The global automobile recession appears to be firmly intact, with new car registrations in Germany falling again in April, according to KBA transport authority data reported on by France 24. The data showed 310,715 new cars had been registered in April, 1.1% less than a year before. Sales for the first four months of 2019 were flat compared to the same period in 2018, at almost 1.2 million.

While places like the United States have been grappling with higher average sale prices and high interest rates on top of a broke consumer, markets in Europe continue to struggle with new EU emission regulations that began last September. These regulations have been the main scapegoat for an industry in Europe that clearly has been grinding to a halt for months now, with manufacturers claiming that the regulations have caused production and sales bottlenecks.

Some more on German auto sales, from France24 and Bloomberg:

-

Mammoth Volkswagen highlighted the new cycle, known as WLTP, as a challenge for high-end subsidiary Audi when it released first-quarter results Thursday. Volkswagen sales dropped 11.2% m/m.

-

Looking at carmakers’ performance from January to April, VW’s own-brand vehicles accounted for almost one in five sales in Germany, at 221,000 — although that figure was down 4.5 percent on the same period in 2018.

-

Audi’s sales were down 12.8 percent year-on-year in April, although competing luxury brands BMW and Mercedes-Benz both moved more cars.

-

Peugeot-owned mass-market brand Opel was also down 3% YOY and 5.2% m/m.

-

And while BMW, Mercedes and Audi were all up slightly year-on-year, VW subsidiary Porsche suffered a precipitous tumble in sales, shedding 24.9 percent.

-

BMW fell 17.4% on a m/m basis, however.

A technical recession is defined as “two successive quarters of negative growth,” a data point that Germany barely missed this period. And the economically pressured consumer is also turning up in places like Germany, where appetite for luxury vehicles has been muted amid a broader economic slowdown. Berlin last month slashed its 2019 GDP growth forecast to just 0.5%

Just yesterday we reported another dismal month for US auto sales in April, as well. As we said then, the poor numbers were blamed on rising car prices, which easily pushed away an overextended, broke and debt-laden U.S. consumer.

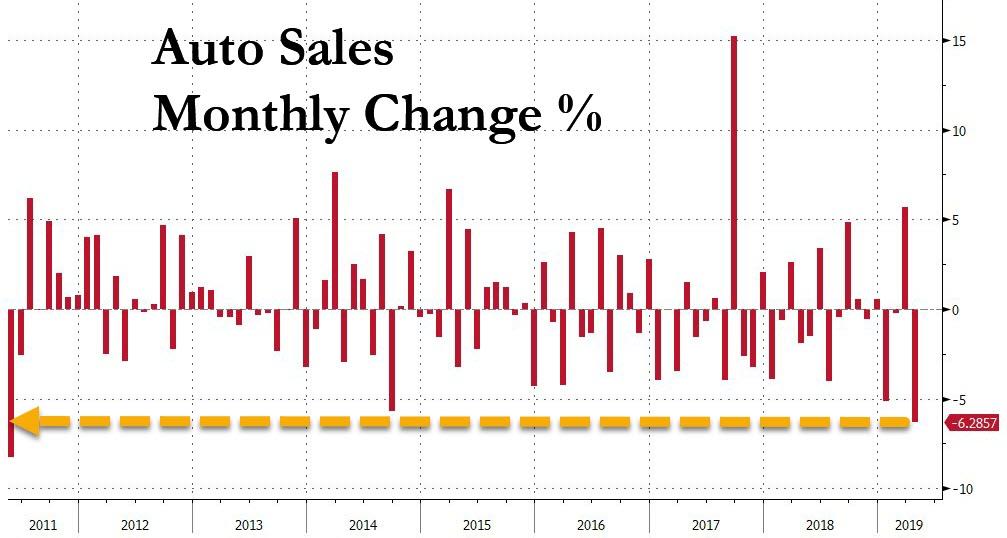

In a nutshell, US auto sales in April tumbled by 6.1% – the biggest monthly drop since May 2011 – to just 16.4 million units, the lowest since October 2014. Aside for an incentive-boost driven rebound in March, every month of 2019 has seen a decline in the number of annualized auto sales. Furthermore, as David Rosenberg notes, the -4.3% Y/Y trend is the weakest it has been for the past 8 years.

The one common theme that seems to be following car markets across the globe? Consumers are broke and the auto industry is in recession.

via ZeroHedge News http://bit.ly/2JfQneT Tyler Durden