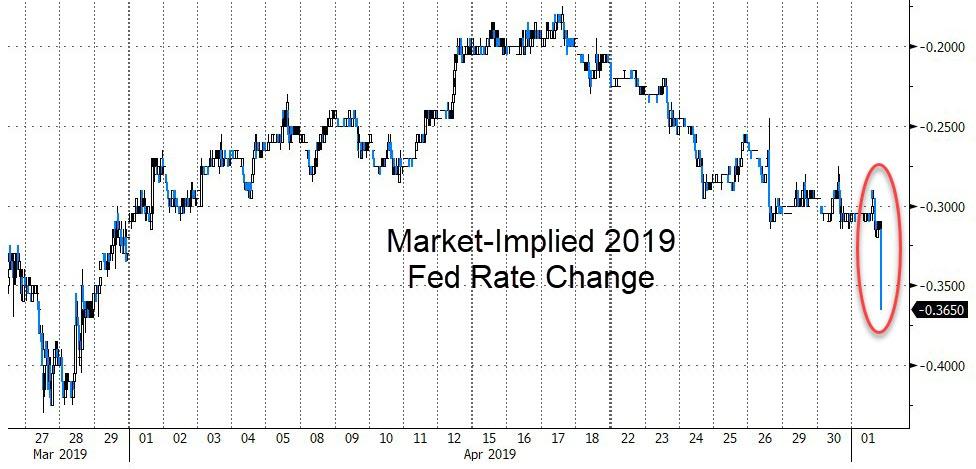

The market has instantly priced in an even more dovish Fed (now expecting 37bps of rate cuts to the end of 2019) as the IOER cut has dragged down bank stocks and bond yields broadly…

Bond yields are lower…

And bank stocks are sliding…

As BMO explains:

The most important development from the FOMC this afternoon was the cut of IOER to 2.35%; a drop of 5 bp while the Committee maintained the target Fed funds range of 2.25-2.50%.

The front-end of the curve is intuitively outperforming on this ‘fine-tuning’ cut and the curve, which has been grinding flatter on the day, has snapped back steeper. This also has created an outside-day steeper for the curve (very rare), which projects to at least 28 bp in 2s/10s.

To be clear, the IOER is a direct response to the relatively increasing scarcity of reserves (liquidity shortage) amid the balance sheet runoff.

via ZeroHedge News http://bit.ly/2XYxuRO Tyler Durden