Is the US “Schrodinger” economy on the verge of a boom or a recession? That is the question investors are increasingly asking, prompted by the record disconnect between record high stock prices and 10Y yields on the verge of dropping below 2%.

Over the weekend, two major banks shared their perspectives on the topic, with Deutsche Bank framing the issue in the terms of quantum superposition, whereby the Fed’s intervention collapse the wave function of the US economy, and defines it as either in recession or growth, while JPMorgan was more pragmatic summarizing the divergence as one of growing dovish expectations and imbalanced positioning, and warning that “this is a major risk for equity markets going forward: if central banks fail to validate over the coming months market expectations of universal rate cuts, equities could be hit not only by a potential selloff in bonds that would mechanically make investors more OW in equities, but also by a potential increase in cash allocations as investors cover their currently extreme cash UW.”

JPMorgan also pointed out that only one scenario, that of a pre-emptive Fed that is set to provide insurance similar to the 1995 and 1998 episodes, “is positive for equities” explaining that “preemptive means cutting rates when growth indicators are still good rather than waiting for growth indicators to weaken.”

Which in turn brings up what JPMorgan believes is the most important question following this week’s FOMC meeting: “If the Fed is truly committed to preemptive rate cuts in order to provide insurance why did it not cut its policy rate this week?”

On Monday morning, Morgan Stanley’s increasingly bearish chief equity strategist, Michael Wilson, also waded into the debate, this time from the position of economic fundamentals, with a decidedly pessimistic take, cautioning that “the casefor material upside is getting harder” and adding that his “view remains that the US economy is experiencing a material slowdown after running too hot last year and this slowdown is now manifesting itself in poor earnings growth and deteriorating economic conditions.” Echoing JPMorgan, Wilson writes that “if the Fed is cutting rates because it’s truly the end of the cycle, rather than the Fed simply taking out insurance against that outcome, it has much different implications for equity markets.”

His conclusion: “The evidence is building that it’s more the former than the latter.”

But instead of relying on some questionable comparison which perceives the US economy in a quantum state of either alive or dead, the far more pragmatic Wilson instead looks at the recent deterioration in economic data, highlighting the following point which he has observed in the past:

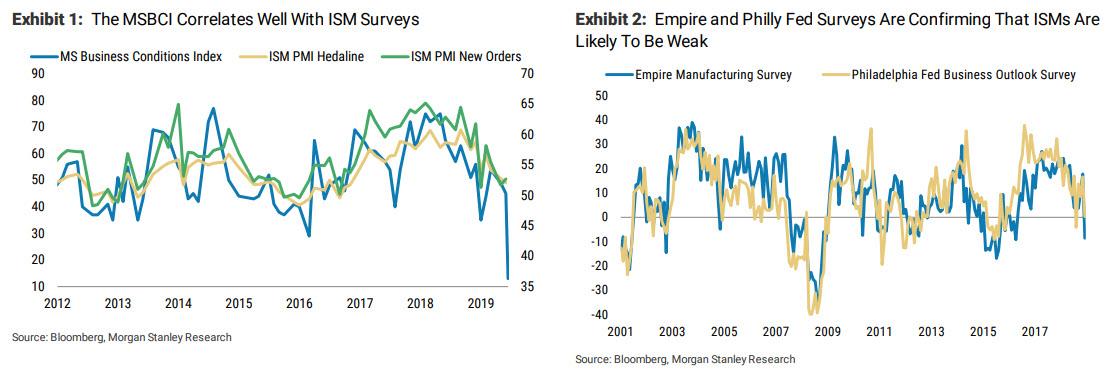

- The Morgan Stanley Business Conditions Index(MSBCI) showed the biggest one month drop-off in its history going back to 2002 and very close to its lowest absolute reading since December 2008. This matter because the index correlates closely with ISM New Orders and earnings revisions as we discussed last week.

