S&P futures levitated on Monday, rising to a high of 2,962 and just shy of a new record, alongside buoyant Asian stocks while European shares slumped as the Stoxx 600 Index reversed an earlier gain following the third profit warning from Daimler, and a slump in German business confidence; the dollar dropped to three-month lows as hopes waned for progress in China-U.S. trade talks at this week’s G20 meeting, while Trump was expected to announce even harsher sanctions against Iran today.

The European Stoxx 600 index fell 0.2%, reflecting losses in Paris and Milan. Stocks in London were little changed. Germany’s export-sensitive DAX fell 0.5% after a profit warning by Daimler caused its shares to drop nearly 5%.

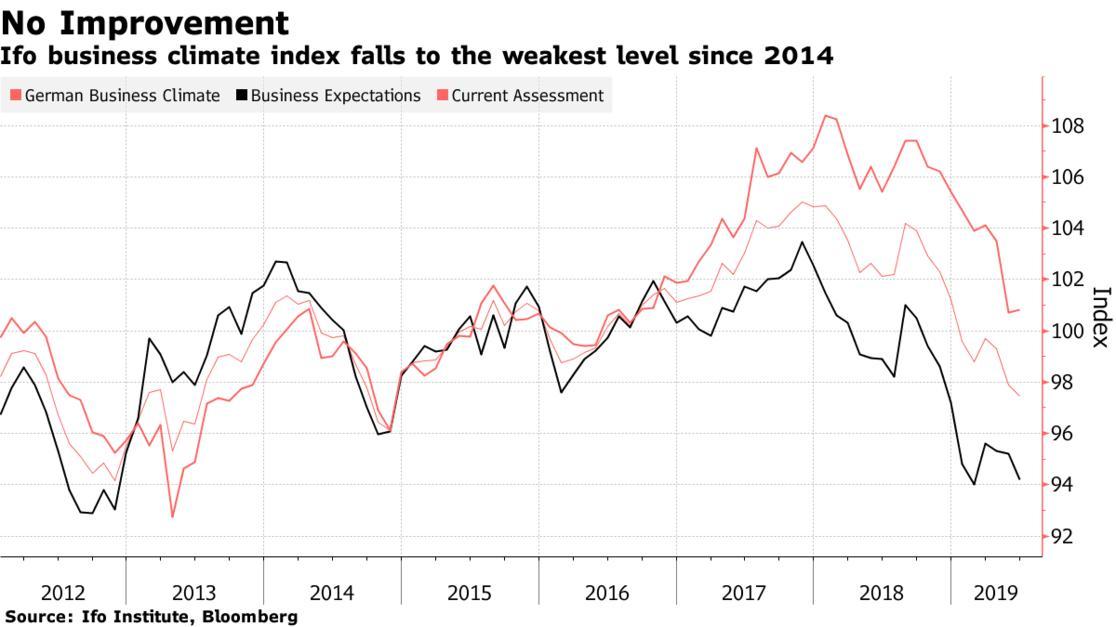

Europe’s woes were compounded by the latest slump in German business confidence as trade tensions weighed on manufacturers. The June Ifo Business Confidence dropped to 97.4, its lowest level since late 2014, while an index of expectations also worsened, even though the news was largely priced in and the euro barely moved on the news and was up 0.2% at $1.1392 in early trading.

“It could get worse, maybe not much worse but a little,” said Ifo President Clemens Fuest in a Bloomberg Television interview. “It’s justified to at least postpone any tightening of monetary policy. But I don’t think further easing will help very much. Mario Draghi has rightly pointed out that governments need to use other instruments.”

Earlier in the session, gains in Asia saw the MSCI regional and global stocks gauges rise again towards last week’s six-week highs. Asian stocks advanced, led by health care and consumer discretionary firms, as investors awaited possible new sanctions against Iran and gauged the probability of a U.S.-China trade deal later this week. Markets were mixed in the region, with Australia climbing and Singapore retreating. Japan’s Topix reversed earlier losses to close 0.1% higher, with Sony and Daiichi Sankyo among the biggest boosts. The Shanghai Composite Index advanced 0.2% as U.S. and China trade teams prepared for a meeting between Donald Trump and Xi Jinping on the sidelines of the G-20 summit in Japan. The S&P BSE Sensex Index edged 0.2% lower, driven by Reliance Industries and Infosys, as India’s central bank deputy chief Viral Acharya asked to resign from his post

Investors are waiting to see if Presidents Donald Trump and Xi Jinping can de-escalate a trade war that is damaging the global economy and souring business confidence. The leaders will meet during a G20 summit in Japan which starts on Friday. Wall Street also looked in line for more gains after closing lower on Friday. S&P 500 e-minis pointed to a 0.2% rise at the open.

