The global equity rally stumbled for the second day, and risked running out of steam ahead of Wednesday’s action-packed event bonanza, even as Asian and European shares gained while US equity futures pared losses as investors appeared to shrug off threats from President Trump for new tariffs on goods produced in the EU in retaliation for Airbus subsidies. Treasuries were unchanged, as the dollar drifted lower.

Amid a generally muted tone, Asia rose to an 8-month high overnight with European shares initially opening flat after the office of the U.S. Trade Representative sent its proposals to the World Trade Organisation, saying the EU had provided $11 billion worth subsidies to Airbus; however the Stoxx Europe 600 inched higher in morning trade, up 0.1%, with the banking sector rising before the ECB meeting Wednesday, overshadowing losses in the tech sector, led lower by SAP.

In notable moves, SAP fell 2.5% after being downgraded to hold from buy at HSBC, cut to neutral from buy at UBS ahead of the software company’s 1Q results later this month. Airbus shares dropped as much as 2.5 percent in early deals, with many of its key suppliers lost between 0.7 percent and 1.2 percent, though much of the early losses were then recovered.

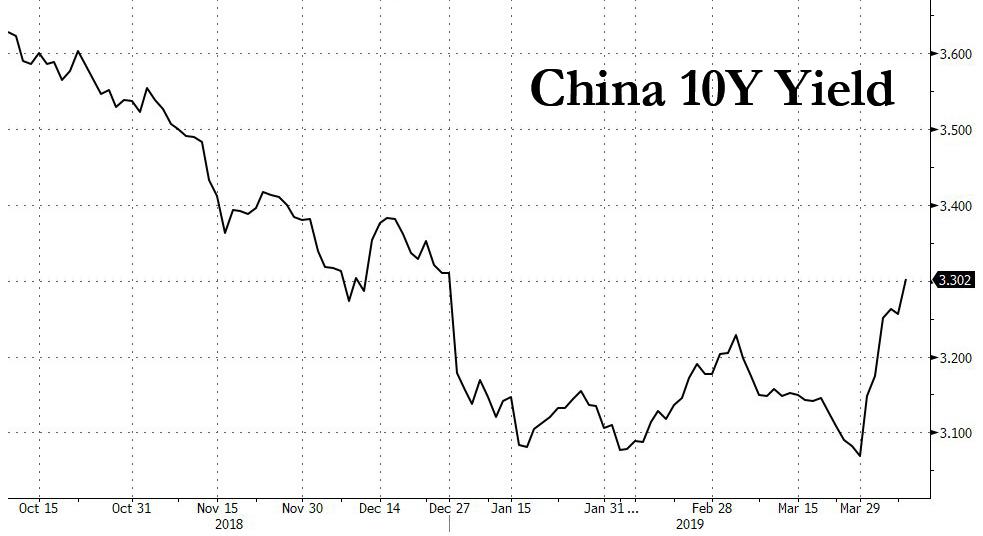

While most Asian markets were higher, Chinese stocks dipped modestly, down 0.2%, but it was the ongoing surge in Chinese 10-year sovereign yields that continues to grab attention, with the paper rising another 4bps to 3.294%, the highest level of the year following a torrid surge last week, when yields jumped 19bps, the most since November 2013.

Aberdeen Standard Investment’s head of global multi-asset strategy, Andrew Milligan, told Reuters that “signals like this just remind people… that the strategic rivalry between the U.S. and other countries is serious and is not going to go away.”

Ahead of “Super Wednesday”, the other focus was set to be the International Monetary Fund’s half-yearly forecasts, which will reinforce the message that the global economy continues to slow down for a variety of reasons, which in turn will likely push stocks even higher. According to Reuters, the Fund is expected to make quite a sizable cut to its growth number and Germany’s benchmark 10-year bond yield stayed just below zero percent on bets interest rates are set to stay extremely low globally.

Finally, the reason why markets may be subdued today is because all hell is set to break loose tomorrow when the EU emergency Brexit summit, ECB meeting, US CPI report and FOMC minutes all take place.

In currencies, Sterling was largely unchanged, after earlier jumping on speculation Germany would accept a 5-year time limit on the Irish backstop; the jump quickly fizzled after a German government spokesman denied the report. Additionally, Prime Minister Theresa May is set to meet Germany’s Angela Merkel and France’s Emmanuel Macron to ask for another Brexit delay. Elsewhere, the The Australian and Canadian dollars and Norwegian crown and Russian rouble also rose as a surge in oil prices to five-month highs lifted most other commodity-linked currencies too, as the dollar continued its 2-day slide.

