Authored by Lance Roberts via RealInvestmentAdvice.com,

For the fifth time, since the end of 2017. the market hit an all-time high. Each previous all-time high has led an almost immediate sell-off.

Will this time be different? This was the question I asked last Tuesday:

“Such is the belief currently which is being driven primarily by the ‘Pavlovian’ response of a more ‘accommodative’ Federal Reserve which is expected to cut rates sharply by the end of this year. It is also the ‘hope’ there will be a resolution to the ongoing ‘trade war’ with China at the G-20 Summit next week.”

However, while the markets rallied on Monday on the news of a “cease-fire,” as I noted in this past weekend’s newsletter, nothing has really changed.

“As we suggested previously, the most likely outcome was a truce…but no deal.

While the markets will likely react positively next week to the news that ‘talks will continue,’ the impact of existing tariffs from both the U.S. and China continue to weigh on domestic firms and consumers.

More importantly, while the continued ‘jawboning’ may keep ‘hope alive’ for investors temporarily, these two countries have been ‘talking’ for over a year with little real progress to show for it outside of superficial agreements.

Importantly, we have noted that Trump would eventually ‘cave’ into the pressure from the impact of the ‘trade war’ he started. This was evident in this weekend’s agreement.

By agreeing to continue talks without imposing more tariffs on China, China gains ample running room to continue to adjust for current tariffs to lessen their impact. More importantly, Trump gave up a major bargaining chip – Huawei.”

So, yes, the market rallied on Monday given “relief” that no NEW tariffs will be imposed. However, such does not counter-act the negative impact from the existing tariffs which continue to weigh on both producers and consumers.

Secondly, the agreement to temporarily put the “trade war” on hold also takes the pressure off of the Federal Reserve to cut rates in July. If the employment report on Friday keeps the unemployment rate at historic lows, and shows growth of around 150,000 jobs, as is currently expected, there is a rising probability the Fed will remain on hold.

This is not what the markets are betting on currently.

As I noted last week, assumptions are always a dangerous thing as markets have a nasty habit of doing exactly the opposite of what the masses expect.

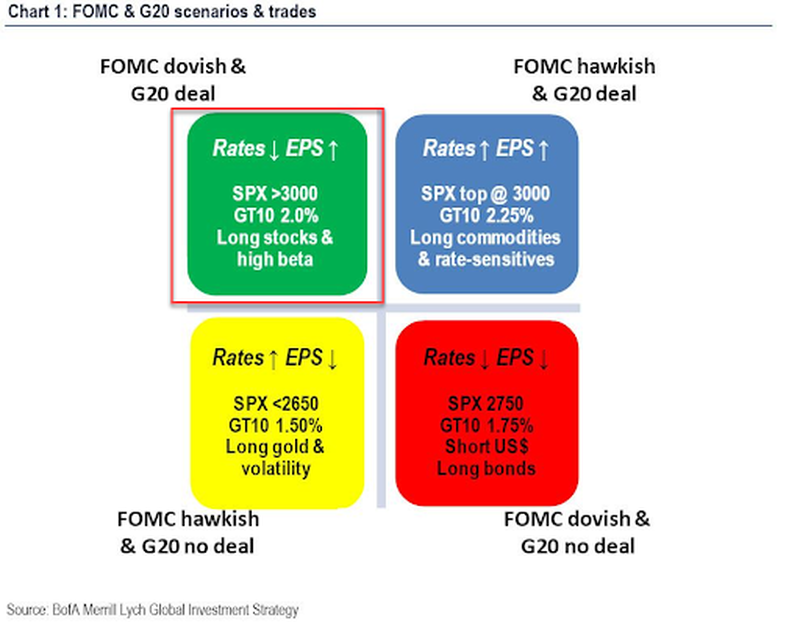

Nonetheless, the market rally on Monday was expected and followed along with BofA’s recent analysis:

“Of these 4, two are most remarkable: the best/best and the worst/worst cases. The first one sees a Dovish Fed statement, coupled with a G-20 deal, which according to BofA will send the S&P > 3000, and the 10Y yield to 2.00%, while the worst possible outcome would be if there is a 1) a hawkish Fed surprise and 2) no Deal at the G-20, which would send the S&P below 2,650, or potentially resulting in a 12% drop in the market, while sending 10Y yields to 1.50%and pushing gold above its 5 year breakout zone as the VIX surges.”

Hartnett was correct in his outlook with the “best” possible of outcomes.

