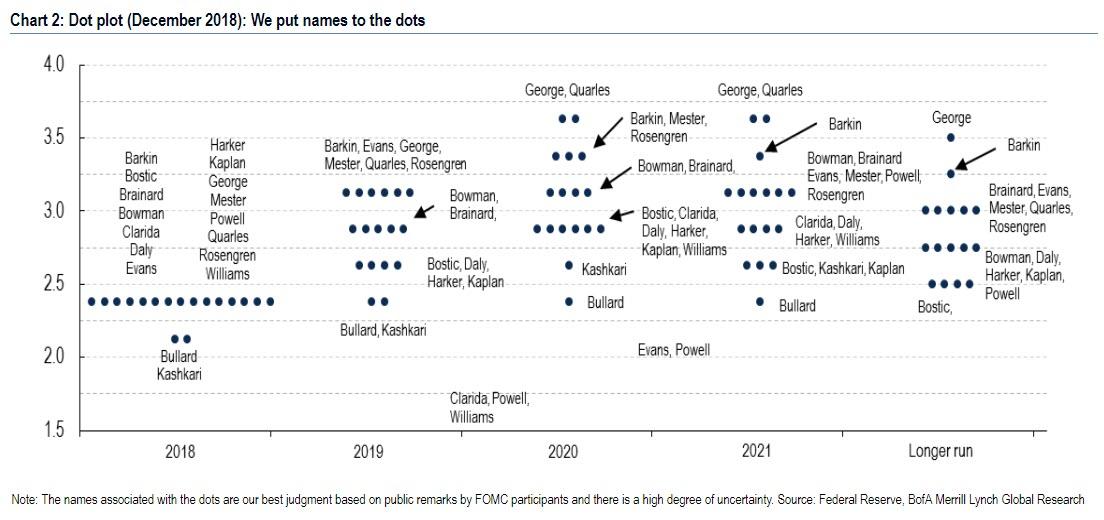

As discussed over the weekend, when looking at Wednesday’s FOMC announcement, the market appears to be focused on one of two possibilities: a dovish Fed, where the dot plot is cut to 1+1 hikes in 2019/2020 or a very dovish Fed, in which the Fed projects 1 hike in 2019 and none in 2020, with an appropriate cut to the Fed’s Summary of Economic Projections. As a result, BofA even laid out a comprehensive analysis looking at which FOMC member would have to lower their dots to reach this new level:

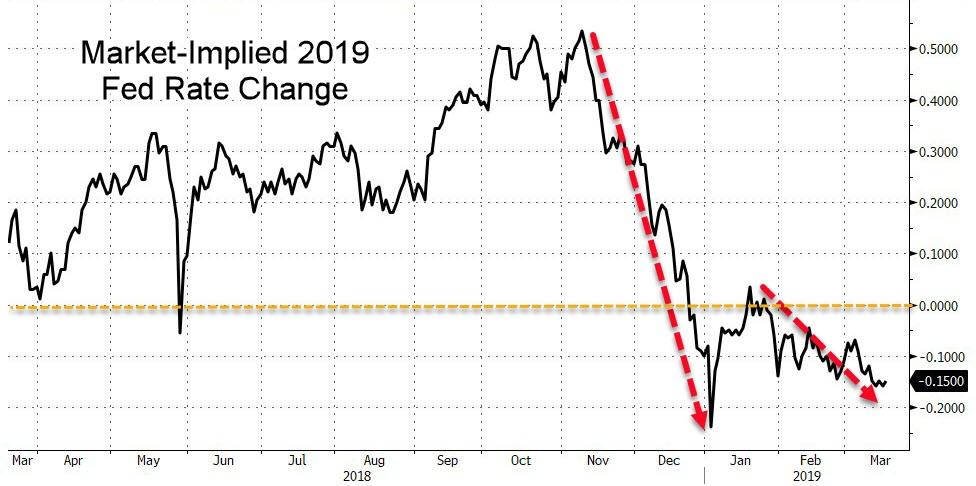

To be sure, the market is already pricing in an uber-dovish Fed, with the Fed Funds market already expecting a rate cut in 2020.

Meanwhile, virtually nobody expects a hawkish surprise. Commenting on a potential reversal by Powell, earlier today Std Chartered’s Steven Englander said that given the shift in Fed rhetoric and market pricing, staying at two + one would be very hawkish because even though investors discount the dot plot projections, they “would be concerned that the shift in narrative was not visible in the projections. Two projected hikes in 2019 would suggest that the Fed would either be expecting a hike in June or two hikes in a row in H2-2019. Investors would see that as suggestive that FOMC members were seeing a pause, but not an end, to the hiking cycle.”

This would lead to a prompt and violent selloff in risk assets as the “one and done” narrative ends with a bang – at least until the market drop forces the next Powell Put – and lead to even angrier outbursts from the president. Worst of all, it would further cripple the Fed’s credibility, as the central bank will be seen as flip-flopping twice in just three months, driven entirely by the market.

