The National Low Income Housing Coalition has published its latest “Out of Reach” report which shows that renting is becoming increasingly unaffordable for countless Americans.

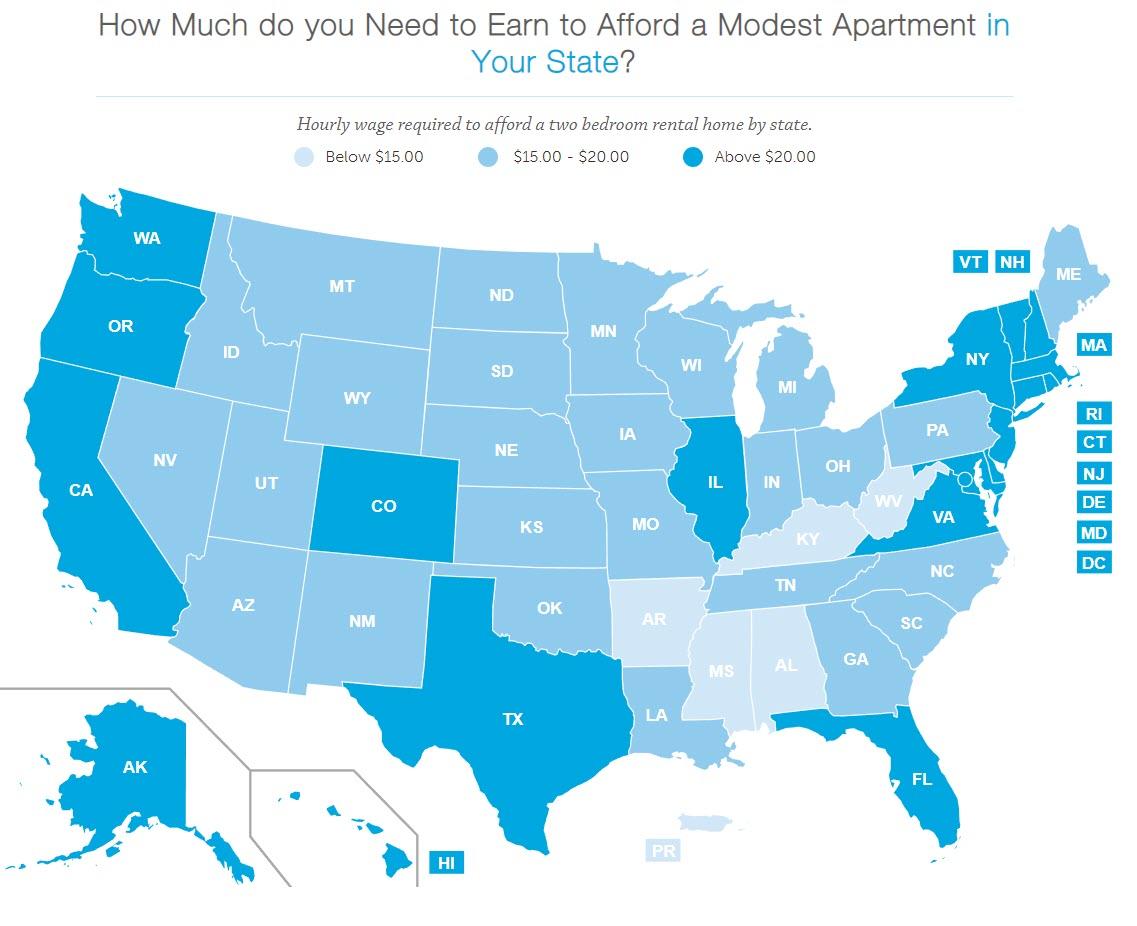

Its central statistic is the Housing Wage which is an estimate of the hourly wage a full-time worker must earn to rent a homewithout spending more than 30 percent of his or her income on housing costs. As Statista’s Niall McCarthy notes, for 2019, the Housing Wage is $22.96 and $18.65 for a modest two and one-bedroom flat respectively based on the “fair market rent”.

A worker earning the federal wage would have to put in 127 hours every week – equivalent to more than two full-time jobs – to afford a two-bedroom apartment. It isn’t just a regional issue – there isn’t a single state, metro area or county in the U.S. where a full-time worker earning the minimum wage can afford to rent a two-bedroom property.

It isn’t just workers on the minimum wage who are effected.

The report also states that the average renter’s hourly wage is $1.08 less than the Housing Wage for a one-bedroom rental and $5.39 less than a two-bedroom rental. That means that an average renter in the U.S. has to work a 52 hour week, something that becomes increasingly difficult if that renter is a single parent of someone struggling with a disability. When it comes to the situation in different occupations, a median-wage worker in eight of the country’s largest ten occupations does not earn enough to afford a one-bedroom apartment.

You will find more infographics at Statista

Software developers, general managers and nurses are able to meet both Housing Wages but for many other occupations and accomodations, renting is becoming increasingly difficult. Medical assistants, laborers and janitors are among those falling short while the gap back to minimum wage workers is even greater still. Worryingly, these are the ten jobs that are expected to see the biggest growth over the coming decade and that is likely to result in an even greater disparity between wages and housing costs by 2026.

via ZeroHedge News https://ift.tt/2Nnwm9S Tyler Durden