It’s groundhog day again as global markets and US equity futures are once again higher on the same regurgitated “news”, this time courtesy of the WSJ, that the US and China are “In the final stages of completing a trade deal.” If Phil Connors had the distinct displeasure of covering geopolitics for the past 3 months, his report today would be that presidents Trump and Xi Jinping “might” seal a formal trade deal around March 27, as the two countries appear close to a deal that would roll back U.S. tariffs on at least $200 billion worth of Chinese goods. The proposed trade deal would require Beijing to follow through on pledges ranging from better protecting intellectual-property rights to buying a significant amount of American products, including 50 million liters of Jack Daniels whiskey.

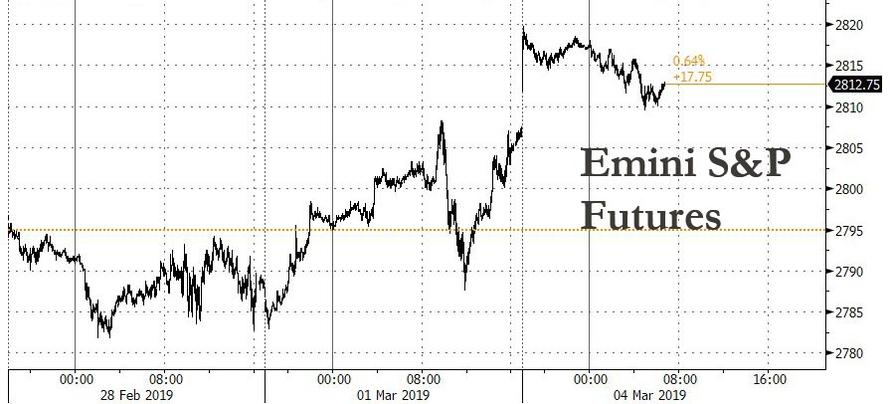

And Phil would be suicidal to see the same old market reaction as global stocks rose on the news, with European markets following their Asian counterparts higher. Asia’s MSCI ex Japan index was up 0.2%, Europe’s STOXX 600 index was up 0.4%, while the E-Mini was 0.3% higher…

… however much of the early burst higher faded with Eminis losing half of the initial euphoria …

… as even the algos appear to be growing bored with the now daily ruse, and the key outstanding question is whether all of the upcoming “trade deal” has now been priced in.

Actually, according to Lukman Otunuga, research analyst at FXTM, there was another question: “The key question is – will all tariffs will be removed instantly, or will they be gradually dialled back?” wrote “While the renewed risk appetite is seen boosting European and U.S. stocks, investors should consider how much upside is left, given that markets have been actively pricing in the possible resolution to the trade saga.”

Questions or not, the news was enough to reverse any lingering doubts about ongoing trade talk progress and MSCI’s All Country World Index was up 0.1% on the day, as the S&P500 is rapidly approaching its all time highs again.

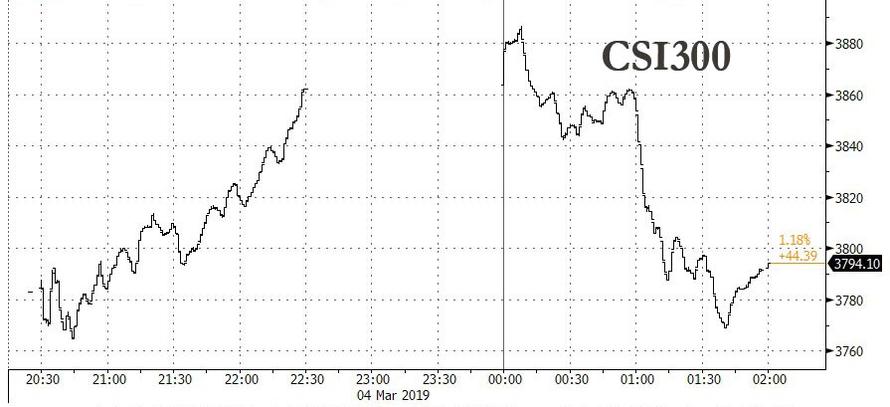

In Asia, Chinese shares were the biggest gainers, with the blue-chip index up as much as 3 percent, before however losing much of the overnight gains. The CSI300 index rallied last week after index provider MSCI quadrupled its weighting for mainland shares in its global benchmarks.