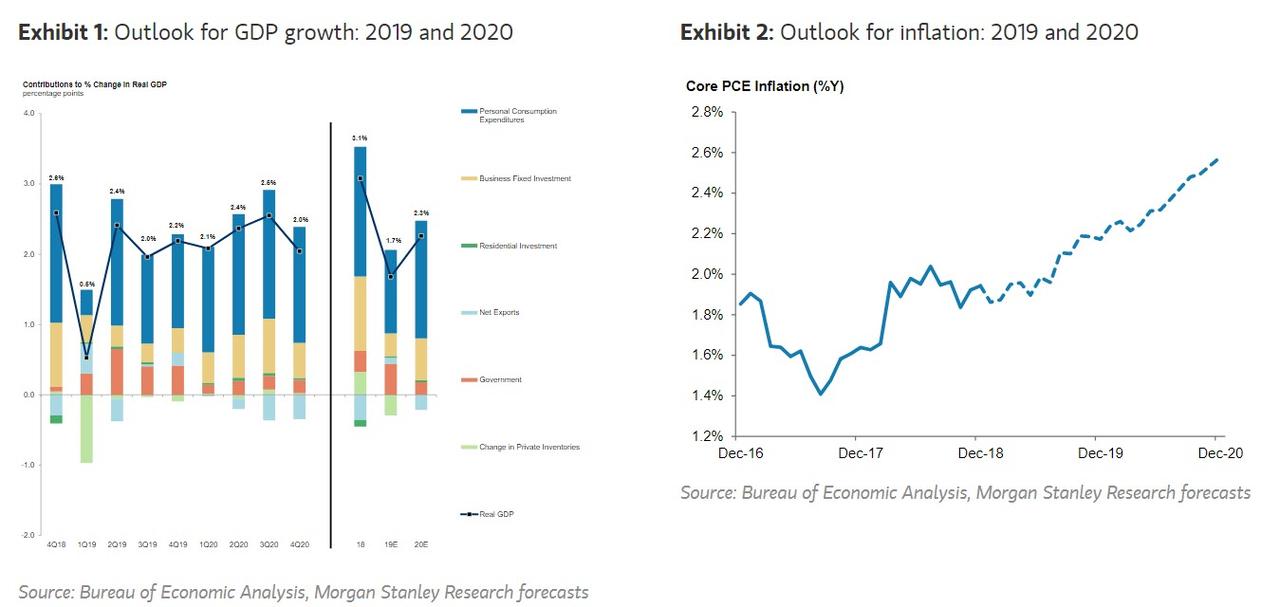

Incidentally, a surprisingly hawkish Fed is not out of the picture: as Morgan Stanley predicted last week, the Fed will not only hike once in 2019 (December) but also hike a total of three more times in 2020.

Needless to say, such an outcome would be devastating for both Treasuries and risk assets, as it crushes both the “indefinite pause”, and QE4 narratives, and it will be up to the market to once again force the Fed’s hand to turn even more dovish, something which as December demonstrated may not happen before the S&P drops back to 2,300.

Most importantly, however, the market is convinced that this outcome is impossible without the Fed laying the verbal groundwork for a hawkish “surprise”; Since this has yet to take place – if ever – investors are comforted that the only possible surprise on Wednesday is whether Powell comes out just modestly dovish or very, very dovish.

Yet just maybe, 2019 is – as some bulls dread – a rerun of 2016 when the Fed, following a lengthy pause as a result of Chinese turmoil, resumed its rate hikes.

Making precisely that case on Monday afternoon was former NY Fed president Bill Dudley who said that the Fed’s tightening may be “back in play” later this year.

“I think what is going to happen is we are going to have a pretty weak first quarter, and that’s going to cause the Fed to wait for even more information,” the former New York Fed President said during a Bloomberg TV interview with Scarlet Fu and Caroline Hyde.

“But if the economy picks up speed again, as I expect will happen, and inflation starts to drift higher” as Morgan Stanley predicted it will last week “then the Fed will be back in play, maybe as early as the second half of this year,” Dudley said, effectively echoing Morgan Stanley’s 2019/2020 forecast.

“The key issue is, if inflation stays low, then it’s going to be hard for the Fed to hike. If inflation starts to drift up — and we’ve seen some acceleration in wages — then I think that puts Fed tightening back on the table”, the former head of the most important Fed told Bloomberg.

Meanwhile, looking at Wednesday’s announcement, Dudley said that “we’re just going to hear about how we are going to end the balance-sheet runoff. Maybe we will hear a little bit about the composition between Treasury bills, notes and bonds, but I’d be surprised if they got to the bigger issue of the composition of the balance sheet, and how we’re going to get there.”

While Dudley is no longer on the FOMC, there is a distinct possibility that he is being used as a conduit to disseminate the “less than pleasant” possibility of a Fed that returns to tightening as soon as the Q1 period of weakness – where GDP is expected to drop as low as 0.5% – is over. In such a case, it is very possible that 2019 ends up being a mirror image of 2018, a year where stocks stampede to all time highs in the late summer, only to tumble later in the year when Powell once again “shocks” everyone by announcing that the neutral rate is a long way away, and that the Fed will aggressively hike well into 2020.

On the other hand, judging by the S&P’s ramp into the close, not a single algo believes that the Fed is even close to an even mildly hawkish surprise on March 20, which is just as problematic for the Fed should it indeed find itself behind the inflationary curve as first Morgan Stanley and now Bill Dudley believe will happen.

via ZeroHedge News https://ift.tt/2Hu5OjA Tyler Durden