Millennials using the Robinhood financial app have been “buying the f*cking dip” in Boeing for the third straight week since the jet maker’s 737 MAX narrow-body aircraft was involved in its second deadly crash in five months, according to Bussiness Insider.

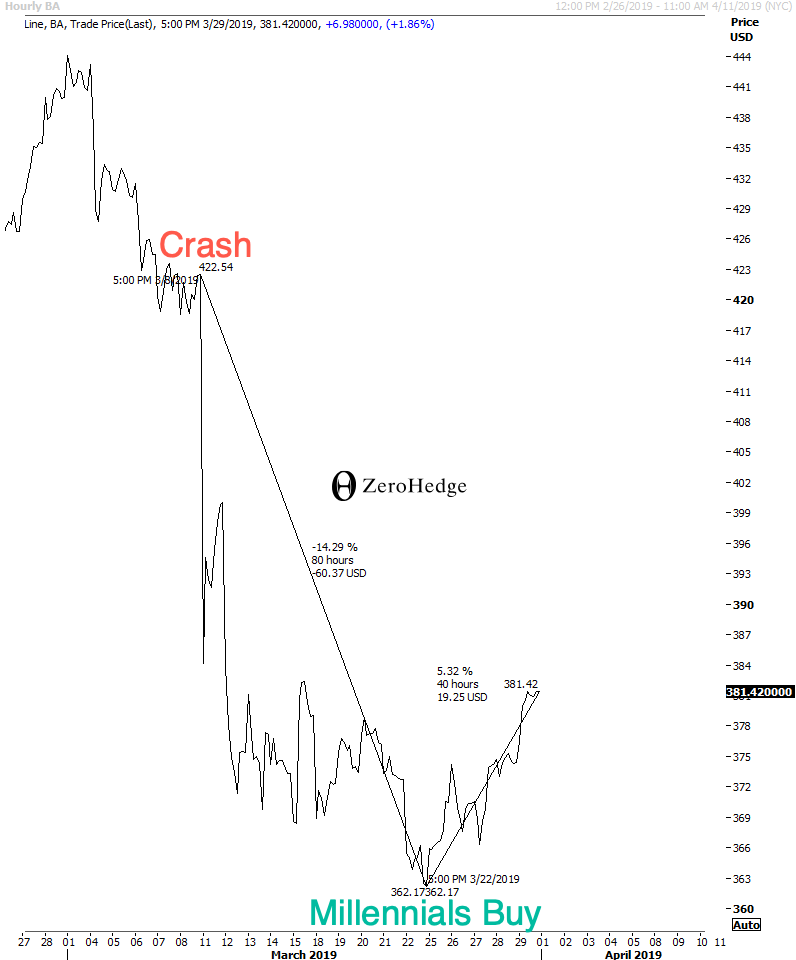

Boeing’s stock corrected 14.29% in 80 hours following the crash, bottoming at $362 per share the day President Trump grounded the aircraft across the U.S. That was the moment when thousands of Millennials, disregarded all risks associated with the downed airliner(s) and added Boeing stock to their portfolios.

Last week, Boeing was one of the hottest stocks on the mobile app, with almost 3,000 more users holding a position than a week earlier. The two weeks prior saw 6,528 additional users and 11,167 additional users with the stock added to their portfolios.

On Wednesday, Boeing unveiled the fixes to the controversial MCAS anti-stall software on its 737 MAX 8 jets – software that is suspected of having contributed to two plane crashes that left more than 350 people dead.

Later in the week, a family of a passenger who died on Ethiopian Airlines flight ET302 filed a lawsuit against the aerospace company in a US federal court.

While Millennials focused solely on “buying the f*cking dip” – neglecting to understand any future risks associated with the lawsuits, nor glancing at the warning signs in Boeing’s debt and credit markets, they have put their trust in the $20 billion stock buyback program authorized by the company in late 2018.

The risks are not abating. Boeing is still dealing with a lawsuit filed by the family of a man who was killed aboard the Lion Air crash, which took place on Oct. 29 when a 737 MAX owned by Lion Air plunged into the Java Sea just minutes after takeoff. The suit alleges that the 737 was “unreasonably dangerous” and is calling for what would be an embarrassing jury trial in Chicago, per Reuters.

The lawsuits have not been the only disappointing headlines. The WTO ruled on Thursday that the US had failed to comply with an earlier ruling calling for it to end illegal subsidies for Boeing, setting the stage for potentially damaging retaliatory damage from the EU, according to WSJ.

Since Millennials started piling into the stock – disregarding the risk/reward ratio is somewhat out of their favor, the stock has inched up 5.32% in 40 hours to 381.42, still a long ways away from the 444 per share seen before the crash.

via ZeroHedge News https://ift.tt/2V9BSMH Tyler Durden