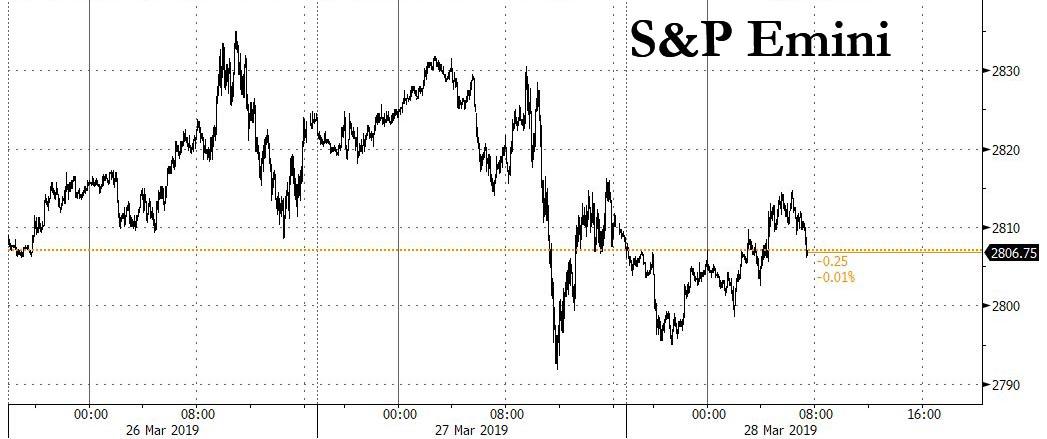

While global markets showed tentative signs of a rebound in sentiment in early Thursday trading, as the global bond rally showed signs of easing, with Treasuries turning lower alongside most sovereign debt in Europe, this quickly reversed around the time US traders start showing up at their desks, and European stocks faded almost all of their earlier gains, while U.S. equity futures drifted, once again within striking distance of the 2,800 key level.

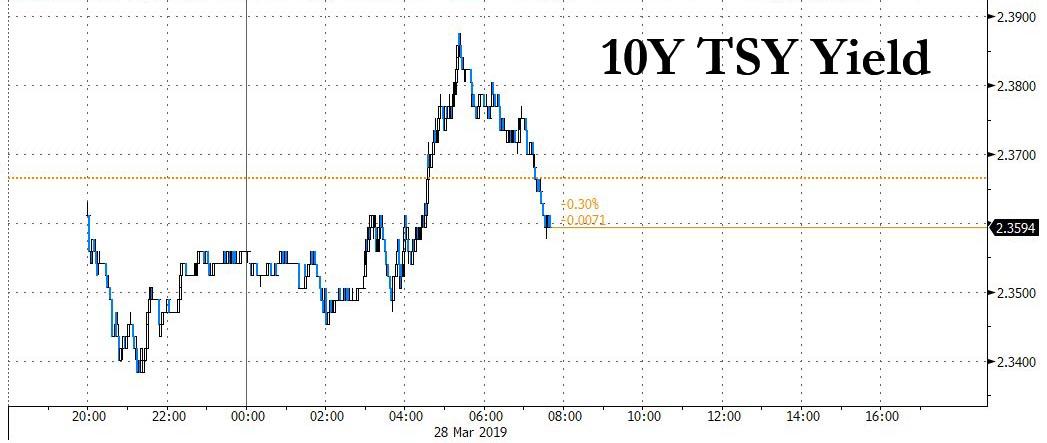

After the 10-year US Treasury yield crept back above 2.37% during Asia trading, a renewed flight to safety saw the yield on the benchmark paper slide in the red again, as global bond yields continued to spiral lower on Thursday as recession fears fed expectations of more policy easing by major central banks, with the 10Y trading below 2.36% at last check.

