Via Bloomberg’s Richard Breslow,

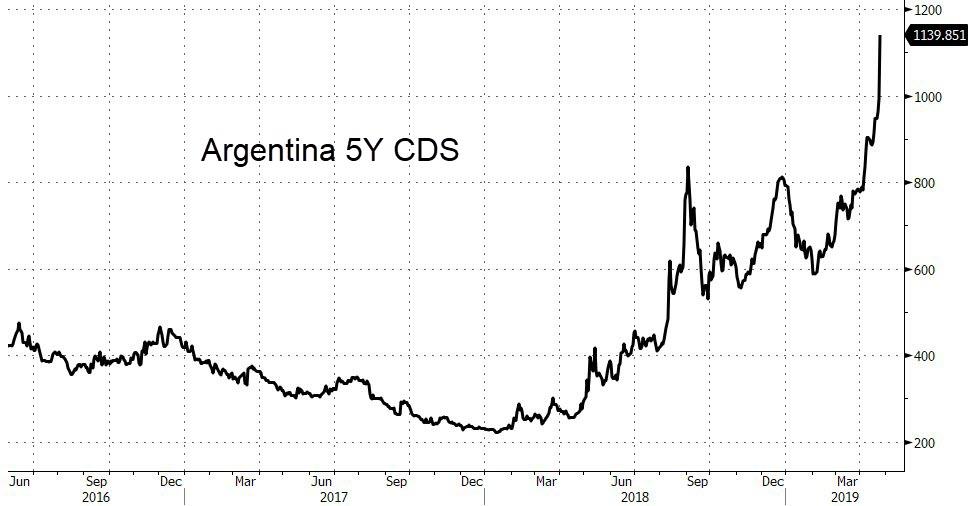

South Korea’s GDP miss was a bad one. The Shanghai Composite fell 2.4%, bringing its week-to-date performance to negative 4.5%. Sweden’s Riksbank surprised the market by how dovish it was. The euro made a new low for the year versus the dollar, with the upcoming set of European elections looming larger as the German manufacturing slump continues. Argentine credit default swaps have blown out. Emerging market equities and currencies are in a rough patch. The Japanese yen rose despite BOJ Governor Haruhiko Kuroda talking about downside risks to prices and the need to strengthen forward guidance.

An eventful night to be sure.

It raises the question of whether we are meant to be scared. And the answer is it is way too early to answer in the affirmative if you are talking about financial markets. Sanguine in the midst of all this news? You probably can afford to be if you are a trader. And prepared to do your job.

There isn’t a lot of ameliorating things to say about the Korean number. The won and Kospi seem to have agreed with that sentiment and got hit accordingly. But we are still in wait-and-see mode for the details of the already planned new fiscal spending package. That matters because, while exports remain a challenge, the biggest negative from this report came from public sector investment. Which plummeted. Greater fiscal spending was one of the reasons the BOK came out as firmly on-hold at last week’s monetary policy meeting.

Chinese stocks are having a bad week. They have also been having a stellar year. And as much as any index out there it is a traders’, or speculators’ if you prefer, market. After some tremendous downs then ups, the Shanghai Composite is almost perfectly flat over the course of the last year. And is it any wonder, with all the holidays coming up, that positions are being adjusted? You would have done much better trading these indexes using moving averages than trying to debate how friendly the PBOC or Robert Lighthizer is going to be.

The Riksbank was dovish. They can see the German numbers like everyone else. Their message was concern for growth outside, not inside, the country. In fact, they remain upbeat on domestic matters. They know what everyone should know. The world needs a weaker euro. It’s a good thing. And the Riksbank’s purported desire to strengthen the Krona isn’t consistent with that. In a world with a good amount of red on the screens today, the OMX 30 Stockholm Index has been having a nice up day and making a new four-year high. Low rates and a weak currency are working their magic.

The economic situation in Argentina is bad. But the default-risk pricing is intimately tied to the presidential election campaign, which doesn’t occur until October. And at the risk of being cavalier, markets have a bad track-record pricing political risk. Especially in Latin America. My advice is leave this one to the professionals. It’s for them to suss out the veracity of the soothing words Peronist leader Miguel Angel Pichetto had for an institutional investors meeting yesterday in New York.

As for the yen, take everything with a grain of salt. Japan is about to embark on the public vacation of all time. And traders have had a ball convincing themselves of the flash-crash risk from it. Easy for me to say, but that is looking for trouble in all the wrong places. Kuroda was more dovish than expected. In any case, this safe-haven currency made a new low for the year just yesterday and today’s strength merely takes it back within the range it’s been trapped in.

If you want a cool thing to watch for sentiment today, the MSCI EM currency index has traded back down to a level (1632) where it has bounced from three times this year.

Today could be the canary moment. The gray rhino may be crashing around our China shop. That possibility is why traders use charts and leave stops. But one dicey day doesn’t merit a complete change of worldview

via ZeroHedge News http://bit.ly/2ISkDw2 Tyler Durden