Today, gasoline taxes are rising in a dozen U.S. states. The following infographic shows where gasoline taxes are going up today and it’s based on data from the Institute on Taxation and Economic Policy.

You will find more infographics at Statista

California is among the states with increases and taxes in the Golden State are going up by 5.6 cents. That now equates to 47.3 cents per gallon, meaning California once again has the highest gasoline pricesin the country.

But, the increase is particularly notable in Illinois given, as Statista’s Niall McCarthy notes, that the state hasn’t altered its gas tax since 1990. It’s bumping its gas tax by 19 cents to 38 cents a gallon.

As IllinoisPolicy.org’s Vincent Carudo and Joe Barnas detail below, Illinoisans will shoulder one of the nation’s heaviest tax burdens at the pump – and the DMV.

On June 28, Gov. J.B. Pritzker signed into law a $45 billion infrastructure plan that will bring Illinois drivers a record gas tax hike and higher vehicle registration costs.

Those tax and fee increases will come in addition to tax hikes on cigarettes, e-cigarettes, parking and real-estate transfers, on top of new revenue from a massive gambling expansion that includes new casinos and legalized sport betting – all of which the Illinois General Assembly introduced and passed in a single day.

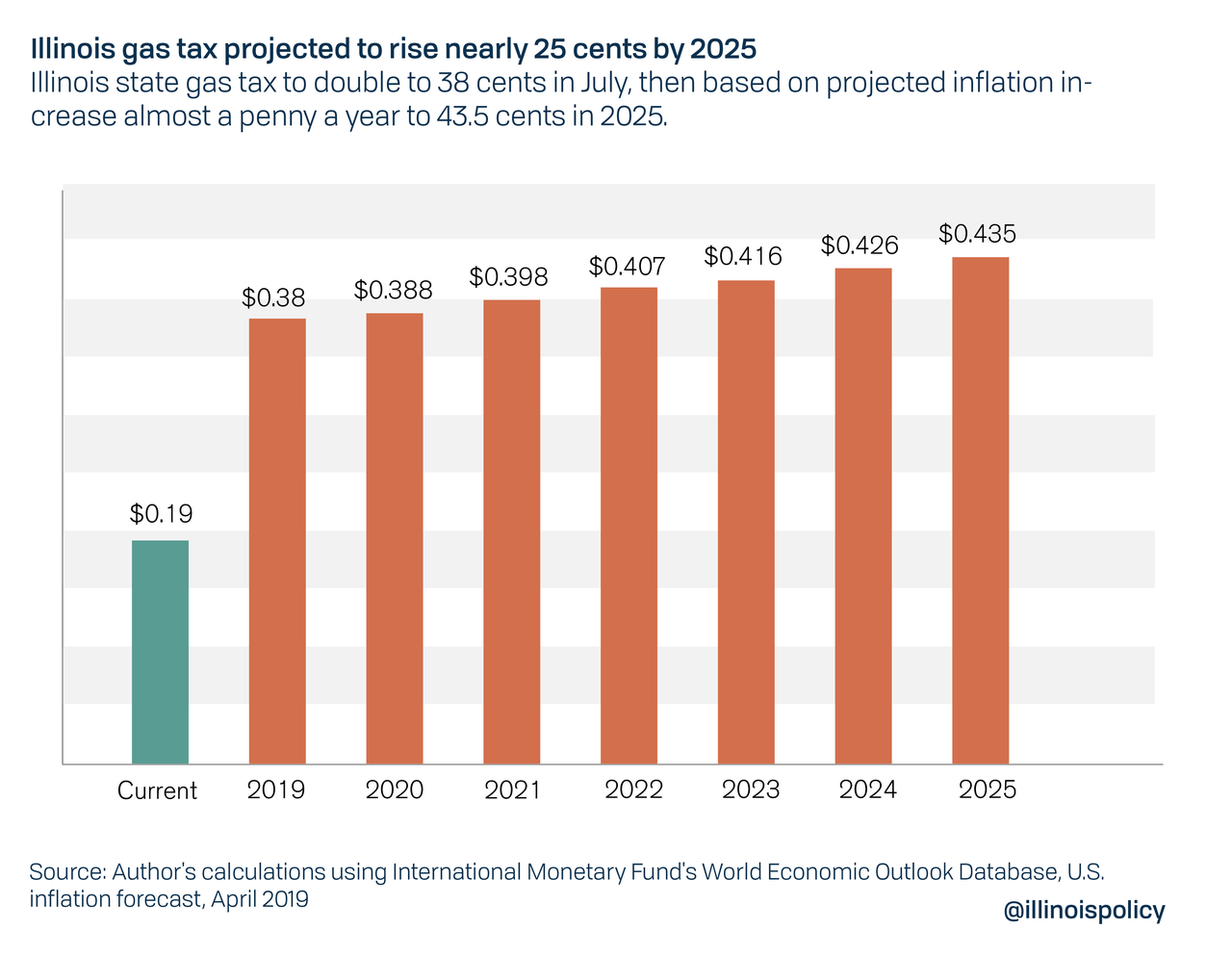

The gas tax hike is the most painful increase to come, doubling to 38 cents from 19 cents per gallon.

This will bump Illinois’ total gas tax burden to the third-highest in the nation, and possibly higher if local governments exercise their increased taxing authority under the plan. An Illinois Policy Institute analysis found the typical Illinois driver will pay at least $100 more on gasoline each year under a doubled gas tax.

Illinois is one of just seven states where drivers pay layers of both general sales taxes and special excise taxes on gasoline at the state and local levels. Those multiple layers mean drivers filling up in Chicago, for example, will pay 96 cents in taxes and fees on a $2.46 gallon of gasoline – an effective tax burden of 39%.

