Will the Minutes attempt to walk back Powell’s ‘hawkish’ transitory/transient inflation comments, will they mention frothy prices in financial markets, or will an insurance rate-cut be discussed against trade-war threats?

The answer is mixed:

Hawkish

*MANY FED OFFICIALS SAW INFLATION DIP AS LIKELY ‘TRANSITORY‘

Dovish

*FED OFFICIALS SAW PATIENT APPROACH APPROPRIATE FOR ‘SOME TIME‘

Bloomberg lays out the key takeaways from FOMC minutes:

-

Fed doubles down on its wait-and-see strategy, as FOMC members felt their patient approach on interest-rate adjustments “would likely remain appropriate for some time” even if global economic and financial conditions continued to improve.

-

Backing up Powell’s comments at the press conference, minutes say “many participants” viewed recent dip in inflation as “likely to be transitory”; minutes contain multiple references to support for patience strategy.

-

A “few” officials said that policy firming would be needed if economy evolved as they expected and inflation pressures built up, while “several” saw a risk that inflation expectations could become anchored below 2%; minutes don’t contain explicit reference to support for possible rate cut.

-

The FOMC held a discussion on the future maturity composition of the central bank’s bond portfolio without making a decision. Staff presented two scenarios: a portfolio similar to maturity of outstanding Treasuries, and a portfolio with bond maturities of three years or less. The minutes show extensive debate on the pros and cons of each approach, particularly on how much capacity they would provide to provide economic stimulus through a maturity extension program.

-

There was little discussion about the U.S.-China trade war, a sign that the worsening of tensions since the meeting probably came as a surprise.

-

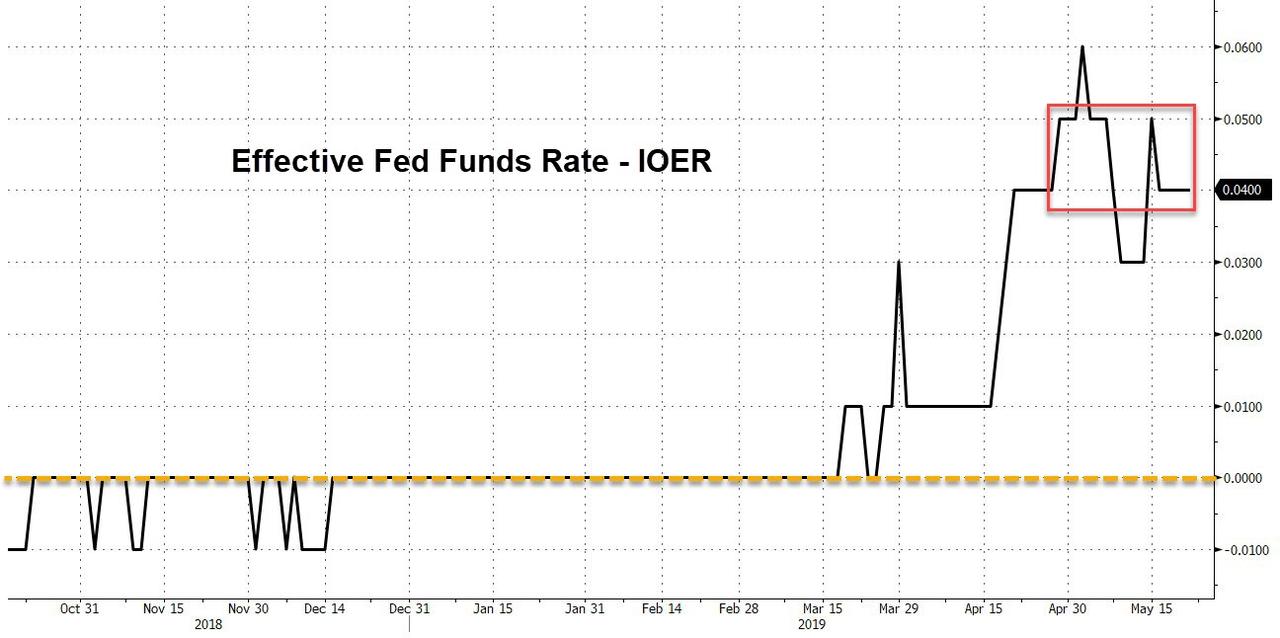

On the decision to lower interest on excess reserves rate by 5 basis points, the minutes say Fed staff noted that the effective fed funds rate rose to 5 bps above IOER after the federal income tax deadline on April 15; while a similar dynamic occurred in prior years, the magnitude of the change was larger this year.