In commodities, Brent rose as high as $71.34 a barrel, the highest since November, while WTI crude also hit a November 2018 high of $64.77 and was up 22 cents at $64.62. Oil prices are up more than 40 percent this year, jumping on expectations that global supplies will tighten due to fighting in Libya, OPEC-led cuts and U.S. sanctions against Iran and Venezuela.

Levi Strauss is due to release earnings after its IPO last month. Economic data include JOLTS job openings, small business optimism.

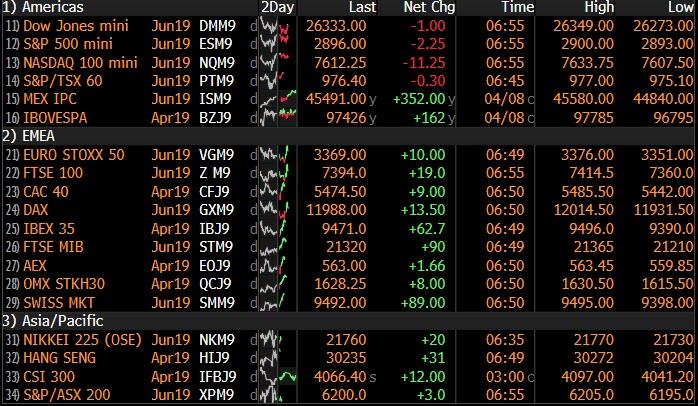

Market Snapshot

- S&P 500 futures down 0.1% to 2,894.75

- STOXX Europe 600 up 0.09% to 387.85

- MXAP up 0.3% to 163.34

- MXAPJ up 0.4% to 543.47

- Nikkei up 0.2% to 21,802.59

- Topix down 0.09% to 1,618.76

- Hang Seng Index up 0.3% to 30,157.49

- Shanghai Composite down 0.2% to 3,239.66

- Sensex up 0.3% to 38,800.85

- Australia S&P/ASX 200 up 0.01% to 6,221.82

- Kospi up 0.1% to 2,213.56

- German 10Y yield fell 0.9 bps to -0.002%

- Euro up 0.08% to $1.1272

- Brent Futures up 0.2% to $71.26/bbl

- Italian 10Y yield rose 0.8 bps to 2.132%

- Spanish 10Y yield fell 0.6 bps to 1.081%

- Brent Futures up 0.2% to $71.26/bbl

- Gold spot up 0.3% to $1,301.75

- U.S. Dollar Index down 0.1% to 96.95

Top Overnight News from RanSquawk

- The EU is preparing retaliatory tariffs against the U.S. over subsidies to Boeing, significantly escalating transatlantic trade tensions hours after Washington vowed to hit the EU with duties over its support for Airbus SE. Trump’s administration on Monday said it would impose tariffs on $11 billion in imports from the EU because of the European aid

- The EU and China managed to agree on a joint statement for Tuesday’s summit in Brussels, papering over divisions on trade in a bid to present a common front to Trump, EU officials said

- The slump in the Chinese car market showed no signs of easing, with retail sales of sedans, sport utility vehicles, minivans and multipurpose vehicles dropping 12 percent to 1.78 million units in March, the China Passenger Car Association said Tuesday. That follows an 18.5 percent drop in February and 4 percent decline in January

- Turkey’s ruling party will demand a rerun of last month’s local election for the mayor’s seat in Istanbul after tallies showed it lost the vote, according to Recep Ozel, a ruling party official assigned to the election board. The election looked like it had stripped the city from President Recep Tayyip Erdogan and parties affiliated to him for the first time in 25 years

- Societe Generale SA said it plans to cut about 1,600 jobs after a slump in trading revenue pushed Chief Executive Officer Frederic Oudea to intensify efforts to boost profit at the investment-banking unit

Asian equity markets eventually turned mostly positive on what was a predominantly cautious session following a mixed performance on Wall St amid tentativeness ahead of upcoming earnings season and this week’s central bank activity including FOMC Minutes and ECB policy meeting. ASX 200 (U/C) and Nikkei 225 (+0.2%) were indecisive but with losses in Australia stemmed by strength in the energy sector as the escalating conflict in Libya lifted oil prices, while Tokyo sentiment mirrored a choppy currency. However, the region was not without its success stories as Crown Resorts surged over 20% after it announced it was in discussions regarding a takeover approach by Wynn Resorts and with Sony higher by more than 7% on news Third Point was building an activist stake in the Co. and called for a review on ownership of several divisions. Hang Seng (+0.3%) and Shanghai Comp. (+0.1%) were also tepid amid a lack of any firm drivers and as trade-related news quietened down, while the PBoC also continued to refrain from open market operations. Finally, 10yr JGBs were lacklustre amid an indecisive risk tone and as participants awaited a 5yr auction, as well as Saudi Aramco’s USD 10bln bond offering which was more than 7x oversubscribed. Prices later recovered off their lows as the 5yr JGB auction later proved to better than previous with an improvement seen across most metrics including a higher b/c and accepted prices.

