In the latest sign that at least some progress might be made this week toward a US-China trade accord as the seventh round of talks gets underway in Washington, Bloomberg just reported that the US – in addition to its other demands – also been pressing China to “stabilize” the yuan, a move aimed to neutralize efforts by Beijing to devalue its currency to counter American tariffs.

According to sources close to the talks, the two sides are discussing how to codify language prohibiting currency manipulation in a memorandum of understanding that would form the outline of a deal.

Bloomberg also notes that while the wording remains unresolved, “a pledge of yuan stability has been discussed in multiple rounds of talks in recent months and both sides have tentatively agreed it will be part of the framework of any final deal.”

What if China refuses to comply? Well, it appears higher tariffs would follow as a key, perhaps the only enforcement tool would are tariffs. The Trump administration has been clear in its talks with Beijing that “any attempt to depreciate the yuan – a strategy aimed at offsetting existing U.S. duties on Chinese imports – would be met with more or higher American tariffs.”

Which, at least superficially, is confusing considering the Yuan is at least loosely pegged to the dollar, which begs the question: is the US also asking China to prevent the Fed from manipulating the US Dollar.

What is also confusing is that Trump’s request to keep the yuan from depreciating is also difficult to square with US calls for China to adopt more market-driven reforms and complaints that Beijing manipulates its currency to gain a trade advantage.

China’s foreign-exchange intervention has long been a political target in the U.S. and Trump vowed to declare China a currency manipulator during his 2016 campaign. After two years in office, his Treasury Secretary Steven Mnuchinhasn’t found grounds to do so but has continued to monitor the yuan closely.

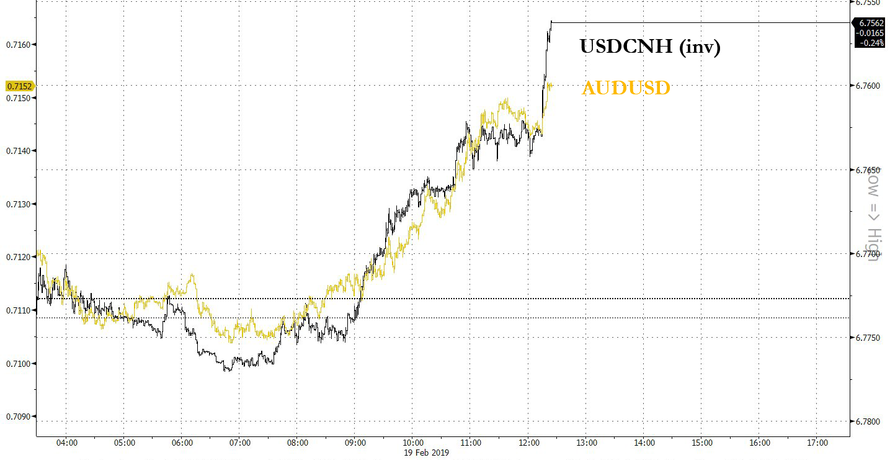

While we fail to see how Beijing would agree to such a stipulation – agreeing in principle is easy for Beijing; implementing safeguards and controls preventing currency manipulation is virtually impossible – the market has once again lapped up the news, sending the yuan and the Aussie dollar higher as the headline was seen by algos as another indication that talks are at least moving along, even if nobody appears to have considered the actual content of the report.

The latest confirmation that the US is less than pleased with a weaker yuan (which was hammered in mid and late 2018) comes just months after the Treasury Department declined to formally name China as a currency manipulator (though it did add Beijing to its currency manipulation “watch list”).

via ZeroHedge News http://bit.ly/2BKsNCi Tyler Durden