Elsewhere, Australian shares rose 0.4 percent and Hong Kong’s Hang Seng index added 0.7 percent. That left MSCI’s index of Asia-Pac shares ex Japan higher 0.2% on the day, and up almost 10% so far this year. Japan’s Nikkei strengthened more than 1 percent.

In Europe, gains in miners and media companies led the Stoxx Europe 600 Index to five-month high.

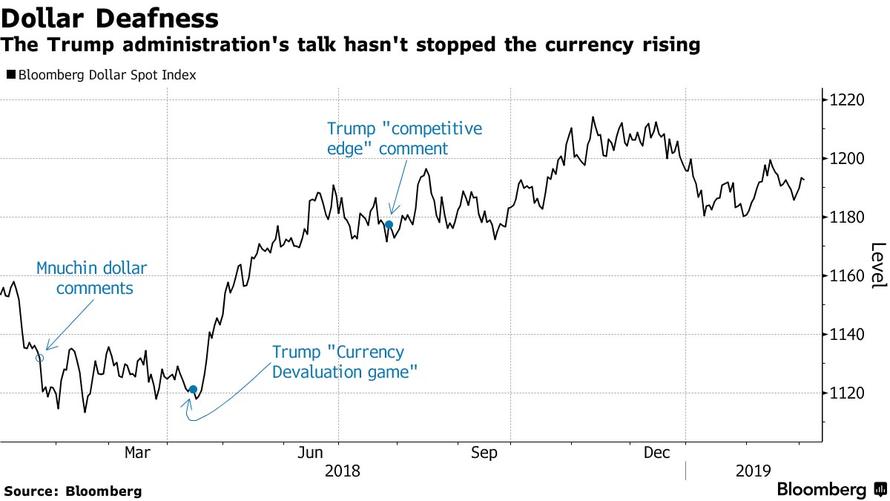

One possible reason for the fizzling euphoria is that the dollar jumped higher overnight even after U.S. President Donald Trump warned against it becoming too strong.

Despite the market’s enthusiasm, not everyone was fooled: “while we have all these great headlines about what could be achieved under a U.S.-China trade agreement, we’re still a little way away,” said Kerry Craig, JP Morgan’s global market strategist. “There could be a chance for a disappointment. It could be phased in over a number of years. There’s still questions about how and what China will actually buy to try and reduce their deficit.”

Sure, but for now, as for the past 10 consecutive weeks of upside, the algos are buying first and aksing questions later, if at all.

Meanwhile, in addition to the daily trade talk, the market will keep focused on several other key developments as well: China’s annual National People’s Congress may yield policy clues when it kicks off on Tuesday and investors will get the latest read on the U.S. economy with the monthly jobs report on Friday.

“While it will take time for economic data to stabilise from the current slowdown, policy shifts by central banks and governments, especially in the U.S. and China, should help support investor confidence for now,” said Tai Hui, Asia-Pacific chief market strategist at JPMorgan Asset Management.

In FX, the dollar recovered from an earlier slump that was fueled by President Donald Trump’s renewed criticism of Fed Chairman Jerome Powell and complaint about the greenback’s strength. The dollar reached a session high in early London trading while Treasury yields were little changed after reversing an earlier climb; the euro reversed gains on cross selling versus the yen and the pound. Earlier, turozone Sentix investor confidence rose to -2.2 in March, vs -3.1 estimate and -3.7 in February.

