The US Treasury department refrained from labeling China a currency manipulator on Tuesday, avoiding even greater escalation in the trade war between the world’s two largest economies, although leaving to door open to stigmatize China at some future date.

Washington hasn’t labeled a major trade partner a currency manipulator since 1994.

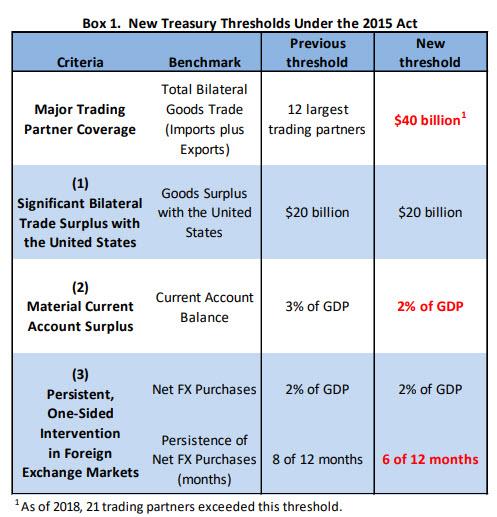

In its semi-annual foreign-exchange report to Congress, which was originally due in mid-April but was delayed due to the changes to the criteria used to evaluate countries, the Treasury expanded the number of countries it scrutinizes for currency manipulation to 21 from 12, after Steven Mnuchin lowered the threshold for qualification.

Five countries including Ireland, Italy, Vietnam, Singapore and Malaysia, joining China, Japan, South Korea and Germany on a watch list for manipulation, while India and Switzerland were removed. It was not immediately clear why Italy – which is part of the common currency – was singled out when together with the rest of the Eurozone its “currency” is subject to the monetary policy of the ECB. Unless of course the US Treasury still thinks Italy uses the lira.

Of course, the report itself is largely useless, and mostly a political weapon as branding any nation a currency manipulator does not actually impose any penalties. Contrary to previous reports, the US avoided accusing Vietnam of manipulating its dong, with Bloomberg reporting that the label was avoided last this week when Vietnamese officials visited Washington last week.

As the report further notes, Vietnam avoided the designation after its officials “credibly conveyed” that the nation’s net purchases of foreign exchange were below 2% of its GDP in 2018, putting it below the key intervention threshold, although that number appears suspiciously low in light of the recent collapse in the dong. The Treasury, however, said that Vietnam “tightly manages the value of the dong against the dollar.”

While no major changes were expected to the status quo, strategists were unsure until the last moment if the US Treasury wouldn’t pull out a surprise at a time when currency policy has emerged as President Trump’s latest tool “to rewrite global trade rules that he says have hurt American businesses and consumers” in the process making FX policy a key piece of trade deals with Mexico, Canada and South Korea, and should a deal with China ever be reached, the Yuan would be a core part of it.

Today’s lack of surprises was notable because Bloomberg reported last week that the administration ramped up its focus on foreign exchange, proposing tariffs on goods from countries found to have undervalued currencies.

The Commerce Department’s move would let U.S.-based companies seek anti-subsidy tariffs on products from countries found by Treasury to be engaging in competitive devaluation of their currencies. Currently no country meets that criteria.

“Treasury takes seriously any potentially unfair currency practices, and Treasury is expanding the number of U.S. trading partners it reviews to make currency practices fairer and more transparent,” Mnuchin said in a statement.

As part of the loosened criteria for watch list inclusion, countries with a current-account surplus equivalent to 2% of gross-domestic product are now eligible for the list, down from 3%. Other thresholds include persistent intervention in markets for a nation’s currency, and a trade surplus with the U.S. of at least $20 billion.

All eyes were on China again, because ever since he was a presidential candidate in 2016, Trump often said that he would label China a currency manipulator on “day one” of his administration. So far, the Treasury’s criteria does not allow such a designation.

Countries that meet two of the three criteria are placed on the watch list. While China only met one of the criteria, the Treasury said it’s on the list because of its large trade surplus with the U.S.

The other problem is that while the implicit understanding is that countries manipulate their currencies lower, China has been doing the opposite in recent years, doing everything in its power to prevent the Yuan from dropping below 7.00 against the dollar as any continued devaluation carries the risk of significant capital flight (hence China’s constant crackdown against bitcoin).

Ironically, this is what the Treasury said about China’s FX policy:

Treasury continues to urge China to take the necessary steps to avoid a persistently weak currency. China needs to aggressively address market-distorting forces, including subsidies and state-owned enterprises, enhance social safety nets to support greater household consumption growth, and rebalance the economy away from investment. Improved economic fundamentals and structural policy settings would underpin a stronger RMB over time and help to reduce China’s trade surplus with the United States.

The report also said that “Treasury continues to have significant concerns about China’s currency practices, particularly in light of the misalignment and undervaluation of the RMB relative to the dollar. China should make a concerted effort to enhance transparency of its exchange rate and reserve management.”

Despite not accusing China of manipulting the yuan, the report warned that “notwithstanding that China does not trigger all three criteria under the 2015 legislation, Treasury will continue its enhanced bilateral engagement with China regarding exchange rate issues, given that the RMB has fallen against the dollar by 8 percent over the last year in the context of an extremely large and widening bilateral trade surplus. Treasury continues to urge China to take the necessary steps to avoid a persistently weak currency.”

The punchline – the US was quite clear in its demands to Beijing:

China needs to aggressively address market-distorting forces, including subsidies and state-owned enterprises, enhance social safety nets to support greater household consumption growth, and rebalance the economy away from investment. Improved economic fundamentals and structural policy settings would underpin a stronger RMB over time and help to reduce China’s trade surplus with the United States.

Of course, none of this means that Trump won’t accuse China of manipulating its currency on the “semi-official” channel that is his twitter account. In fact, we expect him to do just that in very short notice.

The full Treasury report can be found here.

via ZeroHedge News http://bit.ly/2Xb5Cdl Tyler Durden