Global markets and US equity futures are higher for the third day in a row, driven by the familiar, binary trade talk “optimism on, optimism off” news cycle…

… with optimism prevailing after President Trump signaled a more conciliatory signal toward China that he could let a March 1 deadline for a trade agreement with China “slide” if both sides are near an agreement, fueling hopes of a breakthrough in the trade war when talks get underway later in the week. As Treasury Secretary Steven Mnuchin and Trade Representative Robert Lighthizer prepared for talks in Beijing on Thursday and Friday to hammer out a trade deal, markets cheered the signal that there could be an extension to a tariff truce.

“Markets have interpreted the fragments of information emanating from the trade talks positively, with risk assets starting to recoup recent losses,” said Nema Ramkhelawan-Bhana, an economist at FirstRand Bank Ltd. in Johannesburg. “Let’s hope that the positivity imbued in risk assets is not based on false optimism, especially as concerns over slowing global growth continue to mount.”

Optimism got a further boost following a SCMP report that China’s president Xi is expected to join trade talks with the US delegation in Beijing in a sign of further good will, if little else. Bulls also felt empowered following apparent progress over border wall funding negotiations, which have decreased the probability of a government shutdown this Friday.

“There’s still a level of uncertainty there but at least the rhetoric does not show he is digging his heels in, so the market has quite rightly taken it as a positive,” said Justin Onuekwusi, fund manager at Legal & General Investment Management. “But of course the key thing is he can change his mind.”

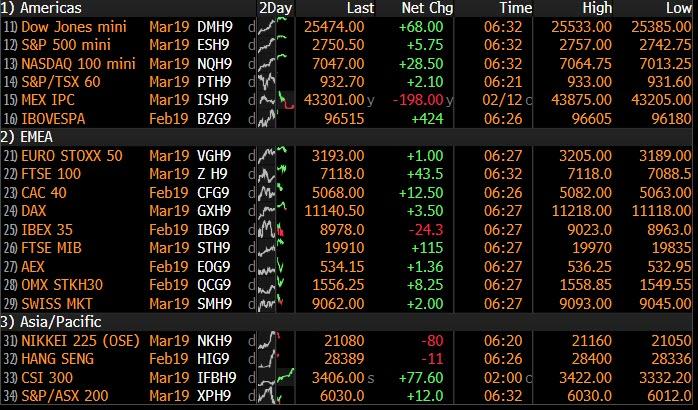

As a result, it’s an almost uniform sea of green this morning, a deja vu repeat of yesterday, and the trend will likely continue until Trump tweets something “provocative”, or until – once again – trade talks conclude with nothing definitive being decided.

Predictably, Asian stocks rose, the MSCI index of emerging-market equities headed for a one-week, and China’s blue-chip CSI 300 rose around 2% to a four-month high overnight, with IT shares leading gains. The Shanghai Composite surged 1.8%, the most in five weeks.

European stocks followed Asia higher, with the Stoxx Europe 600 Index climbing for a third day as companies including beer maker Heineken and chemicals producer Akzo Nobel delivered upbeat earnings, while futures on the S&P 500, Nasdaq and Dow Jones rose. Of note: the S&P is expected to open above a key resistance line, its 200 Day Moving Average, for the first time since the start of December.

Optimism over China-US trade talks continues to be supportive for the yuan, said Ken Cheung, senior Asian FX strategist at Mizuho Bank. While analysts see an agreement on no additional tariffs sending the yuan on a sustained rally, they have also sounded caution that the Chinese currency could weaken to 7 per U.S. dollar in the event of a breakdown in the ongoing trade talks.

Emerging market stocks, which were hurt last year by a strong dollar, climbed 0.4 percent. BAML on Tuesday said investors saw emerging markets as the “most crowded” trade, for the first time ever.

As investors went back into risky assets they sold safe-haven government bonds, driving yields up. The 10-year U.S. Treasury note yield hit a one-week high at 2.700 percent before fading lower while the curve was largely unchanged. Spanish 5-year bond yields hit a two-week high in early trading ahead of a possible snap election call. Ongoing buoyant risk sentiment and relatively solid 3-yr and 7-yr auctions lifted BTP futures, with Italy/Germany 10-yr spread tightening for a third straight day to ~268bps.