The pound led gains among major currencies after the Sunday Times reported that Pro- Brexit hardliners in May’s Conservative party have outlined conditions for supporting her plan; the sterling trimmed gains after construction PMI fell to 49.5 vs 50.6 in January and estimated 50.5. Meanwhile, the Aussie and kiwi retreated from early highs; poor economic Australian data over company profits and inventories sparked concern over growth data due later in the week; both currencies earlier advanced on hopes of a potential U.S.-China trade deal.

Greece’s benchmark 10-year government bond yields dropped to their lowest since 2006 on Monday after Moody’s raised its rating late last week, bolstering investor optimism towards the euro zone’s most indebted country. Moody’s on Friday lifted Greece’s issuer ratings to B1 from B3, citing the effectiveness of the country’s reform programme.

Looking ahead, March is expected to be a crucial month for global markets. Britain’s parliament will vote on an agreement to leave the European Union, the U.S. Federal Reserve will hold a policy meeting that could yield clues on its plans for interest rates and balance sheet reduction, and the European Central Bank will hold its scheduled policy meeting this week.

Elsewhere, oil prices gained on Monday with Brent (+0.7%) and WTI (+0.9%) benefitting from the positive trade sentiment following reports that US and China are in the final stages of completing a trade deal, alongside China’s spokesperson Zhang stating that substantial progress has been made. Adding to the upside is Friday’s Baker Hughes rig count where US oil rigs fell by 10 to 843, the lowest level since May 2018. Elsewhere, Russian oil output was 11.34mln BPD in February, 75k barrels below the October baseline level; according to Energy Ministry Data. Separately, Barclays have maintained their Brent price forecast, stating that prices have moved in-line with their view however Barclays does note that downside risks remain.

Gold (-0.4%) prices are weaker weighed on by the positive risk sentiment, with the yellow metal trading towards the bottom of a USD 10/oz range. Elsewhere, Vale have, on a temporary basis, removed its Chief Executive Schvartsman, along side 3 other executives following recommendations by both state and federal prosecutors. Elsewhere, nickel futures, which is used to make stainless steel, have climbed to around a 5-month peak, as the price of stainless steel continues to rise with Chinese steel mills actively replenishing their stocks in-spite of the rising prices; although some mills have been delaying purchases due to the price increase.

It’s a quiet day otherwise, with only construction spending data due, while Salesforce.com is scheduled to report earnings

Market Snapshot

- S&P 500 futures up 0.3% to 2,814.00

- MXAP up 0.4% to 159.69

- MXAPJ up 0.2% to 525.32

- Nikkei up 1% to 21,822.04

- Topix up 0.7% to 1,627.59

- Hang Seng Index up 0.5% to 28,959.59

- Shanghai Composite up 1.1% to 3,027.58

- Sensex up 0.6% to 36,063.81

- Australia S&P/ASX 200 up 0.4% to 6,217.41

- Kospi down 0.2% to 2,190.66

- STOXX Europe 600 up 0.4% to 375.83

- German 10Y yield unchanged at 0.183%

- Euro down 0.2% to $1.1345

- Brent Futures up 1% to $65.70/bbl

- Italian 10Y yield fell 1.8 bps to 2.375%

- Spanish 10Y yield rose 1.1 bps to 1.208%

- Brent Futures up 1% to $65.70/bbl

- Gold spot down 0.5% to $1,287.03

- U.S. Dollar Index unchanged at 96.53

Top Overnight News

- The U.S. and China are close to a trade deal that could lift most or all U.S. tariffs as long as Beijing follows through on pledges ranging from better protecting intellectual-property rights to buying a significant amount of American products, two people familiar with the talks said

- China is planning to cut the value-added tax rate that covers the manufacturing sector by 3 percentage points as part of measures to support the slowing economy, a person familiar with the matter said

- President Donald Trump’s attempts to blame Federal Reserve Chairman Jerome Powell for any hiccups in the U.S. economy have made a comeback — this time directed at his conservative base as he gears up for a tough 2020 re-election campaign