China Vice Commerce Minister Wang Shouwen said China and US trade teams are having discussions, while he added that both sides should make compromises and hopes G20 sends a clear signal on fighting against trade protectionism. At the same time, China Assistant Foreign Minister Zhang Jun said the world economy faces increasing risks and the international community recognizes harm from protectionism, while he added that G20 should ensure unity and cooperation but also stated that China will safeguard its fundamental interests and will not allow anyone to interfere with its internal affairs no matter what forum.

“G20 is turning into a high-stakes poker game for risk, and if the sideline talks between Trump and Xi fail and trigger an escalation in tariffs, the odds of a full-blown global recession increase exponentially,” said Stephen Innes, managing partner at Vanguard Markets.

On Monday, Chinese Vice Commerce Minister Wang Shouwen said China and the United States should be willing to compromise in trade talks and not insist only on what each side wants. U.S. Vice President Mike Pence’s decision on Friday to call off a planned China speech was also considered a positive sign. Pence had upset China with a fierce speech in October that laid out a litany of complaints ranging from state surveillance to human-rights abuses.

Still, virtually all analysts doubt the two sides will come to any meaningful agreement. Tensions are reaching beyond tariffs, particularly after Washington blacklisted Huawei, the world’s biggest telecoms gear maker, effectively banning U.S. companies from doing business with it.

“Any high hopes ahead of the G20 meeting may be disappointed,” said Benjamin Schroeder, senior rates strategist at ING in Amsterdam. “In the end, uncertainty will persist and central banks could still be pushed closer to invoking their contingency plans.” (For Goldman’s preview of what to expect at the G-20, see this article).

Overnight, a Chinese newspaper said FedEx Corp was likely to be added to Beijing’s “unreliable entities list” following yet another delivery fiasco involving a Huawei shipment.

In FX, the dollar index slipped 0.1% lower to 96.11 after its biggest weekly drop in four months last week, when the Federal Reserve said that it may cut interest rates soon to bolster the U.S. economy. The dollar has led a broad selloff in major currencies as global central banks signaled a dovish outlook on monetary policy amid growing signs of a weak global economy. The dollar fetched 107.39 yen, having slipped as low as 107.045 on Friday, the lowest level since its flash crash on Jan. 3.

“The market is not expecting more Fed rate cuts than it had so far, but that the reasoning behind them is being interpreted in a different manner,” Commerzbank’s head of FX and commodity research, Ulrich Leuchtmann, wrote in a note to clients. “While for a long time the expected weakening of growth, fears of a recession and low inflation were used as reasons for rate cuts, another reason has now been added to the list: the Fed caving in to the White House.”

The euro rose to a three-month high of $1.1387 against the dollar, while the Aussie gained for a fifth day as central bank Governor Philip Lowe said there are limits to what further monetary easing can achieve. In developing markets, the Turkish lira strengthened as much as 2% after Turkey’s main opposition party won Istanbul’s re-run election for mayor, a blow to President Tayyip Erdogan.

In rates, European government bonds climbed alongside U.S. Treasuries, where 10- year yields fell 2bps to 2.03%, its first decline in two days.

In cryptos, the resurgent Bitcoin pulled back from 18-month highs after jumping more than 10% over the weekend. Analysts said the gains came amid growing optimism over the adoption of cryptocurrencies after Facebook announced its Libra digital coin.

Meanwhile, gold resumed its rise amid economic woes, looming U.S. interest rate cuts and tensions between Tehran and Washington: the precious metal stood at $1,404.79 per ounce, not far from Friday’s six-year high of $1,410.78. The rising tensions between Iran and the United States, after Iran shot down an American drone, also pushed oil prices higher. U.S. Secretary of State Mike Pompeo said “significant” sanctions on Tehran would be announced.

