Submitted by Ted Dabrowski and John Klingner of Wirepoints

It didn’t take long for new Chicago Mayor Lori Lightfoot to propose a plan that would wash her hands of Chicago’s pension crisis altogether. According to a recent report in Crain’s, Lightfoot wants the state to take over Chicago’s pension debts and merge them with the other pension plans throughout the state. The move would make all state taxpayers responsible for paying down the city’s debts.

The plan to shift city debts to the state would bail out the mayor from having to raise about $1 billion in additional taxes to pay for increasing pension costs by 2023. A massive tax hike is something she’s desperate to avoid.

But while Lightfoot may think the cost-shift is a solution, it will only make things worse for Illinois. She should expect significant pushback from many sides.

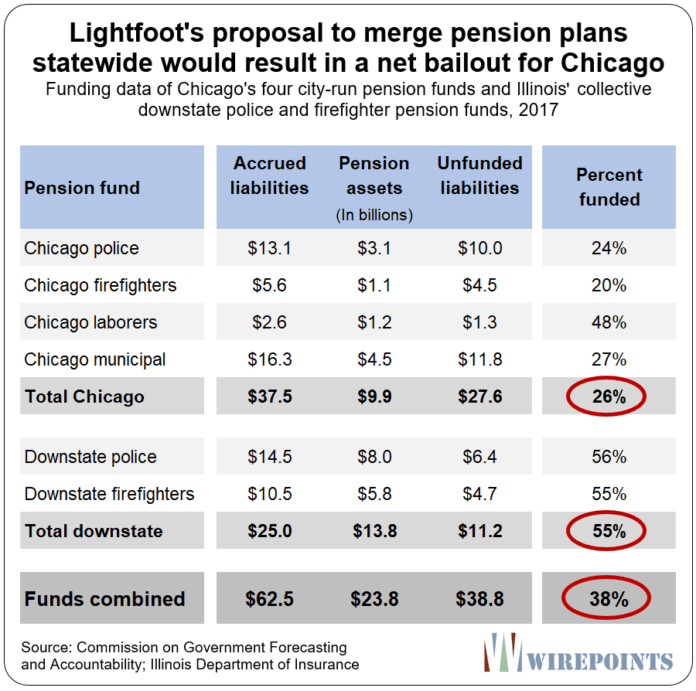

Start with downstate and suburban residents. Sure, their public safety pension funds would get consolidated under the state, too, but it’s the Chicago funds that are some of the biggest and worst-funded in the state. The four city-run funds are collectively funded at just 27 percent and face an official shortfall of $28 billion.

In contrast, the 650 downstate pension plans are 58 percent funded and have a shortfall of nearly $10 billion. The end result of any statewide pooling of pension funds will be a net bailout for Chicago.

Non-Chicagoans aren’t going to just accept yet another bailout of the city. Downstaters’ most recent bailout of Chicago came when the state’s new education funding formula locked in special subsidies for Chicago Public Schools. That included hundreds of millions in hold-harmless funding as well as $200 million-plus annually to pay for the district’s pension costs.

The mayor can expect pushback from the rating agencies, too. Illinois already has what Moody’s Investors Service calculates as a $234 billion state pension shortfall, while the state’s retiree health insurance fund has another gaping $73 billion hole.

Adding $42 billion more – what Moody’s reports as Chicago’s true pension debt – may push the state’s credit rating into junk category. That’s significant since no state in modern times has been rated junk.

Lightfoot’s pension proposal might come as a surprise to some given her comments last week to the Chicago Sun-Times. According to the paper, “Mayor Lori Lightfoot said Friday she’s willing to tackle Chicago’s ‘mounting, looming, all-consuming’ pension debt once and for all, even if it means risking her political future.”

“We cannot keep asking taxpayers to give us more revenue without the structural reforms that are fundamentally necessary to make our city and our state run better. Now is the time to act,” she said.

Lightfoot has obviously given up on structural reforms. Her proposal does nothing to actually reduce the overwhelming debts of the city’s pension funds. Instead, it appears her only goal is to socialize the costs across all state residents.

That’s not “risking her political future.” Making everyone else pay for the city’s debts, if she can make it happen, is the easy way out.

Few options

Lightfoot the candidate knew what a mess the city’s finances were in. The city was already rated junk by Moody’s when she took over, while CPS was five notches deep into junk – worse than even Detroit.

But Lightfoot never signaled a plan for pension reform during her campaign. Her only commitment was that she would protect pensions: ”First, we must start from the firm position that pensions are a promise – and that protecting the retirement security of our public employees is imperative to maintaining a stable middle class and, thereby, our local economy.”

Now she’s found that, in the absence of reforms, the city is running out of options.

Reamortizations – kicking debt payments further into the future – are getting pushback from both rating agencies and public sector unions alike.

Pension obligation bonds, another kind of can kick that Rahm Emanuel pursued, have also run into opposition. Rating agencies, pension funds and actuarial associations are calling POBs what they really are: a gamble with taxpayer dollars.

City tax hikes aren’t a solution either. Chicagoans are tapped out. City residents have been hit by an avalanche of state and local tax increases over the past several years, including the state’s 2017 income tax increase and the biggest property tax hike in the city’s history. Increasing taxes yet again to get the $1 billion needed for pensions could result in severe backlash against the mayor.

Fixing things

Lightfoot’s words to the Sun-Times are all the more disappointing considering the reforms she could have called for: a constitutional amendment to the pension protection clause, changes to how the city doles out retirement benefits going forward, and tough cuts in upcoming contract negotiations with CPS and other labor unions.

Instead, her desperate plan abrogates any responsibility for the city’s largely self-inflicted retirement crisis. And more importantly, it leaves nobody better off. Despite all the tricks, Illinoisans, including Chicagoans, would still be under the same mountain of debt.

Reforms, not can kicks, are the solution to the state’s pension woes. If not, expect more and more Illinoisans to cut their share of retirement debt down to zero by leaving.

via ZeroHedge News https://ift.tt/2XlqyCh Tyler Durden