- House Judiciary Chairman Jerrold Nadler said he’s aggressively investigating whether there’s evidence of wrongdoing by President Donald Trump, thrusting the veteran New York City lawmaker into center of a politically risky probe

- The Swiss National Bank racked up a 14.9 billion- franc ($14.9 billion) loss for 2018 as the global stock market rout eroded the value of its foreign-currency holdings

Asian equities were higher across the board amid trade-optimism after WSJ noted that a US-Sino trade deal is reportedly being finalised and may be signed during a Trump-Xi Summit at the end of March. On Friday, US equities rose amid the overall risk appetite wherein the S&P closed above the 2800 level for the first time since November last year. The Dow closed above 26000 as Nike and Chevron led the gains, whilst Nasdaq advanced due to outperformance in heavyweight Amazon. ASX 200 (+0.4%) was led by the outperformance in the IT sector alongside a strong performance in material names, whilst Nikkei 225 (+1.0%) was lifted by its heavy China-exposed machinery sector and a marginally weaker domestic currency. Elsewhere, Shanghai Comp. (+1.2%) was the marked outperformer and breached the key 3000 level to the upside with all sectors firmly in the green ahead of the China National People’s Congress coupled with reports of optimistic trade developments. Meanwhile, Hang Seng (+0.5%) posted modest gains but initially failed to piggy-back on the same momentum as its mainland peers as the heavy-weight financial and energy names weighed on the index. Huawei are said to be preparing to sue the US government for banning federal agencies from using their products. Prior to this, Huawei CFO Meng Wanzhou has sued the Canadian government, police and border officials, claiming her legal rights were violated. Elsewhere, the UK could cap the use of Huawei equipment following the UK government’s review of the company; according to FT citing sources

Top Asian News

- South Korea, U.S. Decide to End Biggest Joint Military Exercises

- China, Malaysia Sign $891 Million of Palm Oil Purchase Deals

- China Copper Premium Falls to 22-Month Low as Stockpiles Expand

Major European indices are off best levels [Euro Stoxx 50 +0.2%], continuing from a strong overnight session where Shanghai Comp breached 3000 to the upside. Although, there is some slight underperformance in the DAX (U/C) which is weighed on by Fresenius Medical Care (-2.3%) after US President Trump’s administration have stated they are looking at value based pricing to promote home dialysis and kidney transplants, designed to spur innovation and decrease in-clinic dialysis; with the market currently dominated by the Co. and US Company DaVita, who are down by around 2% in the pre-market. Sectors are similarly in positive territory; however, the healthcare sector is largely unchanged with sentiment capped by the aforementioned performance of Fresenius Medical Care, along with Novarits (-2.5%) who in spite of their positive update regarding psoriasis are in the red as they are trading ex-dividends today. Other notable movers include, British American Tobacco (+0.5%) who opened down by just under 2% following a class action lawsuit against the Co’s Canadian unit. Elsewhere, Casino (-1.6%) are in the red after being downgraded at Societe Generale. Towards the top of the Stoxx 600 are Daily Mail (+4.9%) after the Co. stated they are offloading their GBP 900mln stake in Euromoney, with funds to be returned to shareholders. Separately, Julius Baer (+0.9%) are up after the Co. increased their stake in NSC Asesores by 30% to 70% for an undisclosed amount.

Top European News

- Ted Baker CEO Kelvin Resigns After Misconduct Allegations

- VW Straddles Old and New With Electric Buggy, Passat Face-off

- Bill Gross Sees ‘Much Less’ Alpha in Era of QE and Quant Trading

- U.K. Construction Contracts as Brexit Delays Building Projects

In FX, The Dollar is somewhat mixed vs its major counterparts, but the DXY recovered from another US President Trump set-back to revisit 96.600 and marginally eclipse tech resistance (96.594 Fib) on the way. However, latest encouraging reports on US-China trade, suggesting a deal is in the offing have hampered the Greenback to an extent, especially vs more risk-sensitive and high beta currency peers.

