Despite nothing being achieved in Osaka apart from a resumption of more-of-the-same trade talks (and a fold by Trump), markets are decided ‘risk-on’ as they open this evening.

Treasuries are being dumped along with gold (because everything is awesome right?) and stocks and yuan are surging.

Dow is up over 250 points…

The biggest reaction for now is in Yuan, spiking to 8-week highs…

As a reminder, this is not news – but do not tell the algos…

“Stocks rally as China, US closer to a deal following G20”

Headline on Monday probably

— Hipster (@Hipster_Trader) June 28, 2019

S&P 3,000 here we come at tomorrow’s open!?

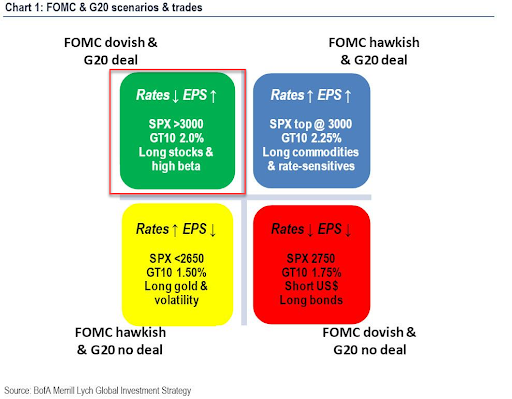

However, is good “trade” news bad news for stocks as odds of a July rate-cut drop?

In case you wondered, you are here…

Additionally, reported agreements between Russia and Saudi Arabia to extend the OPEC production cuts has spiked oil prices as they open this evening…

Oil producers from the OPEC+ alliance are moving toward extending their supply cuts for nine months into the first quarter of 2020, as they grapple with surging U.S. shale output and weakening growth in demand.

Since Russia and Saudi Arabia reached a deal on the margins of the Group of 20 summit on Saturday to roll over the curbs by six to nine months, other nations have voiced their support for an extension into next year.

“The longer the horizon, the stronger the certainty to the market,” OPEC Secretary-General Mohammad Barkindo said in Vienna on Sunday after meeting with Khalid Al-Falih, the Saudi oil minister. “It will be more certain to look beyond 2019. I think most of the forecasts that we are seeing now and most of the analysis are gradually shifting to 2020.”

Russian President Vladimir Putin – after meeting with Saudi Crown Prince Mohammed Bin Salman – opened the door to 2020 by mooting longer curbs.

via ZeroHedge News https://ift.tt/2ZTKrNE Tyler Durden