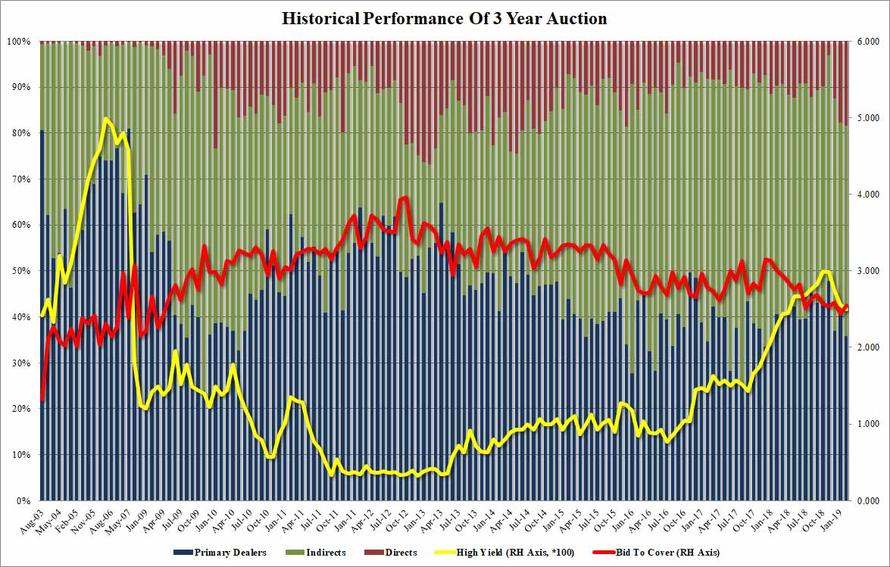

The refunding auction deluge is upon us with today’s $38 billion in 3Y notes pricing moments ago, in what was a strong auction which stopped at a high yield of 2.502%, the lowest since April 2018, and stopping through the When Issued 2.505% by 0.3bps. This was the first stopping through 3Y auction since April 2018, and followed 10 consecutive auctions which tailed as investors were less than eager to buy short-term debt during the Fed’s actively tightening phase which however is now officially over.

The internals were solid as well, with the Bid to Cover rising from 2.44 in January to 2.55, which was just below the 6 month auction average of 2.578.

The Indirects takedown also rebounded, rising from 41.9% in January to 45.7%, just below the recent auction average of 46.2. And with Directs taking down 18.5%, also above last month’s 17.7% and well above the 6 auction average of 17.7%, it left Dealers holding 35.9%, the lowest Dealer allotment since January 2018.

Overall a strong auction, and an indication that this week’s 10Y and 30Y auctions should all price with little indigestion.

via ZeroHedge News http://bit.ly/2t4oU6B Tyler Durden