* * *

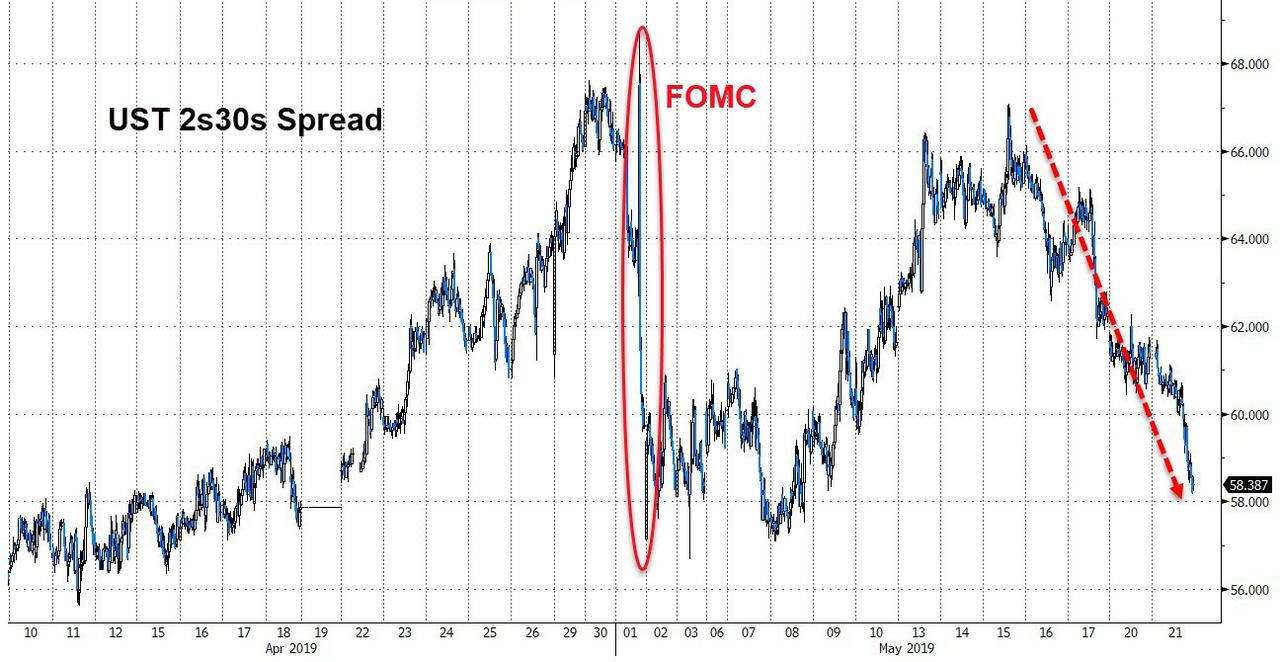

Since the FOMC Meeting on May 1st, the yield curve has had a wild ride but overall has collapsed…hardly a signal that Fed policy is approved by the market.

Stocks and Gold have been the worst hit with bonds and the dollar rallying since Powell’s transitory press conference…

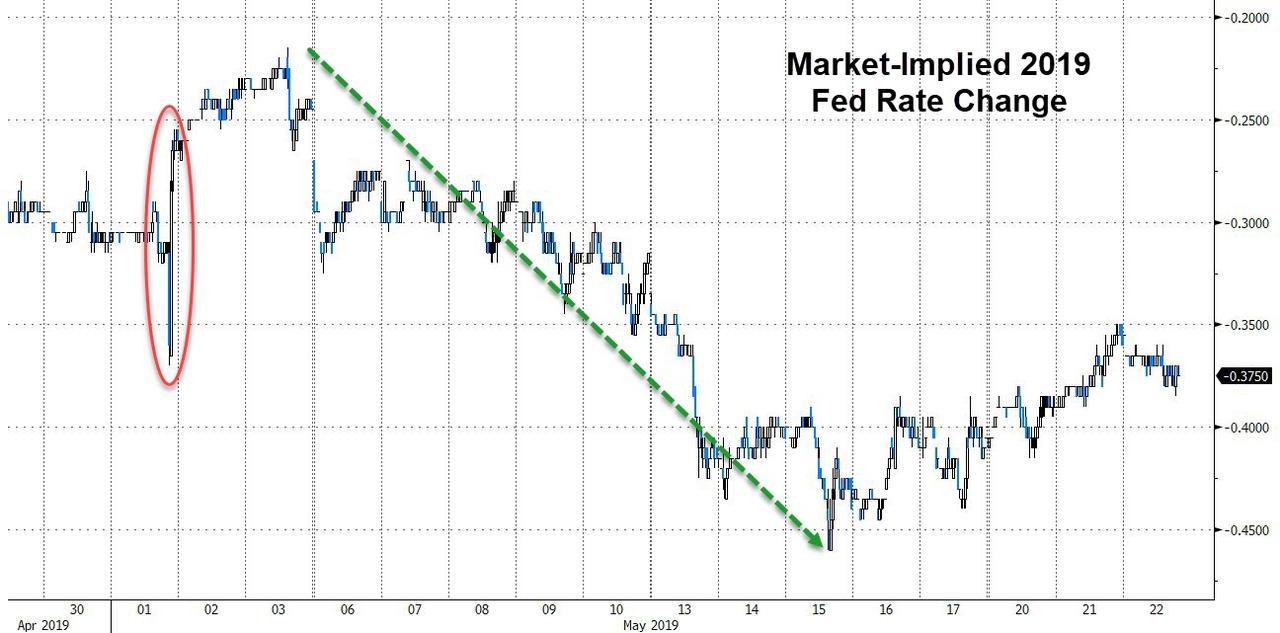

But while the price action looks (and Powell sounds) hawkish, the market-implied Fed rate-change expectations have plunged dovishly since the FOMC meeting…

And, perhaps most notably, despite The Fed’s actions on IOER, the short-term liquidity market remains broken…

* * *

Full Minutes below:

via ZeroHedge News http://bit.ly/2M3ySRS Tyler Durden