Authored by Ritech Jain viaWorldOutOfWhack.com,

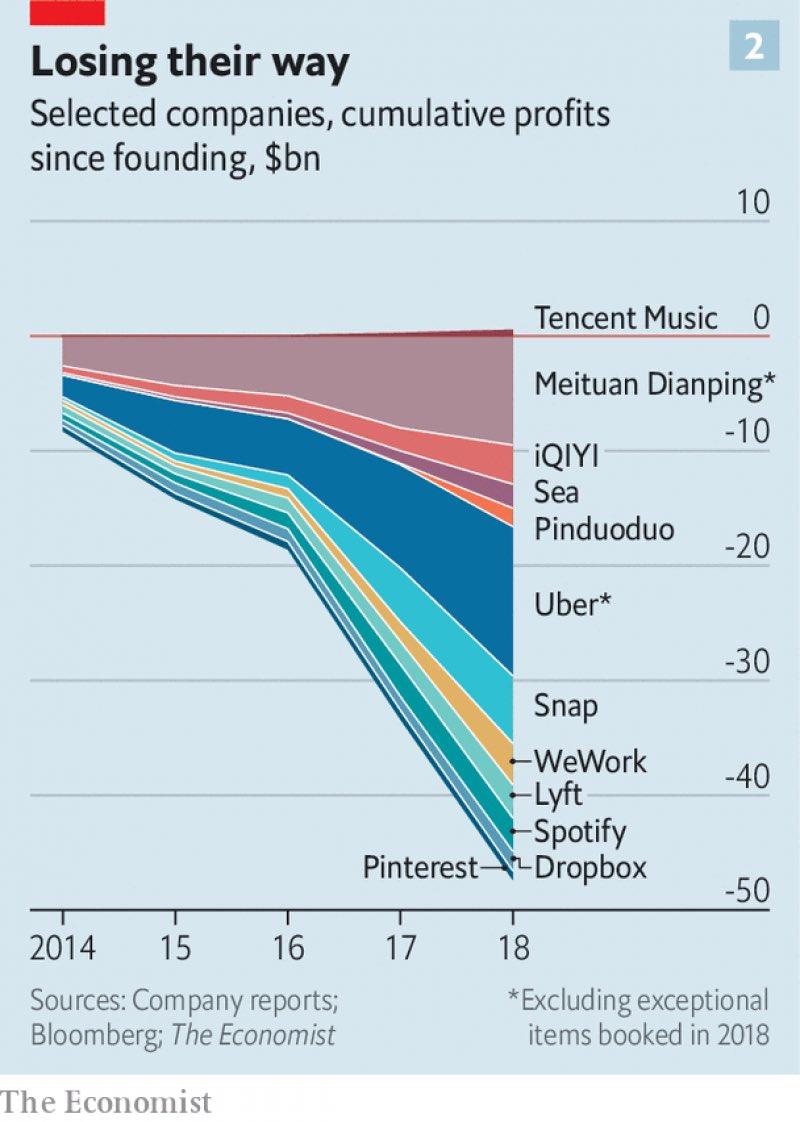

The wave of unicorn IPOs reveals Silicon Valley’s dangerous groupthink: a dozen unicorns that have listed, or are likely to, posted combined cumulative losses of $47bn.

Justification is doctrine of “blitzscaling” in order to conquer “winner-Takes-all” markets.

Is it different this time? Has innovation and winners-take-all triumphed over the lack of cash flows. In fact companies like Lyft and UBER are brazen enough to tell you that they might never make profit.

Think from a point of view of poor fund managers with fiduciary responsibility to manage your money and is struggling to beat the market or from a private equity guy who is not finding enough unicorns to invest his overflowing coffers.

This is what leads to groupthink aided by free money created out of asset inflation and it will continue till we see first sign of real price inflation in real economy.

via ZeroHedge News http://bit.ly/2ILjvKT Tyler Durden