If yesterday global markets were a “sea of red”, roiled by a wave of selling as traders digested all the latest trade war escalations (which, as Rabobank said, it was getting impossible to keep up with all of them) and latest economic headwinds, today is shaping up as a whipsaw day, as US equity futures are sharply higher…

… while market are, as one would expect, a “sea of green.”

While there was no specific catalyst, stocks edged higher on Friday and oil prices bounced on the same recurring trigger – “optimistic” comments by President Trump, who repeated previous reports that he would meet China’s Xi in June at the G-20 meeting, which boosted “hopes of progress” in U.S.-China trade talks, especially after Trump once again predicted a quick trade deal with China, one that could include Huawei; elsewhere, Theresa May’s expected resignation briefly sent sterling fluctuating wildly.

Meanwhile, in the latest trade war salvo, the Commerce Department said late on Thursday it was proposing a new rule to impose anti-subsidy duties on products from countries that undervalue their currencies, in another move that could penalize Chinese products. This, too, was broadly ignored by markets.

Despite today’s rebound, growing trade tensions hit global markets this week, with the MSCI All Country index in line for a more than 1% fall in its third week in the red, its longest losing streak since a rout in December.

The MSCI World index gained 0.2% on Friday following the overnight comments from Trump, who said issues with China’s Huawei Technologies Co Ltd might be resolved within the framework of a broader trade deal. However, no high-level talks have been scheduled and Trump also labeled the telecommunications company “very dangerous”. As one would expect, the algos only took the positive spin from the speech.

After a poor start, following yesterday’s US stock rout, Asian markets were initially torn between fears of a more protracted U.S.-China trade war and hopes the world’s two largest economies would reach a deal soon (spoiler alert: they won’t). China and Hong Kong stocks climbed around 0.3% while Japan’s Nikkei fell 0.2% as the yen surge took the USDJPY as low as 109.46.

“It might be a step too far that there is optimism over a trade deal but there may be a little more optimism over the way talks are going,” Investec chief economist Philip Shaw said.

European stock markets were more upbeat. The pan-regional Euro Stoxx 600 index, Germany’s DAX, France’s CAC and Britain’s FTSE 100 all rose around 0.8 percent. The best performing sector was the Stoxx 600 Automobiles & Parts Index, which rose 1.5% in early trade, the best performing sector on the broader gauge, as China outlined details on earlier announced car-purchase tax cuts. Among battered European carmakers, Volkswagen shares +1.8%, Fiat Chrysler +1.7%, Peugeot +5%, Daimler +1.4%; among suppliers, Faurecia +2.5%, Valeo +1.5%, Hella +1.5%, Continental +1.3%.

The European auto rally echoed similar action in Chinese automakers, which jumped in afternoon trading after China’s Ministry of Finance issued a statement detailing tax subsidies for buying cars. However, the rally quickly fizzled out as analysts pointed out that the new statement merely provided details on tax cuts already announced last year.

In a remarkable move on Thursday, US yields plunged and curves inverted as the 10-year Treasury yield hit 2.292% the lowest level since mid-October 2017. It has since rebounded modestly, and last stood at 2.3220%. “Fixed income safe-haven sovereign markets are the asset of choice at the moment, and although we had a recovery in European stock markets this morning, there has not been much of a retracement at all in (German) bunds or (British) gilts,” Investec’s Shaw said. While not as “kinked” as yesterday, the 3Month-10Year curve remained inverted to the tune of -3bps, flashing another warning sign about the health of the world’s biggest economy.

The more positive trade chatter emanating from the China-US trade dispute has seen debt futures lower across the curve, with 10yr debt futures trading with losses of over 9 ticks and printing a session base of 124-07 in the EU morning. This comes as yields recover following yesterday’s print of fresh 10yr YTD lows at 2.292%, with yields up by just over 4 bps. Traders will now be looking ahead to US durable goods data to round off the week.

Elsewhere, euro-area bonds traded, with Italian debt rallying on conciliatory comments by Salvini

“The fear now is that the economic recovery from the poor second half of 2018 may be dying before it even emerges,” said Peter Schaffrik, global macro strategist at RBC Capital Markets.

