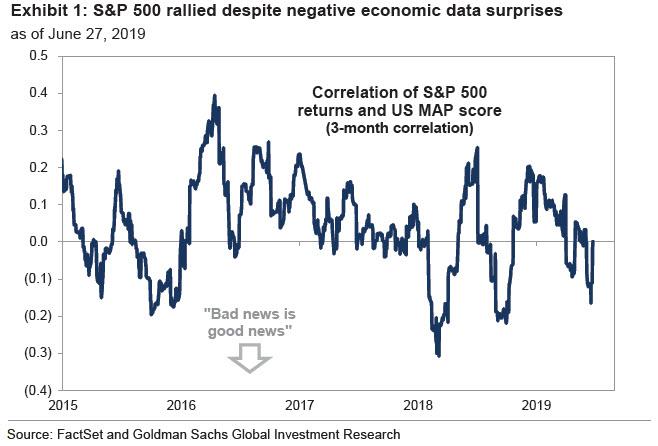

The S&P may have just enjoyed its best June in 84 years but not because of rising corporate profits and earnings. Quite the contrary: according to Goldman, while the S&P 500 rose 7% from its trough on June 3, valuation expansion accounted for 90% of the rally in response to the Fed’s becoming “impatient” and signaling an easing cycle has begun. As Goldman’s chief equity strategist David Kostin writes, the realized 3-month correlation between S&P 500 returns and the bank’s MAP index, a measure of economic data surprises, reached a low of -0.2 last week versus a 10-year average of +0.1.

Meanwhile, weak economic data – which validated the Fed’s easing bias – have generally been “good news” for equity valuations but “bad news” for earnings expectations during the past three months.