The Federal Reserve will chart plans to stop letting its bond holdings roll off “at coming meetings,” Cleveland Fed President Loretta Mester said on Tuesday, signaling another major policy shift for the Fed after pausing interest rate hikes.

“Mester’s comments follow on quite clearly from what Powell said at the recent press conference, which was already quite a dovish shift which the market wasn’t expecting,” said Mohammed Kazmi, portfolio manager at UBP in Geneva. “Everyone wants to catch this rally because they know at some point it will fade, there will have to be some sort of adjustment later this year because this is pretty much as dovish as [the Fed] can get without moving to a rate cut which would only come in a recession scenario,” he added.

The January CPI report in the US due this afternoon is the data highlight of the week. The consensus expects a +0.2% mom core reading although base effects are expected to result in a small pullback in the annual rate to +2.1% yoy. That said, the seasonal revisions this week resulted in a slightly lower January 2018 reading which therefore makes for a lower hurdle to keeping the year-on-year rate near recent levels. DB economists highlight that the December print was boosted by outsized gains in a few specific categories so it wouldn’t be a great surprise to see some payback. Another interesting point is that January prints have tended to be higher than in other months, suggesting some residual seasonality. Over the past five years, January prints have averaged about 5bps higher than the prints in the other months of the year, though the recent methodological revisions are supposed to reduce this discrepancy by around half. So a bit more uncertainty than usual in the numbers today.

In FX, the dollar reversed its Asia-session decline on further signs of easing in U.S.-China trade tensions, while the New Zealand dollar and the Swedish krona rallied as policy makers sounded less dovish than expected. The Bloomberg Dollar Spot Index advanced as early London flows send the euro to day lows, while the pound steadies after dipping on softer U.K. inflation. The euro edged lower, reversing an earlier gain, after a report showed industrial production across the 19-nation region is falling at the fastest pace since the financial crisis.

Sweden’s krona gained after the Riksbank dropped its currency-intervention mandate. The British pound was steady after U.K. inflation fell below the Bank of England’s 2 percent target for the first time in two years. New Zealand’s dollar rallied after the central bank played down talk of an interest-rate cut; kiwi gains as much as 1.7% and New Zealand bonds slump after central bank Governor Adrian Orr said the odds for a rate cut haven’t increased, defying speculation it would follow the Fed and RBA in turning more dovish. Leveraged and macro funds scrambled to cover kiwi shorts as spot surged through buy-stops above 0.6780, traders said.

Elsewhere, oil added to its rebound from a two-week low after Saudi Arabia pledged to deepen output cuts. WTI (+1.2%) and Brent (+1.5%) are holding onto most of yesterday’s Saudi-induced gains with prices underpinned after the API crude inventories printed an unexpected drawdown (-0.998mln vs. Exp. +2.700mln). The session also saw the release of the IEA monthly report which deviated slightly from the EIA STEO published yesterday. The IEA maintained 2019 global oil demand (compared to EIA’s modest downgrade), whilst raising non-OPEC supply growth (in-fitting with the OPEC and EIA reports) and cutting OPEC crude demand. Little sustained reaction was seen across the energy benchmarks post-release. On a more optimistic note, Goldman Sachs continues to expect further upside for Brent crude prices, citing resilient demand growth topping low expectations, as well as large OPEC supply cuts. Finally, traders will be eyeing the release of the weekly DoE’s later today with focus on US production, as usual.

Gold prices are marginally firmer on the day as the pullback in the DXY’s yearly highs helped the yellow metal nurse some of the prior day’s losses. Furthermore, CFTC data show that money managers have cut their bullish gold bets over 6k net long positions to just under 44k.

Expected data include mortgage applications and inflation. Dish, Hilton, AIG, and Cisco are among companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.2% to 2,749.00

- STOXX Europe 600 up 0.3% to 363.93

- STOXX Europe 600 up 0.3% to 363.93

- German 10Y yield fell 0.7 bps to 0.125%

- Euro down 0.01% to $1.1325

- Italian 10Y yield fell 5.5 bps to 2.484%

- Spanish 10Y yield rose 0.9 bps to 1.248%

- German 10Y yield fell 0.7 bps to 0.125%

- Euro down 0.01% to $1.1325

- Italian 10Y yield fell 5.5 bps to 2.484%

- Spanish 10Y yield rose 0.9 bps to 1.248%

- Brent futures up 1.4% to $63.32/bbl

- Gold spot up 0.2% to $1,312.93

- U.S. Dollar Index up 0.1% to 96.79

Top Overnight Headlines from BBG

- U.S. President Donald Trump is eyeing a path to avoid another government shutdown where he would reluctantly accept the congressional border-security deal and attempt to tap other funds for his wall with Mexico, said a person who talked to the president Tuesday and asked not to be identified

