Over the weekend China reported a key inflection point in its manufacturing PMI , which had its first expansionary print in 5 months, and the market saw right through this attempt to generate optimism that global economic headwinds are finally abating, and promptly sold off.

Just kidding, April fools!

As happens every single time, global stocks surged higher on Monday, extending gains from their best quarter in nearly 10 years, as algos and traders dutifully ignored the fact that every single number out of China is carefully goalseeked and politically motivated – in this case meant to shift the trade war balance of power in favor of China whose economy is now on the rebound despite the ongoing US tariffs – and overnight global markets were a sea of green as “Chinese economic optimism” is now the dominant narrative, taking over from “US-China trade talk optimism.”

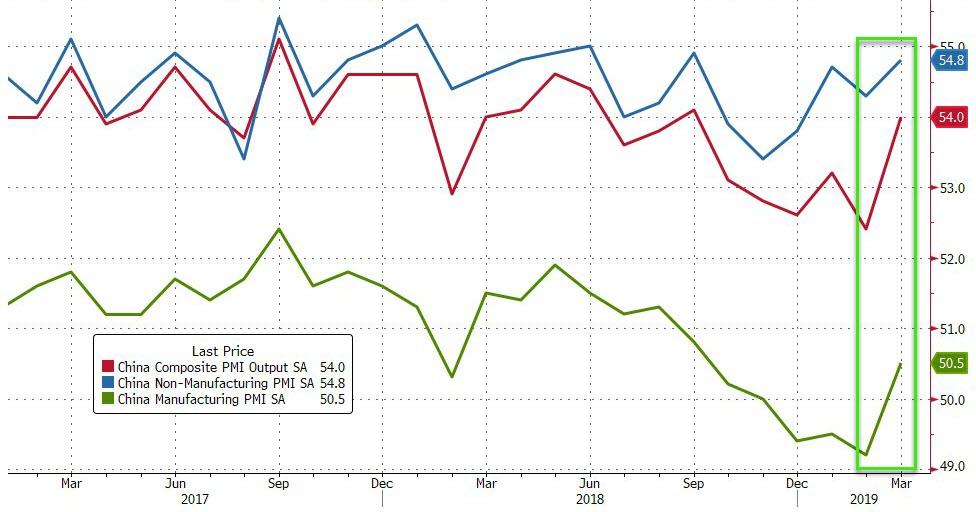

As we reported previously, on Sunday China’s NBS said that the country’s manufacturing PMI rebounded strongly in March from a contractionary 49.2, printing at 50.5, its first expansion since September 2018, and beating estimates of a 49.6 reading. The non-manufacturing PMI continued its recent improvement, rising to 54.8, also the best reading since last September, as both the services and construction PMIs strengthened, and resulted in the composite PMI rising to 54.0 from 52.4.

Predictably, Asian stocks, European bourses and S&P 500 futures all jumped as traders woke up to news of “strong manufacturing data” out of the world’s second largest economy which helped ease investor worries about a slowdown in global growth.

Just as predictably, analysts were effusive in their praise of this goalseeked Chinese number:

- “Investors’ sentiment seems to be tilting to the side of optimism at the beginning of the second quarter, following a robust manufacturing report from China,” said Konstantinos Anthis, head of research at ADSS. “This news helps ease market participants’ worries over the odds of an upcoming recession on a global scale, even though there are plenty of signs suggesting caution,” Anthis said.

- China’s PMI reading “was encouraging,” said Thomas Harr, global head of fixed income and commodity research at Danske Bank. “There is still a good chance that global and euro-zone growth will improve in coming quarters, as the U.S. and China will reach a trade deal, while the Fed’s dovish shift and China’s stimulus will help.”

Confirming China’s renaissance, the private Caixin/Markit PMI business survey released on Monday also showed the manufacturing sector in the world’s second biggest economy returning to growth.

The immediate result was investor euphoria which swept across Asia as MSCI’s index of Asia-Pacific shares outside Japan added 1%, Chinese shares surged 2.6% to the highest since May, while Hong Kong stocks entered a bull market. Australian stocks climbed 0.6 percent, South Korea’s KOSPI gained 1.3 percent and Japan’s Nikkei advanced 1.4 percent.