Still A Sellable Rally

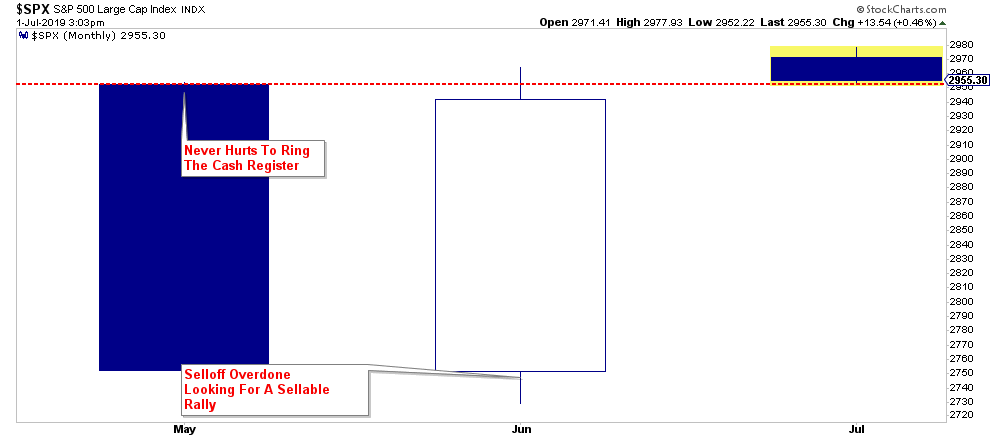

While the current breakout to new highs is indeed bullish, it is important to note the entirety of the “June rally,” which was proclaimed the best in 80-years, barely recouped what was lost in just the month of May.

Importantly, the market, which was deeply oversold at the beginning of June, and formed the basis of our “sellable rally” call, is now back to extremely overbought. Such suggests limited upside from current levels. The chart below shows that previous test of multiple support levels, and the rally back to overhead resistance, which we are once again challenging.

As noted previously, while there is a “rush” to bid up equities due to recent “talk” from the White House and the Fed, the reality is that nothing has really changed.

-

A Trade deal wasn’t reached and China will continue to refuse to give in to demands for economic reform. Additional tariffs are coming by the end of the summer.

-

Existing tariffs, which were just ratcheted up at the beginning of June, have not been fully recognized in the economy as of yet. More “pain” is coming by the end of the summer.

-

While the markets think that Trump has the “upper hand,” it is China for now. They can hold out to economic pressures far longer than Trump as Xi is not facing re-election. China knows this.

-

The Fed has now started to recognize their “independence” has been threatened. Look to Powell to flex his muscles a bit in July and NOT cut rates particularly if the June jobs report is moderately strong.

-

The Fed is still reducing its balance sheet.

The point is there are more than a few outcomes which could disappoint the financial markets and why this remains a “sellable rally” for now.

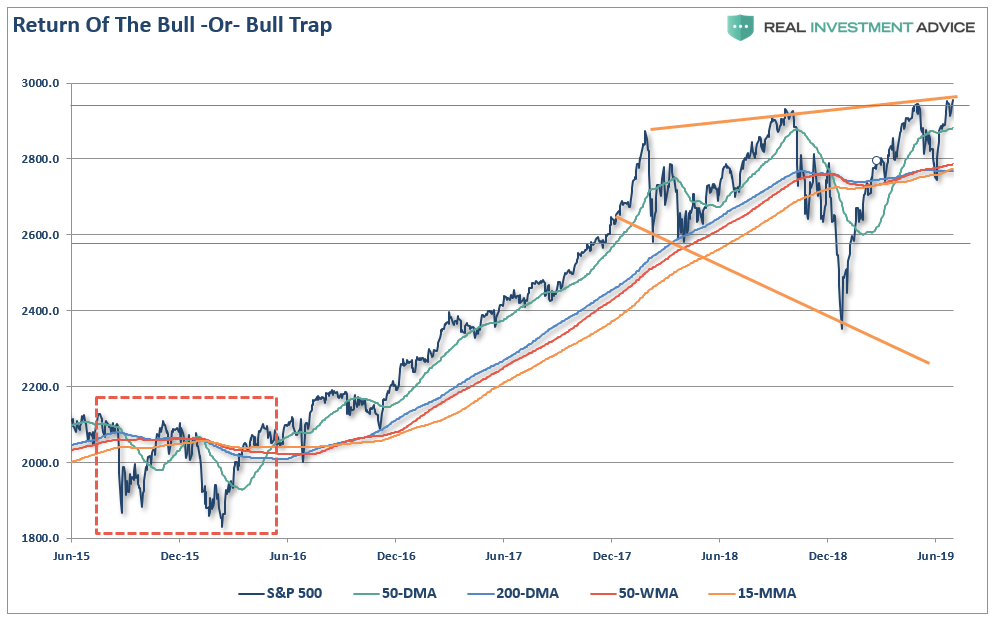

But aside from the technical underpinnings, which remain moderately unfavorable for higher highs currently, there is also a deteriorating fundamental backdrop.