After shares slumped in Japan and fell in China and South Korea at the start of trading, contracts on the S&P 500 pointed to a modestly red open fading an earlier rebound, while the Stoxx Europe 600 paring earlier gains of as much as 0.4 percent, with banking stocks the regional benchmark’s weakest sector. The Stoxx 600 was steady as of 11:36am in London, with the index tracking banking stocks dropping 1.3% following fresh turmoil in Sweden over money-laundering, while healthcare gauge climbs 0.8%. Rating agency S&P became the latest to cut its euro zone growth forecasts while a Reuters report that the United States and China had made progress in all areas in trade talks seemed to bolster sentiment a little, though sticking points still remained and there was no definite timetable for a deal.

Worries that the inversion of the U.S. Treasury curve signaled a future recession only deepened as 10-year yields fell to a fresh 15-month low at 2.34% on Wednesday. “We think that the ongoing flattening, or outright inversion, of the curve is a bad sign for equities, as it usually has been in the past,” said Oliver Jones, markets economist at Capital Economics. “Arguments that the yield curve is no longer a reliable indicator seem to resurface every time it inverts, only to be subsequently proved wrong.”

Meanwhile, Chinese Premier Li said world economy faces slower growth and increasing uncertainties, while he added that some fluctuation in quarterly economic growth this year cannot be ruled out. Chinese Premier Li further commented that China must achieve goal of tax and fee cuts this year, while it will also publish a revised negative list for foreign investors and will treat domestic and foreign companies equally. Separately, adding that changes in their economy in March have exceeded expectations, adds that China’s economic operations were steady in Q1.

US administration official said US and China made progress in all areas of trade talks but enforcement and intellectual property remain sticking points, while China was also said to have made proposals on trade including tech transfers that are more specific and with wider scope than ever before. However, the official added that there is no specific timeframe for a trade deal with talks to conclude anytime from April-June and whether to lift current US tariffs on China is a sticking point and will be worked out as part of a deal. Subsequently, Chinese Premier Li said China must protect IP to support China’s transformation, adding that he does not think there is a trust deficit between US and China.

As the flight to safety accelerated, so did the rise in the dollar, which headed for a fifth gain in six sessions, while Britain’s pound weakened after the U.K. Parliament rejected eight possible options for a new Brexit strategy.

But it was the Turkish lira, one of the currencies at the heart of last year’s emerging market meltdown, which was once again the overnight highlight as plunged as much as 5% against after the central bank unveiled that it had burned through a third of its reserves in 1 month and the attempt to crush shorts had ended, inviting a fresh wave of bears. As Reuters notes, authorities were showing the first sign of easing a draconian squeeze put on international lira traders ahead of local elections this weekend but a day after the country’s stock market also slumped there was little good will. Ugras Ulku at the International Institute of Finance in Washington said the question was, when the dust settles, whether portfolio managers want to continue to invest in Turkey or not “we will have to wait and see,” he said

Elsewhere, hints of rate cuts from New Zealand’s central bank had the desired effect on its currency, which was pinned at $0.6816 after diving 1.6 percent overnight. The Aussie was on the defensive at $0.7090. Draghi’s comments likewise kept the euro back at $1.1250, and left the U.S. dollar a fraction firmer against a basket of its competitors at 96.874. Only the yen held its own thanks to its safe-haven status and firmed to 110.00 per dollar.

The Swiss franc’s surge to a 20-month high hasn’t spooked strategists at Credit Agricole CIB out of their bearish view. The Swiss National Bank is unlikely to tolerate further franc strength, which would threaten policy makers’ battle against deflation, and may rein in the exchange rate via currency interventions, according to the bank

In commodity markets, palladium was the focus of attention after sliding 7 percent on Wednesday as its meteoric rally finally ran into profit-taking. It was down 0.4 percent on Thursday. Gold was relatively sedate at $1,310.85 per ounce. Oil prices nursed modest losses after data showed U.S. crude inventories grew more than expected last week as a Texas chemical spill hampered exports.

Economic data include initial jobless claims and the final print of quarterly GDP. Accenture is due to report earnings.