- U.K. Prime Minister Theresa May and the EU are heading for a high-stakes, last-minute gamble that will decide whether the U.K. leaves the bloc with or without a deal, people familiar with both sides said; However, May’s strategy may face a renewed threat in Britain’s parliament. The Conservative pro-Brexit European Research Group is still deciding whether to abstain or vote against the government’s motion Thursday, the BBC said

- The Federal Reserve’s dovish shift is beginning to diminish the dollar’s appeal for currency speculators. A Citigroup Inc. index has dropped below zero for the first time since March 2018, indicating currency funds are holding net short positions on the U.S. currency

- Euro-area industrial production fell more than twice as much as forecast in December, raising further questions over the state of the bloc’s economy. The 0.9% month-on-month drop — more than twice the 0.4% forecast — was driven by declines in capital and non-durable consumer goods production

Asian equity markets traded mostly higher with global sentiment underpinned as US government shutdown fears abated and amid increasing hopes for a US-China trade breakthrough after the senior US delegation arrived in Beijing ahead of schedule. Furthermore, US President Trump has also kept the door open for an extension to the March 1st tariff deadline if a deal was close. ASX 200 (-0.3%) and Nikkei 225 (+1.4%) gained from the open although the former was later dragged lower by weakness in financials and as focus turned to earnings, while a weaker currency continued to fuel the dominance of the Japanese benchmark. Elsewhere, Hang Seng (+1.2%) and Shanghai Comp. (+1.8%) were positive with participants encouraged by the early arrival of US Treasury Secretary Mnuchin and US Representative Lighthizer to Beijing which some suggested signalled a willingness to reach a deal, while source reports later noted that Chinese President Xi is scheduled to meet with the US delegation on Friday. Finally, 10yr JGBs traded choppy in which they initially tracked the downside in T-notes and with demand dampened by the risk appetite, although prices then recovered as investors returned from the Tokyo break despite mixed 5yr auction results.

Top Asian News

- China’s Yuan Nears a Critical Juncture as Trade Talks Loom

- Pig Farmers Are Big Winners in China’s Silicon Valley

- Greenland Is Said to Buy China Minsheng’s Prime Shanghai Land

Major European indices are broadly in the green [Euro Stoxx 50 +0.2%], albeit off highs, as risk-appetite seen at the open somewhat waned ahead of US-China trade talks in Beijing. The materials sector remain the outperformer, while other sectors are predominantly in the green, although there is some slight underperformance in utility names. At the top of the Stoxx 600 are Ingenico (+9.2%) who beat on their FY revenue, with the Co. targeting organic growth of 4-6% for 2019. Alongside Swedish Match (+7.1%) after their Q4 sales increased. Heineken (+5.1%) are also higher after their earnings beat on estimates, alongside their shipments of their flagship brand increasing by their fastest pace in over 10 years by +7.7% Elsewhere, Wirecard (-2.9%) are once again in the red, following investors being notified of a class action lawsuit against the Co. and certain officers. Separately, at the bottom of the Stoxx 600 are ABN Amro (-7.2%) after the Co. missed on their Q4 profit; Clariant (-3.0%) are also lower following earnings.

Top European News

- U.K. Inflation Below BOE Target for First Time Since 2017

- Riksbank Commits to Rate-Hike Plan and Backs Off Currency Lever

- Italy’s Government Under a Hail of Criticism in EU Parliament

- Santander CoCos Rebound as Investors Swallow Call Disappointment

In FX, the NZD has descended from overnight highs, but remains well ahead of its major rivals in wake of a less dovish than anticipated RNBZ policy statement. Although the Bank retained the option to raise or lower rates and rolled out its OCR hike projection to 2021, Governor Orr refrained from cutting the odds of an ease despite recent disappointing data (like the Q4 jobs report) as many were expecting. Hence, the revised guidance sparked a short squeeze and scramble for cover that lifted Nzd/Usd up to around 0.6850 from circa 0.6730 at one stage, and well in excess of break-even pricing via options ahead of the event. Aud/Nzd recoiled to 1.0400 vs just shy of 1.0545, even though Aud/Usd also rebounded further from recent lows to 0.7135 or so at best amidst heightened hopes of a breakthrough in US-China trade negotiations and on the US Government funding front. Back to the Kiwi, 0.6850+ vs the Usd is still proving tough to overcome given Fib and MA resistance nearby.

