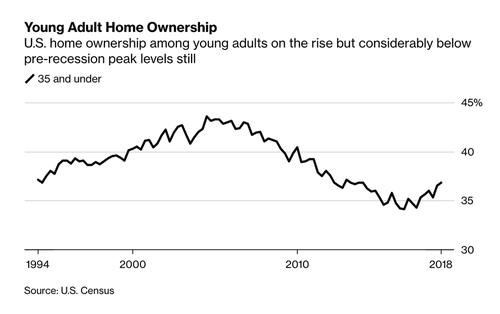

Millennial homeownership has collapsed. About 1 in 3 millennials owned a home as of 2018, according to the U.S. Census Bureau. That’s a nine percentage point drop than baby boomer homeownership rates at ages 25 to 34, signaling the American dream is becoming less affordable.

Even millennials who own homes are having second thoughts. A little more than two-thirds, or 63%, of millennials regret buying their home, according to a new Bankrate survey.

Overall, 44% of homeowners said they had regrets about buying a home while 56% had no buyer’s remorse. Homeowners (18%) cited unexpected maintenance bills that strained their finances, with more than 25% of millennials echoing similar thoughts, the survey found.

Allocating funds to cover expenses can be challenging for millennials after making a sizable down payment and covering closing costs, says Luis Rosa, a financial planner in Nevada.

“When you buy a house, you can’t call the maintenance company or a landlord to fix major issues; it’s all on you,” Rosa told Bankrate, adding that these expenses, such as a new air conditioner, refridgeartor, water heater, and or roof, often take first-time millennial buyers by shock. “I always advise homebuyers to create savings buckets and open a savings account that can collect interest that’s set aside specifically for housing repairs.”

About 79% of Americans believe that homeownership is a large segment of the American dream, ahead of retirement (68%), having a strong career (63%) and owning an automobile (58%), the Bankrate survey found.

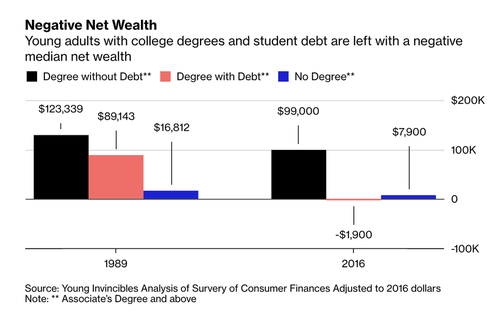

Although Americans view homeownership as a desirable goal, most cannot afford to own due to an affordability crisis, stagnant wage growth, and too much debt.

Half of the survey respondents who don’t own – say their incomes are too low to buy. That sentiment reflects the affordability crisis that is prevalent in major U.S. metropolitan areas (Atlanta, Boston, Charlotte, Chicago, Cleveland, Dallas, Denver, Detroit, Las Vegas, Los Angeles, Miami, Minneapolis, New York, Phoenix, Portland, San Diego, San Francisco, Seattle, Tampa and Washington, D.C.). Median home prices increased much faster than average weekly wages in these cities, which has since triggered the crisis.

To make matters worse, 41% of Americans who don’t own say they can’t even afford a down payment and closing costs, and one-third cite lofty home prices as a significant hindrance.

For millennials, the $1.5 trillion student loan debt crisis is preventing most from achieving the American dream, or other life goals such as marriage and having children.

According to the latest figures on housing affordability from the National Association of Realtors (NAR), the housing affordability index (HAI) dropped from 167.1 in 2016, to 146.2 at the end of 2018. The HAI is a measure of home affordability and suggests that the crisis is worsening.

Given that millennials, who will make up a majority of the workforce in the next several years, represent a considerable homebuyer segment, but with affordability issues expanding, the crisis will only deepen.

While home prices have continued to outpace inflation, the rate of income growth has not kept up with inflationary trends. Given that millennials are still in financial ruins, they offer a unique insight into an upcoming trend where owning a home is not viewed as the American dream. What is even more disturbing, millennials who already own want out.

via ZeroHedge News https://ift.tt/2F3JIBS Tyler Durden