Market Snapshot

- S&P 500 futures little changed at to 2,811.50

- STOXX Europe 600 up 0.06% to 377.51

- MXAP down 0.4% to 158.73

- MXAPJ up 0.1% to 523.64

- Nikkei down 1.6% to 21,033.76

- Topix down 1.7% to 1,582.85

- Hang Seng Index up 0.2% to 28,775.21

- Shanghai Composite down 0.9% to 2,994.94

- Sensex up 0.9% to 38,457.70

- Australia S&P/ASX 200 up 0.7% to 6,176.08

- Kospi down 0.8% to 2,128.10

- German 10Y yield rose 0.4 bps to -0.077%

- Euro down 0.03% to $1.1241

- Brent Futures down 0.7% to $67.37/bbl

- Italian 10Y yield fell 1.4 bps to 2.1%

- Spanish 10Y yield rose 1.4 bps to 1.07%

- Brent Futures down 0.7% to $67.37/bbl

- Gold spot down 0.1% to $1,308.46

- U.S. Dollar Index up 0.3% to 97.02

Top Overnight News

- Britain’s political standoff over Brexit escalated further, with even Theresa May’s announcement that she’ll quit as prime minister doing nothing to move closer to a resolution

- Federal Reserve Bank of Kansas City President Esther George says it was appropriate to put policy on hold after the central bank’s interest-rate increases last year. Asked if the Fed’s quarter- point hikes in September and December had been mistakes, George replied: “No, I do not think we made a mistake in September. I was one who advocated for a long time concern about low-for-long interest rates”

- Investors dumped Turkish bonds and stocks on Wednesday after the nation orchestrated a currency crunch to prevent the lira from sliding days before an election that will test support for President Recep Tayyip Erdogan’s rule. The cost of borrowing liras overnight on the offshore swap market soared past 1,000 percent at one point on Wednesday

- China’s economy is showing further signs of recovery after months of slowdown, though downward pressures still persist. That’s according to a Bloomberg Economics gauge aggregating the earliest available indicators on market sentiment and business conditions

- U.S. and China have made progress in focus areas under the trade talks, Reuters reports, citing four senior U.S. administration officials. One official said China had come up with proposals on forced tech transfers that went further than in the past in terms of scope and specifics

- The European Central Bank’s chief economist says there needs to be a solid monetary-policy case before officials act to mitigate the side effects of negative interest rates on banks. ECB staff are examining the issue of tiering — where some of banks’ excess reserves are exempt from the lowest rate — but action isn’t a done deal, Peter Praet says

- Thailand’s pro-military party won the most votes in Sunday’s election, authorities confirmed on Thursday, bolstering its claim to legitimacy as it competes with an anti-junta alliance to form a government

Asian equity markets traded mostly negative as the downbeat sentiment rolled over from US where all major indices finished lower amid lingering growth concerns and as the yield curve inversion deepened. As such, ASX 200 (+0.7%) opened subdued but with losses eventually pared by resilience across nearly all sectors, while Nikkei 225 (-1.6%) underperformed and briefly slipped below the 21000 level with selling exacerbated by a firmer currency and rotation into bonds. Elsewhere, Hang Seng (+0.2%) and Shanghai Comp. (-0.9%) were also cautious with weakness in financials due to earnings in which China’s 2nd largest lender China Construction Bank missed on FY net forecasts and posted its first quarterly Y/Y profit decline since 2015 which doesn’t bode well for the other Big 4 banks to report this week, while China Life Insurance also posted a near-65% drop in FY net. Nonetheless, sentiment in China slightly improved as US and China senior trade negotiators began the latest round of trade talks in Beijing and a Trump administration official suggested progress was made in all areas of trade talks but some sticking points remained. Finally, 10yr JGBs were supported by the negative risk tone in Japan and amid the recent bond market rally as global yields declined in which the US 10yr yield fell to a fresh 15-month low and the Aussie 3yr yield printed its lowest on record, while the results of today’s 2yr auction were also bullish as all metric improved from the prior month, albeit marginally.