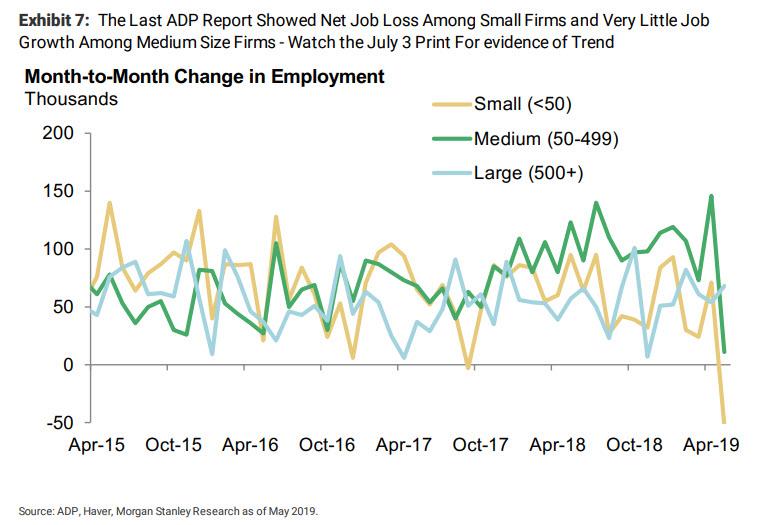

- Weak jobs numbers from both non-farm payroll and ADP reports, with the latter indicating net firings among small businesses.

- Lower commodity prices (CRB Rind Index) including weaker pricing for crude and its derivatives on the back of weaker than expected demand.

- Weak earnings from retailers and restaurants indicating consumer spend that is slowing, on the margin.

- Housing stocks that have failed to keep pace with the move lower in rates.

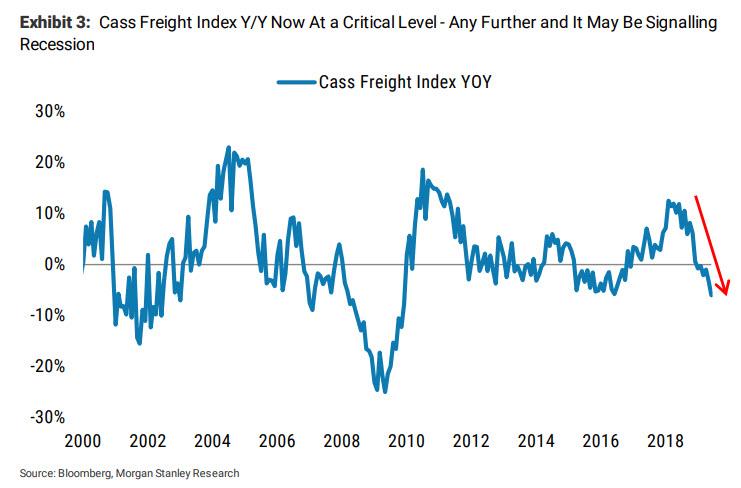

Today, to underscore his point that only economic pain lies ahead, Wilson looks at some of the latest regional Fed data to validate his skepticism. Specifically, he writes that last week we saw big misses from both the NY Fed’s Empire Manufacturing and Philly Fed’s Business Outlook Surveys (Exhibit 2), which printed in line with the plunge in the MS Business Conditions Index (had Wilson waited just a few hours more, he could have also added the Dallas Fed mfg index which plunged to a 3 year low). Some more details:

The New York Fed’s Empire Manufacturing survey fell to -8.6 from 17.8. That was the largest one-month decline on record and the lowest level for the index since 2016, driving the index into contraction territory (48.4) on an ISM weighted basis. The Philly survey did not drop by quite as much, but a headline decrease of 16.3 points in June is not a positive sign. The Philly Fed remained in expansion levels (and actually modestly ticked up on an ISM weighted basis), but this was propped up by longer supplier delivery times and inventory builds – neither of which are strong signals for growth going forward. In both surveys,new orders and employment fell.

