As a result of high taxes and government debt, combined with a nightmarish looming pension liability, Chicago’s housing market continues to collapse, according to a new write-up in the City Journal.

Average home prices in Chicago have still not recovered from the downturn that started in 2009, despite the fact that property taxes continue to climb. This is part of the reason Illinois ranks highest among states losing people to other areas of the country. Chicago homeowners are also taking big losses when they sell their homes.

Ball State economist Michael Hicks said last month:

“Taxes are high, the services [that taxes] pay for are terrible, and the debt load is so high, so palpably unsustainable that people have no belief that the resources can be found to turn it all around.”

“You won’t recruit a business, you won’t recruit a family to live here,” Chicago mayor Rahm Emanuel said in 2012, warning about the city’s pension problems. And that looks to be the case: Realtor.com predicted that Chicago would have the weakest housing activity this year among the nation’s top 100 markets.

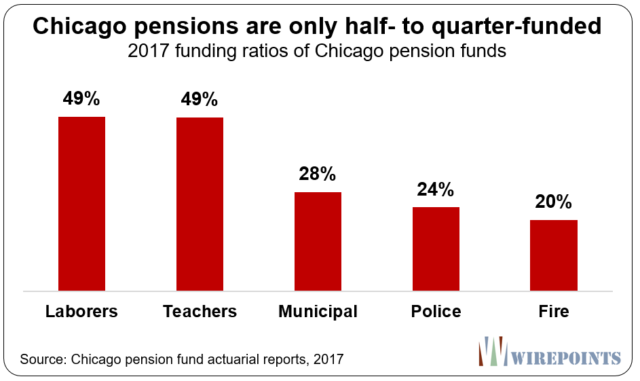

But unions in Chicago continue to push for higher pension contributions, even while efforts to curb the problem have failed. This has resulted on the money having to come from somewhere – and that somewhere is taxes. According to the report, Chicago’s annual pension payments have doubled over the last few years, to nearly $1.2 billion, and are set to rise to $2 billion in 3 years.

In 2015, the city approved $543 million in property tax increases as a result. Chicago schools also raised local homeowner taxes by $224 million in 2017. “Every penny” of these taxes goes into the pension system and Chicago now bears the title of “highest residential property-tax rates of any American city.”

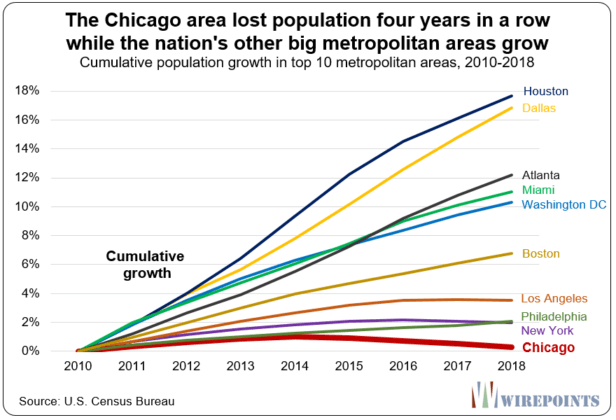

And not surprisingly, residents are leaving Illinois and Chicago as a result. From 2011 to 2017, the state ranked second among states in outmigration, losing 640,000 more residents than it gained:

A recent Bloomberg study of metropolitan-area migration data found that the city had a net migration loss of 105,000 in 2014; it got worse in 2017, with the net loss totaling 155,000.

And while some governors, like New York’s Andrew Cuomo, acknowledge that taxes are driving people out, Illinois’ new governor Jay Pritzker has instead introduced legislation for more taxes on the wealthy, offering them a great excuse to leave Chicago, and the state. The city is losing its luster with millennials, too. Chicago now ranks as third-least attractive among the 53 largest metro areas in the U.S., losing an average of 19,000 young adults per year. Illinois ranks behind all but two states in trying to attract young adults.

The city’s economy is also sputtering, averaging less than 1% growth in private sector jobs in each of the last 2 years.

And when residents flee the city, they put a home up for sale in the market without buying one in the same market. This has caused the price of housing to plunge – according to the report, the “average price of a single-family home in Chicago is lower than it was before prices began plunging back in 2009.”

The national average is a rise of 30% in home prices since the crash. Housing speculators in the city have been decimated:

Crain’s Chicago Business told the story of a Chicago-area executive who lost more than half a million on the sale of his home when he retired to move elsewhere. If he had invested the money in the stock market instead, he said, “I’d probably have $6 million now.”

This has led to a slew of underwater mortgages – the most in any major US market. It’s estimated that 135,000 mortgages may risk default during the next economic downturn.

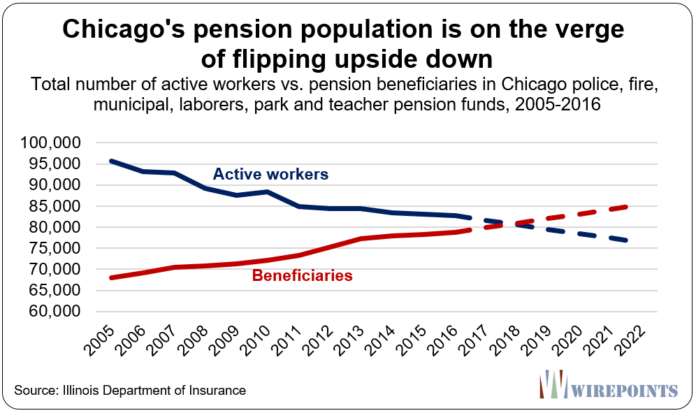

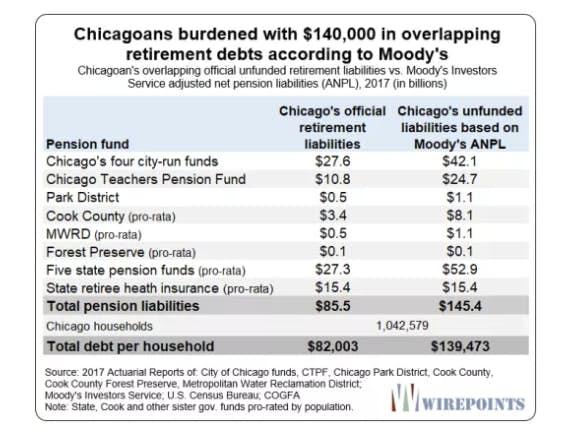

In early April, we noted that Chicago pension funds looked like a “collapsing ponzi scheme”. Back in December 2018, we noted that each Chicagoan owed $140,000 to bail out the city’s pensions.

And we’d love to say, “Let this be a lesson to the rest of the nation” who believes that government financial problems and pension liabilities are simply “no big deal”, but we’re certain they’re not listening anyway.

via ZeroHedge News http://bit.ly/2wyBLj6 Tyler Durden