Was that it for the global economic recovery?

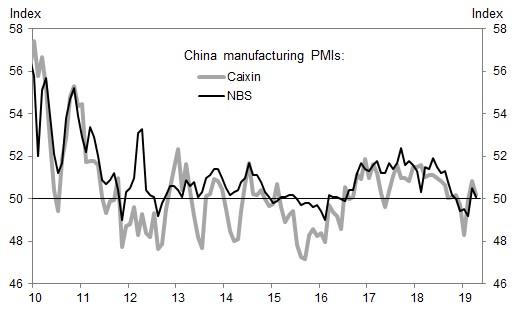

Just hours after China reported disappointing PMI data across the board, with both manufacturing and services surveys posting a drop to levels just above contraction…

… the latest Chicago PMI confirmed that the slowdown is accelerating in the US, as the index tumbled to 52.6 from 58.7, and sharply below the 58.5 estimate. It was also the lowest print since January 2017.

The details:

- Forecast range 56 – 62 from 25 economists surveyed

- Business barometer rose at a slower pace, signaling expansion

- Prices paid rose at a slower pace, signaling expansion

- New orders rose at a slower pace, signaling expansion

- Employment rose at a slower pace, signaling expansion

- Inventories fell at a slower pace, signaling contraction

- Supplier deliveries rose at a slower pace, signaling expansion

- Production rose at a slower pace, signaling expansion

- Order backlogs rose and the direction reversed, signaling expansion

More notably, the two-month plunge in the PMI was breathaking and after printing at 64.7 in February, the index has plunged 12.1 points in the past two months, its biggest drop since mid-2014.

And with all that, it now appears that China’s gargantuan credit injection which was 40% greater than a year earlier, has now been exhausted and the credit impulse tailwind is over.

via ZeroHedge News http://bit.ly/2GUiC17 Tyler Durden