With another flurry of bond auctions on deck this week, among them tomorrow’s benchmark 10Y, moments ago the Treasury sold $38BN in 3Y paper in what was at best a subpar bond sale, and certainly a far cry from today’s blockbuster $100BN bond sales by Saudi Aramco.

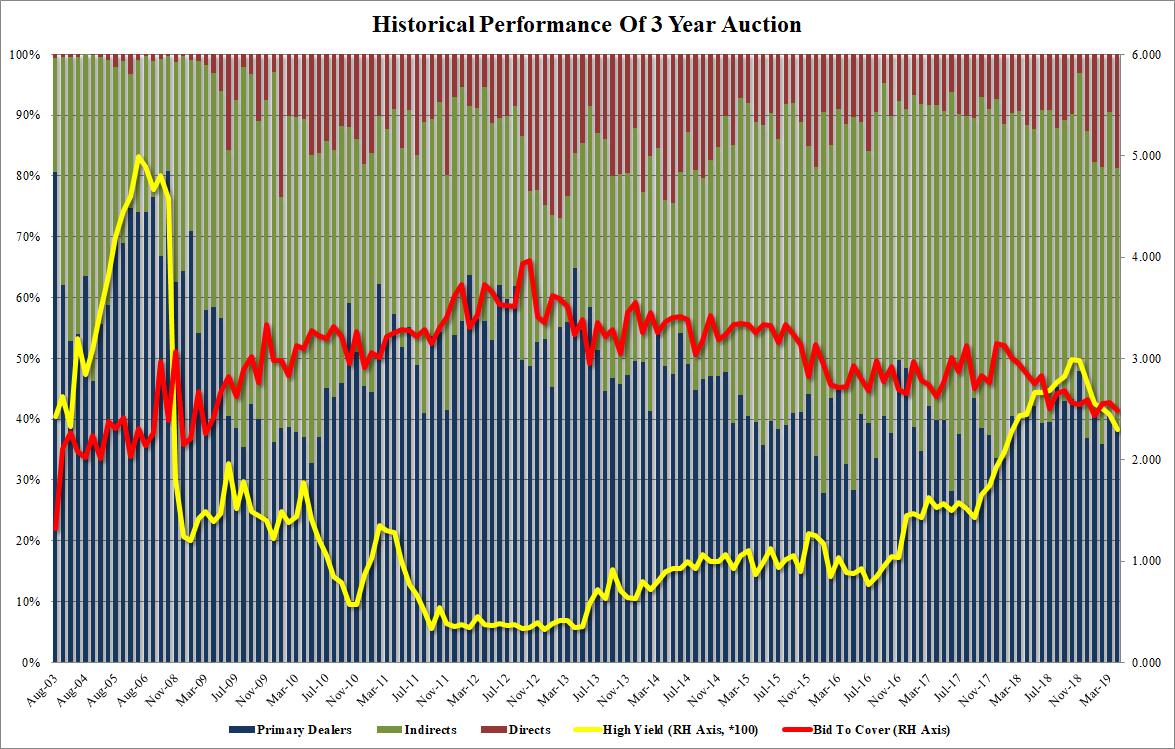

Pricing for the 3Y auction came at 2.301%, a 0.2bps tail to the 2.299% When Issued, and the 12th tailing auction in the past 13. This was the lowest yield on 3Y paper since February 2018, and well below the 2.4480% in March.

The Bid to Cover of 2.49 was slightly below the 2.56 in March, and below the 2.54 six auction average.

The internals were surprising: while Indirects were also in line, if on the low end, coming in at 42.7%, below the 49.5% in March and below the 6 auction average, it was Directs that were notable, as the Direct takedown doubled from 9.4% to 18.7%, the highest since September 2014. It was not immediately clear what prompted this latest surge in the Direct bid. Finally, Dealers took down 38.6%, also below the March total of 41.1% and the recent auction average of 41.3

Overall, a relatively disappointing auction which may be the result of both the drop in yields today, the recent depletion of the short base, and the anticipation for “Super Wednesday’s” CPI report which may lead to a notable repricing of the yield curve.

via ZeroHedge News http://bit.ly/2WYHwlw Tyler Durden