Top Asian News

- Sony’s Turnaround Architect Retires as Tech Giant’s Growth Slows

- Guinigundo Sees Flexibility to Consider Philippine Policy Easing

- China’s Economy Shows More Signs of Recovery, Earliest Data Show

- Thai Pro-Military Party Won Most Votes in General Election

Major European indices have gained some traction following a subdued start to the session [Eurostoxx 50 +0.2%] as the region diverges from the downbeat sentiment experienced in Asia. UK’s FTSE 100 (+0.6%) outperforms its peers as the weaker domestic currency bolsters the export-heavy index. Sector-wise, material stocks lead the gains as base metals benefit from recent turnaround in the risk sentiment whilst utility names lag as investors move away from defensive sectors. In terms of notable movers, Swedbank (-3.7%) shares took another hit amid the slew of open investigations in relation to money laundering. As the bank’s AGM gets underway, it announced that CFO Anders Karlsson has replaced Birgitte Bonnesen as acting President and CEO. Company shares are halted until further notice. Elsewhere, chip names remain pressured in a continuation of yesterday’s sell-off after DAX-listed Infineon (-1.1%) announced a profit warning due to rising global tensions.

Top European News

- Iliad Chairman Lombardini Faces French Market-Abuse Case

- Iceland’s Wow Air Says It Has Ceased Operations

- Hochtief Shares Drop After Atlantia Sells a Quarter of its Stake

- Euro Hits 10-Week Low Versus Yen as German Inflation in Focus

In FX, JPY/NZD were the best G10 performers, albeit off best levels as the Usd retains a firm underlying bid in its own right as a safe-haven amidst a tentative and intermittent revival in broad risk appetite. Usd/Jpy is holding above 110.00 within a 110.03-53 range having tested bids/support just ahead of the big figure where decent option expiry interest resides (1 bn) and is back above daily chart resistance between 110.07-12, while Eur/Jpy has also rebounded from sub-124.00 lows and heavy Japanese selling that pushed the cross down through a key Fib (123.81) at one stage. Meanwhile, the Kiwi has regained some composure after its post-RBNZ rout to reclaim 0.6800 status, but Nzd/Usd remains vulnerable following a marked deterioration in NZ business sentiment and expectations according to ANZ’s March survey, which provides more justification for the change in rate guidance towards an ease vs a neutral stance previously. Note, RBNZ Governor Orr is due to orate later on the new framework for monetary policy.

- AUD/EUR – Also weathering a bout of downside pressure relatively well, as the Aussie keeps tabs on the 0.7100 handle vs its US counterpart and remains above 1.0400 against the Nzd, however Aud/Usd could be hampered by a 1 bn expiry ahead of the NY cut along with dovish positioning for next week’s RBA on the notion that the balance of risks could shift towards cutting benchmark rates from a balanced prognosis at present, ala the RBNZ. Meanwhile, the single currency succumbed to spill-over Jpy cross sales vs the Usd that forced the headline pair through recent lows and chart support (at 1.1241), but not much further as it consolidates back above the 76.4% Fib retracement of the 1.1177-1.1448 move.

- GBP/SEK/NOK/CAD/CHF – All lagging their major peers, and especially the Pound, Swedish and Norwegian Crowns. Cable has fallen below a fairly resilient 1.3150 mark following the latest UK Parliamentary votes on Brexit ended with no majority support for any of the 8 options tabled, and in fact resounding rejection in 6 instances, leaving the situation even more uncertain than it was before the HoC took the baton from PM May. Meanwhile, Eur/Nok and Eur/Sek have both bounced further in wake of yesterday’s worse than expected Norwegian jobs data and as Swedbank suffers more investor angst over money laundering allegations, with the former up to 9.7465 and latter at 10.4935 before easing back. The Loonie is also weaker post-data, between 1.3400-30 vs its US rival, with the Franc still somewhat mixed as it pivots 0.9950 vs the Greenback and 1.1200 against the Euro in advance of a speech from SNB’s Maechler that could fan speculation about intervention to curb excess Chf strength/demand.