“The rebound likely reflects both the resumption of production after the Chinese New Year break and renewed stimulus and policy easing,” UBS strategists wrote in a note to clients. “We expect China to continue easing policy, with signs of economic stabilization backing our overweight position on offshore Chinese equities in our Asia portfolios” they added.

Asian optimism quickly went global as European stocks posted their best daily gains since mid-February, as the pan-European STOXX 600 index surged 0.8% in early trading. Germany’s trade-sensitive DAX outperformed with a 1 percent rise helped by gains in auto maker stocks as European carmakers advanced more than 2 percent. That’s despite manufacturing data for Europe coming in at the lowest since 2013, which briefly caused the euro to pare some of its gains.

The German manufacturing Purchasing Managers Index slipped to 44.1 in March, worse than a flash reading of 44.7 that was already well below economist estimates. With sentiment at Asian factories stabilizing, German bonds fell, pushing the yield on 10-year securities up 3 basis points to minus 0.04 percent at 9:34 a.m. Frankfurt time.

French manufacturing also shrank more than expected as the PMI there was revised down to 49.7, however all this was generally ignored in light of the newly-found Chinese economic optimism.

As Bloomberg notes, global equities are building on their strongest quarter since 2010 amid bets that dovish tilts by major central banks will help prop up earnings. The Chinese data went some way toward easing worries about a slowdown prior to the release of American monthly jobs numbers at the end of the week, while Treasury 10-year yields have also increased. U.S.-China trade talks will resume when Vice Premier Liu He leads a delegation to Washington later this week, potentially offering more positive developments for investors.

China’s recovery pushed yields higher, and the closely watched 3-month/10-year yield spread has pulled back from negative territory and stood around 3 basis points after investing two weeks ago.

In currencies, the dollar traded lower versus most of its G-10 peers after better-than-expected China data eased concern global growth was slowing. The Bloomberg Dollar Spot Index dropped 0.2%, snapping a four-day winning streak amid strong demand for upside exposure through options; it briefly pared losses after German mfg PMI data misses estimates, before falling to a new day low amid strong risk sentiment. Major emerging-market currencies advanced while sterling gains ahead of a U.K. parliamentary debate on various Brexit options.

Sterling was 0.6% higher to the dollar at $1.3114 on Monday, after taking its latest knock after British lawmakers rejected Prime Minister May’s Brexit deal for a third time on Friday. The Australian dollar advanced 0.45 percent to $0.7127, also benefiting from the China data. The Aussie is sensitive to shifts in the economic outlook for China, the country’s main trading partner.

Treasury 10-year yield climbed as much as 4bps to 2.4475%; Risk-sensitive currencies lead gains in the G-10, while the yen drops; Antipodean and Scandinavian currencies gain along with China’s yuan as Chinese Vice Premier Liu He scheduled to lead a delegation of trade negotiators to Washington on Wednesday after officials held talks in Beijing. The yen declined, while the Turkish lira slipped initially as preliminary results from the weekend’s municipal elections showed that Turkey opposition party claimed victory in Istanbul and Ankara, while the ruling AK Party also initially claimed to have won in Istanbul following local elections over the weekend which was seen as a referendum on President Erdogan. However. President Erdogan later commented that although the Mayorship may have been lost in Istanbul, they won in many of its municipalities; the lira initially slumped lower before it exploded higher after it emerged that Turkey is once again cracking down on shorts as the overnight swap rate surged to 260%.

In commodities, oil prices rose, adding to gains in the first quarter when the major benchmarks posted their biggest increases in nearly a decade, as concerns about supplies outweigh fears of a slowing global economy. Crude oil prices added to Friday’s gains, with U.S. West Texas Intermediate futures gaining 0.9 percent to $60.69 per barrel. Brent was 1.3 percent higher at $68.46 per barrel.

Economic data include retail sales, ISM manufacturing, construction spending and business inventories.

