While stocks continue their scorching post-Christmas rally, the big story so far of 2019 is not so much the move in the market which was to be expected once the Fed capitulated to petulant traders, but the fact that investors have so far shown no faith in the sustainability of the rally and instead have been withdrawing capital from equity funds for the duration of the rally.

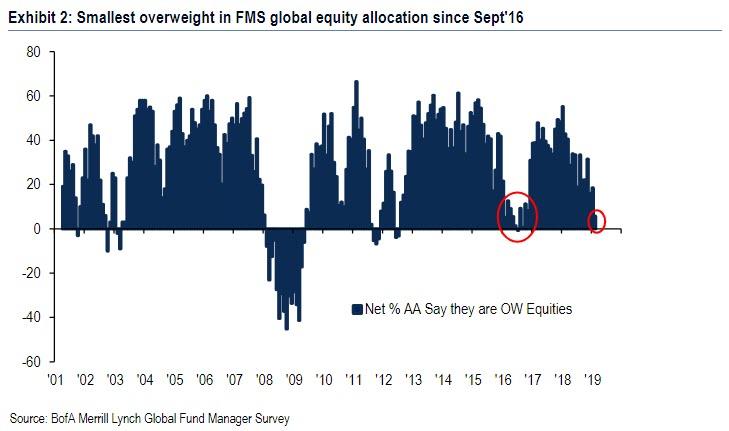

Confirming this, the latest BofA Fund Managers Survey showed that professional investors’ allocation to global equities tumbled 12% to just net 6% overweight, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan’19 survey) to Feb 7th (end of Feb’19 survey) on record.

Logically, this bizarre divergence can end in one of two ways: trader skepticism is validated and stocks resume their slide to the abyss of the 2018 December lows, or bears capitulate and plow back into equities.

Until then, however, the “pain trade” is back, and as Nomura’s Charlie McElligott comments on yesterday’s action in the markets which has continued on Wednesday, “it was not pretty within the Equities-space today despite the large index rally, as many in the fundamental universe who had been fighting this U.S. Stock rally YTD look to be “tapping” on their short-books / underweights in an attempt to get their “Beta-” and “Net Exposure-“ UP (as a result, seeing their “Gross Exposure-“ DOWN), as the market is now really “getting away from them” performance-wise YTD.”

This is hardly a surprise in light of the persistent derisking observed in recent weeks, which we summarized in “This Is Strange”: Despite Historic Rally, Investors Continue To Dump Equities.

It may be “strange”, but it is also a source of not only chronic underperformance by active managers, as well as a constant threat of a burst higher as a result of what McElligott calls a “forced grab” back into exposure. And underexposed they are, for the following reasons note by the Nmura strategist:

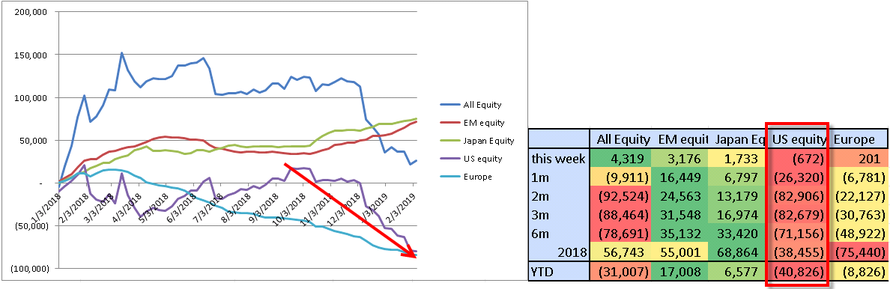

- 10 consecutive weeks of outflows from US Equities Funds per EPFR, with -$26.3B of redemptions over the last 4w alone and now -$40.8B YTD

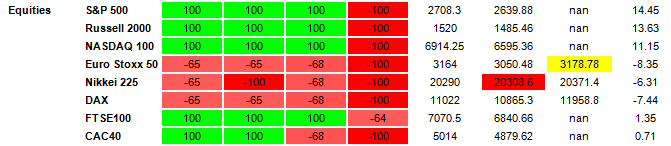

- HFR Equity Hedge Fund Index with 1m rolling “beta to S&P” at just 36% (for context, was 81% in late Sep ’18)

- Macro Fund positioning proxy shows 1m rolling “beta to S&P” just 4th %ile since 2003