- DXY – The index has climbed into a higher range after recent declines amidst falling US Treasury yields and deeper curve inversion to probe above 97.000, and from a technical perspective the Buck may be able to overcome residual month end flows that are said to be mildly bearish.

- Brazil’s Economy Minister Guedes said that if the pension reform bill of BRL 1tln passes, interest rates would naturally decline by 2 percentage points. (Newswires)

- New Zealand ANZ Business Confidence (Mar) -38.0 (Prev. -30.9). (Newswires) New Zealand ANZ Activity Outlook (Mar) 6.3 (Prev. 10.5)

In commodities, WTI (-0.6%) and Brent (-0.6%) futures languish following yesterday’s pullback, although the benchmarks remain off worst levels amid an improvement in market sentiment. Despite this week’s builds in API and DoE crude inventories (API +1.9mln, DoE +2.8mln), UBS analysts note that both weekly data and for the year thus far are more bullish than usual. Meanwhile, WSJ reported that Saudi Aramco plans to issue a USD 10bln bond, to be used as part of a payment for their 70% purchase of Sabic which is valued at USD 69.1bln, according to sources. On the OPEC+ front, Russian Energy Minister Novak told RIA newspaper that the OPEC+ Charter could be signed in either May or June. Elsewhere, precious metals are pressured by firmer buck with gold (-0.2%) hovering close to its 50 DMA at 1307/oz. Meanwhile, base metals are faring better, with risk-gauge copper bouncing off lows as the risk appetite supports the red metal.

US Event Calendar

- 8:30am: GDP Annualized QoQ, est. 2.3%, prior 2.6%

- Personal Consumption, est. 2.6%, prior 2.8%

- GDP Price Index, est. 1.8%, prior 1.8%

- Core PCE QoQ, est. 1.7%, prior 1.7%

- 8:30am: Initial Jobless Claims, est. 220,000, prior 221,000; Continuing Claims, est. 1.78m, prior 1.75m

- 10am: Pending Home Sales MoM, est. -0.5%, prior 4.6%; Pending Home Sales NSA YoY, est. -3.0%, prior -3.2%

- 11am: Kansas City Fed Manf. Activity, est. 0, prior 1

DB’s Jim Reid concludes the overnight wrap

Last night saw the most exciting European vote in the U.K. since Bucks Fizz won the Eurovision Song Contest in 1981. MPs spent the evening making their minds up on 8 options in relation to Brexit although as expected no majority was found for any path. The vote occurred soon after Mrs May announced to backbench Conservative MPs that she would step down as PM after her Brexit deal was delivered and would not lead the next stage of negotiations. This was aimed at increasing the chances that her WA (MV3) can rise like Lazarus and pass, although as we’ll see later the speaker and the DUP have made it more difficult for the government to try again. Anyway, back to the votes, it is perhaps easiest to list the options available and show the scores on the doors in order of most votes in support of a particular pathway. There were no nul points.

- Putting any deal agreed to a second referendum. Defeated 295-268.

- Permanent customs union. Defeated 272-264.

- Labour’s plan (which includes a permanent customs union, but also involves alignment in a number of other areas). Defeated 307-237.

- Common Market 2.0. (stay in the single market, negotiate a customs union “at least until alternative arrangements” to avoid a hard border in Ireland have been found. Defeated 283-188.

- Revoking Article 50 if a deal has not been ratified and the House does not approve leaving without a deal. Defeated 293-184.

- Leaving with no-deal on 12 April. Defeated 400-160.

- Version of the Malthouse plan (UK offers EU payments for two years in return for market access). Defeated 422-139.

- Seek to remain a member of the EEA and reapply to join EFTA (so single market but not customs union). Defeated 377-65.

