Authored by Sven Henrich via NorthmanTrader.com,

We don’t need no intervention

We don’t need no market control

No dark sarcasm in the trading room

Hey, central bankers, leave them markets alone

All in all it’s just another wedge in the wall

My apologies to Pink Floyd, but man, can’t they just leave markets alone?

The answer is a resounding no. I’ve written about it plenty of times including this weekend in Theater of the Absurd, but the 100% reliance of markets on dovish central bankers should be obvious to everyone by now. No new highs anywhere without dovish central bankers. 10 years after the financial crisis this remains the one trick pony markets rely upon. And don’t expect it to change. This year’s global renewed dovish groveling by central bankers has once again revealed that markets just can’t do without and already we see political pressure in the US to push for a cut in rates in the re-introduction of QE. And while we’re at it, why not argue for the ECB to buy stocks? The BOJ does it, the SNB does it, why not the ECB, why not the Fed? We’re not there yet, but does anyone really doubt that this is where we are all heading when the next swoon unfolds? After all the ammunition available this time around is much less plentiful as nobody has been able to normalize during this cycle. What’s it say about the actual foundation of our market system if it simply can’t function without accommodative central bankers. 10 years after the financial crisis no less.

But no matter for now, central banks, and greatly aided by a torrent of buybacks, have once again succeeded in making markets levitate relentlessly higher, fundamentals be damned. And once again bulls take credit and comfort in having been bailed out again. One trick ponies.

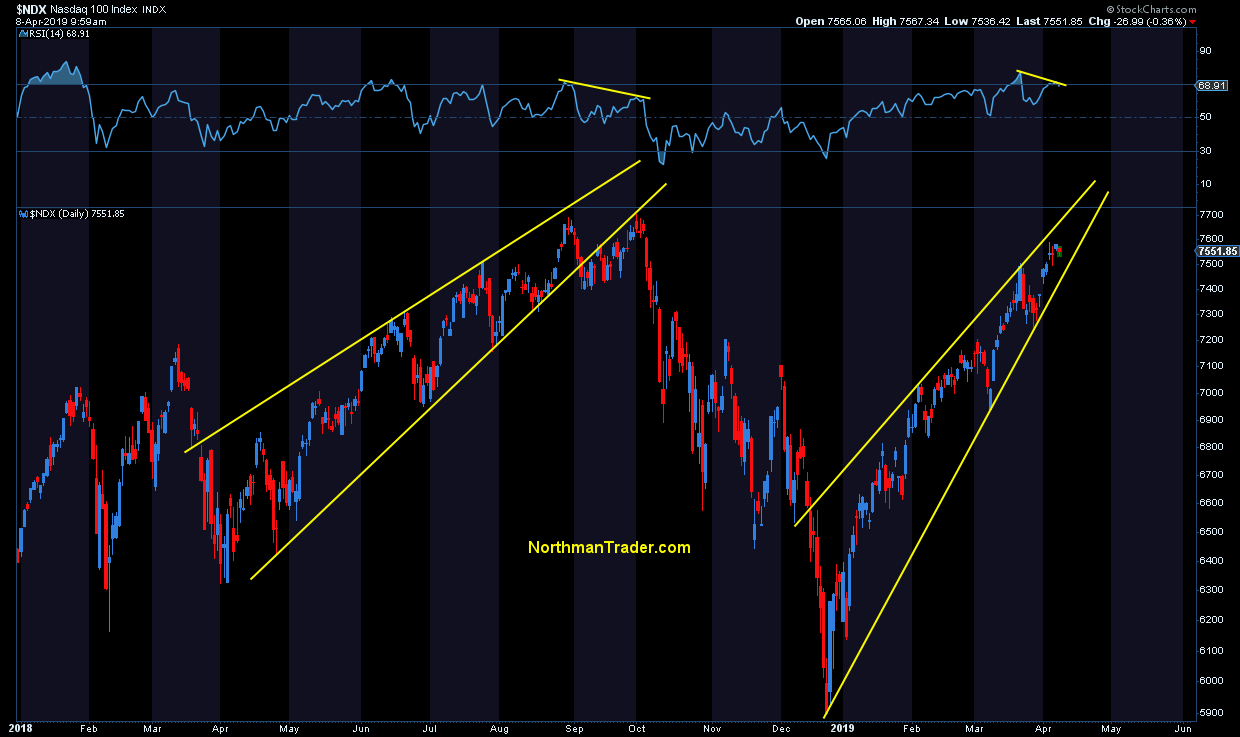

But is it all an illusion setting up for the next “punch” as I asked this morning on CNBC? During the interview I outlined a specific pattern, that of a rising wedge on $NDX, a pattern eerily similar to what we saw unfold last summer:

As we saw last summer these patterns can keep going until they break, but note even last summer’s break still managed to squeeze out new highs first before really falling apart. But nevertheless the energy released can be awesome as we all saw culminating in that 20% market drop.

If you’re not familiar with the concept of a rising wedge pattern here’s the classic structure as outlined by Investopedia:

And this is precisely what happened last year. Textbook. Here’s the updated $NDX chart as of this morning, showing last year’s structure and the current setup:

It is perhaps ironic, but also telling, that last year the wedge broke as the Fed transitioned after 10 years of “accommodative” to non accommodative with a view to keep raising rates and a balance sheet roll-off on autopilot. This new wedge nw having arisen from the depths of the Fed’s capitulation and going back to accommodative. Well, they tried for 3 months and it blew up in their face.

This new wedge here, coming from massive oversold conditions in December now is steeper and more narrow. Sustainable? Hardly. It will break at some point. Will it have the same reaction as last year? Hard to say. After all central bankers are back in accommodative mode and remain in control for now. But clearly $NDX has some open gaps to fill and some retesting to do, but until this wedge breaks it can also go higher and even new highs could be squeezed out of this, but note once again a negative divergence on new highs. It doesn’t matter until it does. For now nothing matters. Again.

Hey, central bankers, leave them markets alone.

All in all it’s just another wedge in the wall.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2YZgaNZ Tyler Durden