One week before the Trump-Xi summit, we explained how Trump – in his pursuit of a lower US dollar, lower interest rates and higher stocks, had managed to outplay Powell.

As we said at the time, having considered firing or demoting Powell at the start of the year, Trump realized he can’t do so directly, so instead he decided to pressure Powell to do his bidding in response to Trump’s actions

To be sure, by now Trump has certainly figured out that his strongest leverage over the Fed is by escalating the uncertainty in the trade and political arena, forcing the Fed to tip its cards and unveil its open-ended dovish policy which the market now expects will result in as many as 4 rate cuts in the next 12 months, setting up Trump nicely for the election, with the S&P at or near all time highs, even if the overall economy continues to deteriorate (it is, however, unclear how much longer markets will ignore the growing risk of a recession just because the Fed has promised to cut rates further).

As such, if Trump feels the need to extract more concession from Powell, all he needs to do is to make good in part or in whole on his $300BN in new Chinese tariffs, which will force the Fed to take on an even more dominant role to preserve the economic cycle by doing the only thing it knows how to do: push assets to new all time highs with even more dovish policies.

Which, we concluded is the reason behind the perverse outcome that the White House is now confident that the more it pushes China – in word or in deed – toward a full blown trade war, the more Powell will be forced to concede to Trump in the simmering feud between the executive and the money printing branches of US government.

One week later, none other than Bank of America has picked up on this argument, describing this relationship between Trump’s trade policies and the Fed’s monetary policy as a “perverse feedback loop”, which would leave the stock market “in a range-bound “collar” trade, with its upside and downside capped by the trade war and the Fed, respectively.”

But first, let’s back up.

In a summary of this weekend’s events, an unimpressed Bank of America writes that the G-20 summit in Osaka proceeded largely as expected, and notes that “additional tariffs were delayed indefinitely, but there was no rollback of earlier measures. The two sides agreed to restart negotiations, and China pledged to buy more agricultural products from the US. There was one positive surprise: US companies will be allowed to sell products to Huawei. Although Huawei is still blacklisted from US markets, the move eases the pressure on Huawei and its US suppliers.”

In its take on the market’s reaction, BofA said that traders are likely to view the summit as a modest positive in the short run, even though the bank saw several reasons for concern.

- First, there are still 25% tariffs in place on $250bn of Chinese exports to the US, and (on average) almost 20% tariffs on $110bn of US exports to China. Here, BofA’s Aditya Bhave writes that “tariff termites have been eating away at growth in China and its trading partners in Europe and Asia-Pacific, some of whom have very little room for policy easing. In the US, the manufacturing sector has started to weaken.”

- Second, the US still has a long to-do list on trade. And while BofA expects a deal with China later this summer, it could take a large market correction to get there. The risk of another round of tit-for-tat tariffs remains elevated. BofA also expect tariffs on a growing list of products and countries in the coming quarters. In addition, if the dollar remains strong despite Fed cuts, and an FX intervention by the US to weaken the dollar is not to be ruled out.

Where this goes back to what we said ten days ago, however, is that as Bank of America notes, the components of the current equilibrium point to “a worrying feedback loop between the Fed and trade policy.” And here is Bank of America saying exactly what we said one ahead of the G-20 meeting:

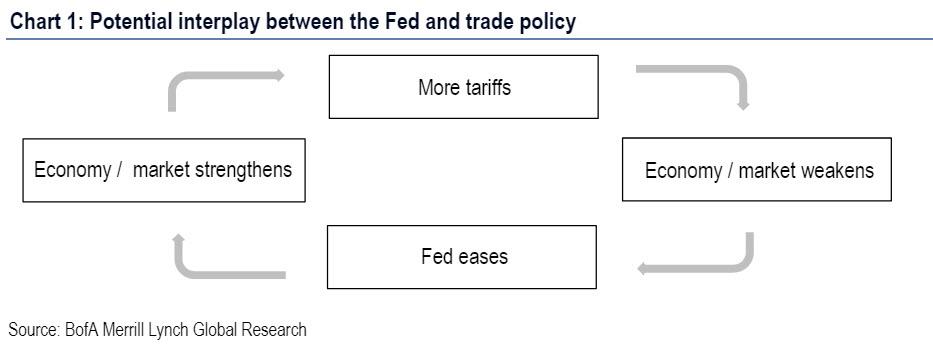

The Fed is determined to raise inflation by sustaining above-trend growth. To this end it seems willing to offset the negative impact of the trade war on the economy. But the risk is that the “Fed put” could encourage an even tougher stance on trade, which would trigger even more Fed accommodation, and so on (Chart 1). The end result would be a loss of Fed policy ammunition, with an economy that is still soft.

This is what the perverse feedback loop looks like:

Bank of America then continues, with an explanation why the biggest risk going forward is this “perverse feedblack loop between the Fed’s attempts to support the economy and President Trump’s incentives to re-escalate various trade conflicts”, to wit:

suppose (1) the Fed is following a “risk management” approach, in which it tries to raise inflation by sustaining above-trend growth, and avoids disappointing the stock and bond markets, and (2) the Trump Administration only stops escalating the trade war if there are notable signs of pain in the economy or markets.

If this “Powell Put” and “Trump Call” are strong enough, Bhave warns that they could create an ever-escalating trade war matched by an ever-lower funds rate. The stock market would be left in a range-bound “collar” trade, with its upside and downside capped by the trade war and the Fed, respectively.

So what breaks this nefarious feedback loop?

- First, it is BofA’s view that the Fed will not be able to fully offset an escalating trade war: as the uncertainty shock worsens, rate cuts will become increasingly less effective in countering the shock. Even lowering borrowing costs by 2% cannot make up for the risk of a 25% tariff.

- Second, the economy and markets are not the only motivators in the trade war-political costs matter as well. If the trade war expands it will hit more consumer products. But unlike “stable inflation” which can’t be extrapolated into inflation expectations, “the public will view explicit tax increases on consumer items very differently from the subtle price pressures that come from raising input and capital costs.”

- Third, and most insidious, the Trump administration might ingeniously take the opportunity to make a deal with China after the Fed has cut rates, in order to try to “supercharge” the economy and markets going into next year’s elections.

As a reminder, #3 is precisely the scenario that David Rosenberg’s stumbled upon one month ago, when he asked “what if he finally gets the steep Fed rate cuts he has been demanding? After that, he ends the trade wars, tariffs go to zero, and the stock market surges to new highs – just in time for the 2020 election!” However, to BofA even this outcome would be costly, as facing an economy that is even more likely to overheat, the Fed might have to quickly reverse course and start hiking, at the risk of damaging its credibility, which in turn is also why three weeks ago, another BofA strategist, Michael Hartnett said that the biggest risk is if the Fed cuts rates now, a process which would culminate with another asset bubble and the loss of what little credibility the Fed has left.

via ZeroHedge News https://ift.tt/2xqEM5r Tyler Durden