- GBP – The Pound has shrugged off an unexpected fall in UK construction PMI through the 50 growth/contraction threshold, and instead remains supported at the top of the G10 table on the more positive Brexit-related news in the form of growing support for PM May’s Withdrawal Agreement among the more ardent Tory leaver ranks, albeit with set conditions. Indeed, Cable remains close to 1.3250 and Eur/Gbp has retreated from highs around 0.8600, though the latter partly due to relative weakness in the single currency. Note, however, a hefty 1 bn option expiry at the 0.8500 strike looks too distant to come into play today as the cross hovers near 0.8560.

- EUR – As noted above, an underperformer amidst broadly risk-on trade at the start of the new week, with stops noted vs the Usd on a break of 1.1350 once last Friday’s low was breached taking the headline pair down to 1.1335. Similarly, sell orders are said to have been triggered in Eur/Jpy, possibly through 127.00 and in Eur/Gbp, but the single currency has pared some lost ground in wake of a more upbeat than forecast Sentix index.

- CHF/JPY – A bit of divergence between the traditional safe-havens, as the Franc remains below parity vs the Greenback on the aforementioned positive US-China paper talk, but the Jpy rebounds from worst levels circa 112.00, perhaps with the aid of those Eur cross sales, to sit just off 111.73 highs.

- NZD/AUD/CAD – The Antipodean Dollars are off best levels achieved overnight when the WSJ trade deal between Beijing and Washington near to completion report broke, but still underpinned as the Kiwi keeps its head above 0.6800 and Aussie hovers just below 0.7100. However, Aud/Nzd has slipped back towards 1.0400 in wake of some disappointing pre-RBA data in the form of Gross Company Profits and the Loonie is still underperforming circa 1.3300 lows following last Friday’s sub-consensus Canadian GDP release in the run up to the BoC.

- EM – The Lira and Peso are under pressure vs the Buck on bearish specific/independent impulses, as softer than expected Turkish CPI could prompt the CBRT to tweak its tight monetary stance on Wednesday, or even shift guidance in preparation for an ease ahead, while the Mxn is clearly feeling the adverse effects of S&P’s move to credit watch negative from stable. Note, Usd/Try is currently around 5.3850 vs almost 5.4000 at one stage and Usd/Mxn circa 19.3500 vs 19.3820 earlier, while in stark contrast the Thai Central Bank has been forced to curb excess Thb strength with a 31.75-85 range.

Brent (+0.7%) and WTI (+0.9%) are benefitting from the positive trade sentiment following reports that US and China are in the final stages of completing a trade deal, alongside China’s spokesperson Zhang stating that substantial progress has been made. Adding to the upside is Friday’s Baker Hughes rig count where US oil rigs fell by 10 to 843, the lowest level since May 2018. Elsewhere, Russian oil output was 11.34mln BPD in February, 75k barrels below the October baseline level; according to Energy Ministry Data. Separately, Barclays have maintained their Brent price forecast, stating that prices have moved in-line with their view however Barclays does note that downside risks remain. Gold (-0.4%) prices are weaker weighed on by the positive risk sentiment, with the yellow metal trading towards the bottom of a USD 10/oz range. Elsewhere, Vale have, on a temporary basis, removed its Chief Executive Schvartsman, along side 3 other executives following recommendations by both state and federal prosecutors. Elsewhere, nickel futures, which is used to make stainless steel, have climbed to around a 5-month peak, as the price of stainless steel continues to rise with Chinese steel mills actively replenishing their stocks in-spite of the rising prices; although some mills have been delaying purchases due to the price increase.

