By Mark Orsley of PrismFP

- Fed cuts IOER but it likely will not fix the “issue”

- Signaling from the IOER cut important – builds the case for the steepener and zero bound ED calls

- Powell’s Q&A comments misguided – PMI’s + Core inflation tell the real story

- The three doves tomorrow makes chasing the selloff dangerous

Obviously the big news from yesterday was the IOER cut that then turned into a substantial reversal. Let’s tackle both of those…

With regards to the IOER cut, it was surprising because it is extremely unclear if it will bring down Fed Funds with it, but it was the quick, easy thing for the Fed to try. I would argue it was a hasty, risky move because what happens if FF does not follow IOER lower? The Fed just put its credibility on the line and if FF does not come down, calls that the Fed has “lost control” will increase.

To be succinct, cutting IOER does not fix the issue because the whole FF/IOER problem stems from:

- April 15 tax deadline MMF selling – I am struggling to find data on the amount people had to pay in taxes but the fund flows speaks of this and I can confirm taxpayers received less of a refund than previously

- Increasing deficits that led to increased bill/UST supply

Therefore, does cutting IOER really help? No! You could argue it made the matter worse. If you are a FHLB with the choice of investing in repo (jostling between 2.50% and 2.60%) and FF (now 2.35%), what would you chose?? Of course you would show up in repo land and shun FF and the Fed just further incentivized you. In other words, the FHLB’s will not be present to provide liquidity (see chart from last week’s note). Day 1 post IOER cut, FF remains a “sticky” 2.45%. It likely comes in a bp or two, but until we get a repo facility or QT ends; it remains a problem for the Fed.

The signaling here is important. When you think about it, FF’s never went through their upper bound where you would certainly expect some action. So the fact the Fed took swift action like yesterday’s IOER cut reveals to us that higher rates are not happening – ie: there will be no more hikes.

That can be seen when FF’s first broke above IOER last week and Dollar shot higher, EM sold off, and risk assets turned irritable (like an old man trying to send back soup in a deli – for you Seinfeld fans). The US has reached its breaking point with higher rates and we saw that bigly in Q4, last week when FF broke IOER, and even yesterday on the reversal. Higher rates are a problem.

That tells me that the steepener is still the play despite the sharp reversal flatter yesterday (gonna happen given positioning). The IOER cut yesterday is a steepener because:

- Lower front end rates at the end of a cycle are inherently a steepener

- When you think about reasons why the curve flattened in the first place, besides Fed hikes which are now a thing of the past, it was front end supply. This FF/IOER problem is all about the supply glut. Therefore, yesterday’s action by the Fed will likely not be last (not only because it may not work). There will need to be either/and: a repo facility to allow for banks to build reserves again and take down future supply, or a more abrupt end to QT which will ultimately be the end of the Fed tightening cycle. Both will act to steepen the curve.

Therefore, this rinse out yesterday is giving you an entry point to initiate/add/reload.

Let me say this bluntly: the FF/IOER widening may seem micro, but it is a problem. Growth was accelerated last year due to fiscal stimulus that led to increased deficits. Increased deficits leads to increased treasury supply. Increased treasury supply led to FF/IOER widening. FF/IOER widening is the first sign of the pipes bursting as it led higher front end rates, a dollar breakout (only an EU growth surprise stopped it – for now), EM selloff, and then risk off. The Fed did not fix this with the IOER cut yesterday.

* * *

Moving on to the post-announcement/Q&A reversal. It came after Powell made some positive comments on growth and inflation. Now let me ask you something; does anyone expect the Fed Governor to walk up there and say “wow, inflation is really falling off a cliff!” Obviously no, he needs to maintain some positivity in order to keep inflation expectations anchored.

However, those comments triggered two things:

- The account base that wants to fade the idea the Fed will cut soon sold – ie: sell “white” Eurodollars (very reasonable)

- With most of the world on holiday (Asia and Europe), liquidity was poor and given how quickly the market reacted to those rather benign comments on growth/inflation; it stunk of algo’s.

If Powell really wasn’t concerned about inflation and thought it was going to return to 2% (standard CB rhetoric), why did the official statement downgrade inflation? Last month’s statement tried to blame lower energy prices on the “meh” inflation, but with energy firmer since then and inflation actually LOWER, they had to strike that reference to lower energy. Not only that, the Fed then downgraded inflation to “declined and running below” their mandate. Well that’s not very positive and does not jibe with Powell’s Q&A comments. Always follow the official communication.

So in some respects, the reversal is reasonable on the back of the idea the Fed is not ready to start the cutting cycle soon, but the selloff can only go so far – we know a cut is coming. Therefore you can price out some cuts in September (very reasonable), December (ehhh, getting dicey), and March (very risky, I wouldn’t touch it personally). Some follow through on that theme is entirely possible.

However, the idea the market sold off on some “positive” rhetoric from Powell in the Q&A is extremely dangerous to trade off of. Again, he is the Governor of the Fed. He has to maintain some positivity, but more importantly, let’s keep an eye on what really matters; the economic data.