The biggest political event so far, was the widely expected announcement from Theresa May that she would resign on June 7, sending the pound on a rollercoaster ride. It popped up nearly half a percent against the dollar after the announcement but the gains were short lived and it subsequently traded back at $1.2672, and not far off the day’s lows versus the euro, only to rebound again after, and then slump once more.

According to online bookies, May will be succeeded by a Eurosceptic leader, most likely Boris Johnson, increasing chances of a no-deal Brexit, although some analysts saw a rising chance the UK will be compelled to request further Brexit delay, which would raise probability of early general election or second referendum.

On Thursday, the pound had suffered its 14th consecutive day of losses against the euro, its longest losing streak on record, although that streak may end today.

Elsewhere in currency markets, the dollar slipped against most peers as soft US data saw a short-squeeze in the euro extending ahead of a long weekend in the U.S. and U.K. The Australian dollar fell as investors positioned for RBA rate cuts with some analysts hinting at QE coming down under. The euro, which on Thursday slumped to levels last seen in May 2017 as a recovery in euro zone business activity was weaker than expected, traded at $1.1182 on Friday.

A quick note on the yuan, which after a startling slide in the first half of May, has found its feet this week and stayed in a narrow range, just as the central bank would like. The stabilization came as the People’s Bank of China barely budged on the daily reference rate, fixing the yuan just stronger than the 6.9 per dollar level throughout the week. PBOC deputy governor Liu Guoqiang said Thursday that “China is able to keep the exchange rate basically stable at a reasonable and equilibrium level.” The message to support the yuan is clear, according to Stephen Chiu, senior FX analyst at China Construction Bank Asia Corp. “China is continuing to send a signal that they don’t want further depreciation in the yuan. And to defend the spot rate from 7, it’s probably better to defend the fixing at 6.9.” The PBOC set the yuan reference rate at 6.8993 on Friday, compared with 6.8994 Thursday, 6.8992 Wednesday, 6.8990 Tuesday and 6.8988 Monday.

In commodities, oil prices gained amid OPEC supply cuts and tensions in the Middle East. Crude futures tumbled on Thursday as trade tensions dampened the demand outlook, with the benchmarks posting their biggest daily falls in six months. U.S. crude was at $58.7 a barrel, up 1.4%, after Thursday’s 5.7% fall that took it to the lowest in two months. Brent crude futures rebounded 1.3% to $68.65 per barrel, after falling 4.6% in the previous session.

Expected data include durable goods orders. Foot Locker is among companies reporting earnings.

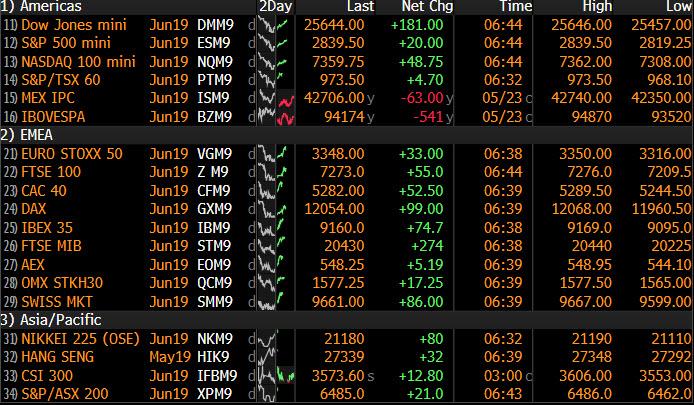

Market Snapshot

- S&P 500 futures up 0.6% to 2,836.75

- STOXX Europe 600 up 0.7% to 376.35

- German 10Y yield rose 0.3 bps to -0.117%

- Euro up 0.1% to $1.1192

- Italian 10Y yield rose 0.5 bps to 2.265%

- Spanish 10Y yield fell 2.2 bps to 0.83%

- MXAP up 0.2% to 153.08

- MXAPJ up 0.2% to 499.34

- Nikkei down 0.2% to 21,117.22

- Topix up 0.04% to 1,541.21

- Hang Seng Index up 0.3% to 27,353.93

- Shanghai Composite up 0.02% to 2,853.00

- Sensex up 1.4% to 39,352.38

- Australia S&P/ASX 200 down 0.6% to 6,456.04

- Kospi down 0.7% to 2,045.31

- Brent futures up 1.3% to $68.64/bbl

- Gold spot down 0.2% to $1,281.45

- U.S. Dollar Index little changed at 97.86

Top Overnight News

- U.K. Prime Minister Theresa May said she will step down on June 7, triggering a leadership contest that could make way for a more pro-Brexit leader such as Boris Johnson

