Following an impressive rally in the price of gold heading into June as the Fed turned pathologically dovish, the price of the precious metal dropped when St Louis Fed President James Bullard’s said this week that the “situation doesn’t call for a 50 bps rate cut.” As a key proponent of the emerging Fed easing consensus at the start of June, Powell’s views carry significant weight, and his comment was enough to cause a stumble for gold bulls.

But, as Deutsche Bank asks, is it really time to sell gold?

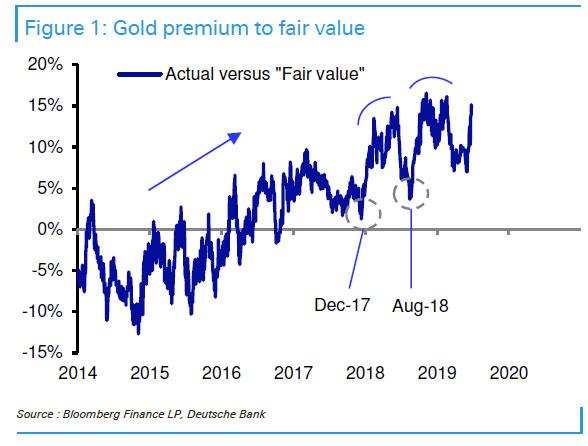

In response, the bank’s research analyst Michael Hsueh writes that one might certainly think so. After all, gold’s performance to the recent high of USD 1,439/oz has been similar to the February 2019 rally to USD 1,347/oz in that the premium to fair value touched a peak of 16% in both cases; much higher premiums have been difficult to come by outside of the GFC 2008-09 experience. Therefore this may be seen as a sell signal since the premium has cycled between 7-16% during the year.

That said, while there may be scope for modest downside, the German bank recommends to shy away from outright short positions for two reasons.

Reason not to go short #1

Gold’s premium to fair value is trending higher, which is sensible in the context of the shift towards a Fed easing stance, according to DB. Additionally, brief lows in the premium in Dec 2017 and Aug 2018 (Figure 1) tend to be followed by more sustained periods of high premiums lasting months in duration. Also, it has been more dangerous to sell tops in the premium, than buy bottoms. Selling an apparent top in November 2018 would have been poorly timed as gold then rose from USD 1,220/oz to 1,286 by early January.

Reason not to go short #2

While one should consider all possible scenarios for trade negotiations at the G-20 summit, “recent indications are poor”, Hsueh writes. A concerted effort by Treasury Secretary Mnuchin and Commerce Secretary Ross to pave a constructive runway into the event was given a splash of cold water by Global Times editor Hu Xijin (“No Chinese official now speaks with such optimism”). With the public comment period now complete for the next stage of 10% US tariffs to be levied on Chinese goods, it is easier to envision another step down the path of disentanglement than a stroke of luck.

Downside to USD 1,375/oz in the case of -25 bps July cut

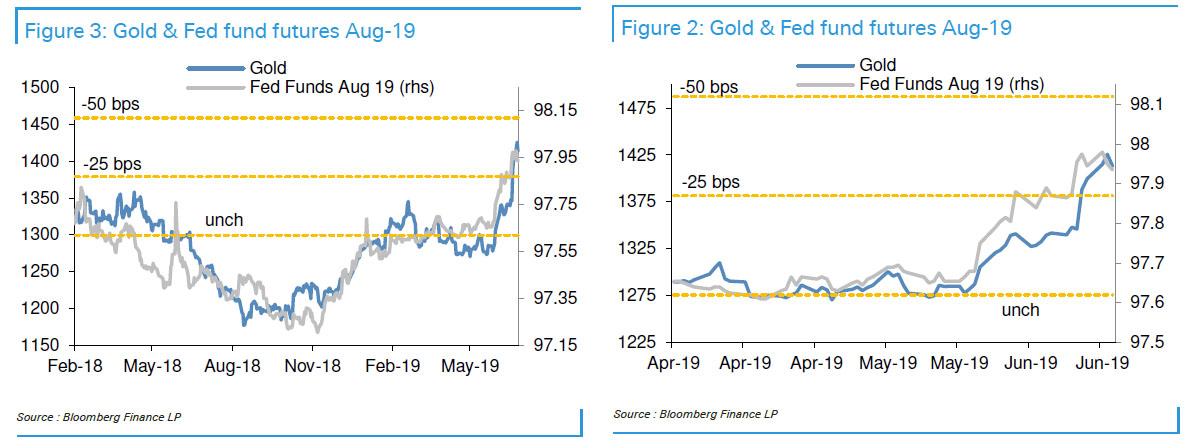

Finally, to avoid overly relying on the premium to fair value as a guide, DB examines the behavior of August Fed fund futures relative to gold. This relationship indicated that a -25 bps cut to Fed funds in July would be consistent with gold around the USD 1,380/oz level (scaling matters, see Figures 2-3).

This makes sense given that August Fed fund pricing currently indicates -32 bps. More significant gold downside would require an elimination of the Fed easing bias, which is now seen as the base case through the end of the year (-75 bps).

In short, with the Dove in Chief now dictating monetary policy, the risk of a washout in gold is virtually nil.

via ZeroHedge News https://ift.tt/2IUxfT8 Tyler Durden