Brent crude futures rose 0.4% to $65.42 per barrel, near Friday’s three-week high of $65.76. U.S. crude futures were up 0.9% at $57.91, standing at its highest in over three weeks

Over the weekend, President Trump said that they are moving ahead with additional sanctions on Iran aimed at preventing it from getting a nuclear weapon and that military action is still on the table, while other reports also noted the White House is pressing for additional options including in cyberspace and other additional clandestine plans to counter Iranian aggression in the Persian Gulf. Subsequently, Iranian Navy Commander says the downing of the US Spy drone was a “firm response” and can be repeated, according to Tasmin News. Russian Deputy Foreign Minister says Russia and allies will counteract US sanctions on Iran. Additionally, Russia’s Deputy Foreign Minister stated that the US is deliberately increasing tensions with Iran.

Today’s expected data include Chicago Fed National Activity Index and Dallas Fed Manufacturing Outlook. No major company is scheduled to report earnings

Market Snapshot

- S&P 500 futures up 0.2% to 2,957.25

- STOXX Europe 600 down 0.2% to 384.00

- MXAP up 0.3% to 159.71

- MXAPJ up 0.2% to 525.93

- Nikkei up 0.1% to 21,285.99

- Topix up 0.1% to 1,547.74

- Hang Seng Index up 0.1% to 28,513.00

- Shanghai Composite up 0.2% to 3,008.15

- Sensex down 0.2% to 39,127.17

- Australia S&P/ASX 200 up 0.2% to 6,665.44

- Kospi up 0.03% to 2,126.33

- German 10Y yield fell 1.0 bps to -0.295%

- Euro up 0.2% to $1.1392

- Italian 10Y yield rose 0.4 bps to 1.786%

- Spanish 10Y yield fell 2.2 bps to 0.416%

- Brent futures up 0.5% to $65.52/bbl

- Gold spot up 0.3% to $1,404.21

- U.S. Dollar Index down 0.2% to 96.07

Top Overnight News from Bloomberg

- In the first signs of negotiations since talks broke down in May, U.S. and Chinese trade teams are discussing next steps after Presidents Donald Trump and Xi Jinping agreed to meet on the sidelines of the upcoming Group of 20 summit in Japan, a senior trade official said in Beijing

- Turkish opposition candidate Ekrem Imamoglu won the redo of the Istanbul mayor’s race by a landslide on Sunday, in a stinging indictment of President Recep Tayyip Erdogan’s economic policies and his refusal to accept an earlier defeat

- Turkish President Recep Tayyip Erdogan, weakened by an opposition party’s landslide victory in Istanbul’s repeat election, scrambled to reassert his standing as the country’s most dominant politician in half a century by refocusing attention on a crucial trip to Asia

- Australian central bank chief Philip Lowe threw his support behind those casting doubt on how effective a new round of monetary policy easing by major economies would be in supporting global growth

- President Trump is threatening Iran with additional sanctions as soon as Monday, but there’s not much left for the U.S. to target because most of the Islamic Republic’s economy is already crippled under the weight of financial restrictions. Oil gains on the threat of new sanctions against Iran

- Viral Acharya, deputy governor of the Reserve Bank of India, resigned six months before his term ends, Business Standard reported, citing him

- Boris Johnson faces mounting pressure to submit to public scrutiny, after his rival in the race to be U.K. prime minister tried to turn questions about the front-runner’s character to his advantage

- President Trump denied that he’d threatened to demote Federal Reserve Chairman Jerome Powell but said he’d “be able to do that if I wanted”

- President Trump sent North Korean leader Kim Jong Un a personal letter, and the U.S. is ready to restart talks with Pyongyang “at a moment’s notice,” Secretary of State Michael Pompeo said

- New Zealand plans to introduce a bank deposit protection regime to bring it into line with other developed nations and increase public confidence in its lenders

- A slump in German business confidence deepened in June as trade tensions weighed on manufacturers. U.S.-led protectionist threats have clouded the growth outlook in Europe’s largest economy for months, contributing to a manufacturing slump

- The Reserve Bank of India will lose one of its most outspoken officials, further raising questions about the independence of the central bank six months after the governor resigned under a cloud. Deputy Governor Viral Acharya has asked to leave the central bank not later than July 23, 2019, citing “unavoidable personal circumstances”

Asian equity markets began the week somewhat choppy with participants tentative ahead of the Trump-Xi meeting at the G20 this week and following the mild pullback last Friday on Wall St where all majors ended slightly lower on the day, but still notched gains of more than 2% for the week. ASX 200 (+0.2%) was initially led lower by underperformance in Consumer Staples and as comments from RBA Governor Lowe appeared to question the impact easing could have on the economy, while a non-committal tone was seen in the Nikkei 225 (+0.1%) amid a mixed currency. Hang Seng (+0.2%) and Shanghai Comp. (+0.1%) were indecisive after the PBoC refrained from open market operations and as global markets await the latest developments in the trade war saga including the Trump-Xi showdown this week, while the US recently added 5 Chinese entities to its blacklist barring them from buying US parts without government approval. Finally, 10yr JGBs were subdued with after recent similar moves in T-notes and as yields bounced back from multi-year lows, while demand was also dampened after stocks in Tokyo pared opening weakness and amid the absence of the BoJ in the market.