Market Snapshot

- S&P 500 futures up 0.8% to 2,859.75

- STOXX Europe 600 up 1.1% to 383.38

- MXAP up 1% to 161.44

- MXAPJ up 1% to 534.46

- Nikkei up 1.4% to 21,509.03

- Topix up 1.5% to 1,615.81

- Hang Seng Index up 1.8% to 29,562.02

- Shanghai Composite up 2.6% to 3,170.36

- Sensex up 0.9% to 39,024.05

- Australia S&P/ASX 200 up 0.6% to 6,216.96

- Kospi up 1.3% to 2,168.28

- German 10Y yield rose 4.5 bps to -0.025%

- Euro up 0.3% to $1.1248

- Italian 10Y yield rose 0.2 bps to 2.134%

- Spanish 10Y yield rose 3.7 bps to 1.134%

- Brent Futures up 1.7% to $68.71/bbl

- Gold spot down 0.1% to $1,290.74

- U.S. Dollar Index down 0.3% to 97.04

Top Overnight News from Bloomberg

- IHS Markit’s Purchasing Managers’ Index for Germany slipped to 44.1 in March, worse than a flash reading of 44.7 that was already well below economist estimates

- U.K. manufacturers intensified stockpiling last month as they prepared for Brexit. IHS Markit’s Purchasing Managers Index rose to 55.1 in March, the highest since February 2018, from 52.1 the previous month, the firm said on Monday

- The Chinese government said it will extend a suspension of retaliatory tariffs on U.S. autos and include the opioid fentanyl in a list of controlled substances, two steps that could generate a positive atmosphere for trade negotiations due to resume this week. Beijing temporarily scrapped the 25 percent tariff imposed on vehicles as a tit-for- tat measure on Jan. 1, after the White House delayed a rise in tariffs on $200 billion of products that had been due that day

- Saudi Aramco was the world’s most profitable company in 2018, easily surpassing U.S. behemoths including Apple Inc. and Exxon Mobil Corp., according to an extract of the firm’s accounts published by Fitch Ratings

- Asset managers switched to net long NZD from short, CFTC data for week ended March 26 show. Leveraged funds raised their net GBP long positions and boosted net EUR shorts

Asian equity markets began the new quarter on the front-foot with momentum sustained from last Friday’s global rally in which the S&P 500 notched its best quarterly performance in nearly a decade and as the region also cheered encouraging Chinese PMI data. ASX 200 (+0.6%) and Nikkei 225 (+1.4%) gained from the open in which Consumer Staples led the broad gains across Australia’s sectors after Woolworths completed the sale of its petrol business and announced to return funds through a AUD 1.7bln off-market buyback, while the Japanese benchmark shrugged off a weak Tankan survey and was among the best performers with risk appetite fuelled by favourable currency flows. Hang Seng (+1.8%) and Shanghai Comp. (+2.6%) were uplifted by strong Chinese data in which the Official Manufacturing, Non-Manufacturing and Caixin Manufacturing PMIs all topped estimates with the official reading in expansionary territory for the first time since October. Furthermore, trade optimism and the inclusion of China’s onshore bonds in the Bloomberg Barclays Global Aggregate Index from today further added to the optimism with the mainland firmly extending on the over-3% gains seen on Friday and with the Hang Seng now in bull market territory. Finally, 10yr JGBs were lower amid similar weakness in T-notes and as a rally across riskier assets dampened safe-haven demand, while the BoJ recently announced its purchase intentions for the month in which it kept all amounts unchanged.

Top Asian News

- Analysts Downgrade China’s Stocks at Fastest Clip Since 2011

- Why Trump’s Sale of Fighter Jets Designed in 1970s Spooks China

- China Stocks Start April With Bang, Bonds Slide After Data Boost

- Philippine Stocks Falls Most in Asia as World Bank Cuts Forecast

A stellar start to the week for European stocks [Eurostoxx 50 +0.7%] following an inspiring performance in Asia where mainland China advanced in excess of 2% on the back of optimistic China manufacturing PMIs. Broad-based gains are being seen across major European indices, although Germany’s DAX (+1.5%) modestly outperforms peers, driven forward by the likes of auto names [Daimler +3.5%, Volkswagen +2.6% and BMW +1.8%] after Chinese PMIs topped estimates. Furthermore, the release also bolstered other China exposed sectors, i.e. luxury names, with Swatch (+1.4%), Richemont (+0.8%), LMVH (+1.0%) all performing well in their respective bourses. Sectors are also showing broad-based positivity, although utilities are underperforming as investors move away from defensive stocks. In terms of notable movers, WPP (+3.2%) rests at the top of the FTSE after a Deutsche Bank upgrade, whilst easyJet (-7.9%) shares declined after company CEO warned of a cautious H2 outlook as he expects softer yields from UK and European tickets.