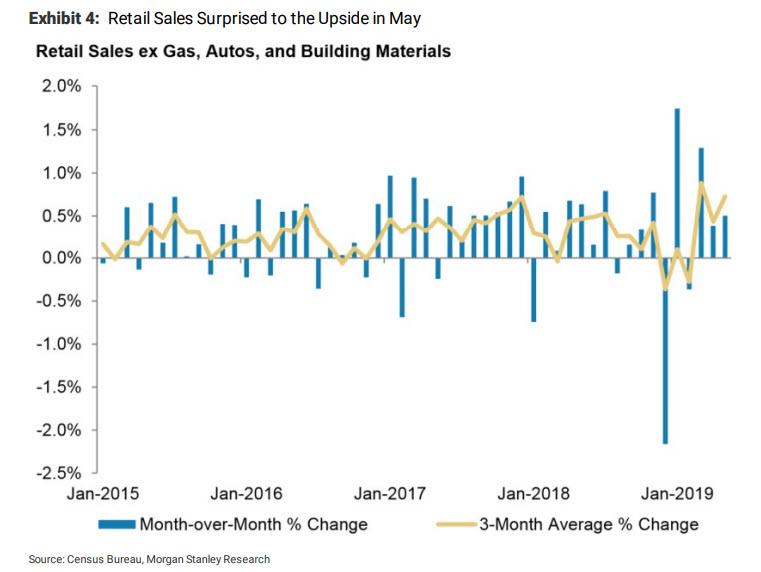

Meanwhile, picking up on our post from last week describing the “apocalyptic” mood among truckers, where BofA found that sentiment has crashed the most on record (see “Quietest Season In 20 Years”: Truckers Turn Apocalyptic As Sentiment Crashes Most On Record“), Wilson next takes aim at the The Cass Freight Index, which has also deteriorated further, down 6.5% y/y vs down 3.5% y/y in the prior month.

Why does this matter? Because according to Wilson, “there is perhaps no broader measure of economic activity for the US than Freight shipments and this index has been falling since before trade tensions re-escalated and the trend is still accelerating. The y/y change in the index is now at a critical level as further deterioration could be sending a real signal about recession risk.”

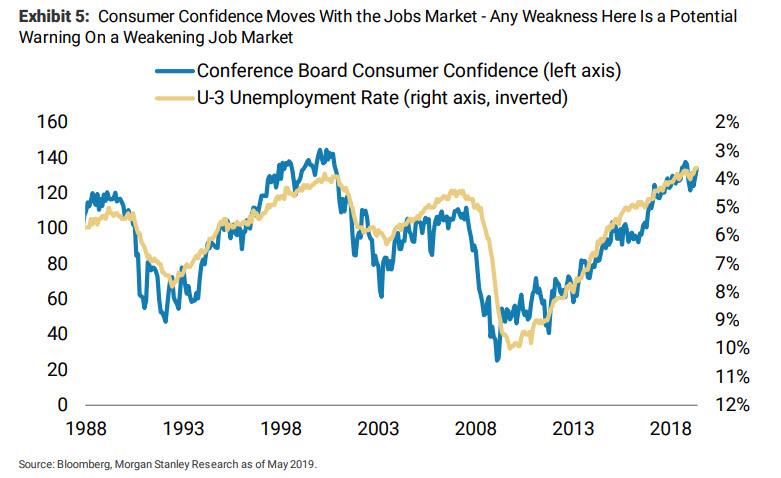

It’s not just trade that is on the verge of recession: the US consumer as measured by his favorite activity – dining out (cheaply) – is also tapped out. To wit, last week, Darden, a company with about a broad a read as possible on casual dining, missed on both comps and forward guidance. Wilson then says that he continues to see data points like this as early reads on a consumer curbing spending, though he note some evidence to the contrary as well – retail sales remained strong in May and surprised to the upside.

This increase in retail sales lifted the bank’s Economics team’s 2Q GDP estimate to 1.9% from 1.7% and real PCE growth is now tracking at 3.7%. The ISM non manufacturing index also surprised to the upside in May indicating that activity in the domestic services sector remains strong.

As Wilson concedes, the strength of the consumer has been one of the last bright spots in the economic data. However, he warns “it is easy for that to tip over and consumer confidence/spending would fall if companies begin firing.”

* * *

So with confusion over the future state of the US economy all the rage, Wilson urges patience, noting that over the next two weeks we will receive more important data points that have the potential to move markets. The data that Wilson will be watching very closely are the following:

- Regional Fed Surveys (June 24/25) – Dallas (which as we reported today was a disaster), Chicago,and Richmond Fed surveys will be released over the start of this week. The others have disappointed, so expectations will already be quite low.

- Consumer Sentiment (Conf. Board June 25, U. Mich. June 28) – Consumer sentiment moves with the jobs market (Exhibit 5). If the jobs market is still just stalling, rather than contracting, so dont’ expect too large of a move here, but be on the lookout at any weakening for signals on the employment report.

- Initial Jobless Claims (June 27, July 3) – Not as meaningful to us as the NFP and ADP prints, but worth monitoring for an early read on those indices.

- G20 Summit (June 28/29) – While not an economic data point like the others on this list, clearly the market will be focused on the outcome. The most bullish outcome is a resumption of trade talks that leads to a resolution of disputes soon. Such an outcome will likely help push markets higher, but is unlikely as Morgan Stanley’s political strategist Michael Zezas wrote on Sunday. Meanwhile, with a month between the G20 and the July Fed meeting, Morgan Stanley suspects that intervening period will see greater focus on data and earnings .