- SEK, NOK – The Swedish Krona has also strengthened on CB factors, as the Riksbank maintained that the next tightening move is likely to come in H2 this year given very little change in the outlook for domestic growth and inflation since its last policy gathering in December (when the repo rate was lifted), even though external risks may be more pronounced. Eur/Sek has extended its retreat from 10.5000+ levels to fill reported bids at 10.4400, but not much further, while Eur/Nok has also continued to decline and is currently just above 9.7600 vs 9.8000+, with the Norwegian Crown deriving more momentum from another rise in oil prices.

- GBP – Conversely, the Pound remains hampered by Brexit-related issues with Cable fading again to sub-1.2900 levels and hardly helped by softer than expected UK inflation data. Note also, 1.2928 represents the 30 DMA and capped recovery gains made largely due to relative Greenback weakness, or a deeper pull-back from recent highs to be more precise (DXY down to 96.621 earlier vs 97.200 at yesterday’s new 2019 peak).

- JPY – In contrast to the overall trend, Usd/Jpy has edged up again to register a fresh ytd high around 110.75, as firmer US Treasury yields and the ongoing improvement in risk appetite overrides all else. However, the headline pair still faces big offers at 111.00 where option and exporter interest await.

In commodities, WTI (+1.2%) and Brent (+1.5%) are holding onto most of yesterday’s Saudi-induced gains with prices underpinned after the API crude inventories printed an unexpected drawdown (-0.998mln vs. Exp. +2.700mln). The session also saw the release of the IEA monthly report which deviated slightly from the EIA STEO published yesterday. The IEA maintained 2019 global oil demand (compared to EIA’s modest downgrade), whilst raising non-OPEC supply growth (in-fitting with the OPEC and EIA reports) and cutting OPEC crude demand. Little sustained reaction was seen across the energy benchmarks post-release. On a more optimistic note, Goldman Sachs continues to expect further upside for Brent crude prices, citing resilient demand growth topping low expectations, as well as large OPEC supply cuts. Finally, traders will be eyeing the release of the weekly DoE’s later today with focus on US production, as usual. Elsewhere, gold (Unch) prices are marginally firmer on the day as the pullback in the DXY’s yearly highs helped the yellow metal nurse some of the prior day’s losses. Furthermore, CFTC data show that money managers have cut their bullish gold bets over 6k net long positions to just under 44k. This roll-back in gold-bulls comes amid as US President Trump downplayed the threat of a second government shutdown alongside hopes of positive US-Sino trade developments with Chinese President Xi reportedly to meet with key members of the US trade delegation on Friday. Meanwhile gains for copper remain limited amid weakness in Dalian iron ore prices following its recent rally.

Looking at the day ahead, the big focus is the January CPI report while later we’ll get the December monthly budget statement. The Riksbank meeting is also due today (no change in policy expected) while the scheduled central bank speakers are the ECB’s Lane and Visco, and the Fed’s Mester, Bostic and Harker.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -2.5%

- 8:30am: US CPI MoM, est. 0.1%, prior -0.1%; CPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%

- 8:30am: US CPI YoY, est. 1.5%, prior 1.9%; CPI Ex Food and Energy YoY, est. 2.1%, prior 2.2%

- 8:30am: Real Avg Weekly Earnings YoY, prior 1.18%; Real Avg Hourly Earning YoY, prior 1.1%

- 2pm: Monthly Budget Statement, est. $11.0b deficit, prior $204.9b deficit

DB’s Jim Reid concludes the overnight wrap

Back from the Middle East today and the highlight was a big meeting in Saudi where 25 very important clients from one institution sat me in a room, stared me out in silence with the head then opening proceedings by saying “so we read your research, but the question we really want the answer to is as follows. How do you think Game of Thrones will end?” As I always try to have a view I gave what I think is the answer. In case you don’t want spoilers from my imagination I’ll spare you here but email me if you want to know my view.