Top European News

- Euro-Area Inflation Slows as Core Measure Falls to 11-Month Low

- Turkey Election Board Says Opposition Leading Race in Istanbul

- U.K. Parliament Seizes Control Amid Brexit Rift in May’s Tories

- U.K. Factory Index Climbs to 13-Month High on Brexit Stockpiling

- Korian Shares Fall After Deaths at French Retirement Home

In FX, AUD/NZD/GBP/NOK/SEK – All beneficiaries of forecast-beating PMIs, albeit indirectly in the case of the Antipodean Dollars, as encouraging Chinese surveys overnight lifted broad risk sentiment and the Aussie and Kiwi accordingly. Meanwhile, a significantly better than expected UK headline print was mainly boosted by further pre-Brexit stock-piling, although output, new orders and jobs sub-components also improved and activity in both Scandi manufacturing sectors expanded at a faster pace. Hence, Aud/Usd and Nzd/Usd are both looking firmer above big figure levels at 0.7100 and 0.6800 respectively, with the former also probing above its 50 DMA (0.7119), while Cable extended its rebound from last week’s lows and back over 1.3000 to circa 1.3100, breaching its 55 DMA (1.3075) on the way. However, the latest round of IVs present more risk and uncertainty for the Pound with up to 8 amendments up for selection around 2.30 pm before debates and voting tonight – for a more detailed schedule and analysis see our headline feed. Elsewhere, Eur/Nok is back down below 9.6500 and Eur/Sek sub-10.4000 to test multi technical support levels including the 30 DMA (10.3844), 200 DMA (10.3812) and the bottom of a chart cloud (10.3785). Back down under, and the Aud will be looking for independent impetus via the RBA tomorrow with options pricing a 35 pip break-even for the event – full preview also available via the headline feed.

- EUR/CHF – Also firmer vs the Usd as the DXY retreats towards 97.000 again, but capped around 1.1250 and 0.9935 respectively in wake of relatively downbeat PMIs and Swiss retail sales.

- CAD/JPY – The G10 laggards, as the Loonie meanders between 1.3340-30 vs its US counterpart and the Jpy pivots 111.00 amidst the aforementioned general revival in risk appetite post-Chinese PMIs, and with the headline pair also underpinned by a downbeat Japanese Tankan report. However, 111.20 is holding (just) and represents a 61.8% Fib retracement of the 112.13-109.70 downmove.

- EM – Contrasting fortunes for the Lira and Rand, as weekend municipal elections in Turkey saw some key losses for the ruling AK Party to main opposition CHP, but not enough to threaten President Erdogan’s overall majority and result in regime change. Usd/Try has been up to 5.7000+ in response vs Usd/Zar that has been as low as 14.2225 after Moody’s delayed its latest credit review of SA and any potential cut in the rating and/or outlook, for the time being at least.

In commodities, the upbeat sentiment emanating from the optimistic China metrics overnight has supported sentiment alongside the demand outlook for the energy complex. Brent futures are marching with gains of around USD 1.0/bbl while WTI futures advance over USD 0.50/bbl. Brent oil has reached levels last seen in November, and from a technical front, the 200 DMA for Brent resides around USD 69.68/bbl and around USD 61.50/bbl for WTI. Furthermore, BAML expects Brent to average USD 74/bbl in Q2 2019, and USD 70/bbl in 2019. Meanwhile, the bank sees WTI averaging USD 56/bbl in 2019 and USD 60/bbl in 2020. Elsewhere, the latest CFTC data shows that speculative net long NYMEX WTI by almost 26k lots over last week, with a bulk of the buying coming from fresh longs. Of note, this month sees the EIA short-term energy outlook release on the 9th, OPEC monthly report on the 10th and IAE oil market report the day after. It is also worth noting that traders will be keeping an eye on trade developments as US is to host a Chinese trade delegation on the 3rd. In metals, gold prices succumbed to the positive risk tone as the yellow metal remains below the USD 1300/oz, albeit off lows. Meanwhile, the aforementioned China data bolstered copper prices to levels just shy of USD 3.00/lb, to levels last seen in June 2018. Elsewhere, iron ore prices have been supported by the Caixin-beat alongside a force majeure by Rio Tinto which will result in a loss of around 14mln tonnes of production this year. As such, Goldman Sachs raised iron ore price forecasts with 3-month estimate at USD 85/ton (Prev. USD 80), 6-month estimate at USD 80/ton (Prev. USD 75/ton) and 1-year estimate at USD 70/ton (Prev. USD 65).