Negative Earnings Guidance

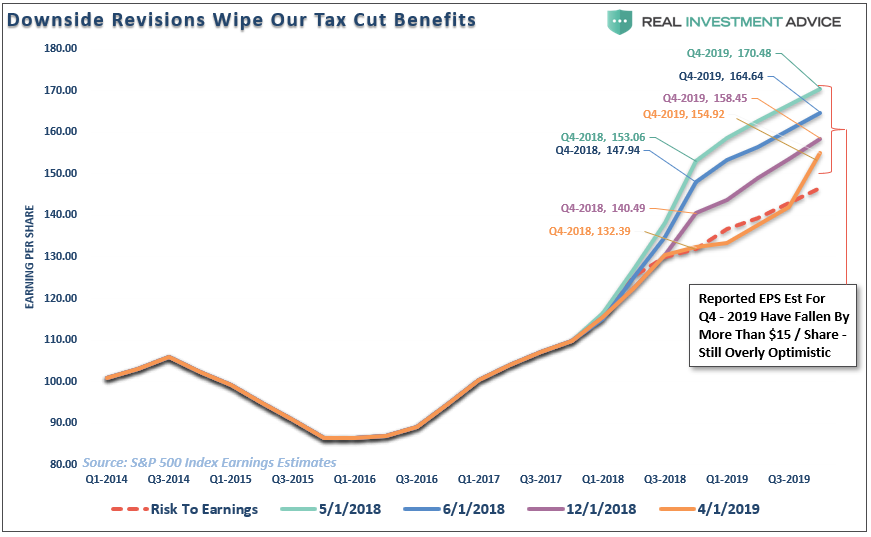

I have been noting for the last several quarters, the consistent and large decline in forward earnings expectations. From our last analysis:

“As of the end of the Q4-2018 reporting period, guess where we are? Exactly 11% lower than where we started which, as stated then, has effectively wiped out all the benefit from the tax cuts.”

“Importantly, the estimates for the end of 2019 are still too high and will need to revised lower over the next couple of quarters as economic growth remains materially weaker. The burgeoning debts and deficits, corporate and household leverage, and slower job growth will ensure slower growth into year end.”

That expected reduction in both 2019 and 2020 estimates is underway. As John Butters of Factsetrecently penned:

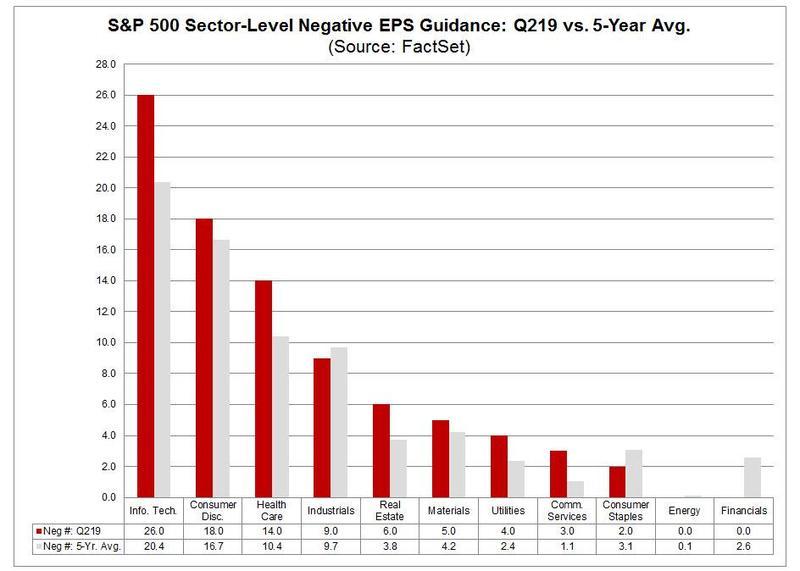

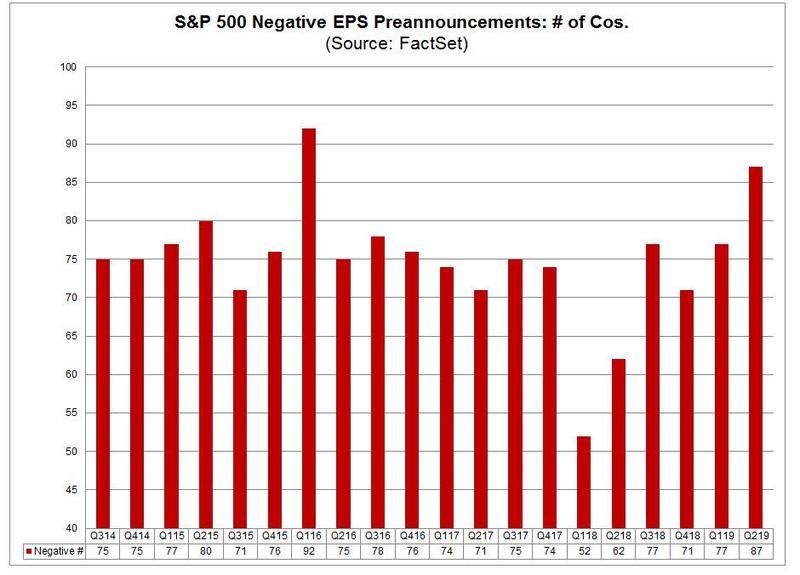

“Heading into the end of the second quarter, 113 S&P 500 companies have issued EPS guidance for the quarter. Of these 113 companies, 87 have issued negative EPS guidance and 26 companies have issued positive EPS guidance.

The number of companies issuing negative EPS for Q2 is above the five-year average of 74. In fact, if 87 is the final number for the second quarter, it will mark the second highest number of S&P 500 companies issuing negative EPS guidance for a quarter since FactSet began tracking this data in 2006 (trailing only Q1 2016 at 92).”

“What is driving the unusually high number of S&P 500 companies issuing negative EPS guidance for the second quarter?

At the sector level, seven of the 11 sectors have seen more companies issue negative EPS guidance for Q2 2019 relative to their five-year averages. However, the Information Technology and Health Care sectors are the largest contributors to the overall increase in the number of S&P 500 companies issuing negative EPS guidance for Q2 relative to the five-year average.”

Why is this happening?

“It’s the economy, stupid.”

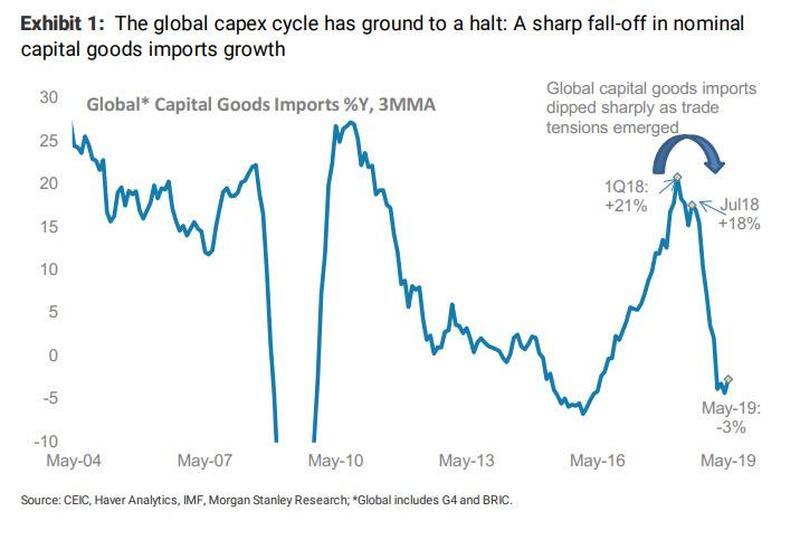

As economic growth slows, companies have to begin to adjust for lower levels of consumption. This initially shows up in things that under the immediate control of corporate decision makers like unspent capital investment. It’s easy to shelve a project, or development, that money was committed to but not yet spent. As Chetan Ahya, Morgan Stanley Chief Economist recently stated (via Zerohedge):

“…It was clear that the global capex cycle had ground to a halt. Capital goods imports, a capex proxy, began their descent in mid-2018, when trade tensions first re-emerged. In July 2018, they were tracking at 18%Y on a three-month moving average basis but plummeted to 2%Y in January 2019 and an estimated -3%Y in May 2019. In aggregate, private fixed capital formation (investments in fixed assets) in the G4 and BRIC economies fell from a peak of 4.7%Y in 1Q18 to just 2.8%Y in 1Q19.”

