As the international money laundering scandal that started with revelations about Danske Bank’s Estonian branch and has since spread to taint Swedbank and other Scandinavian and Baltic lenders spreads, a Finnish broadcaster on Monday was reportedly preparing to publish a report detailing Nordea’s role in laundering billions of euros flowing out of the former Soviet Union.

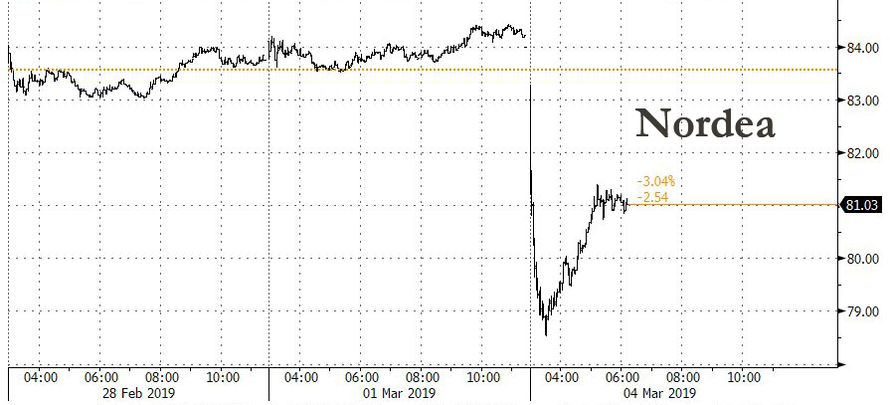

The news sent shares of Nordea reeling – it was down more than 6.5% at the lows – while shares of other Nordic banks fell in tandem. DNB ASA, Norway’s largest lender, declined as much as 4.6%, while SEB AB fell as much as 2.1%.

Already, Swedbank AB, Sweden’s oldest lender and the dominant financial presence in the Baltics, has shed roughly one-fifth of its market value since Feb. 20, when a Swedish broadcaster published a report linking it to the Danske case. The bank had previously denied wrongdoing, and is now being investigated by authorities in Sweden and Estonia, according to Bloomberg.

Investors dumped the shares because they were essentially left in the dark about the allegations, and have been unsure when the next shoe will drop.

Nordea, for its part, said it hasn’t yet seen the program, but based on what it has been asked to comment on, it believes most of the allegations have already been made public.

“Investors are essentially left in the dark with regard to Nordic banks, waiting to see what and when new allegations will emerge on money laundering,” said Philip Richards, an analyst at Bloomberg Intelligence in London.

“The issue has now moved on from Danske Bank to engulf Swedbank and Nordea, but the entire sub-sector appears to be getting drawn in,” Richards said. “Until banks come clean and reveal the full extent of what suspicious transactions they have been involved in, this looks set to run and run.”

Nordea said it “is aware of the media story and has been in dialogue” with the Finnish broadcaster YLE and the Danish newspaper Berlingske, which are intending to publish the laundering report later on Monday.

“We have not yet seen the program or article. Based on what we have been invited to comment on, these are all issues that we have seen and commented on before and are therefore in line with previous statements made on AML issues,” Nordea spokeswoman Kati Tommiska said in an emailed statement.

Nordea, which moved its headquarters to Finland from Sweden for regulatory reasons last year, has already been fined by Swedish authorities for failing to uphold AML controls. And recently, investor Bill Browder brought a complaint against Nordea alleging the bank is tied to the Danske scandal.

But as the money laundering scandal spreads, criminals and other shady entities in the CIS might be the biggest losers here, as they struggle to find new venues for laundering their money into the western financial system.

via ZeroHedge News https://ift.tt/2IPO0kc Tyler Durden