US Event Calendar

- 8:30am: Retail Sales Advance MoM, est. 0.3%, prior 0.2%; Retail Sales Ex Auto MoM, est. 0.3%, prior 0.9%

- Retail Sales Control Group, est. 0.3%, prior 1.1%

- 9:45am: Markit US Manufacturing PMI, est. 52.5, prior 52.5

- 10am: ISM Manufacturing, est. 54.5, prior 54.2;

- 10am: Construction Spending MoM, est. -0.2%, prior 1.3%

- 10am: Business Inventories, est. 0.5%, prior 0.6%

DB’s Jim Reid concludes the overnight wrap

Happy April Fool’s Day, the day I first met my wife 9 years ago. Insert your own gag here. I can guarantee she has no idea of this anniversary. The problem or advantage (depending on your view) with doing a market’s related April Fool’s is that there have been so many strange things happen over the last few years that nearly anything could be true! Anyway I hope you all had a good weekend. On Saturday I played golf in shorts in the blazing sun and on Sunday I took the family out for Mother’s Day lunch to find that tables were only available outside. Problem was that it was freezing as the weather had completely turned. A lot of tears followed. The children were also upset. The clocks also went forward here in Europe and my wife thinks it must have been a male conspiracy to ensure that Mother’s Day was only 23 hours long this year.

There is some good news to start the week and the new quarter as yesterday saw the crucial Chinese manufacturing PMI number rise to 50.5 from 49.2 last month, the biggest increase since 2012 and beating all consensus estimates. Sub components that are very closely watched for forward looking momentum – new orders (51.6 from 50.6) and new export orders (47.1 from 45.2) – both rose to the highest levels in six months. The non-manufacturing also rose to 54.8 from 54.3 last month and 54.4 expected. The composite number increased from 52.4 to 54 the highest since September 2018. Overnight, China’s Caixin March manufacturing PMI also beat expectations at 50.8 from 49.9 last month (50.0 expected). The accompanying commentary along with the Caixin release said that the sub-index for new orders climbed to its highest level in four months while the new export orders returned to expansionary territory. Given the recent domestic stimulus – which our rates strategist Francis Yared has written about being around half the size of the growth bursting 2016 version – we have been expecting a bounce back in China but it had been a little elusive until now. The data could have elements of lunar holiday distortions depressing the comparisons from February but for now it will be a tentative welcome relief for global growth, especially for the Europeans. Our Chinese economists point out that we’ll know more as to whether this is an upswing when March’s activity data is released on April 17th.

In response, Chinese equities are leading the gains in Asia with the Shanghai Comp (+2.29%), CSI (+2.31%) and Shenzhen Comp (+3.03%) all up. The Nikkei (+1.72%), Hang Seng (+1.65%) and Kospi (+1.18%) are also up alongside most Asian markets. The Japanese yen is down -0.17% this morning and the yield on 10yr JGBs is up +1.4bps to -0.087%. Elsewhere, futures on the S&P 500 are up +0.63% and the 2yr and 10yr treasury yields are both up c. +3bps this morning.

Overnight China’s government has said that it will extend a suspension of retaliatory tariffs on US autos and include the opioid fentanyl in a list of controlled substances. The moves comes ahead of a visit by China’s Vice Premier Liu He later in the week to the US for continuing trade talks. The statement from China’s Minsitry of Finance said that the move seeks to “continue to create a good atmosphere for China-U.S. economic and trade talks” and is a “positive response” to the U.S. decision to delay tariff increases.

Elsewhere over the weekend, we had local elections in Turkey yesterday where President Erdogan’s party lost in the country’s capital Ankara and key cities along the Mediterranean coast while retaining its control in rural interiors and Istanbul (Bloomberg). The Turkish lira is down c. 1% overnight as market participants remain concerned about the ruling party announcing further populist policies to shore up declining support. Ahead of the elections, the BIST 100 equity index fell -6.1% last week, its worst weekly performance since October. The overnight swap rate ended the week at 28.98%, having risen over 1300% during last week.