US Event Calendar

- 10am: Construction Spending MoM, est. 0.2%, prior 0.8%

DB’s Jim Reid concludes the overnight wrap

Happy Monday. I’m so dazed I hardly know what day of the week it is. I’ve had the most virulent strain of man-flu imaginable and spent a lot of the weekend in bed drained and with a hacking cough. I wasn’t very popular at home as you can imagine. Bronte the dog has been so worried that every time I go to sleep somewhere she curls up next to me. It’s fair to say that my wife hasn’t replicated this.

If I live to see it, the highlight this week is likely to be the ECB meeting on Thursday. We’ll also see the start of China’s NPC (Tuesday – 15th March) and the latest employment report in the US (Friday). The final PMI revisions (Tuesday) are also likely to be closely watched and you never know when you’re going to get the next US/China trade headline.

Speaking of which, overnight the WSJ broke a story highlighting that the US and China are close to a trade deal that could lift most or all US tariffs as long as China follows through on its pledges ranging from better protecting intellectual-property rights to buying a significant amount of US products (increasing by $1.2tn over 6 years). Specifically, its being reported that China would buy $18bn in natural gas from Houston-based Cheniere Energy Inc. Elsewhere, the WSJ reported that the likely summit between President Trump and his Chinese counterpart Xi Jinping could happen around 27th March. The WSJ report added that China is offering to lower tariffs on US farm, chemical, auto and other products while pledging to speed up the timetable for removing foreign-ownership limitations on auto ventures, and to reduce tariffs on imported vehicles to below the current rate of 15%. China’s National People’s Congress spokesman Zhang Yesui also said that substantial progress has been made in trade talks before the start of legislative meetings. Meanwhile, after extending the deadline last week of a planned tariff increase on March 1, Trump has tweeted that “I have asked China to immediately remove all Tariffs on our agricultural products (including beef, pork, etc.) based on the fact that we are moving along nicely with Trade discussions….”

Sentiment has improved overnight on the positive trade headlines with China’s bourses leading the advance – the Shanghai Comp (+3.05%), CSI (+3.47%) and Shenzhen Comp (+3.95%) are all up. The Nikkei (+1.09%), Hang Seng (+1.22%), and Kospi (+0.09%) are also up. In the meantime, China’s onshore yuan is up +0.24%. Elsewhere, futures on the S&P 500 are +0.45% and in commodities, US futures on corn and soybeans are up +0.74% and +0.63%, respectively.

Also over the weekend, (per Bloomberg) Mr Trump commented on the Fed again saying that there is “a gentleman that likes raising interest rates in the Fed, we have a gentleman that loves quantitative tightening in the Fed, we have a gentleman that likes a very strong dollar in the Fed.” In response the dollar is (-0.11%) slightly weaker overnight and 10yr Treasuries are up +1.0bps. Sterling is also up +0.25% on incrementally more positive Brexit noises. See later for more details.

Now going back to the highlights of the week ahead. While no change in policy from the ECB is expected, we will get updated staff forecasts (which are likely to show downgraded growth forecasts) and perhaps further hints about TLTRO2. Recent ECB commentary and the accounts of the January ECB meeting clearly signal that addressing TLTRO2 maturity is on the agenda, although its not clear that a decision will come as soon as Thursday’s meeting. Nevertheless, it’s likely to be a topic of discussion. Our economists believe that at the very least, it is appropriate for the ECB to implement a TLTRO2 solution that allows net exposures to be rolled over. This would help the ECB to preserve its monetary policy stance and prevent a temporary economic slowdown from propagating through unnecessary deleveraging, especially in the periphery.

Also of significance for markets is China’s National People’s Congress which officially gets underway on Tuesday and runs through until March 15th. Premier Li will present the government’s draft working plan on Tuesday and the details of the government’s draft budget will come out on Wednesday. Throughout the 10 days we’re also expecting the PBoC and ministries to hold press conferences which may send important policy messages. Our China economists expect the Chinese government to keep the policy stance flexible at this stage without committing to aggressive loosening measures. On growth, our colleagues expect the government to lower the GDP growth target for 2019 to “above 6%” or “between 6% and 6.5%”, which would represent a downward revision from “around 6.5%”. They expect the official fiscal deficit target to be around 2.8% to 3.0% of GDP, up from 2.6% in 2018, and also for the government to announce a total of RMB 1.2-1.5tn of tax cuts. On monetary policy, the team expect the government to reiterate the “prudent” monetary policy stance and no change in policy stance to the property sector.