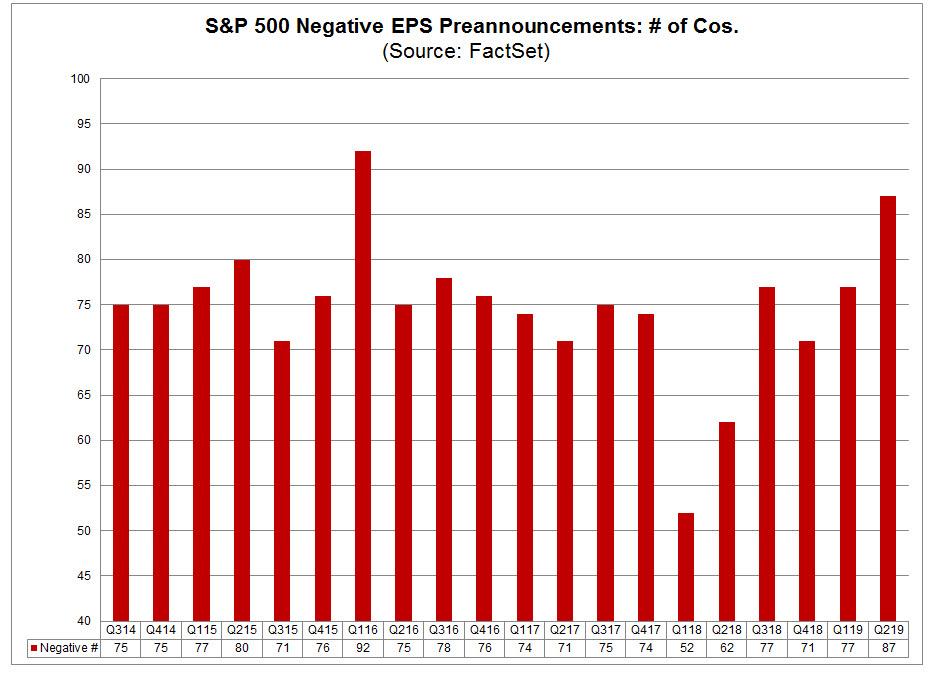

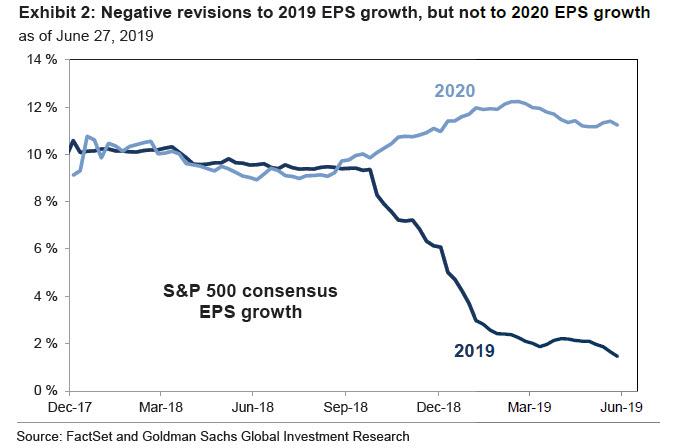

Indeed, if investors are looking for some upside from corporate fundamentals, they probably won’t find them in the upcoming Q2 earnings season, as consensus bottom-up 2019 EPS estimates have resumed their downward trend following a brief reprieve during 1Q earnings season. Consensus has lowered its estimate of 2019 EPS by $1 to $166 (+2% growth year/year) during the past six weeks, with Goldman noting that since the start of 4Q 2018, 2019 EPS growth expectations have declined from +10% to +2%. As we reported yesterday, companies issuing negative guidance has jumped to 87, the second highest on record, while 1-month EPS revisions have been most negative in Energy and Info Tech

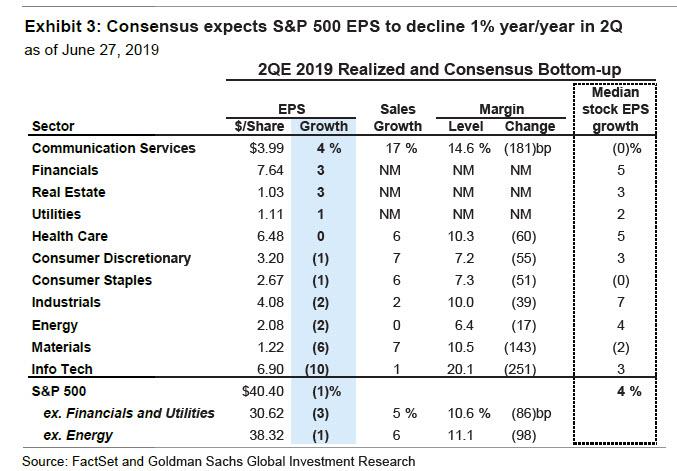

So with 2Q earnings season kicking off in earnest on July 15, consensus expects aggregate EPS to decline by 1% year/year , and if realized, this would be the first year/year decline in quarterly EPS since 2016.

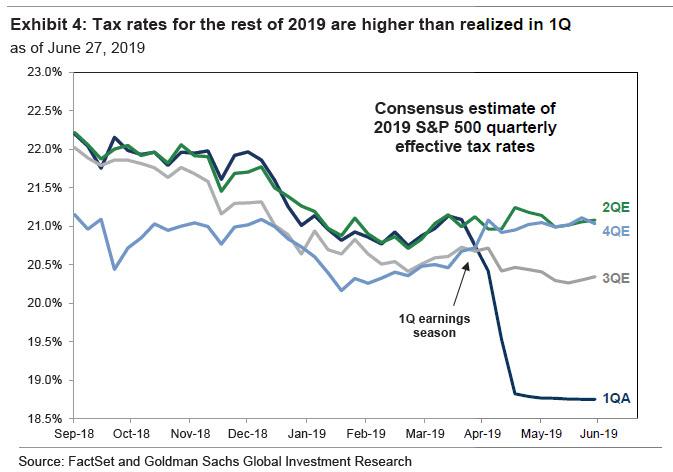

To be sure, consensus also expected a 2% decline in EPS at the start of earnings season in 1Q, however, realized growth ultimately equaled +2%, with the number saved by Trump’s tax cuts, as effective tax rates were lower than originally anticipated.

Meanwhile, excluding Financials and Utilities, S&P 500 sales are forecast to grow by 5% in 2Q but to be more than offset by an 86 bp decline in net profit margins. Consensus expects all 8 sectors to see positive sales growth and margin contraction in 2Q. Communication Services (+4%) and Financials (+3%) are forecast to post the fastest EPS growth.

Despite the broad-based drop in EPS, the median S&P 500 company is still expected to post modest growth and see its EPS grow by 4% year/year in 2Q. The culprit, perhaps unexpectedly, is Info Tech which has an outsized weight in the index, accounting for 20% of earnings, and is forecast to see EPS fall by 10% year/year this quarter driven by AAPL (-10%) and semiconductors (-28%). As a result, aggregate EPS growth distorts the fundamental outlook for the median company. Notably, within Info Tech, Software & Services 2Q EPS growth is expected to be healthy (+7% year/year).