Top Asian News

- India Poised to Lose Outspoken Central Banker as Acharya Resigns

- Pakistan to Get $3b in Deposits, Investments From Qatar

- China Is Going Bananas for Bananas as Purchases Surge to Record

- Nostrum Oil & Gas Studies Options Including Sale of Company

A choppy day for European equities thus far [Eurostoxx 50 -0.4%] following on from a similar Asia-Pac session as markets await the Trump-Xi showdown later this week. Major bourses are mostly in the red, losses for the DAX (-0.5%) stem from declining auto names after Daimler (-4.7%) issued its third profit warning in 12 months, citing losses caused by the diesel emission scandal; hence, Volkswagen (-1.2%) and BMW (-1.2%) have fallen in sympathy. Sectors are also lower with consumer discretionary names pressured by Daimler’s profit warning. In terms of individual movers, Leonardo (+2.4%) shares spiked higher at the open amid speculation that the Co. is considering bidding for Maxar Technologies’ space robotics business, which sources state could be valued over USD 1bln. Meanwhile, Carrefour (+1.6%) shares are underpinned after it reached an agreement to sell 80% of its Chinese operations with the transaction representing an enterprise value of EUR 1.4bln. Finally, Morphosys (+7.2%) shares are bolstered amid news that a treatments primary endpoint was met.

Top European News

- German Business Confidence Takes Another Dive as Economy Wobbles

- Italy Wins Temporary Reprieve in Bid to Stop EU Punishment

- Hunt Says Johnson Dodges Scrutiny as Race for U.K. PM Heats Up

- Santander Pays Allianz $1.1b to Terminate Spanish Venture

In FX, the USD has fallen further following last week’s dovish Fed policy meeting and Friday’s relatively weak PMIs, with the DXY faltering after a fleeting attempt to pare losses and probe above 96.200. The 96.000 handle looks under threat and could be relinquished amidst strength elsewhere, with Gold edging back over Usd 1400/oz and Eur/Usd eyeing 1.1400. Note also, the pressure could build as the week unfolds with at least one currency rebalancing model flagging a strong sell signal for the end of June, Q2 and H1, not to mention the G20 where US President Trump is due to meet his Chinese counterpart Xi for extensive trade talks.

- NZD/AUD – Perhaps surprisingly given ongoing global trade and geopolitical uncertainty, the Antipodean Dollars are outperforming major peers, or rather deriving most momentum from their US rival’s demise. The Kiwi is pivoting 0.6600 and Aussie 0.6950 ahead of this week’s RBNZ meeting on Wednesday with rates widely tipped to remain unchanged before another cut in August, while comments from RBA’s Lowe may have dampened some dovish expectations as he questioned the effectiveness of easing to support the economy in the context of moves by other Central Banks aimed at sustaining growth and reaching inflation targets.

- CAD/EUR – The next best G10 currencies, as the Loonie consolidates recovery gains through 1.3200 after its post-Canadian retail sales wobble, with some support from firmer crude prices, and the Euro draws encouragement from the latest German Ifo survey that was not as weak as forecast overall. Moreover, the institute maintained its 2019 GDP estimate and played down the prospect of a recession even though the economy is in the doldrums, or heading that way. However, Eur/Usd has tested the 50 DMA (1.1390) after clearing 200 DMA and WMAs, but falling just short barriers at the next big figure where the top end of 2 bn option expiries lie (from 1.1390 coincidentally).

- CHF/GBP/JPY – All narrowly mixed vs the Buck as the Franc stalls ahead of 0.9750 and Pound meets resistance above 1.2750 in the form of a 38.2% retracement of the fall from 1.3185 to 1.2506 at 1.2766. Meanwhile, the Yen has retreated a bit further from 107.00 and into a 107.29-48 band with technical support seen a fraction under (107.27 Fib) and decent expiry interest a whisker above (1.3 bn at the 107.50 strike).