In my absence it hasn’t taken much for risk assets to go back into full blown rally mode again as the prospect of an averted government shutdown and dovish comments from Trump on trade helped the S&P 500 climb +1.28% yesterday and close at the highest since 3 December. There were similar moves for the DOW (+1.49%) and NASDAQ (+1.46%) while prior to that the STOXX 600 also climbed +0.46% and continuing to reverse some of last week’s losses. HY credit spreads in the US also rallied -8bps while conversely rates were weaker with 10y Treasuries yields +3.4bps and Bunds weakening +1.2bps. Meanwhile the USD finally brought to an end an 8-day winning run, weakening -0.36% with EM FX (+0.46%) a main beneficiary of that. WTI Oil (+1.30%) helped the latter on the back of comments from the Saudi Arabian Energy Minister who suggested the nation had pledged to make further production cuts.

As mentioned, the trade headlines certainly helped, as President Trump said that he could allow the March 1 tariff deadline to “slide” if “we’re close to a deal.” US negotiators are having high-level meetings with Chinese officials in Beijing this week, and flexibility on the deadline would reduce the pressure for an immediate breakthrough. Any delay to higher tariffs would be positive for markets, so the news was greeted by an equity rally, with cyclical and trade-dependent stocks outperforming. Caterpillar (+2.89%), Boeing (+1.68%), and 3M paced the gains (+2.79%). Just on those trade headlines, overnight the South China Morning Post reported (citing sources) that China’s President Xi Jinping “is scheduled to meet” key members of the US trade talks delegation, including US trade representative Robert Lighthizer and US Treasury Secretary Steven Mnuchin, in Beijing on Friday after lower level talks already planned tomorrow for the US delegation. If true, we could get some additional colour on trade talks post this meeting and an indication of whether the US will actually let the March 1 deadline slide.

Just on the shutdown, Trump still hasn’t actually confirmed whether he will support the bipartisan congressional agreement before the Friday night deadline. The proposal must be written into legislation and pass both chambers of Congress before it gets sent to the President’s desk for his approval or veto. After a cabinet meeting yesterday, President Trump said that “I can’t say I’m thrilled” with the deal but that “I don’t think you’re going to see a shutdown.” So there is still an element of uncertainty.

So that should be one of the next hurdles for markets to navigate however in the meantime they’ll get a chance to temporarily divert away from politics today with the January CPI report in the US due this afternoon being the data highlight of the week. The consensus expects a +0.2% mom core reading although base effects are expected to result in a small pullback in the annual rate to +2.1% yoy. That said, the seasonal revisions this week resulted in a slightly lower January 2018 reading which therefore makes for a lower hurdle to keeping the year-on-year rate near recent levels. Our US economists also highlight that the December print was boosted by outsized gains in a few specific categories so it wouldn’t be a great surprise to see some payback. Another interesting point our colleagues make is that January prints have tended to be higher than in other months, suggesting some residual seasonality. Over the past five years, January prints have averaged about 5bps higher than the prints in the other months of the year, though the recent methodological revisions are supposed to reduce this discrepancy by around half. So a bit more uncertainty than usual in the numbers today.

This morning in Asia markets are largely following Wall Street’s lead with the Nikkei (+1.41%), Hang Seng (+0.80%), Shanghai Comp (+0.94%) and Kospi (+0.41%) all up benefitting from the positive spin on trade headlines. China’s onshore yuan is also up +0.27%. In the meantime, the New Zealand dollar is up as much as +1.71% along with 10y sovereign yields (+7.2bps) as the central bank pushed out its forecast for an interest-rate increase to early 2021 thereby paring investors dovish bets who were looking for signs of a policy easing later this year. Elsewhere, futures on the S&P 500 are up +0.30% with the contracts again reaching the 200 day moving average levels post early December. In terms of overnight data releases, Japan’s January PPI stood at -0.6% mom (vs. -0.2% mom expected).

