Authored by John Rubino via DollarCollapse.com,

In late 2018 the US stock market tanked, in effect holding a gun to its own head and threatening to pull the trigger unless the Fed stopped raising interest rates. The Fed, painfully aware that an equities bull market is an existential threat in today’s hyper-leveraged world, quickly caved, promising no more rate increases if the market would just put down the gun.

This worked for a little while. Stocks jumped to new record highs and unicorn tech IPOs started pouring out of Silicon Valley. Normal, which is to say booming, markets were back.

But of course it couldn’t last. An overleveraged economy is not just addicted to new credit, but to ever-increasing levels of new credit. So stable interest rates won’t stave off withdrawal. From here on out only steadily (or steeply) falling interest rates will delay the inevitable crisis.

That’s the signal the financial markets are now sending the Fed, as stocks begin to roll back over …

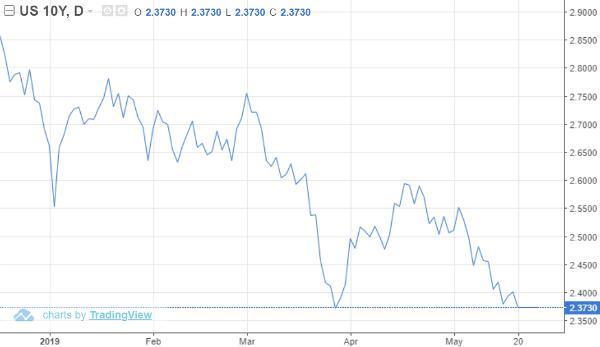

… bond yields tank …

… and demands grow for not just patience but acquiescence. Now the question is not if but when the Fed responds with the required cut.

At the moment – mostly because the stock market hasn’t fallen very far — there’s still some resistance to lower rates:

Federal Reserve is reluctant to cut interest rates, latest minutes show

(CBS News) – According to minutes released Wednesday, Fed officials noted that economic prospects for the U.S. and global economy were improving, while inflation had fallen farther below the Fed’s 2% target.

Some officials “expressed concerns that long-term inflation expectations could be below levels consistent with” the Fed’s target of 2%. However, officials still believed a return of inflation to the Fed’s 2% target was “the most likely outcome,” according to the minutes.

“Patience persists,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a note. “Most, perhaps all, FOMC members are content to leave rates on hold for some time yet.”

At its last meeting, the Fed kept its key policy rate unchanged in a range of 2.25% to 2.5%, where it has been since the Fed hiked rates for a fourth time last December. That end-of-year hike contributed to a nosedive in financial markets as investors began to worry that the central bank was in danger of sending the country into a recession.

In January, the Fed did an about-face in response to a worsening global outlook and other risks to growth and began signaling it would be “patient” in changing interest rates. While Fed officials had projected in December two more rate hikes for 2019, they now expect to hold steady for the year.

The most recent minutes indicate that, despite recent economic improvements, the Fed remains cautious and prefers to act slowly.

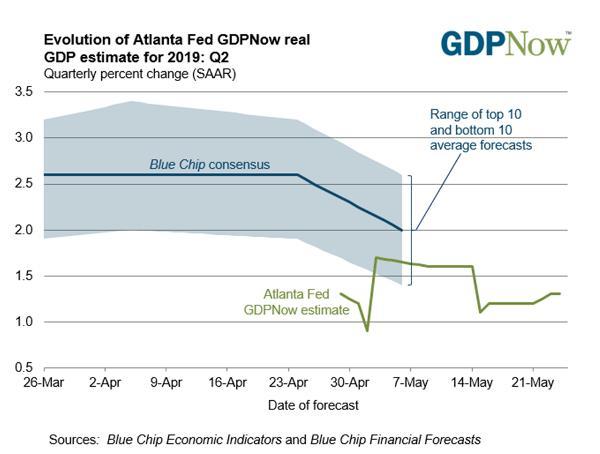

But patience is a luxury afforded by stability, and that’s already changing. The Atlanta Fed’s GDPNow report, for instance, shows both the Fed’s and the Blue Chip Economist consensus for Q2 growth at levels that are too low to generate positive year-over-year corporate profit comparisons. Falling earnings will probably cause falling stock prices, leading the Fed to conclude that cutting interest rates is the only way to head off a global financial contagion.

This cycle – recurring financial instability forcing the steady ratcheting down of interest rates – will continue until lower rates become the problem rather than the solution. Which is another way of saying until there are no more solutions.

via ZeroHedge News http://bit.ly/2VV8euf Tyler Durden