Yesterday was the long awaited deadline for Elon Musk to explain to the SEC why his recent (grossly erroneous) Tweet regarding annual production – a Tweet that had to be amended by his lawyers 4 hours after it went out – didn’t violate Musk’s already existing settlement with the SEC over another far more grossly fraudulent Tweet, when he lied that he had a buyout offer lined up for his $60 billion company.

The SEC had sought to hold Musk in contempt of court as a result of his recent Tweet and after figuring out that Musk had not had his Tweet pre-approved by company lawyers, as is required by his “funding secured” settlement with the SEC. Recall, on February 19, Musk Tweeted that Tesla would make “around 500K cars” in 2019.

Tesla made 0 cars in 2011, but will make around 500k in 2019

— Elon Musk (@elonmusk) February 20, 2019

This production target immediately caused a stir on Twitter, with many of the company’s critics pointing out that Tesla’s run rate for the rest of the year would have to be breakneck and record-setting in order to substantiate such production. Some chose to forego pleasantries and simply call Musk out immediately after the Tweet. Short seller Mark Spiegel, for instance, called the guidance “100% fraudulent” minutes after Musk Tweeted it out.

Musk’s response as to why he should not be held in contempt for this Tweet was laughable, if not sad at this point.

For example, it opens with a little light comedy, stating that production numbers – the lifeblood of the company’s relationship to Wall Street – were immaterial, also claiming that the Tweet “dutifully complied with the [settlement] Order”.

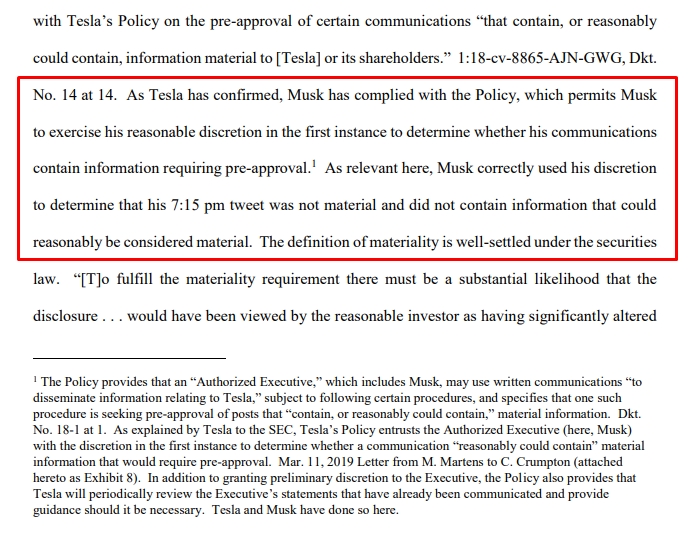

He then went on to argue semantics with the SEC settlement, claiming that he could act as his own “Authorized Executive” to pre-approve his own Tweets. The response astonishingly claims that Musk, not the company’s lawyers, are permitted by the settlement to determine whether or not his Tweets are of a material nature first.

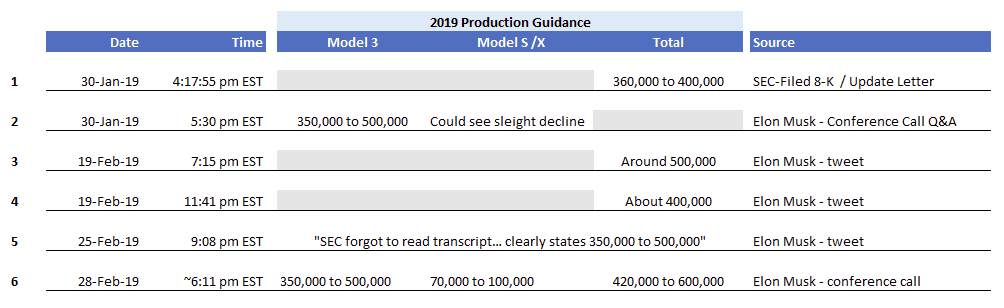

His lawyers then argue that Musk’s guidance was “entirely consistent with prior public disclosures detailing Tesla’s anticipated production volume,” which this Tweet from Twitter sleuth Keubiko shows to be hilariously incorrect, as Tesla has disclosed a vast number of guidance projections going forward.

(Chart source: @Keubiko)

Musk’s lawyers then claimed that the Tweet was “celebratory and forward-looking—a type of statement that courts have concluded is immaterial as a matter of law.”

Musk then says that he has “dramatically reduced” his volume of Tweets regarding Tesla in particular. “Musk has cut his average monthly Tesla-related tweets nearly in half,” the response later argues. He did not say anything about dramatically reducing the number of secret conference calls the company was undertaking, however.

As if there was any doubt that Musk was officially “fighting” the SEC, he alleges that the contempt motion was done in “retaliation and censorship” based on comments that Musk made on 60 Minutes, when he made it clear that he “did not respect the SEC”.

His lawyer argued that the “contempt action, following Musk’s sincerely-held criticism of the SEC on 60 Minutes, also reflects concerning and unprecedented overreach on the part of the SEC.” Musk also later calls the SEC motion an “unconstitutional power grab”, seemingly unaware that Musk theoretically waived his first amendment right when he entered into a settlement that would constrain what he could and could not say on Twitter.

To end this shitshow response, Musk finally asserts that he only changed his Tweet four hours later “out of an abundance of caution and because pundits and others were consistently looking for any reason to criticize me or Tesla”.

* * *

In related news, Morgan Stanley downgraded the company this morning, saying that Tesla will be hitting “an air pocket in demand that is coming earlier that we expected”. They also wrote in a note this morning, lowering their price target to $260 from $283:

- For what many investors believe to be a high growth tech firm, TSLA has made notable moves to cut costs/prices & stimulate orders.”

- Firm cuts first- quarter delivery view by 23% “to allow for sluggish U.S. sales and potential impediments to international deliveries”

- “We expect the share price to remain in a volatile range with modest downside to our assessment of fair value”

- Stock is “fundamentally overvalued while potentially strategically undervalued”

- Investors should “keep medium/long-term expectations for Tesla’s ability to run a profitable Chinese business very low, due to a variety of technological and legal/regulatory factors”

Tesla shares are lower by about 2% in the pre-market session. We look forward to a judge ruling on the SEC’s motion and will follow the story closely.

via ZeroHedge News https://ift.tt/2CheJk9 Tyler Durden