From “Sunday Start”, authored by Andrew Sheets, Morgan Stanley chief cross-asset strategist.

Markets frequently change their mind, but even adjusting for that, the shift in ‘conventional wisdom’ in recent months has been nothing short of whiplash. In December, there was widespread agreement among investors that recession risk had risen sharply, that rising inflation pressures would keep central banks tightening policy, and that US-based risks around trade and government funding had risen sharply. Skip forward two months and these fears have been replaced by a different (if familiar) term: Goldilocks.

The Goldilocks narrative made repeated appearances from 2010-16, and the current version sounds something like this – inflationary pressures have receded, giving central banks wide latitude to pause almost indefinitely on policy tightening. Global growth is slowing, but not enough to be truly concerning. And US political risks are close to resolution, with growing investor optimism that lasting solutions to funding the US government and US-China trade are now within reach. We are sceptical that this story holds together.

The Goldilocks narrative depends on a lack of inflation, which gives central banks the opportunity (although not the obligation) to continue accommodative policy. Core inflation readings in developed markets have moved sideways in recent months, forward-looking inflation expectations have dropped sharply, and my colleague Chetan Ahya notes that emerging market inflation currently sits near 15-year lows. Taken together, investors sound more emboldened that a lack of inflation pressure means that central banks have nothing but time.

We’re not so sure. Even with recent energy-led declines, headline inflation is near the 25-year average in the US, UK, France, Germany and Japan. Unemployment is near 50-year lows in the US, 45-year lows in the UK, 25-year lows in Japan and 20-year lows in the eurozone, while measures of wage growth in the US and Europe continue to push higher. All these suggest that DM economies are working with significantly less spare capacity than they were under prior periods when ‘Goldilocks’ reigned.

It’s also important to be careful with level-setting in the inflation discussion. Yes, the current level of US core CPI inflation (2.2%Y) is ‘low’ by the standards of the last 60 years. But it is far less extreme relative to the last two decades. And lest one thinks that inflation provides a true late-cycle warning signal, this is a good time to remember that core CPI is currently at the same level as May 2007 and higher than May-December 1999.

But Goldilocks is about more than a lack of inflation; it also requires enough growth to allay downside fears. And that’s our other problem with this argument. Global growth data remain poor.

The weakness in the global economic data is notably broad. Trade data, global PMIs and earnings revisions have all turned sharply lower in the last three months, a powerful reminder that weakness in 4Q18 wasn’t simply about the Federal Reserve. And while US data have held up better, it’s hardly been immune, with this past week seeing the worst month-onmonth decline in US retail sales since the early 2000s.

There is a good debate about whether this weakness is currently troughing. Our economists think we are close to more aggressive economic stimulus from China, viewing the sharp rise in total social financing in the most recent monthly data as a sign that policy-makers are taking more aggressive action. But if these measures provide a strong boost to the Chinese (and global) economy, that wouldn’t fit the ‘Goldilocks’ script. And if those measures fail to materialise, or are unsuccessful, it wouldn’t be Goldilocks either.

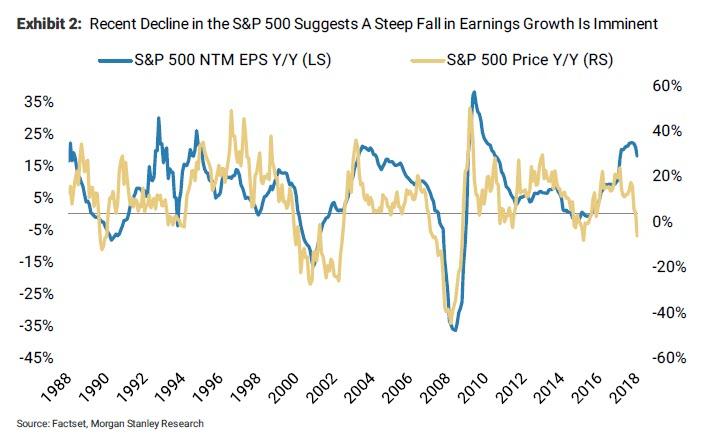

Meanwhile, it’s important to remember that, for US earnings, the weakness is just beginning. Our US equity strategists now expect just 1% EPS growth for the entire year, a reminder that the challenges to the US fundamental story aren’t going away any time soon.

Finally, politics. The third part of the Goldilocks story is that risks around US trade and government funding will now provide positive catalysts. Our US public policy team, led by Michael Zezas, disagrees. This is partly because investor optimism on both issues has already risen materially while key issues remain unresolved. On trade, we don’t think tariffs go higher on March 2, but major issues remain unresolved. On government funding, the US administration’s intention to declare a state of emergency to secure funding would set up a new confrontation with Congress.

In short, we think that investors should be sceptical of the Goldilocks narrative, and look for strategies that benefit from inconsistencies within it. Big picture, we are not looking to add exposure here, and have been looking to reduce some emerging market beta into strength. Our forecasts for stimulus that will help China growth stabilise while US growth continues to moderate support the strategic case to be short the broad USD and overweight international over US equities, and a bullish view on both A-shares and the renminbi. On a smaller scale, our rates strategists continue to think that the level of US real rates is too high relative to expectations that the Fed is now done hiking for the cycle. Either those expectations of further hikes should come up, or 10-year real rates should come down.

via ZeroHedge News http://bit.ly/2X8t8b5 Tyler Durden