Top Asian News

- China Investor Loves This Tiny Maker of Floating Flamingos

- Malaysia’s Felda Is Said to Seek $1.5 Billion Government Rescue

- Japan to Cut Japan Post Stake to >1/3 in Sale This Year: Nikkei

- Tumbling China Bonds May Soon Look Good to Foreign Investors

Choppy trade for European equities thus far [EuroStoxx 50 +0.2%] following a cautious Asia-Pac session where China was tepid amid the lack of any firm drivers ahead of tomorrow’s risk-packed session. Analysts at HSBC believe that the Chinese economy has bottomed, and growth will pick-up in the coming months as the private sector feels the effects from corporate tax cuts. Over in Europe, stocks nursed some of the losses seen at the open after jitters from the US’ release of prelim tariffs on USD 11bln of EU products [Full list available on the headline feed] somewhat waned after sources noted that the legal actions taken against Airbus (-1.5%) subsidies are “greatly exaggerated”, and the EU remains open to dialogue with the US. Furthermore, upside in equities was initially exacerbated amid reports that German Chancellor Merkel is reportedly willing to put a 5yr time limit on the Northern Irish backstop, although equities shed some gains after this was dismissed, but remain in positive territory. Sectors are relatively mixed with no clear outperformer or laggard. In terms of individual stocks, Swiss heavyweight Novartis’ (-9.8% unadj.) Alcon unit (+5.2%) began its first trading day on the front foot and opened above the CHF 46.50-53.50 indicative range at CHF 55.00. Elsewhere, SAP (-2.1%) fell to the foot of the DAX in light of downgrades at HSBC and UBS. Finally, Italy’s Prysmian (-3.9%) extended on losses seen at the open following further failed commission tests.

Top European News

- U.K. Minister Sees ‘Common Ground’ With Labour: Brexit Update

- Debenhams Lenders Poised for Control as Ashley Falls Short

- Telenor Takes on Telia in Nordics With $1.7 Billion DNA Deal

- Porsche Bets on 911 Demand to Rally Sales to Record After 1Q Dip

In currencies, Sterling leapt towards the top of the G10 table amidst reports that German Chancellor Merkel may be open to a fixed backstop timeframe (5 years touted), which could appease some of those unwilling to back the WA, according to a Brexiteer. Cable cleared the 55 DMA (1.3096) and 1.3100 handle on its way to 1.3121 in response, while Eur/Gbp retreated to 0.8595 from 0.8627 at one stage before a denial by the German Government. Looking ahead, UK PM May’s is in Berlin to see her German counterpart and has a subsequent meeting with French President Macron before Wednesday’s emergency EU Summit. Meanwhile, talks between Tory Cabinet members and the Labour party are ongoing to try and strike a deal, and interim updates remain mixed.

- AUD/NZD – The Aussie has extended gains to 0.7150 vs its US counterpart and 1.0600 against the Kiwi as commodities continue to rally and overnight data in the form of housing finance confounded expectations to the upside. Aud/Usd is now looking at bullish chart levels including the 100 DMA and a 50% Fib at 0.7142 and 0.7149 respectively to maintain momentum on a closing basis, with decent if not insurmountable option expiries between 0.7150-55 (circa 770 mn) also on the radar. Meanwhile, Nzd/Usd is trying to tag along and trying to breach 0.6750 ahead of offers said to be sitting at 0.6760.

- JPY – Usd/Jpy has drifted down within a 111.57-24 range and into a relatively heavy expiry zone, as 1.8 bn runs off from 111.20-25 vs 1.7 bn at 111.35-40, with the Yen seeing some safe-haven demand due to renewed US/EU tit-for-tat tariff posturing. Chart-wise, 111.25 also represents the 10 DMA, while resistance ahead of the 112.00 big figure comes via a daily formation around 110.78.

- EUR – The single currency has consolidated yesterday’s clearance of 1.1250 vs the Dollar and is eyeing 1.1280 as the DXY slips a bit further below 97.000 to test support at 96.806 amidst broad declines in Usd/major pairings. However, a thick cluster of option expiries may drag Eur/Usd back down given 5.8 bn rolling off between 1.1245-75, not to mention a further 3.1 bn lower down.