In terms of votes in favour, the amendment for a second referendum led the pack, while the customs union proposal was the closest vote, losing by a margin of only 8 votes. Indeed, both amendments achieved more positive votes than May’s deal did the second time round, when it achieved only 242 yes-votes. The pound depreciated -0.58% versus the dollar after the votes were taken, as the odds of continued stalemate and an eventual general election seem to be rising. The plan now is for a possible MV3 on May’s deal before the end of the week, followed by, assuming MV3 fails again, an additional set of indicative votes on Monday. Speaker Bercow said he would eliminate the less popular options and leave only the top few, to see if a majority can be achieved from a shorter list.

In terms of whether there’ll be a third meaningful vote soon, it’s obviously in the PM’s plan this week. However, this will have to circumnavigate Speaker Bercow’s further intervention that said any further vote would still have to comply with his ruling from March 18 that the House couldn’t vote on the same motion again and would require some form of change. Interestingly, he said that the government couldn’t seek to get round this using a ‘paving motion’, which blocks off a route the government could have possibly used to get round his ruling. Also the DUP said (late last night) at this stage they still can’t support the deal. Whether that changes or whether that just means an abstention is not clear although DUP Dodds said that with regards to the Union they don’t abstain. Before this there were signs that Prime Minister May is making some progress in winning over MPs to the deal, with a number of Conservative MPs who opposed the deal on the last meaningful vote saying they would now be willing to support the deal (generally out of a fear from pro-Brexit MPs that any alternative would only be a softer Brexit than the PM’s deal, or possibly no Brexit at all). However, without the DUP they will likely need a fair amount of Labour MPs on their side. Also, one wonders that with Mrs May now going, will loyal remain Tory MPs be fearful of a harder Brexit replacement PM and decide to vote against it to stop a Brexit that might then get handed over to the hard Brexiteers.

Outside of Brexit, the biggest story was the interaction of Draghi’s comments, European bank stocks, deposit tiering, and a big rates rally. On page 6-7 of our recent “How to fix European banks… and why it matters” (see here ) we explained how strange it was that of all the central banks operating with negative rates, the ECB were the only one not offering deposit tiering. Implementing this was a small part of our policy recommendation list. Recent news hasn’t suggested they were close to this, but things moved quite quickly yesterday. First, we had an early morning Reuters story which said that the ECB were looking at the idea of a tiered deposit rate and then at lunchtime Draghi said that “if necessary, we need to reflect on possible measures that can preserve the favourable implications of negative rates for the economy, while mitigating the side effects, if any.” The ECB have been worried that moving to such a system would lead to concerns that this signals rates staying low or negative for much longer. To be fair, this was what happened yesterday as Bunds rallied -6.6 bps to -0.081% with the front end of the curve flattening even more. Euribor futures for December 2019 and 2020 rallied by -4 and -7bps to their lowest levels ever, leaving the curve as flat as a pancake through the next six quarters. A 10bps hike is not fully priced in until March 2021.

This morning ECB’s Chief Economist Peter Praet has said that the tiered rate would need a monetary-policy case while adding that the lending conditions are not impaired and there is no need to rush for tiering. On TLTRO, he said that the ECB could decide on pricing at its June meeting while adding that the conditions could change during the program.

European banks made strong advances on the news though, albeit on a risk-off day with the STOXX Banks index up +1.85% with Italian banks +1.59%. Another side effect was a rally in 10yr BTPs, -1.4bps lower on the day and -10.2bps from the morning highs. Delving deeper into the bond move we also saw 10-year bund yields falling below 10-year Japanese government bond yields for the first time since October 2016. However, this morning in Asia the yield on 10yr JGBs (-1.2bps to -0.091%) is again below that of 10yr bund as the race to the bottom continues. In the US, yields continued to rally yesterday as well, with 2- and 10-year yields dropping -6.6bps and -5.7bps, respectively. That meant the 2s10s curve steepend again to 16.3bps, back to slightly above its year-to-date average. The 2yr and 10yr treasury yields are both down a further c. -1.2bps this morning with 10yr treasury yields now hovering at 2.355%, the lowest since December 2017.