- EM – The Lira has rebounded further from recent lows and in large part on the back of a resounding result at the 2nd Istanbul election that will not be contested this time. Indeed, President Erdogan congratulated the victor after the landslide saw Imamoglu defeat ex-PM Yildirim by whopping 800k votes. Usd/Try is hovering towards the bottom of a 5.7085-8200, with additional support for the Lira from an improvement in Turkish manufacturing sentiment.

In commodities, WTI and Brent futures have retreated from highs in recent trade as the upside momentum seen in the complex somewhat wanes ahead of this week’s US-Sino meeting. Over the weekend, US President Trump announced the intention of further tariffs on Iran to stem the country’s nuclear developments, although Russia’s Deputy Foreign Minister noted that the US is deliberately raising tensions with Iran and stated that Moscow and allies will counteract US sanctions on Tehran. WTI futures hover around USD 58/bbl (having hit an intraday high of USD 58.20/bbl) whilst its Brent counterpart trades just below the USD 65.50/bbl mark and closer to the bottom of today’s range. Elsewhere, gold prices hover around 6yr highs amid dovish central banks and rising tensions in the Middle East. Meanwhile, copper prices declined back below the USD 2.7/lb level as the red metal side-lines strikes at Chile’s Chuquicamata copper mine and takes the cue from the subdued risk tone heading into the G20 summit. Finally, Chinese Rebar steel traded near eight-year highs as demand picks up while output curbs have been extended in an attempt to reduce air pollution.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. 0, prior -0.4

- 10:30am: Dallas Fed Manf. Activity, est. -2, prior -5.3

DB’s Jim Reid concludes the overnight wrap

Welcome to the last week of June and ever longer nights here in the northern hemisphere. Many months ago I got time off for good behaviour and booked in to play a 2 day golf tournament over this past weekend. It had a cut at the halfway stage to qualify for Sunday’s final round. However our recent weekends have been busier than anticipated and we desperately needed time to buy two sofas for the new house. After high level negotiations we agreed that if I missed the cut we’d go sofa shopping Sunday morning. If there was a greater motivation to play well then this was it. All Saturday all I could think of when I stood over the ball was that if I made a mistake then I’d have to spend hours the next day comparing different levels of cushion comforts and fabrics. Alas that pressure proved too much and Sunday was spent with scatter cushions and not scattering it around the golf course as I did on Saturday. I wonder if Rory and Tiger are under the same pressure to make the cut at the Open.

I hope there are some nice sofas in Osaka next weekend as the main event this week will be the much anticipated G-20 summit on Friday and Saturday with the Trump/Xi meeting on the sidelines of the utmost importance. It’ll also be interesting to see what global leaders make of trade tensions and the recent growth slowdown, and whether the US will sign up to the accord. Back to US/China tensions, today’s multiple times rearranged speech from VP Pence – expected to be critical of China – has again been postponed as progress seems to be being made between the two sides. So there will be hope that positivity can continue to extend after they meet. If it doesn’t the problem is that the tariffs on the last $300bn of Chinese exports into the US will be very close to being ready to be imposed. So a bit binary but the fact that they are meeting means that we’re in a better place that we were this time last week. Staying with global politics, the US/Iran relationship darkened further last week and over the weekend the US national security adviser suggested fresh sanctions could come as early as today. So another one to watch especially as it appeared that Mr Trump pulled back from planned military strikes last week. He did appear a little conciliatory over the weekend and suggested he is ready for talks. WTI crude oil price is trading up +0.66% this morning.

Just on that upcoming meeting between Trump and Xi, China’s Vice Commerce Minster Wang Shouwen said overnight that “Compromise will be on both sides. It will be a two-way street,” while adding that China’s principles for the trade talks remain the same, including “mutual respect, treating each other as equals, win-win outcomes, working together and respecting the rules of the World Trade Organization.” To highlight that talks will not be easy, the Trump administration has put five more Chinese tech entities on a trade blacklist. The accompanying statement from the US Commerce Department said the new entities listed were part of China’s efforts to develop supercomputers. It said they raised national security concerns because the computers were being developed for military uses or in cooperation with the Chinese military. Companies added to the backlist included AMD’s Chinese joint-venture with partner Higon – THATIC, Sugon, Chengdu Haiguang Integrated Circuit and Chengdu Haiguang Microelectronics Technology.

