In a new note out early this week, J.P. Morgan has shot down the idea of a second half resurgence in the automotive sector that many had expected would be the turning point for the industry, which is now mired in recession.

“We see a challenging 2H ahead of us, possibly seeing signs of a flattish market vs the previously expected H2 recovery at the beginning of the year,” the bank said.

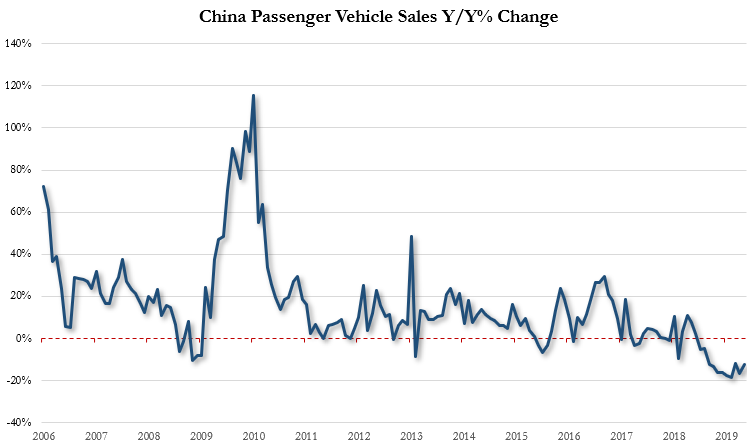

Even worse is that the note took down estimates out of China for the second half of the year. The largest auto market in the world has been helping spearhead the global automobile recession after once being looked at as the potential solution to the slowdown. JP Morgan commented:

“We take down our production forecast for the Chinese car market from -6% to -9% in FY19 in the light of a) feedback from our Asia autos field trip; b) the latest May production data points; and c) discussions with suppliers at our conference.”

Recall, we noted less than a week ago that China had just posted its worst auto sales month ever.

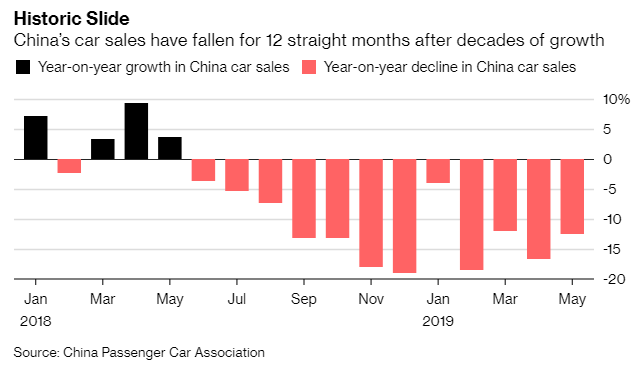

The data showed a decline of 16.4% for May, following a decline of 14.6% in April and 5.2% in March. It was the sharpest decline ever for China’s auto industry.

Xu Haidong, CAAM’s assistant secretary general ignored the fact that his country was in the midst of a trade war and instead told Reuters: “One key reason for the drop was provinces implementing ‘China VI’ vehicle emission standards earlier than the central government’s 2020 deadline, stoking uncertainty among manufacturers.”

Or, the same reason Europe has been using to explain away its own automotive depression recession.

“We gave the manufacturers too little time to prepare,” he continued, also noting that May’s drop in demand was attributable to a “decline in purchasing power in the low-to-middle income groups as well as expectations of government stimulus to encourage purchases.”

May’s drop now marks an entire year of falling sales. The last time China saw retail auto sales rise was back in May 2018. And so, it is looking like a bloated and overextended global auto market will no longer be able to turn to China for reliable growth, as they have done since the 1990s.

This has some automakers delaying expansion plans into China, while others execute global layoffs and restructurings. For example, we reported last month that there had been 38,000 layoffs across the industry over the last 6 months.

The future turned even gloomier when outgoing Daimler CEO Dieter Zetsche said last month that “sweeping cost reductions” are coming to prepare for what he is calling “unprecedented” industry disruption.

Bank of America Merrill Lynch analyst John Murphy said at the same time: “The industry is right now staring down the barrel of what we think is going to be a significant downturn. The pace of decline in China is a real surprise.”

Bank of America had also commented that “the auto cycle has peaked” in a note put out several weeks ago.

via ZeroHedge News http://bit.ly/2KZJNtZ Tyler Durden