Meanwhile, the big data highlight next week comes on Friday when we get the February employment report in the US. The consensus is for another solid round of data. Expectations for payrolls is 185k which as a reminder follows a much stronger than expected 304k print in January. Earnings are expected to have risen +0.3% mom which if true, would likely push the annual rate up one-tenth to +3.3% yoy and so matching the highs from the end of last year. The unemployment rate is expected to fall a tenth to 3.9% and hours hold at 34.5 hours.

Away from that, other data worth flagging in the US includes the final February PMIs and ISM non-manufacturing (+0.5pts to 57.2 expected) on Tuesday, the February ADP report on Wednesday, claims on Thursday and housing starts and building permits on Friday. In Europe, the highlight is the final February PMIs on Tuesday. We’ve already had the flash readings and as a reminder that the services and composite readings for the Euro Area were 52.3 and 51.4 respectively. Expect the main focus to be with Italy and France though where both services readings are hovering below 50. Other than that, we’ll also get the final Q4 GDP reading for the Euro Area on Thursday prior to the ECB meeting. No change from the +0.2% qoq/+1.2% preliminary readings are expected. Finally in Asia we’ve got the February PMIs in Japan and China on Tuesday, and China trade data on Friday. The rest of the day by day week ahead is at the end.

Recapping last week now. On Friday, attention was dominated by trade negotiations and communications from central banks. Equities rallied with the S&P 500, DOW, and NASDAQ ending the week +0.62%, +0.57%, and +0.74% (+0.64%, +0.70%, and +0.91% on Friday), respectively. In Europe, the STOXX 600 gained +0.62% (+0.22% Friday), with the DAX outperforming, up +1.40% (+0.30% Friday). Commodities rallied as well, with Brent crude oil advancing +1.15% (-0.09% Friday) and copper posting its best week since last September to reach its highest level since last June, gaining +5.40% (+1.81% Friday). Basically markets exposed to China did well as the Shanghai Comp. climbed +6.77% on the week and 1.80% on Friday. The offshore yuan appreciated +0.91% on the week (+0.21% Friday) to reach its strongest level since last July.

One of the most important moves last week were the rising yields. 10 year Treasuries, Bunds, Gilts rose 9bp, 7.4bp and 12.3bps respectively on the week but rallied off the yield highs on Friday on disappointing US data led by the manufacturing PMI declining 2.4 points to 54.2 vs 55.8 expected. The reason Gilts rose as much as they did is that the threat of a no-deal Brexit on March 29th seems to have been reduced to close to zero. The chances of Mrs May’s deal being passed before that seem to be increasing as the weekend press disclosed the terms that the ERG would require to support the deal. It does seem that their demands suggest a desire to compromise but all depends on how legally tight any agreement between the U.K. and EU over the temporary nature of the backstop can be. Expect numerous headlines on this this week.

Quickly recapping Friday’s central bank speak. Banque de France Governor Villeroy mentioned that the ECB should “study pragmatically how to contain possible adverse effects on the bank transmission of our monetary policy”. That mirrored earlier comments from the BoJ Governor Kuroda, who said that any future easing would come via tools that have the “least side-effects”. These could be references to some alleviation of the harm from negative interest rates. In the US, many Fed speakers spoke at a conference in New York, including Vice Chair Clarida who said that yield curve control, where 10-year yields are pegged, is one potential option to fight a future recession. The Fed will conduct a thorough review of its policy framework later this year.

via ZeroHedge News https://ift.tt/2IQlK14 Tyler Durden