- The Trump administration is seeking to choke off Beijing’s access to key technologies by limiting the sale of vital U.S. components to China’s Huawei Technologies Co. It’s considering putting at least five Chinese surveillance companies on the same blacklist

- President Trump said Thursday that China’s Huawei Technologies, which was put on a U.S. blacklist earlier this month, could be part of a trade pact with the country

- The U.S. is also proposing tariffs on goods from countries found to have undervalued currencies, in a move that would further escalate its assault on global trading rules

- One of Asia’s best-performing bond managers offloaded his holdings of Huawei Technologies Co. debt last week, underscoring investor concerns over potentially devastating U.S. curbs on the Chinese tech giant

- Euro-area economy remains on track with European Central Bank projections that foresee an upturn later this year, policy maker Bostjan Vasle said

- U.S.-China trade conflict and cracks in the global economy are herding investors to the safest parts of financial markets, pushing yields to multiyear lows and strengthening bets that the Fed will cut interest rates in 2019

- President Trump and Japanese Prime Minister Shinzo Abe are unlikely to resolve trade disputes involving automobile tariffs during meetings starting this weekend in Tokyo, a Japanese official said

- Japan’s key price gauge ticked higher in April as travel costs rose ahead of Japan’s longest postwar holiday, yet multiple factors are set to complicate the Bank of Japan’s mission to boost inflation in coming months

- Oil headed for its biggest weekly drop this year as the escalating trade war caused investors to reassess the outlook for global growth, drowning out concern over supply risks

Asian equity markets were mixed with the region cautious following the headwinds from US where all major indices declined due to ongoing trade uncertainty, weak PMI data and after energy losses snowballed. ASX 200 (-0.6%) and Nikkei 225 (-0.2%) were negative as Australia’s energy sector felt the brunt of the recent sell-off in oil in which WTI fell over 5%, while a firmer currency dampened risk appetite in Tokyo. Conversely, Hang Seng (+0.3%) and Shanghai Comp. (U/C) were kept afloat for most of the session after recent encouraging comments from President Trump that there is a good possibility of a US-China trade deal and that Huawei could be included in a trade agreement. Furthermore, the PBoC refrained from open market operations, although this was due to ample liquidity and as its efforts this week already resulted to a net injection of CNY 100bln. Finally, 10yr JGBs were higher following the bull flattening seen in the US curve and amid the mostly risk-averse tone in the region, while the results of Japan’s enhanced liquidity auction for 2s, 5s, 10s and 20s also showed firmer demand.

Top Asian News

- Japan Downgrades View of Economy Again as Tax Hike Approaches

- Brimming Oil Tanks Forcing China Teapots to Cut Their Losses

- Barclays Says China May Devalue Yuan, Limit Sales of U.S. Goods

- Mobius Says Bear Market Unlikely for Emerging-Market Stocks

European stocks extend on opening gains [Eurostoxx 50 +0.9%] as the region nurses some losses following yesterday’s collapse. Upside in Europe seems to be more of a consolidation, although sentiment is somewhat supported following comments from US President Trump who said there is a good possibility of a US-China trade deal and that Huawei could be included in any trade deal. However, the President did caveat his comments by suggesting it that it would be fine if a meet with China does not happen. Nonetheless, broad-based gains are seen across major bourses, with Italy’s FTSE MIB (+1.2%) outperforming its peers as banks are supported by price action in BTPs (given the large holdings of the Italian debt). Meanwhile, defensive sectors are slightly lagging their peers with healthcare and consumer staples posting milder gains than the riskier sectors. In terms of individual movers, Casino shares (+17.9%) spiked higher amid reports that the co. will not be impacted by its parent company Rallye (-33.2%) confirming administrative procedures. Elsewhere, Deutsche Bank (-1.0%) shares fell following its AGM, although it’s worth noting the Co. is trading ex-dividend. Finally, Moller-Maersk (-1.5%) fell post-earnings as the shipping giant flagged negative impacts from the US-China trade war.

