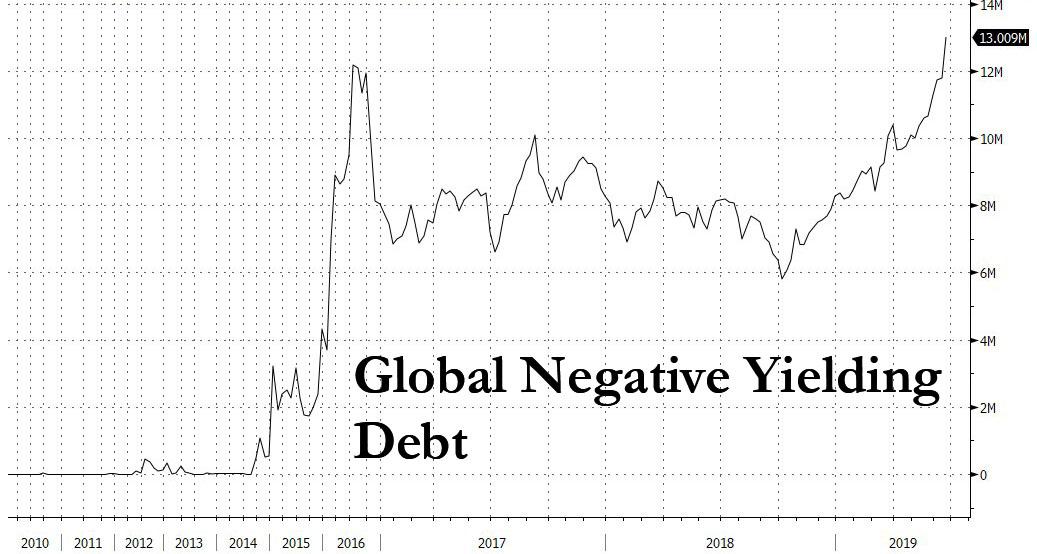

Ten days ago when global bond yields tumbled amid renewed fears that the global economy was headed for a recession, we reported that a record $13 trillion in global sovereign debt was trading with a negative yield.

And while we don’t have the latest numbers from Bloomberg, pending their EOD update at the close, it is safe to say that as of this moment, there is a new all time high in negative yielding debt, because while German yields tumbled deeper into record negative territory this morning following abysmal global PMIs and comments from the ECB that the central bank was prepared for any contingency (i.e., ready to cut rates even more), it was the turn of France to follow Germany into sub-zero territory as the French 10Y yield just dropped below 0%, assuring that the total amount of negative-yielding debt just rose by a few hundred billion.

Meanwhile, the disconnect between global bonds – which are now screaming “recession is coming” – and global stocks which are partying as if the Fed can’t wait for S&P 3,000 to cut rates not by 25bps but 50bps, if not more, has never been greater.

via ZeroHedge News https://ift.tt/2ZZ1kXi Tyler Durden