Looking at the broader macro picture, the slowdown in economic growth during 2Q is consistent with expectations for a decline in EPS growth. With economic growth the primary driver of S&P 500 sales and earnings growth., during 2Q 2019, the Goldman Current Activity Indicator (CAI) averaged just 1.4%, a pace of growth that pales in comparison with the 3.4% growth during 2Q 2018. Global growth has also been weak amid heightened uncertainty and ongoing trade war between the US and China – which while did not escalate this weekend, continue as before – with the GS global CAI averaging 2.9% during the quarter versus 4.2% in 2Q 2018.

Qualifying at the main drivers of downside profitability, Kostin expects profit margins will contract as input costs continue to weigh on profitability. In part due to the one-time boost from tax reform, net profit margins reached an all-time high in 2018. However, margins contracted in 1Q 2019 for the first time since 2016. The unemployment rate stands at a 50-year low (3.6%) and average hourly earnings have grown by more than 3% in each of the last 8 months.

In addition to a tighter labor market, capacity constraints have led to higher transportation and logistics costs, as companies have been unable to keep pace with their prices; an NABE survey shows that the net share of respondents reporting rising wages (57%) and materials costs (36%) is well above the net share reporting rising prices charged (18%). Historically, this pattern has been a precursor to EBIT margin declines, as consensus expects in 2019.

At the same time, tariffs represent a significant source of uncertainty for corporate profit margins, with Goldman pointing out that “tariffs pose a greater risk to company profit margins than to sales” and adding that “if the trade war escalates and a 25% tariff is imposed on all imports from China, current consensus S&P 500 EPS estimates could be lowered by as much as 6%.” And while such an outcome has been averted for now thanks to Saturday’s ceasefire between Trump and Xi, it may still return, in which case S&P 500 firms would need to raise prices by around 1% to offset the impact of tariffs.

Yet while Trump’s tariffs are the primary source of risk to Q2 and H2 earnings, Trump’s tax cuts are the the primary source of upside risk to 2Q and full-year 2019 EPS estimates in the form of an even lower effective tax rate. Consider this: the S&P 500 effective tax rate during 1Q equaled 19%, compared with an estimate of 21% at the start of earnings season, and was a significant contributor to better-than-expected results in the quarter.

However, as Goldman notes, consensus estimates for the effective tax rate in the remaining three quarters of 2019 have remained largely unchanged. Consensus forecasts a 21% effective tax rate through year-end, but if tax rates remains at 1Q levels, it would lift 2019 EPS estimates by roughly $3 (from $166 to $169 or roughly +150 bp additional growth).

It is also worth noting that Wall Street’s bout of pessimism is expected to be a brief one, as while consensus has lowered 2019 EPS growth estimates, they have not adjusted 2020 estimates, which stand at 12% compared with 11% at the start of the year.

Here Goldman, which remains bullish on the overall market (despite the random strategist publishing an occasional bearish note expecting a market crash within the next 12 months), expects that “the macro environment will support an EPS growth acceleration in late 2019 and 2020 relative to the first three quarters of this year.” However, even Goldman forecasts just 4% EPS growth in 2020 and expects negative revisions to 2020 EPS estimates. To wit: on average since 1985, consensus EPS estimates have typically been lowered by an average of 8% from when analyst estimates are first published two years prior to the estimate year. And with Wall Street always eager to delay the moment of cutting its overly optimistic forecasts until the last possible moment, negative revisions to forward year EPS typically accelerate after the 2Q earnings season as investors and analysts shift their focus to the following calendar year.

With all that in mind, Goldman warns that while the dovish pivot from the Fed lifted equity valuations in every S&P 500 sector (furthermore, with a China-US trade deal now once again a possibility as the two sides are once again negotiating, there is a clear risk the Fed may not cut at all as this Bloomberg article details) but Goldman expects that fundamentals, i.e., earnings, will become an increasingly important driver of returns going forward for the simple reason that “earnings drive stocks over the long term.”

What does this means in practical terms? According to Kostin, a long/short factor of S&P 500 stocks with the highest versus lowest trailing FY2 EPS revisions has posted an average annualized return of 3.6% since 1980. But since January, the strategy has traded sideways as a dovish Fed has lifted US equity valuations broadly.

Finally, last quarter, the gap between performance of EPS beats and misses on the day after reporting earnings surged to 600 bps, the highest since at least 2006, and Kostin expect this trend will continue in 2Q as investors shift their focus from broad equity valuations to prospects for earnings growth in 2020.

via ZeroHedge News https://ift.tt/2ZXqMwf Tyler Durden