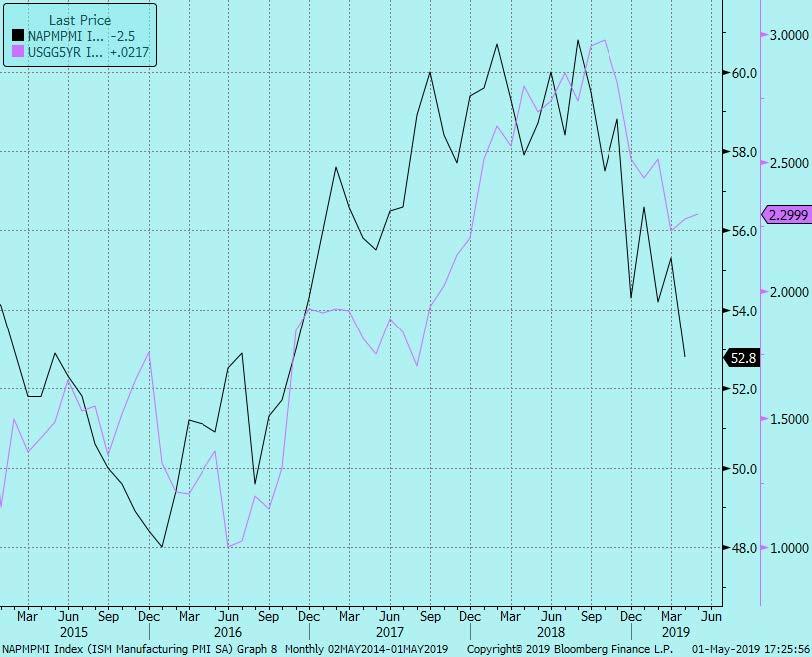

All the regional PMI’s the past couple weeks have rolled over and the headline PMI yesterday confirmed the weakness. Why is this important? PMI have led rates since 2015. As you can see here, in 2016 post Brexit when everyone was worried about growth, PMI’s accelerated and eventually rates followed. Then last year, PMI’s rolled over in September and the rest is history…

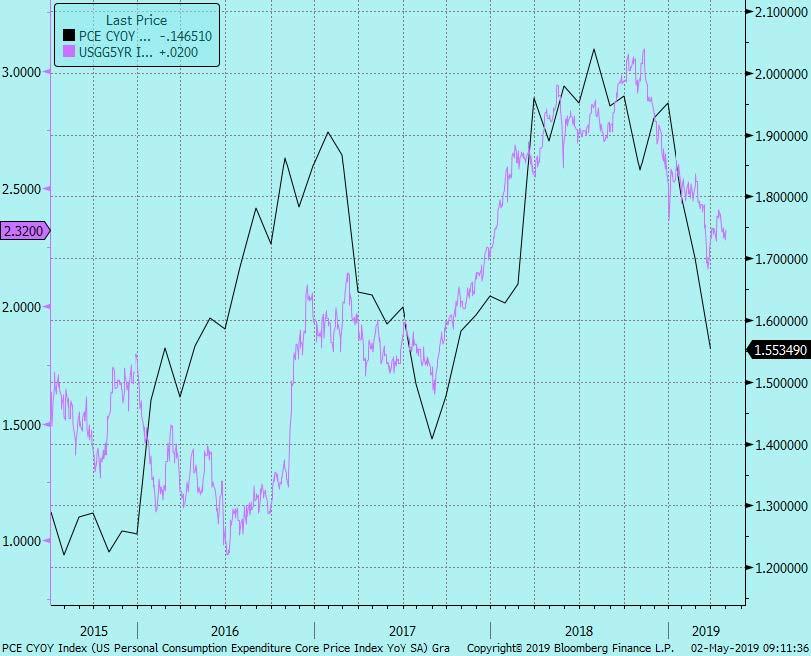

Oh and we want to talk about inflation? Core PCE (black) vs. 5yr yields (purple)….

Therefore, it is extremely risky to follow the banter of the Fed chairman. Of course he has to say things are ok; the reality is different. The data is not only rolling over in the US, but China, who exports growth globally, is also….

So the risk is that Q1 was a blip in a larger downturn, and this downturn could be worse than previous cycles given the theory that Fed has over-tightened – or said more conservatively in economic terms; have overshot the neutral rate. It is therefore reasonable to expect PMI’s in the US to move into contraction this year.

* * *

Lastly, most of us can spin the Q&A as hawkish, or said more conservatively; not dovish enough to realize the easing priced into the front end. The market has sold off on the back of this.

Let me ask you one more question; do you want to be short in front of speeches from the three doves tomorrow? We have: Evans, he of “ought to communicate comfort with 2.5% core inflation” and “if inflation too low, may have to loosen policy,” and the “AIT” brothers Clarida and Williams. These three have all the cover they need to be dovish given core inflation and the PMI’s.

Bottom line: there may be some follow through to price out cuts in 2019 which is completely reasonable. However, you can’t trade off of Powell’s Q&A comments. The trajectory speaks of end of cycle and a Q1 blip, and that means steepeners remain the macro trade of choice.

The new idea is on this back up, consider the zero bound trades that are starting to gain notoriety. Meaning you can buy Eurodollar call structures that pay you 15-1ish if Fed returns to zero rates by 2021. This will work because:

- The fiscal impulse runs out this quarter

- The Fed has tightened the economy into a corner

- The oft discussed long-term demographic issues kicks in around now (baby boomers retiring and entitlements become an issue)

- 2020 election cycle will be ugly

- My theme of 2019: trade wars have languished too long and the damage done to the global economy is done

via ZeroHedge News http://bit.ly/2vAvzqg Tyler Durden