In what appears to be the latest example of Saudi Arabia saying one thing in public and another in private, Saudi Arabia’s energy ministry on. Monday denied reports published last week claiming that the kingdom might abandon the petrodollar if Congress passes the “NOPEC” bill, which would expose members of the oil cartel to American antitrust laws.

The Financial Times reported that the kingdom has “no plans” to sell its oil in currencies other than the dollar, a decision that, if the kingdom did follow through, would seriously undermine the dollar’s role as the dominant global reserve currency.

These reports “are inaccurate and do not reflect Saudi Arabia’s position on this matter,” the energy ministry said in a statement, adding that the kingdom’s decades-long policy of selling oil in dollars “has served well the objectives of its financial and monetary policies.”

This notably comes as Saudi state oil firm Aramco’s first dollar-denominated bond offering was 4x oversubscribed with $40 billion in orders on $10 billion of bonds.

Of course, Saudi Arabia has a long history of subtly threatening the US in response to unfavorable legislation. Three years ago, the kingdom implied it might dump US Treasury holdings following the passage of a law that would hold Saudis accountable for 9/11. That bill was signed into law by Obama after passing both houses of Congress, and since then, the kingdom has been pressuring President Trump to rescind it – though the kingdom remains one of the largest holders of US debt.

Six months ago, the Saudis once again threatened to weaponize their wealth and invoke another of the “nuclear options” to exert leverage against the US as the biggest importer of arms from America threatened to buy arms somewhere else if the US sanctioned it over the death of Jamal Khashoggi. Sanctions instead were levied against 17 Saudi nationals believed to be involved in the killing, though Crown Prince Mohammad bin Salman and the kingdom’s government were spared.

You will find more infographics at Statista

You will find more infographics at Statista

Last week, Reuters reported, citing three unidentified people familiar with Saudi energy policy, that the kingdom had threatened to drop the dollar as its main currency in selling its oil if the US passes the lawsuit bill. While the death of the petrodollar has long been predicted (particularly as the petroyuan gathers momentum), this is the most direct threat yet to the dollar’s privileged position in global commodity markets.

NOPEC, or the No Oil Producing and Exporting Cartels Act, was first introduced in 2000 and aims to remove sovereign immunity from US antitrust law, paving the way for OPEC states to be sued for curbing output in a bid to raise oil prices.

The threats to de-dollarize arrived amid reports that Russia and China have been buying more gold reserves as part of a move away from the dollar.

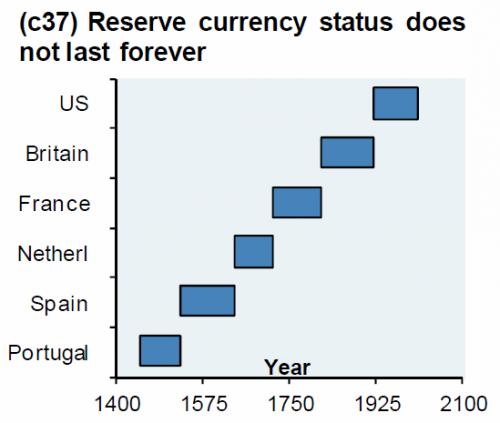

But even if Saudi Arabia keeps the dollar as its currency of choice for trading oil, the Russia and China-led push to create an alternative to the dollar-based financial system will almost certainly continue. And investors who naively expect the dollar’s position will go unchallenged forever would do well to remember the following chart.

via ZeroHedge News http://bit.ly/2YXYiTC Tyler Durden