Top European News

- Bankers Stunned as Negative Rates Sweep Across Danish Mortgages

- U.K. Retail Sales Better Than Expected as Online Purchases Climb

- Maersk Warns of ‘Considerable Uncertainties’ Amid Tariff War

- Julius Baer Misses Key Target as Pressure Mounts on CEO Hodler

In FX, the USD has pulled back further from Thursday’s highs, with the DXY down to 97.685 vs 98.373 ahead of the Markit PMIs and US housing data that prompted the relatively abrupt fall from its fresh ytd pinnacle. However, the index is showing signs of stabilisation around support at 97.700 as the Buck bounces vs G10 and EM rivals ahead of durable goods and a long holiday weekend (Memorial Day in the US, and Spring Bank holiday in the UK).

- CAD/NZD/AUD – The Loonie and Kiwi are leading the comeback vs their US counterpart, but not the major pack as the NOK and SEK outperform following upbeat Scandi labour data, and improvement in overall risk sentiment and a partial recovery in oil prices that has seen Eur/Nok retreat from 9.8000 and Eur/Sek through 10.7500. The crude revival is also weighing on Usd/Cad to an extent as the pair pivots 1.3450 vs 1.3500+ at one stage on Thursday, while Nzd/Usd is back above 0.6500, partly as Aud/Nzd cross flows reverse from near 1.0600 to 1.0560 on even louder RBA easing shouts overnight. Specifically, Westpac is now predicting 3 rate reductions before the end of 2019 and Aud/Usd is struggling to regain a foothold above 0.6900.

- GBP – Better than expected, or not as weak as forecast UK retail sales data has supported the recovery in Sterling to a degree with Cable back above 1.27 from almost 1.2600 yesterday. Sterling strength then aided the pair to clip 1.2700 to the upside after UK PM May decided to step down on June 7th with a leadership contest to begin in the following week (10th June), although those gains faded as PM May continued her speech with GBP falling back below the figure. In terms of the next steps in UK politics, following the leadership contest, a new Tory leader will be elected towards the end of July. Reports then noted the prospect of a potential general election to take place in October (according to Telegraph’s Christopher Hope) before dialogue with the EU recommences in regard to a Brexit deal.

- JPY/EUR/CHF – All relatively flat vs. the Buck following yesterday’s mammoth moves, although the JPY holds onto most of its risk premium having briefly dipped below 109.50 ahead of a Fib at 109.41. The Yen was hardly deterred after Japan’s Government cut their economic assessment in May’s monthly report, which also noted that the Japanese economy is recovering at a moderate pace while the weakness in exports and outputs continues. It’s worth keeping in mind large option expiries in the form of 1.7bln at strike 109.40-50 and 1.8bln between 109.75-85. Similarly, CHF retains most of yesterday’s gains and is ultimately little changed vs the USD and EUR. Elsewhere, the single currency remains just under the 1.1200 handle after having clipped the figure amid the pullback in the Dollar with little to inspire the currency amid the absence of Eurozone data and speakers. EUR/USD currently hovers below its 21 DMA (1.1189) with chunky option expiries in the form of 2.1bln between 1.1170-80 and 2.3bln around 1.1185-1.1200.

In commodities, The energy complex is consolidating some of yesterday’s losses after the sector posted its largest sell-off YTD. WTI (+1.3%) and Brent (+1.3%) hovers around 58.50/bbl and 68.50/bbl respectively with news flow relatively light thus far. Broader macro concerns seem to have sparked yesterday’s selloff alongside several factors including disappointing data, increasing US stockpiles and with technical selling. Elsewhere, metals are directionless with gold (Unch) failing to benefit from the receding Dollar amid a potential unwind in risk premium, whilst copper (+0.3%) prices are supported amid rising demand as traders stockpiled ahead of restrictions on scarp imports coming into force in July.