Moving on to Brexit, over the weekend Conservative Party Deputy Chairman James Cleverly told Sky News on Sunday that the Tories are taking “pragmatic” steps to prepare for an election. He added though that it’s not the central plan, but the party is making preparations nonetheless. Meanwhile, the latest opinion polls are showing that the support for the opposition Labour party is now turning around with the Deltapoll/ Mail on Sunday poll indicating that the Labour party (at 41%) now leads the Conservative party (at +36%) in polls. Another opinion poll released over the weekend by Opinium & The Observer showed both parties at 35%. Will the market start to worry again about a left wing U.K. government? Elsewhere, the Sun reported on Saturday that some 170 Tories, including 11 cabinet ministers, wrote to May on Friday urging a no-deal departure on April 12. In terms of timeline for today’s vote on alternative options, House of Commons speaker John Bercow will announce the exact motions to be debated today at 2:30pm and the plan is to conclude the debate at 8:00 pm and then hold votes. Sterling is trading down +0.08% this morning.

As we start Q2, the European PMIs this morning will be the key event, especially after the disappointing flash numbers around 10 days ago. If China is turning up it might be too early for this to filter into these numbers so maybe disappointment over any softness will be tempered for now given the China strength. The equivalent number in the US will also be important later on. Elsewhere politics can be expected to remain on the agenda, both with the latest trade talks between the US and China, as well as any further Brexit developments which today sees a second round of indicative votes but as the week roles on could see us closer to a fresh general election. Brexit continues to be a high stakes game with no obvious way to resolve it. As ever March’s US payrolls report (Friday) will also be a highlight, as will the minutes from March’s ECB meeting (Thursday) especially given the perceived communication mis-step at that time. As for the rest of the upcoming events we’ll have the full day by day week ahead at the end.

This morning my colleague Craig has got back from his holiday on the West Coast of the US and has just published the Q1/March asset performance review. I mistakenly mentioned on Friday that he had gone skiing and completely forgot that him and I had a long conversation about his trip along the US coast just before he went away. Good man management. Nick in my team is off this week and I think he’s actually gone skiing but perhaps he’s on safari in Africa!! Anyway see here for the full performance review report but suffice to say it was a quarter to remember just as 2018 was a year to forget. Indeed, Q1 ended with 37 out of the 38 assets in our sample finishing with a positive total return in local currency terms, and 35 out of 38 assets in dollar adjusted terms doing so. Picking out some of the highlights at an asset level, this was the best quarter for WTI Oil (+32.4%) and the S&P 500 (+13.6%) since Q2 2009, US HY (+7.5%) since Q4 2011, the Shanghai Comp (+23.9%) since Q4 2014 and the STOXX 600 (+13.3%) since Q1 2015. In fact we had 11 assets end Q1 with double digit returns, the most since Q1 2012. Very impressive and 2018 and Q1 2019 are an illustration as to the impact central banks are still having on global markets in both directions.

Global equities ended the quarter by advancing last week on a bit of a wall of worry as rates plunged. The S&P 500 rose +1.20% (+0.67% Friday), with the STOXX 600 +0.81% (+0.60% Friday). Government bond yields continued to fall, with German ten-year bund yields deeper into negative territory as they lost -5.5bps to settle at -0.072%. US ten-year yields fell -3.4bps, ending the week at 2.41%, although the 2s10s curve steepened +2.1bps last week to close at 14.7bps. Positive sentiment also lifted oil prices, with Brent Crude +2.03% (+0.84% Friday).

Data generally supported the positive sentiment on Friday, with German retail sales rising unexpectedly in February by +0.9% mom (vs. -1.0% expected), while the country’s unemployment rate also fell to 4.9% in March, its lowest rate since German reunification. In the US, the final University of Michigan consumer sentiment index for March rose to 98.4 (vs. 97.8 expected). Ahead of today’s Eurozone inflation reading for March, Friday also saw the French harmonised reading at 1.3%, its lowest since February 2018, while in Italy, harmonised inflation remained at 1.1%.

The latest word from the US-China trade talks was positive on Friday with China’s official Xinhua News Agency saying on Friday that “new progress” had been made in the talks with US Trade Representative Lighthizer and Treasury Secretary Mnuchin in Beijing. Mnuchin described the discussions as “constructive”. Further talks will be taking place this week as Chinese Vice Premier Liu He visits Washington next week for further discussions.

via ZeroHedge News https://ift.tt/2JWKwwZ Tyler Durden