“Sunday Start”, authored by Michael Wilson, Morgan Stanley chief US equity strategist

FOMO!

After the best first quarter in a decade, global equity markets didn’t miss a beat and got off to a strong 2Q start. A marginally better Purchasing Managers’ Index (PMI) reading out of China over the weekend, along with the never-ending optimism about a trade deal, were touted as the reasons. Cyclicals outperformed and the yield curve steepened, suggesting that recession fears sparked by the prior week’s inversion were overblown. A slightly better PMI in the US added to this better mood. Such surveys are what we call soft data points because they are based on opinions and sentiment, which can be heavily influenced by markets and financial conditions. Contrasting with the stronger soft data were weak retail sales in the US and evidence that inventory continues to build in the channel. Auto and home sales also remain fairly weak. Friday’s labor report was definitely good news and much better than last month. However, some of the leading data from that report, like temporary hiring, continued to soften and bear watching.

As equity markets move relentlessly higher in the face of mixed economic and earnings data, institutional investors seem preoccupied with what everyone else is doing, trying to figure out whether every last dollar is already in the market or if there’s more to go. To say that FOMO – the Fear of Missing Out – is alive and well would be a gross understatement. My experience tells me that when investors are more focused on what others are doing than on fundamentals, the trend has probably run its course. Naturally, this anxiety was also present in December, but on the downside. Then it wasn’t Fear of Missing Out, it was just plain fear!

I think the disappointing data in the US will keep coming, both from the economy and from corporations when they report 1Q results this month. Unlike in January, I doubt bad fundamental news will be good for stocks any more, given significantly higher valuations today and the fact that the Fed can’t pivot any further at this point without signaling rate cuts. Historically, the first rate cut is a red flag for stocks because it portends even weaker growth, rather than the positive inflection point that comes from a pause.

Which brings me to my main message in this week’s Sunday Start. The most popular narrative out there is that the sharp sell-off last year was mainly a function of the Fed going too far with rate hikes and balance sheet reduction – i.e., it made a monetary policy mistake. Consequently, the Fed’s rapid about-face has cured all of the market’s ills, and the bull market can simply pick up where it left off last September, when the drivers were strong growth and supportive financial conditions. I agree that the Fed’s tightening was a big part of last year’s rolling bear market. In fact, I felt like a voice in the wilderness six months ago when I warned investors about the speed of the tightening and particularly the balance sheet reduction.

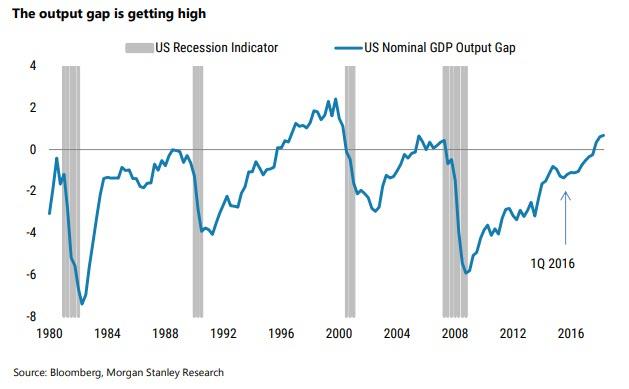

The problem I have with the idea that everything has been fixed is that I don’t think the Fed made a policy error. It was simply responding, appropriately, to the real mistake, which was enacting a massive fiscal stimulus when the economy was already running at full employment and growing just slightly above potential GDP. I do believe cutting corporate taxes is good fiscal policy because the private economy can invest more efficiently than the government. In fact, we were writing back in 2016-17 about a potential productivity boom from capital-deepening, which we think began in early 2017, long before the tax cuts were passed. Those cuts did lead to more investment, but the timing was questionable because they also caused the economy to overheat and move into restrictive territory (see Exhibit). As a result, companies are now facing margin pressure, which started to surface in 4Q earnings reports. We’d point to three excesses in particular that are hurting margins – labor costs, above-trend capital spending, and inventory bloat. Furthermore, while a trade deal with China may be coming, we’re likely never going back to the old relationship, and that means permanently higher costs for US corporations as they rethink their supply chains.

The bottom line is that the Fed has fixed the tight financial conditions which were largely responsible for December’s overshoot to the downside. However, it can’t roll back the corporate cost pressures created by the fiscal stimulus. These pressures now have to play out in what we’ve been calling for since last fall – a profits recession.

I think it’s misguided to assume that the profits recession has magically ended, and I see an increasing chance that it turns into an economic one if companies decide they want to protect profits by cutting labor, capex and inventory. Perhaps the Fed understands this better than investors, who may be merely experiencing a serious bout of FOMO.

via ZeroHedge News http://bit.ly/2Z4TcFc Tyler Durden