- CAD/NOK – Both benefiting from the ongoing strength in oil prices, and the latter to the extent that a knee-jerk spike in Eur/Nok in wake of weak Norwegian GDP data has already been reversed, with the cross currently straddling 9.6200 vs a high just shy of 9.6500. Meanwhile, the Loonie is pivoting 1.3300 vs its US counterpart and just eclipsed its previous April high.

- EM – More thrills and spills for the Lira, as an initial rebound made on a reduced recount in Istanbul was thwarted by another rejection of the electoral board’s decision by the AKP that is insisting on a full election rerun. Usd/Try back up near 5.6700 vs 5.6425 and 5.6949 at the extremes.

In commodities, another day of gains in the energy complex with WTI and Brent futures trading in proximity to USD 64.50/bbl and USD 71.00/bbl respectively; although the complex is trading towards the bottom of the days range. Developments in Libya remain a key factor in the upside seen recently with analysts at TD noting that “military tensions in Tripoli, Iranian sanctions and difficulties in Venezuela may cause deficits as OPEC+ is reducing supply and US shale activity is flattening — USD 68/bbl WTI in the cards”. That said, analysts at Goldman Sachs, due to lower projected inventories, expect further backwardation and modest upside in oil prices whilst forecasting the WTI/Brent spread to tighten to USD 4.50/bbl from Q4 2019 onwards. GS also raised its Q2 2019 Brent forecast to USD 72.50/bbl (Prev. USD 65.00/bbl) and maintained its USD 60.00/bbl 2020 forecast. Meanwhile, Russian Energy Minister Novak stated that there is no need to extend the OPEC+ output deal if the market is forecast to be balanced by H2, which his Saudi counterpart previously said was only 70-80mln barrel away. Elsewhere, metals are benefitting from the recent pullback in the Buck, with gold also profiting from recent flows into the yellow metal ahead of tomorrow’s risk-filled day. Copper gained amid continued strength in Chinese commodity prices in which Dalian iron ore futures gained for a 7th consecutive session amid tightening supply. Finally, Platinum caught a bid as markets speculate the impact of labour strikes in South Africa, which saw the metal break through key resistance levels whilst also triggering CTA short covering, according to TD.

US Event Calendar

- 6am: NFIB Small Business Optimism, est. 102, prior 101.7

- 10am: JOLTS Job Openings, est. 7,550, prior 7,581

DB’s Jim reid concludes the overnight wrap

I know that all parents think their children are special and highly gifted but I have to tell you that I genuinely think that one of my twins – 19 month old Jamie – is showing serious skills that already could mark him down as a future professional footballer. I’ve asked a few people who have seen him perform and they agree that they’ve never seen someone so proficient at his age. Yes, Jamie is going through a phase at the moment that whenever he doesn’t get his own way he launches into the most theatrical dive and bursts into tears. He then rolls about all over the floor and demands action. At times I swear he’s waving an imaginary card at the referee (usually mum). All that’s left is to try to teach him how to kick a ball and the family can retire off his 2035 Premier League contract. On that good luck to all those fans of teams in the Champions League quarter-finals over the next couple of evenings… unless of course you are a Porto fan where I instead wish you all the bad luck in the world (but please still vote for us in II).

In footballing terms if tomorrow is the Champions League of bumper days for markets, yesterday was like watching a lethargic pub team training session as Easter holidays seemed to have started in earnest. News flow has livened up overnight though as the US Trade Representative office has released a list of EU goods which will be subjected to additional tariffs if the EU continues to provide subsidies to Airbus. In the accompanying statement, the USTR office cited the WTO’s finding that the aid to Airbus has “repeatedly” caused “adverse effects to the United States.” The threatened tariffs are on some $11bn of imports from the EU and will be implemented only after the WTO give the final go-ahead this summer. The Trump administration hasn’t always trusted the WTO on these matters so its interesting that they are here. Proposed items in the list include new passenger helicopters, various cheeses and wines, ski-suits and certain motorcycles. This news might also remind investors that the US report on the national security risk of auto imports was delivered back in February without any official response yet. Having said that the US first complained to the WTO about Airbus subsidies 15 years ago so this has been a long running dispute.

Despite the tariff threat, markets are eking out modest gains overnight with the Hang Seng (+0.31%), Shanghai Comp (+0.14%) and Kospi (+0.11%) all up after erasing early losses while the Nikkei (+0.02%) is trading flattish. Elsewhere, futures on the S&P 500 are trading flat (-0.08%).