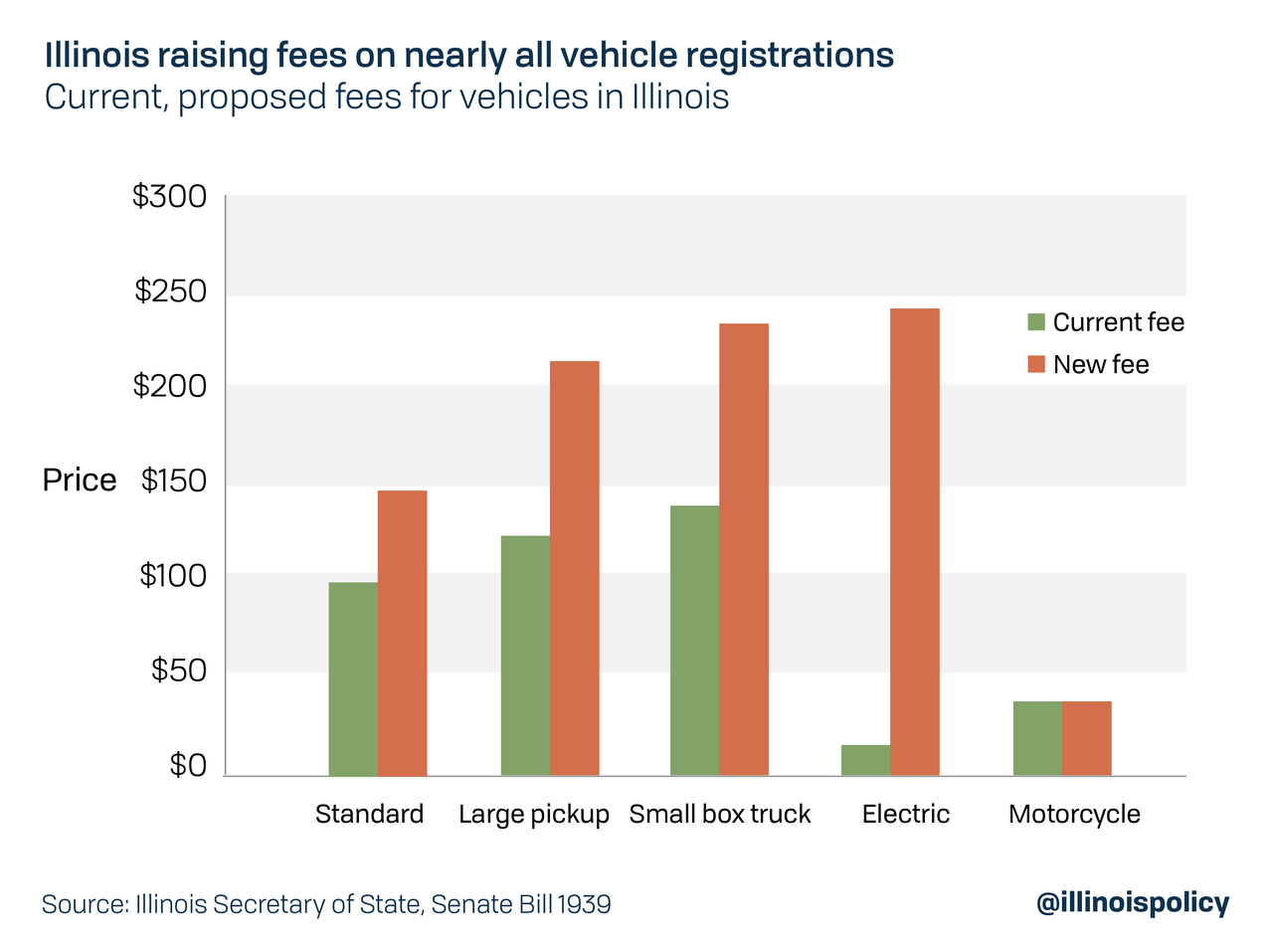

The infrastructure plan also hikes Illinois’ vehicle registration fees to among the highest in the nation. Illinois drivers of standard vehicles weighing 8,000 pounds or less will see registration fees jump to $148 from $98.

The gas tax hike kicks in July 1, and motorists will pay more for license plate stickers starting in 2020.

Taken together, increases in the gas tax and vehicle registration fees alone erase any promised income tax savings included in Pritzker’s progressive income tax plan, which Illinoisans will vote on in November 2020.

Under Pritzker’s proposed progressive tax system, a married couple in Illinois with two kids earning the $79,168 median annual income and paying the average property tax bill of $4,157 would see $195 in total tax relief, according to the Pritzker administration’s online “fair tax calculator.”

But if that same family uses two cars on a regular basis, their budget will take a $300 hit – a $200 gas tax increase and a $100 vehicle registration fee hike.

Notably, the gas tax will be tied to inflation, meaning it will automatically rise annually. This allows state lawmakers in future years to avoid blame from frustrated motorists.

Based on current inflation projections, the gas tax will rise almost a penny a year. Lawmakers’ inflation mechanism could drive the gas tax to 43.5 cents by 2025, nearly 25 cents per gallon more than it is now.

Using the most recent inflation forecasts for the United States, the gas tax will grow just short of a penny each year until 2025 – a 130% increase.

The new law lets Chicago raise its local gas tax by an extra 3 cents, which would put it at 8 cents. It allows Lake County and Will County to impose a gas tax of up to 8 cents per gallon. DuPage, Kane and McHenry counties would be able to double their 4-cent-per-gallon gas taxes to 8 cents.

According to state projections, the doubled gas tax alone will raise $1.2 billion, with $560 million going to the state and $650 million to local governments.

If Chicago and the collar counties increase their motor fuel taxes – along with automatic yearly inflation-tied increases at the state level – residents could soon be looking at the highest average gas tax burden in the country.

The Illinois Policy Institute outlined a plan in May showing how Illinois could finance $10 billion in new capital spending without tax hikes.

State lawmakers could have achieved a more responsible plan by focusing on maintenance infrastructure, reforming costly prevailing wage mandates and using an objective project selection process, while dedicating revenue from legalized sports betting and sales taxes on gasoline to transportation infrastructure.

Instead, state leaders once again chose to demand more of already-overburdened Illinois taxpayers.

via ZeroHedge News https://ift.tt/2Nsz3Hg Tyler Durden