Overnight, Asian markets are following Wall Street’s lead with the Nikkei (-1.45%), Hang Seng (-0.08%), Shanghai Comp (-0.26%) and Kospi (-0.78%) all down. Elsewhere, futures on the S&P 500 are down -0.24% while the Japanese yen is up +0.32%, alongside most G10 currencies.

Back to Mr Draghi, he also talked about inflation and said “we therefore remain confident that the sustained convergence of inflation to our aim has been delayed rather than derailed”. He nevertheless maintained his stance that “uncertainty remains high” and “the risks remain tilted to the downside.” The euro weakened after the speech, falling -0.17% versus the dollar. Staying with FX, we also saw the Swiss Franc climb to its strongest level against the euro since July 2017 yesterday to 1.1195. DB’s strategists don’t think intervention to prevent appreciation is likely until we approach 1.10, so there’s a bit more room to run before that becomes a risk.

It was a bad day for Turkish assets, with the BIST 100 index closing down -5.67% yesterday, its biggest fall since July 2016, while Turkish bond yields also rose dramatically, with local 10-year yields up +114bps to 17.93% and USD up +19.3bps to 7.74%. The overnight implied yield continued to blow out, rising to as high as 1,350% before ending the day at 750%. The market turmoil comes before local elections on Sunday, with the government likely hoping to maintain FX stability ahead of the votes. This morning the Turkish Lira is -1.94% as sentiment continues to be weak

The S&P 500, DOW, and NASDAQ retreated -0.46%, -0.13%, and -0.63% respectively. All sub-sectors fell except for industrials, which were boosted by a positive day for airlines (+1.92%). Southwest, a major operator of the grounded Boeing 737 Max, announced that the impact on first quarter revenue would be smaller than feared at only $150million. The dollar strengthened +0.19%, weighing on multinationals and exporters, after US trade data showed a smaller-than-expected deficit for January. The bilateral deficit with China narrowed by $2.4bn to -$34.4bn, providing a somewhat more positive backdrop as USTR Lighthizer and Treasury Secretary Mnuchin travel to Beijing today for trade negotiations.

In spite of the strong performance from financials, European equity markets fell back before the close, in line with a falling US market, with the STOXX 600 paring their gains to close flat. The DAX, CAC, and FTSE 100 also all closed flat on the session, although southern European equities put in a stronger performance, with the FTSE MIB (+0.26%) and the IBEX 35 (+0.51%) outperforming. This came despite unconfirmed reports in Italian newspaper Il Sole that the Italian government plans to lower its 2019 growth forecast to 0.1% and raise its deficit to 2.4% of GDP.

Looking at the European data, French consumer confidence was in line with expectations at 96, a seven-month high, but the readings from Italy were more negative, with the consumer confidence indicator falling to 111.2 (vs. 112.5 expected) to reach its lowest since August 2017, while the manufacturing confidence indicator fell to 100.8 (vs. 101.4 expected), its lowest since February 2015. The UK also saw some negative data, with the CBI’s reported retail sales index falling to -18 (vs 4 expected) in March, its lowest since October 2017.

In terms of the day ahead, we have a number of data readings, including German March CPI data, Eurozone M3 money supply data for February, and the final Eurozone consumer confidence reading for March. From the US, we’ll get the third reading of Q4 GDP, personal consumption and core PCE, along with pending home sales for February, the Kansas City Fed’s manufacturing activity index for March and weekly initial jobless claims. From central banks, both Federal Reserve Vice Chair Quarles and Vice Chair Clarida will be speaking, along with Bowman, Bostic and Bullard. From the ECB, we have Vice President de Guindos, while Villeroy de Galhau, Knot and Nowotny will also be making remarks.

Last but not least, we have the aforementioned Lighthizer and Treasury Secretary Mnuchin trip to Beijing today for trade negotiations.

via ZeroHedge News https://ift.tt/2FHSgPn Tyler Durden