Asian markets have started the week generally on a slightly firmer footing with the Nikkei (+0.19%), Hang Seng (+0.23%) and Kospi (+0.08%) all up while the Shanghai Comp (-0.09%) is down. Elsewhere futures on the S&P 500 are trading +0.32%. Elsewhere, in mayoral re-elections in Istanbul, opposition candidate Ekrem Imamoglu won 54% of the vote, with the ruling AK Party’s candidate, former Prime Minister Binali Yildirim capturing 45% (per Bloomberg). The report further added that Turkish President Erdogan, who had called for re-election post Imamoglu’s previous win, accepted the outcome of the rerun but has hinted the new mayor could run into legal problems. He suggested Imamoglu might be tried for allegedly insulting a provincial governor, and a prison sentence could lead to his ouster. The Turkish lira is trading up +0.79% this morning. Staying in Europe, the FT has reported overnight (citing sources) that the European Commission won’t formally trigger its excessive deficit procedure for Italy during a meeting tomorrow. The report also added that the Italian PM Giuseppe Conte is determined to follow EU budget rules to avoid an infringement procedure. This seems to be trying to buy both sides some time to come to an agreement.

In other news, the US President Trump continued with his attack on the Fed Chair Powell by saying in a NBC’s interview, conducted Friday and broadcast on Sunday, that “I’m not happy with his actions. No, I don’t think he’s done a good job.” He also denied that he’d threatened to demote Federal Reserve Chairman Jerome Powell but said he’d “be able to do that if I wanted.”

Moving on, in terms of key data this week, the highlights in the US this week include Durable Goods (Wednesday), final Q1 GDP revisions (Thursday) and PCE inflation (Friday). We’ll also get plenty of survey data. Fed Chair Powell will speak (Tuesday) and part two of the Fed’s stress tests results will be released (Thursday) after all passed in round one late on Friday. In US politics, on Wednesday twenty contenders for the Democratic presidential nomination are due to debate over two nights. This includes Senator Elizabeth Warren and front runner Joe Biden. In Europe today’s IFO in Germany is going to be important and given that 5yr5yr Euro inflation swaps hit record lows last week prior to Sintra, June’s CPI reports in Europe (Thursday and Friday) will be of note. The full day by day week ahead is published at the end.

After a busy week of macro news, Friday turned out to be relatively calm. For the most part, market moves were minor retracements of the week’s earlier action, with equities giving back a part of their gains, rates rising slightly after their big rally, and credit spreads widening a touch. The most noteworthy data on Friday, the flash PMIs in Germany, France, and the US, was mixed, with European readings doing better than expected but the US’s falling to a post-crisis low. The S&P 500 ended the week +2.20% (-0.13% Friday) and touched a new all-time high closing level on Thursday, while the NASDAQ and DOW made similar moves, up +3.01% and +2.41% (-0.24% and -0.13% Friday) respectively. In Europe, the STOXX index ended +1.57% (-0.36%) and Italian equities outperformed, with the FTSE MIB up +3.77% (+0.13% Friday). High yields credit spreads ended the week -16bps and -35bps tighter in the US and Europe (+1bps and -1bps Friday).

The moves in currencies continued their trends from earlier in the week, with the dollar dropping -1.40% (-0.44% Friday) and the euro gaining +1.43% (+0.66%). Oil also continued to rally, with WTI staging its strongest week since 2016 as US-Iran tensions heated up. That rally was worth +9.81% (+1.78%) for WTI, and a relatively more modest +5.40% (+1.41% Friday) for Brent. Gold advanced +4.28% (+0.77% Friday) to its highest level in five years. Energy-linked stocks performed well, with the S&P energy sector up +5.16% (+0.82% Friday), and the higher prices also sparked a move higher in inflation breakevens. Five year-five year inflation swap rates rose by +17.0bps and +6.3bps (+0.04bps and -0.8bps Friday) in the euro area and US, respectively after the central bank moves of last week. Those moves in inflation expectations added some nuance to the moves in bonds, where rises in breakevens were offset by falling real yields. Ultimately, the 10-year treasury ended -2.3bps lower (+2.9bps Friday) at 2.057% while bund yields were -3.0bps lower (+3.3bps Friday) at -0.285%. Treasuries had dipped below the 2% mark earlier in the week and bunds brushed a new all-time low. US 2s10s steepened +4.5bps (+3bps on Friday) on the week but traded in an 11.5bps range. For us the fact that the Fed went more dovish and the curve steepened was a sign that the market trusts them for now.

via ZeroHedge News http://bit.ly/2LeBzOr Tyler Durden