Despite his best efforts, Fed Chair Powell managed to spoil the party with his use of one of The Fed’s favorite words – “transitory” – signaling that expectations for rate-cuts predicated on inflation staying low are perhaps not as set in stone as the market believes.

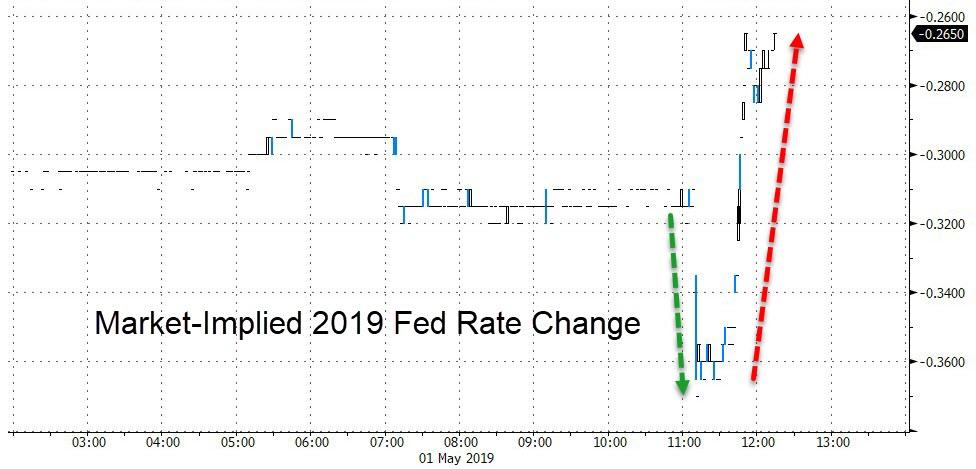

The hawkish tilt was very evident in the market’s implied rate-change pricing…

Additionally, Powell commented on “elevated (but not extreme) asset values.”

If Powell is so sure the decline in core inflation is transitory, why wasn’t this mentioned in the press statement?

— David Rosenberg (@EconguyRosie) May 1, 2019

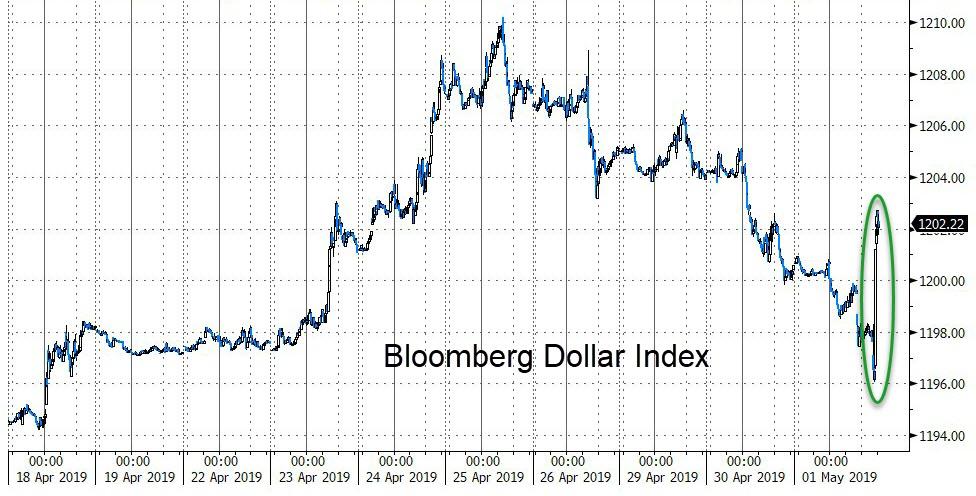

The Dollar spiked, and bonds, stocks, and gold slipped on the “transitory” comment…

Trannies were worst performers on the day, but Powell’s comments dragged stocks broadly lower on the day…

