN, far above the $5.66BN estimate, and – as in the case of Amazon – concerns emerged that Alphabet will have to spend far more on capital to maintain its profit and cash flow.

As a result of this surge in CapEx, shares tumbled as much as 3.8% in extended trading, which as Bloomberg notes, if repeated in the cash market tomorrow, it would be the biggest drop since Dec. 4.

Needless to say, the Nasdaq is not happy and absent some very optimistic disclosures during the earnings call, expect today’s sharp Nasdaq spike to be promptly unwound overnight and during tomorrow’s cash session.

via ZeroHedge News http://bit.ly/2GbuqNr Tyler Durden