DB’s Jim Reid concludes the overnight wrap

As the trade war simmers in the background I’m still of the opinion that Trump’s trade escalation tweet from nearly 3 weeks ago was a game changer for the short-term direction of markets and it would be a surprise if markets didn’t test the resolve of the US and Chinese at some point this summer. It feels that the two sides have retrenched into positions that will be pretty hard to reverse anytime soon and as such this escalation likely has legs. Falling asset prices might be the only way for markets to get the resolution they desperately want.

Yesterday showed that 1) tensions between the US and China are showing little evidence of reducing anytime soon, and 2) the early impact from the recent escalation on the survey data is certainly on the negative side following yesterdays PMIs. The end result was a fairly weak session for equities which saw the S&P 500 and NASDAQ for example drop -1.19% and -1.58% respectively. However they were off their lows hit around an hour before the close of -1.78% and -2.14%. The Philly semi-conductor index closed -1.65%, taking it -16.75% off its recent peak, the STOXX 600 dropped -1.20% and the MSCI EM index dropped -1.26%. After markets closed, President Trump told reporters that he would consider making concessions on his recent limitations on doing business with Huawei, as part of an eventual trade deal, confirming again that the issues are linked and that he remains amenable to a broad deal. This has helped sentiment a little overnight. Meanwhile also overnight the Trump administration has laid out a proposal that would let US based companies seek anti-subsidy tariffs on products from countries found by the US Treasury Department to be engaging in competitive devaluation of their currencies. Currently no country in the world meets that criteria but the proposal sets a broader standard by focusing on the “undervaluation” of currencies (per Bloomberg). The US Commerce Secretary Wilbur Ross said that “this change puts foreign exporters on notice that the Department of Commerce can countervail currency subsidies that harm U.S. industries.” This is likely to add to the US toolkit to deal with trade related scuffles.

This morning in Asia markets are trading mixed with the Nikkei (-0.55%), Shanghai Comp (-0.04%) and Kospi (-0.97%) all down while the Hang Seng (+0.21%) is up. Elsewhere, futures on the S&P 500 are up +0.30% and the Chinese onshore yuan is trading broadly unchanged at 6.9137. In terms of overnight data releases Japan’s April CPI (at +0.9% yoy), Core CPI (+0.9% yoy) and Core-Core CPI (+0.6% yoy) all came in inline with consensus. It’s worth noting that ahead of the US long weekend markets across the pond are expected to close early today.

Also overnight, China’s commerce ministry released its semi-annual trade report saying that China will actively boost imports and seek to diversify its export markets while adding that China faces a more complicated trade environment and more efforts are needed for a stable trade development amid protectionism and domestic economic downward pressure.

On the Brexit front, things continue to evolve. Various news wires (including Bloomberg and the BBC) suggested last night that Prime Minister May will likely announce her schedule to resign today with June 10th the date suggested. A leadership campaign will likely last around 6 weeks with a hard Brexiteer more likely to win. Given that the Brexit Party is expected to win the EP elections in the UK that new Tory PM could tap into that support in an upcoming general election. So as DB’s recent research has been suggesting, a hard Brexit is becoming an increasing probability.

Back to yesterday and high yield credit spreads also got sucked into the risk off widening +14bps in the US while the flight for safety saw 10y Bunds (-3.4bps) hit -0.120% for a fresh 32-month low, 10y Treasuries (-7.2bps) hit 2.310% for a new 19-month low, and 30y yields (-5.4bps) hit 2.748% for a fresh 17-month low. The 1m-10y, 3m-10y, 6m-10y and 1y-10y curves are all negative now, though the 2y10y remains stubbornly in its recent range at 17.0bps. A massive drop for WTI oil (-5.44%; is up +1.16% this morning) only added to the pain for risk while Gold rallied +0.82% along with safe haven currencies like the Yen and Swiss Franc. The dollar had rallied to a two-year high, but sharply retraced after the poor US data to end the session -0.17% weaker.