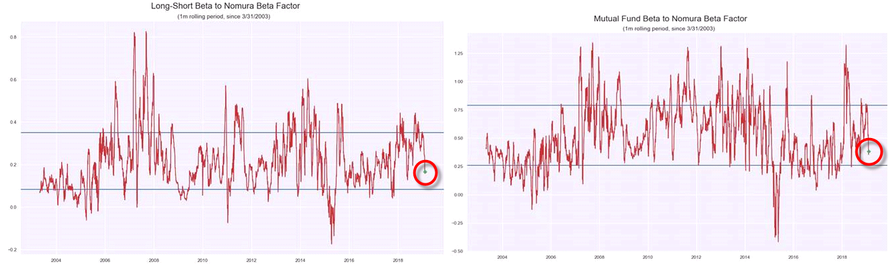

- Hedge Fund L/S positioning proxy shows 1m rolling “beta to Beta (factor)” just 40th %ile since 2003

- Mutual Fund positioning proxy shows “beta to Beta (factor)” just 33rd %ile since 2003

- BAML FMS highlighting the smallest “overweight” of Global Equities allocations in nearly 2.5 years, with US in particular the 2nd least favored region among money managers and overall 3% UNDERWEIGHT

- BAML FMS shows the highest “overweight” to Cash in 9.5 years

Visually, this can be seen in both equity fund flows…

… the sharp drop in the L/S and Mutual Fund beta factor…

… and most notably, in the sharp underperformance of the HFR equity Market Neutral Index.

And as traders increasingly seek to bring up net exposure, cover shorts and “grab for beta”, what are the implications of this divergent behavior observed in recent weeks? McElligott explains:

- Very significant underperformance across the Equities Hedge Fund space with this index move higher, as my model Long-Short portfolio finished only +30bps vs index +140bps

- With Shorts being force-covered (again), we witnessed a meaningful (and recently rare) “Value” factor outperformance of “Growth,” largely on account of Cyclicals (Value Longs) ripping higher (Materials +2.3%, Financials +1.6% and Industrials +1.6% as three of the S&P 500’s top four sector performers on the day)

- This move higher in “Value Longs” corresponded to the move in both Volatility- (+2.1% on day, now +10.7% YTD) and Beta- (+1.8% on day, now +13.3% YTD) factors, with High Beta Cyclicals crushing Defensives / Low Vol (Dividend Yield Factor -1.3% / -1.7 z-score 1Y relative move, Dividend Payout -1.8% / -2.5 z-score move)

- This “pain-trade” is further evidenced in another rough day for legacy positioning as per “1Y Price Momentum” factor, -1.4% on session and now -6.7% YTD

- Additional evidence of today’s “grab,” with the intraday CBOE US Index Put / Call Ratio crashing to lows last seen in late July ’18, as investors lunged for Calls / upside exposure to chase the move

Meanwhile, it is not just human traders who are capitulating to the relentless levitation: the systematic community is also betting it all on green, with CTAs already “Max Long” US equities…

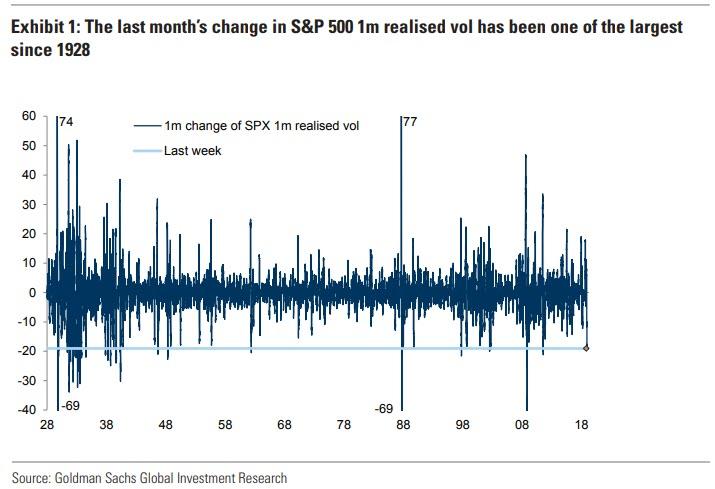

… while Risk Parity funds – as we noted last week – are also returning back to the market courtesy of the biggest drops in realized vol since 1928…

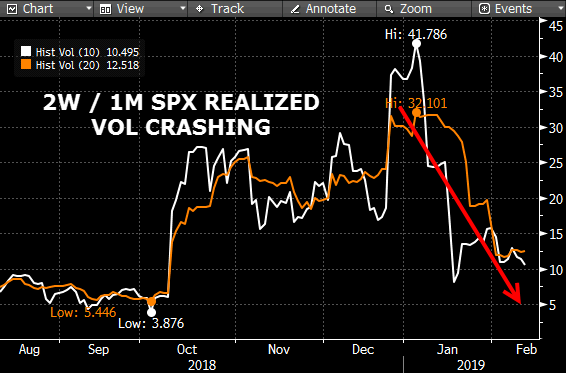

… also shown here:

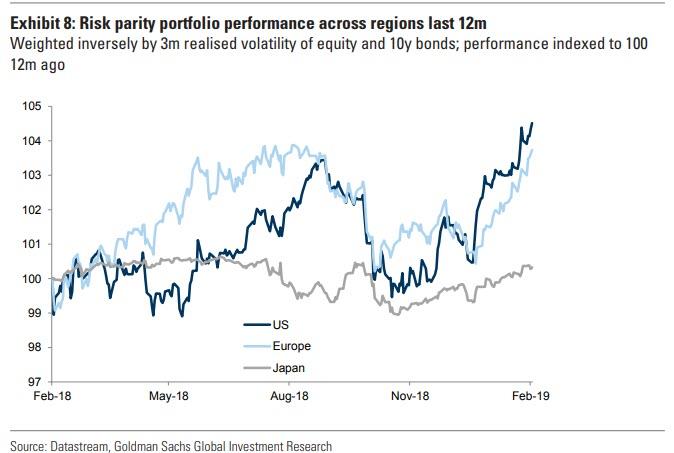

Incidentally, the return of the “Fed Trade”, where both stocks and bonds are rising at the same time, means that the performance of indicative risk parity portfolios has been on fire in the past three months.

So while it appears that investors, having no other choice, are slowly getting dragged back into the market, McElligott issues a warning that as this is happening, and as “length” is reestablished in Equities, we will likely see “the hard part” take shape as the lagging impact of the prior Fed tightening continues to bleed into the real economy, which continues to be the reason that STIRs are pricing-in a Fed CUT in 2020 as the next move.

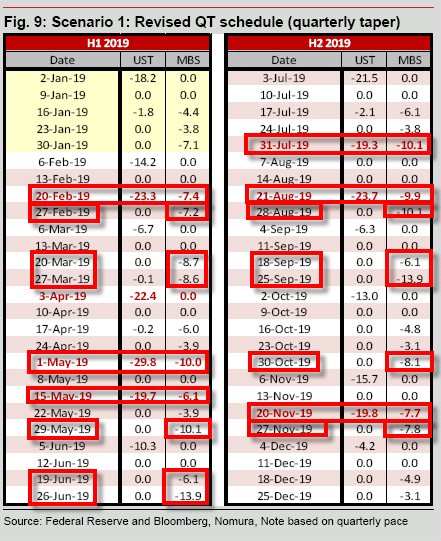

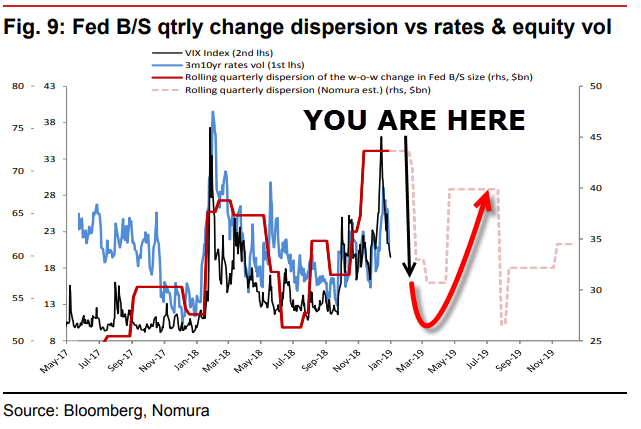

Not only that, but despite the Fed’s verbal assurances that its balance sheet is no longer on auto pilot, “QT does continue unabated for now, and most importantly, the MBS portfolio unwinds MATTER for SPX / VIX” as per the schedule shown below as more imminent unwind events are expected:

And while Fed’s Mester can claim that the December turbulence was not the result of the Fed’s balance sheet shrinkage, empirical data suggests otherwise:

It’s not just the still tightening Fed that makes re-entering markets here dangerous: there are several additional reasons that suggest more pain is set to come shortly, from McElligott:

- Remember that Chinese data is expected to “print lows” in Q1 / Q2 (“gets worse before it can get better”), with the potential to dictate a disinflationary drag globally (despite the start of year “credit / liquidity injection IMPULSE”)

- In 2Q19 we too could see the potential commencement of the “earnings recession” with very tough 2Q18 comps

- From here, it’s even harder for the Fed—as the data has to either get way worse for them in order to get more dovish (for “bad” cycle-reality reasons!) OR the data stabilizes / strengthens, in turn risking another possible FOMC tone inflection which could put us back on the “FCI vicious cycle”—especially if stocks continue their re-pricing higher and “short volatility” positions are re-accumulated.

via ZeroHedge News http://bit.ly/2TRcGKw Tyler Durden