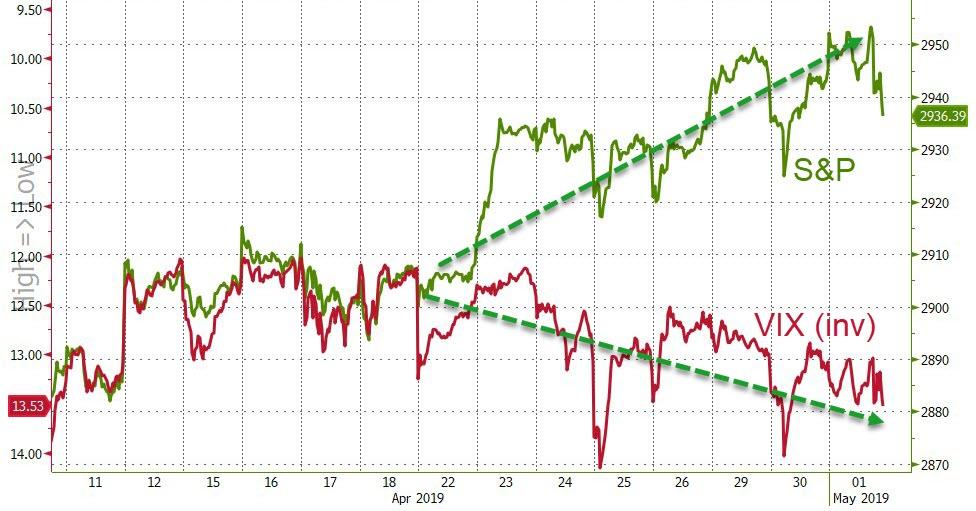

VIX and Stocks continue to decouple…

Credit spreads blew out quite notably Powell’s “transitory” comments…

Treasury yields ended the day higher…with the short-end dramatically so…

Not that the weak ISM and initial Fed statement sent yields lower before Powell’s “transitory” comment…

The dollar followed a similar path, dropping initially and then spiking on “transitory”…

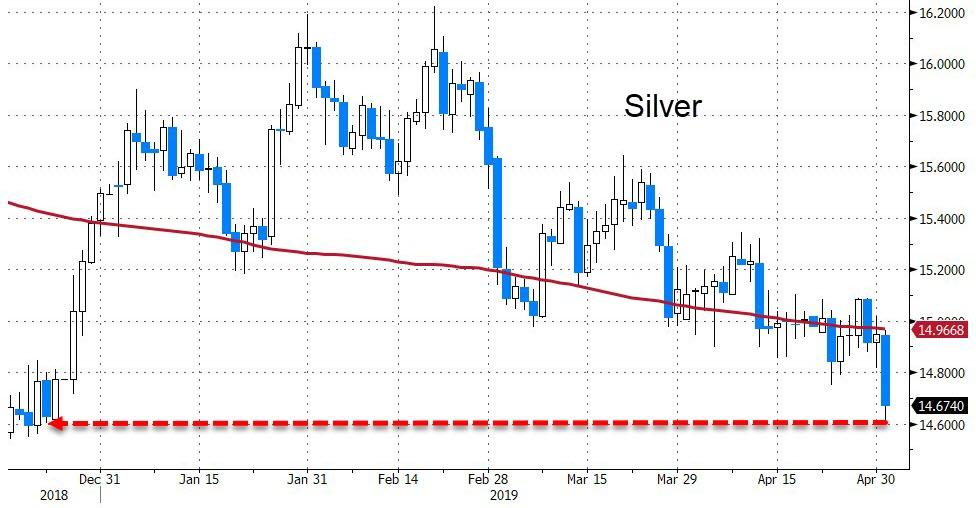

Ugly day for Dr.Copper…and Silver…

Gold pumped initially, then dumped as the dollar spike on “transitory” comments…

Silver snapped below its 200DMA…

Finally, with today’s ugliness in ISM, ‘soft’ survey data has fallen below its ‘hard’ data…

via ZeroHedge News http://bit.ly/2WdLkPS Tyler Durden