Authored by John Rubino via DollarCollapse.com,

A few short weeks ago, the economy seemed to be growing, the trade war looked winnable and the Mueller Report appeared to take presidential impeachment off the table. And then…

The economy hit a rough patch. Auto sales are down and home sales are way down. This morning:

Pending home sales fall, marking the 16th-straight month of annual declines

(MarketWatch) – Pending home sales fell a seasonally adjusted 1.5% in April and were 2% lower than a year ago, the National Association of Realtors said Thursday. The consensus Econoday forecast was for a 0.5% increase.

NAR’s index, which tracks home-contract signings, has been volatile, but the trend is solidly downward. April marked the 16th-straight month of annual declines.

Contract signings precede closings by about 45-60 days, so the pending home-sales index is a leading indicator for upcoming existing-home sales reports.

Only the Midwest saw an increase in April, with a 1.3% uptick. Pending sales were down 1.8% in the Northeast, 2.5% in the South, and 1.8% in the West.

On Tuesday, the widely-followed Case-Shiller index showed home prices had risen at the slowest pace since mid-2012 in March.

Interest rates cratered, inverting the yield curve. Check out the US 10-year Treasury yield in May:

From 2.5% to 2.15% in a single month implies massive changes within the credit markets that signal an economic slowdown and/or a flight to safety because of external risks.

The trade war went parabolic. China refused to budge and Trump upped the ante with more tariffs, to which China responded by threatening to end rare earth exports, a terrifying prospect for US tech companies that rely on those elements. Then last night Trump shocked pretty much everyone by slapping tariffs on Mexico in retaliation for the recent surge of illegal immigration. Meanwhile, global trade flows are collapsing.

Mueller put impeachment back on the table. On Wednesday, Special Prosecutor Robert Mueller appeared to invite Congress to go after the President over Russiagate. The Democrats gleefully complied, virtually guaranteeing political chaos right through the 2020 election.

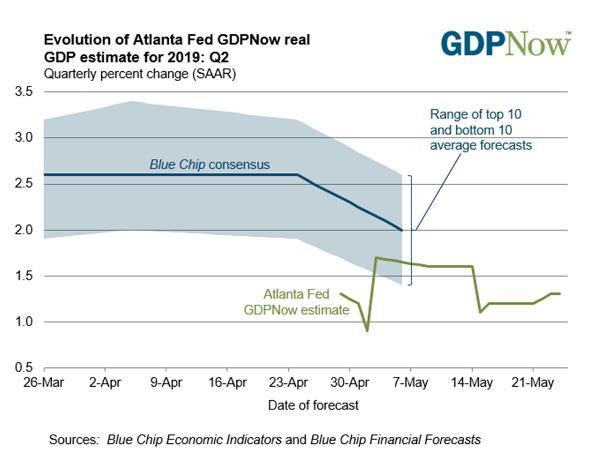

Growth projections evaporated. Economists have been revising year-ahead GDP estimates downward for the past few weeks and are no doubt cutting them again as this is written. The already-anemic numbers on the following chart from the Atlanta Fed are due to be updated on June 3. Look for a sharp drop.

How do modern central bankers respond when faced with this kind of perfect negative storm? They look to the stock market for guidance, of course. If share prices are rising they assume that funky growth numbers and political turmoil are minor inconveniences. If stocks are falling they interpret the above as an existential threat and immediately start cutting interest rates and raising asset purchases.

So we really just have to watch the stock market. Which, as this is written, is tanking yet again. The past month has been relentlessly bad – not quite as brutal as the yearend 2018 flash crash that stopped the Feds tightening, but still pretty ominous.

One more month – or even a couple more weeks – like this, and the US, along with the rest of the world, will be back in full-on easy money mode.

via ZeroHedge News http://bit.ly/2KdTq7U Tyler Durden