Indeed yesterday’s PMIs did part of the damage – particularly those in the US as we’ll discuss below however the PMIs in Europe as well as Germany’s IFO survey did little to help. Comments in the Chinese media including a reference to US politicians making moves to start a “technology cold war” and a spokesman from China’s Ministry of Commerce blaming the US for “unilaterally” escalating trade tensions and suggesting that “China won’t make concessions on matters of principle” also didn’t help.

Back to the details of those PMIs. In Europe the flash May composite rose +0.1pts from April to 51.6 and was a smidgen below the consensus of 51.7. However the headline manufacturing (-0.2pts to 47.7; 48.1 expected) and services (-0.3pts to 52.5; 53.0 expected) readings both fell and missed expectations. Germany’s headline manufacturing print ‘stabilised’ at an albeit low 44.3 with the subcomponents mixed however there was better news in France where the reading rose +0.6pts to 50.6. Overall a picture of continued weakness in the manufacturing sector with the gap up to services showing no sign of closing yet. Our economists in Europe noted that the data also implied a drop of -0.7pts for the non-core reading. We should note that the survey period covered May 13-22 for the Eurozone and therefore the trade escalation period.

As for the IFO survey in Germany, the May reading fell 1.3pts to 97.9 (vs. 99.1 expected) and to the lowest level in more than four years. The drop was concentrated in the current assessment component which hit 100.6 – down -2.8pts from April – while the expectations reading flat lined at 95.3. IFO suggested that they received around 2/3rds of their replies during the first week so the full impact of the trade escalation may not yet be felt, making next month’s data of particular significance.

The data didn’t make for much more palatable reading in the US where the PMIs were a sea of disappointment. The flash manufacturing reading fell -2pts to 50.6 (vs. 52.6 expected) and hit the lowest in just under 10 years. The services reading fell -2.1pts to 50.9 (vs. 53.5 expected) – the lowest in over 3 years while the composite also hit 50.9 (vs. 53.0 last month). So 2009 levels for the manufacturing reading and it didn’t go under the radar that the new orders component went below 50 for the first time since the crisis. That component has led the headline index by around 5 months, suggesting the slide is likely to continue through the summer. The associated commentary did mention trade but not in any great detail which perhaps also raises the risk of further downside. The most obvious mention was that “reduced confidence was commonly attributed to hesitation among clients and increased uncertainty, which were both often linked to global trade tensions”. Interestingly the difference between the US and Eurozone manufacturing PMI is now just 2.9pts and the lowest for the year.

We should note that the May ISM report isn’t due out until June 3rd so we’ll have to wait a while to see what that shows. However there are a number of surveys due next week including consumer confidence, manufacturing surveys from the Richmond and Dallas Fed, and the Chicago PMI. So plenty to keep the market engaged. It’s worth noting that yesterday’s Kansas City Fed manufacturing survey hit 4 yesterday (52.8 on an ISM-adjusted scale), down -1pts and weaker than expected. The other US data was claims which was broadly in line at 211k, and new home sales which fell -6.9% mom in April and more than expected.

Finally, looking at the day ahead, this morning the only data due out in Europe is the April retail sales report and May CBI survey. In the US we’ll then get preliminary April durable and capital goods orders that provide an initial glimpse into the current-quarter capex trend. Our US economists note that headline orders (-1.3% vs. +2.8%) should decline due to Boeing. Orders excluding transportation (+0.1% vs. +0.2%) might also be a bit soft given that the team are mildly cautious on non-defense capital goods orders excluding aircrafts (+0.2% vs. +1.0%), which are a good gauge of equipment spending in the GDP accounts. Away from the data the ECB’s Nowotny is due to give a briefing to an IMF delegation this morning. Finally a reminder that European Parliament elections carry on until Sunday evening with results likely overnight/Monday morning. The UK and US will be on holiday so the results will be digested in a little bit of a market vacuum. For a full preview please see yesterday’s EMR.

via ZeroHedge News http://bit.ly/2X5WsP0 Tyler Durden