Among the greater mysteries facing Wall Street strategists is how, at a time when the Fed “paused” tightening, and with the market expecting more than 1 rate cut before the end of 2019 is almost certain to announce easing in the coming months (especially if inflation as measured by the BLS doesn’t rebound), the dollar has not only failed to drop, but is in fact higher than where it was at the start of October 2018 when Powell made his infamous, and hawkish, “a long way away from neutral” comment.

One possible explanation is positioning thanks to Wall Street analysts who months ago predicted that the next big move in the dollar is lower, only to be proven wrong once again, forcing a short squeeze in the process among specs, hedge funds, and other fast money, which has since learned its lesson and refuses to short the greenback on something as simplistic as projected rate differentials (which incidentally, haven’t worked in years).

Goldman: “In 2019, we forecast the USD will weaken by 6% vs. the Euro and 5% vs. Yen.” Morgan Stanley is even more bearish on the USD, as are most other banks.

Weaker dollar is now the consensus trade, which likely means DXY will soar

— zerohedge (@zerohedge) November 18, 2018

Another, more attractive explanation, comes from Nedbank’s Mehul Daya, who attributes the dollar’s unrelenting strength to the “dollar smile”, which explains not only the dollar’s ongoing strength, but also why the bond market, which has been skeptical of the stock market euphoria for the past 4 months, may end up having the last laugh once again.

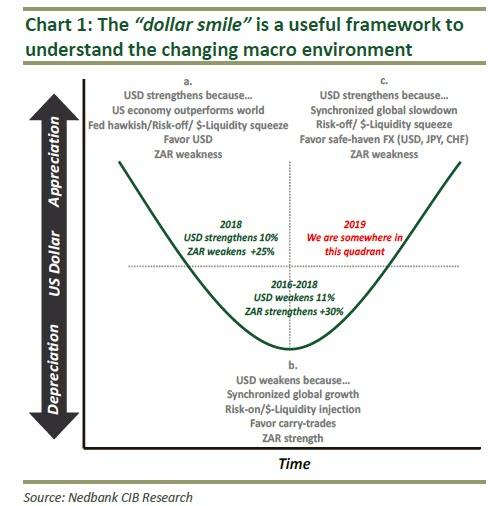

As Daya explains, he uses the “dollar smile” framework to contextualize “the evolving macro-environment and the dynamics of the USD as the reserve currency of the world.” The chart below is a visualization of the “dollar smile” framework. Within the “smile” context, there are three key points.

- Point a: “Strong US economy” – The US’ economic growth is robust and outperforms that of the rest of the world, attracting capital flows favouring the USD. Added to this, the Fed’s hawkish monetary stance (inflationary pressures) favours further USD strengthening (and as a result, EM currency weakness – including the rand).

- Point b: “Synchronised growth” – Global growth is synchronised. The US economy is growing, but inflation remains stable, and as a result, US monetary policy is neutral. This environment favours a weaker USD, along with low volatility, which bodes well for investors’ risk

- Point c: “Synchronised slowdown” – The US economy, along with the rest of the world, enters a slowdown; the Fed and other policy makers attempt to reflate the global economy by easing monetary policies. However, investors’ risk appetite wanes. De-risking by investors favors safe havens such as the USD, JPY and CHF. This comes at the expense of carry-trade strategies (and as a result, EM currency weakness – including the rand).

Needless to say, for Daya who has long been advocating for a dollar liquidity squeeze, well ahead of the Fed’s recent dovish U-turn which confirmed that a dollar shortage was indeed forming at least from the perspective of plunging EM currencies in the end of 2018, “the world economy is past point b and moving towards point c.”

As such, in terms of a multi-month view, Daya believes the global economic cycle suggests “one should consider a general weakening bias when dealing with EM currencies.”

The above framework is also useful in explaining the market “alligator jaws” which have gaped wide open and prompted Goldman’s client to freak out (as we discussed last week).

The chart above, which shows a sharp drop in 10Y TSY yields coupled with a surge in the S&P, confirms Nedbank’s thesis that the USD has gotten stronger in recent weeks as the global economic outlook continues to deteriorate, and that stocks are only rising on expectations that said deterioration will be so bad it will eventually force the Fed to either cut rates, or as even president Trump now demands, launch QE4 something the bond market is also increasingly banking on with the added kicker that deflation is making a comeback.

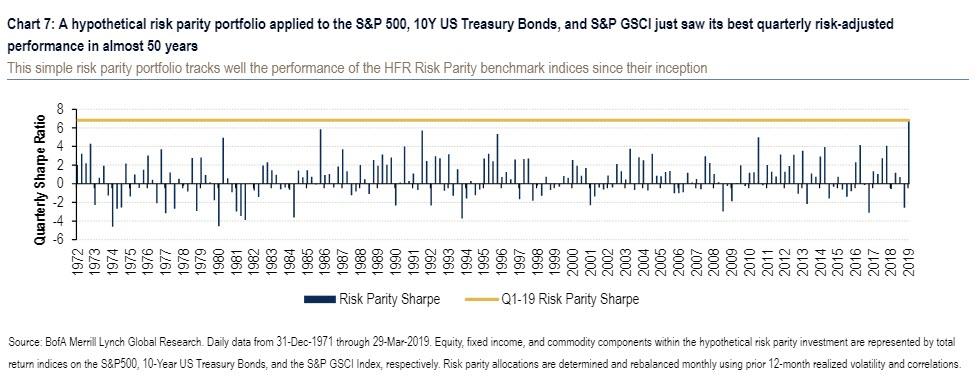

And while bonds don’t buy it, the worst possible outcome for stocks would be if the dollar moves from point c to point b on the “smile”, because while that would telegraph a return in global economic strength, it would also suggest that the US (and/or global) economy is strong enough and that the Fed will no longer be needed to ease in the coming months, forcing a sharp repricing in the “jaws” shown above, as stocks slide and yields jump. Which incidentally may be the best way to play the “dollar smile”: by doing the reverse of what risk-parity funds – which just had their best quarter in years…

… are doing, and shorting bond bonds and stocks, expecting a convergence in the trades above, especially since as Bank of America noted last week, “history suggests such strong simultaneous performance across asset classes cannot be sustained in the coming quarter.” In fact, in 8 out of 9 past periods since 1972 of strong risk parity performance, “subsequent performance was at or below median levels with an even stronger tendency to mean-revert post the global financial crisis.”

via ZeroHedge News http://bit.ly/2KgWNg1 Tyler Durden