There were no surprises in today’s BOE policy decision: the central bank held rates unchanged as expected, in a unanimous decision which gave today’s decision a less hawkish sentiment as some expected one policymaker may break ranks by voting for a hike.

We have kept interest rates at 0.75%. Find out why in our visual summary: https://t.co/NErJey2wDI #InflationReport pic.twitter.com/e66OrM3Owm

— Bank of England (@bankofengland) May 2, 2019

Where there was some surprise was in the bank’s assessment of the monetary policy path and the BOE’s forecast of economic conditions.

Some more highlights from today’s decision, courtesy of RanSquawk:

- Rates: Projections in the accompanying QIR are based on a path for the Bank rate that rises to around 1% by the end of the forecast horizon. (Lower than Feb assumption of 1.1%). Note, the MPC make reference to recent global developments as a factor behind this.

- Brexit: The MPC’s projections continue to assume a smooth adjustment to the average range of possible outcomes for the UK’s eventual trading relationship with the EU. The release doesn’t provide any major update on the MPC’s view on the latest extension to the Brexit deadline.

- Growth: GDP is now expected to have grown by 0.5% in Q1 2019 vs. March view of 0.3%. This increase is largely as a by-product of UK and EU companies stockpiling ahead of Brexit. This boost is expected to be temporary with Q2 growth expected to slow to 0.2%.

- Inflation: Headline CPI in March of 1.9% was was inline with the Feb QIR and expectations at the Bank immediately prior to the release. Over the coming months, CPI was expected to remain fairly close to the 2% target, picking up slightly in April before easing back to just below target.

- Investment: The marginally below potential growth in underlying growth is continuing to have a particularly pronounced impact on business investment. Investment is expected to pick-up at the end of the forecast period.

- Labor: The labor market remains tight, with the unemployment rate expected to fall to 3.5% by the end of the forecast period.

- Wages: Annual pay growth remains around 3.5% whilst unit labour costs have strengthened to rates that are above historical averages

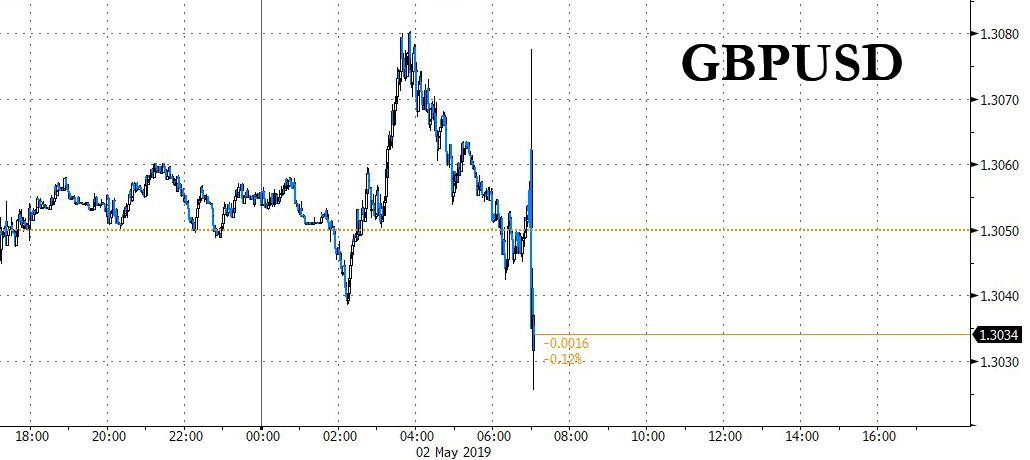

In summary: on one hand, the central bank upgraded its growth outlook for this year to 1.5% from 1.2% and also raised its predictions for 2020 and 2021, while cutting the forecast for the unemployment rate and maintaining the limited, gradual rate hikes will be needed and noting that inflation may be above target in 2 years at current market rates, which sent cable spiking higher in kneejerk reaction.

However, cable then broadly sold off after the market noticed that the BOE cut its inflation forecasts for 2019, 2020, and kept it unchanged for 2021, while conceding that nobody really knows anything, and that economic indicators may be volatile in coming months.

One possible reason for the post-kneejerk reversal in cable: too much hawkishness had been priced in, as ahead of the meeting, banks including JPMorgan, Citigroup Inc. and Toronto Dominion Bank saw scope for a hawkish signal from the BOE ahead of the meeting. And the signal they got was not hawkish enough.

Separately, in the broader market reaction, gilts edged higher, paring underperformance versus bunds, as money markets now see 28% probability of a BOE hike this year versus 35% before the decision, in what ultimately appears to have been a dovish disappointment.

via ZeroHedge News http://bit.ly/2GVTshd Tyler Durden