In other news, the latest on Brexit is that PM May has given herself a bit more wiggle room (as flagged over the weekend), committing to presenting another neutral motion in two weeks time after confirming that she needed “more time” to secure changes yesterday. That assumes a likely vote on February 27th. For now tomorrow’s debate and vote on amendments is still going ahead however we still don’t know what the amendments will be. The closely-watched Cooper-Boles amendment will be deferred until the vote later this month. Last night ITV News reported – citing overheard bar conversation of UK PM May’s chief negotiator Oliver Robbins – that PM May is planning to wait until the last moment before putting her Brexit deal to a vote in Parliament and will then ask law makers to choose between her blueprint and a potentially very long delay to Brexit. Before this Sterling (+0.33%) pared back early losses by the end of play last night although the FTSE 100 (+0.06%) underperformed the majority of other equity markets.

Over at the ECB, there appeared to be a change in stance from Klaas Knot (who was previously seen as a hawk) in an interview with the FT. The tone of the interview suggested a more neutral stance, no longer urging exit in 2019 and instead adopting a “wait and see attitude”. Weidmann, another hawk, also spoke and said that the current economic weakness is “a bit more protracted” than previously thought. So two hawkish members of the Governing Council shifting to a more neutral stance as the race for Draghi’s successor heats up. Speaking of new officials, Philip Lane, the newly designated ECB Chief Economist, spoke for the first time in his new capacity yesterday. He gave a pretty standard assessment of the European economy, saying that domestic demand “remains pretty strong” and that he’ll take a “measured” approach to assessing incoming data. Nothing to rock the boat from him.

Fed Chair Powell also declined to offer any surprises in comments yesterday. He said that “data at the national level show a strong economy” and officials “don’t feel the probability of recession is at all elevated.” He further added that there should be high priority focus on increasing labour force participation and “it is one we consider in our policies.” Nevertheless, he reiterated that rate hikes affect the economy with a long lag, providing justification for the apparent pause in the Fed’s hiking cycle. In the meantime, Fed’s Mester (non-voter) gave an upbeat assessment of the US economy mostly reiterating her comments from last week and added that even though she likes the Fed’s strategy of providing dot plot, the Fed officials “have to do a better job” at conveying the level of uncertainty around those projections. Interestingly, her comments follow those from her peer Bullard (voter) last week wherein he said that the Fed’s dot plot needs a rethink by saying, “I think it has become too prescriptive about the interest rate path. It builds in too much expectation that that is a baseline path from which we have a high bar to deviate. That I think is causing the committee problems. I think it caused us problems in December.” So interesting to see a debate developing around Fed’s dot plots and one to watch for. Mester also said that she has seen no evidence to prove that the central bank’s gradual unwind of its balance sheet was to blame for financial market volatility in the fourth quarter.

Over in Spain, the parliament is set for a key budget vote today. The governing coalition headed by the centre-left Socialist party controls only around 25% of the body’s seats, but needs a majority to pass its spending plan, and therefore needs votes from smaller parties. In particular, some smaller, Catalan parties are likely to vote against the measure, and government sources have indicated that the Socialists will call snap elections if the vote fails. The date for the national election would reportedly be April 14 or 28. Despite the elevated uncertainty, 10-year Spanish bond yields are around one-year lows at 1.24% and their spread to Bunds are right in the middle of their recent range at 111bps.

As for the data that was out yesterday, in the US the January NFIB small business optimism reading pulled back 3.2pts to 101.2 compared to expectations for a much more modest decline to 103.0. That’s now the lowest reading since November 2016. Meanwhile the now somewhat outdated JOLTS report for December saw openings up to 7.34m from an upwardly revised 7.17m in the month prior. So, consistent with a continuation of a robust labour market.

To the day ahead now where the early focus this morning is on the UK with the January inflation data dump. That includes CPI, PPI and RPI with the consensus running at +1.9% yoy for core CPI and unchanged relative to December. Our economists do however expect the core reading to slide a tenth to +1.8% reflecting some softness in food inflation and clothing and transport prices. Also due in the UK is the January house price index while later this morning we’re due to get the December industrial production report for the Euro Area (-0.4% mom expected). In the US this afternoon the big focus is the aforementioned January CPI report while later we’ll get the December monthly budget statement. The Riksbank meeting is also due today (no change in policy expected) while the scheduled central bank speakers are the ECB’s Lane and Visco, and the Fed’s Mester, Bostic and Harker.

via ZeroHedge News http://bit.ly/2UQvUjo Tyler Durden