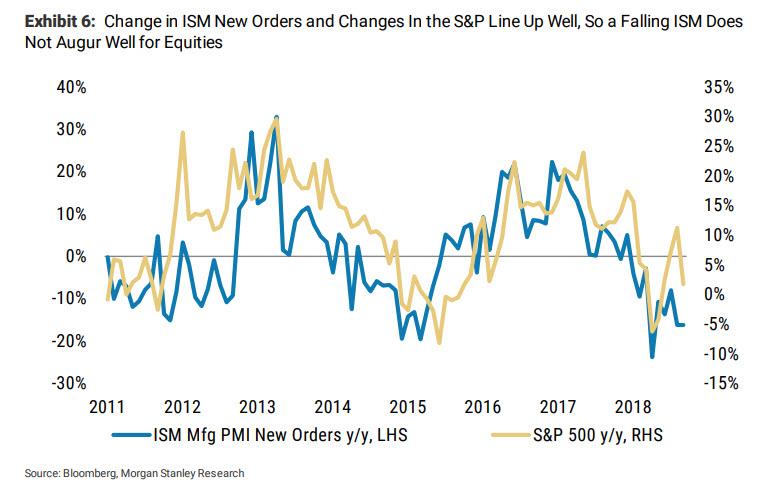

- ISM Manufacturing (July 1) – Based on the plunge in the MSBCI and regional Fed surveys to date, Wilson expects a further weakening here: “we’ll b e watching the headline index as well as new orders for signs of further slowing. As we show in Exhibit 6 the Y/Y change in the ISM has a strong track record of explaining moves in the S&P, so a weaker than expected print here could matter.”

- ISM Non-Manufacturing (July 3) – This will also be worth watching given its read on a broader portion of the economy, though it has been shown not to have as much of a direct relationship with stock price movements.

- ADP Employment (July 3) – The last report showed net job loss (52K) among small companies and a rapid fall off in growth among mid-size firms (Exhibit 7). Together, these cohorts make up over 75% of the overall jobs market, so weakening here is a bad sign for the economy. The data series is noisy though, so the July 3 release becomes more important as either confirming or refuting a trend.

- Non-Farm Payrolls (July 5) – The last NFP print of only 75K jobs added with downward revisions to the prior two months and stalling average hourly earnings growth was not encouraging. In a bear case, where the NFP print surprises below 0, the outlook for risk assets will be challenged, notwithstanding the Fed cutting.

Wilson’s conclusion is that even for those who remain bullish, “we’d look to cap downside until the data are sending a clearer message that a trough is in sight. Market internals like the outperformance of secular growth, quality,and defensives as well as reduced investor exposure to equities all suggest market participants are very much engaging with slowing economic and earnings growth.”

And so, with the economy on the verge of recession, the debate to Morgan Stanley now becomes a matter of degree and whether the Fed and any potential trade pause/agreement can arrest the slowdown. For what it’s worth, the bank’s own view is that “further slowing, earnings cuts, and higher volatility lie ahead, posing absolute downside risk for equities and outsized portfolio risk for many investors given crowding.”

His bottom line:

… we’re stuck in the middle right now between weak data on the left and an accommodative Fed on the right. However, if the data deteriorates further in 3Q, we should get a 10 percent correction. With positioning lighter and investor sentiment somewhere between bullish and bearish, we understand that there are some expectations for weaker data. The Fed and trade have been, and may continue to mean that weaker data will get a “pass” for the time being, but our view remains that risk-reward for equities is poor, particularly where there has been crowding, as the scope for downside disappointment is larger than the markets seem to be discounting. We expect more clarity in the coming weeks and will be particularly focused on jobs and Purchasing Manager Indices.

Finally, if the bank’s equity strategist is wrong, and the Fed keeps the US economy in a slow growth, or “muddle through”, environment, Wilson believes “the upside is limited” and either way uncertainty is high, “which means risk is elevated.” And that of course, keeps the wall of worry growing ever higher (as Eric Peters wrote on Sunday), prompting traders to expect even more intervention from the Fed, and leading to even higher market records in this most paradoxical Catch 22, which will result in the US entering a recession with the market all all time highs.

via ZeroHedge News http://bit.ly/2IFYFw3 Tyler Durden