Before this the S&P 500 spent most of yesterday in the red, but clawed back during the New York afternoon (+0.10%) to extend its winning streak to eight consecutive days. That’s the longest stretch since October 2017. The NASDAQ also squeaked out a positive day (+0.19%) while the DOW (-0.32%) limped to a small loss, suffering from another drop for Boeing (-4.44%). Prior to this, the STOXX 600 (-0.19%) closed lower with all but three sectors in the red, while the story in bond markets was a slight tick up in Treasury yields (10y +2.3bps) and the 2s10s curve back up +0.7bps to 15.9bps. It’s worth noting that ever since the curve went below 20bps in December last year it’s traded in just a 10bp range. Meanwhile in commodities, WTI oil rose +2.16% following the Libya conflict news over the weekend, putting it at the highest since October 31st. The main story in EM was further weakening for the Turkish Lira (-1.14%) after President Erdogan suggested that there were “widespread irregularities” in the local elections. Other emerging markets performed well, with the Russian ruble (+0.72%) and Mexican peso (+0.52%) gaining alongside the advance in oil prices.

As for the daily Brexit update, Mrs May is travelling to see Mrs Merkel and Mr Macron today ahead of tomorrow’s summit that will decide on the UK extension request. So expect headlines from these meetings. Yesterday saw Labour receive an updated offer from the government as part of the ongoing Brexit negotiations. Supposedly there are still ongoing discussions about whether it will include a clear offer of moving to a customs union. The BBC’s Laura Kuenssberg also suggested that there is anxiety on the Labour side as even primary legislation could still be unpicked by the next Tory leader. This means that even if both sides can reach an agreement on a customs union it’s not entirely clear that they’ll be able to deliver a deal politically. It’s worth recapping that our house view base case is for no agreement between Labour and the Tories this week, but indicative votes going forward instead of a compromise solution. Later last night, the House of Lords passed its version of the bill to prevent a no-deal Brexit, though the issue has been a bit overtaken by events since PM May has already promised not to allow a no-deal outcome and is committed to following Parliament’s decision. Sterling floated between gains and losses during the European session before rallying +0.21% during the US session and overnight it has strengthened +0.14%.

As mentioned at the top this week should really kick into gear from tomorrow with a main course of the ECB meeting, the emergency EU Council meeting to discuss the Brexit extension, the FOMC minutes and US CPI data all on the cards. However we’ve got a couple of appetisers to look forward to today with the World Bank/IMF Spring Meetings kicking off, as well as the latest Euro Area bank lending survey covering Q1. A reminder that the survey for Q4 had a much softer tone. The net percentage of banks reporting tightening standards to enterprises was closer to even with -1 in Q4 compared to -6 in Q3. Demand for loans also continued its slowing trend from recent quarters with the net balance to enterprises falling to +9 versus +12 in Q3. It was a similar story for housing loans although demand for the latter did pick up. At a country level the softness was mostly reserved for Italy and Spain. Notably the outlook for Q1 also implied further moderation. So worth keeping an eye on today’s survey to see whether or not there are pockets of improvements. Given the only recent China rebound it might be too early to expect too much.

While we’re on the ECB there was a Bloomberg story doing the rounds yesterday which suggested that Committee members “are said not to have discussed tiering options” since Draghi’s comments towards the end of last month. There was a slight knee jerk reaction for European Banks post that headline however the story didn’t really seem to gather much momentum thereafter. European Banks did however still close down -0.72% while Bunds ended broadly flat and a notch above 0% at 0.007%.

In other news, there wasn’t much to write (or WhatsApp) home about from the data yesterday. In the US February factory orders were confirmed as declining -0.5% mom, matching consensus expectations. Core capex orders were also unrevised at -0.1% mom. Prior to this, in Europe the Sentix investor confidence reading for the Euro Area improved slightly to -0.3 (from -2.2) while February export data in Germany was weaker than expected at -1.3% mom (vs. -0.5% expected).

Finally to the day ahead, which is notably sparse for data releases with nothing due in Europe and only the March NFIB small business optimism print and February JOLTS report due out in the US. Away from that the Fed’s Clarida is set to speak at a “Fed Listens” event in Minneapolis late tonight, while as mentioned above the annual Spring Meetings of the World Bank and IMF begin today, and at some stage we’re expecting to get an update of the IMF’s World Economic Outlook. So expect headlines there. As discussed earlier, we’ll also get the Euro Area bank lending survey today.

via ZeroHedge News http://bit.ly/2G3ufRw Tyler Durden