The next decline occurs in how companies “frame” their outlook. Are they more optimistic, or less?

“Corporate sentiment has also declined to multi-year lows. Global PMIs for May fell in broad-based fashion, with only about one-third of the countries we track reporting a PMI above the 50 expansion threshold. In the US, our Morgan Stanley Business Conditions Index recorded its largest one-month decline ever, plunging to a level not seen since June 2008. Other business sentiment gauges, such as the regional Fed and German Ifo and ZEW surveys for the month of June, paint a fairly bleak picture too. What’s more, consumer sentiment is also starting to sour, with the Conference Board’s Consumer Confidence Index for June falling to the lowest point since September 2017.

But with stock prices at all-time highs, why worry about these risks?

A key reason why we worry about downside risks is that the adverse impact of trade tensions is non-linear. As earnings growth slows and uncertainty and costs rise, the levered corporate sector will face tightening financial conditions. Given higher corporate leverage, this will probably be most pronounced in the US, particularly for companies with weaker balance sheets. Defaults could accelerate, bringing corporate credit risks to the fore, thus amplifying the initial trade shock with even tighter financial conditions, which could impair lending, weaken confidence further and exacerbate the slowdown in growth. Rekindling animal spirits will not be easy.”

The Last Sign

These are not trivial issues for investors. While the market will be focused on the employment number on Friday, this is probably one of the “worst” indicators to look at due to its “lag” to the rest of the important fundamental and economic factors.

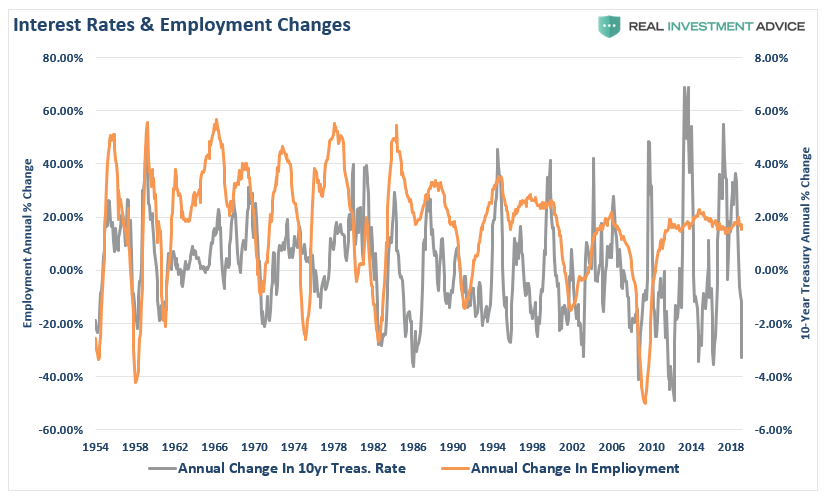

Why? Because companies are “last to hire, last to fire.”

Employees are expensive to hire, train, and maintain. Good talent is extremely hard to replace. So, companies are slow to hire, due to the cost, and slow to fire because they don’t want to give up good talent to potential competitors. When unemployment, along with jobless claims, do begin to tick up, that is generally the last sign before a recession sets in.

However, since interest rates are a reflection of underlying economic strength, it is not surprising there is a decent relationship between sharp declines in interest rates and employment. The chart below is the annual rate of change in both rates and employment.

Don’t be surprised to see weaker employment numbers in the months ahead. As Bloomberg also noted:

“Falling bond yields have been the big surprise of 2019 so far and there’s an excellent chance they will grind lower in the second half — and take stocks with them — as weak growth spurs global monetary easing.

Given how tough it has been to forecast bond yields, getting that call right for the rest of the year is key.

A reminder of how difficult that can be comes from San Francisco Fed President Mary Daly. Twice last week she said it’s very hard to say what the central bank should do, including comments that she’s unsure ‘whether interest rates will be lower a year from now.’

Surveying the outlooks our team came up with at the start of 2019, it’s clear our biggest misses were all in bonds.

The same goes for those readers who took part in our surveys. Treasury yields finished June more than 100 bps below the consensus for end-2019, while bunds were ~75 bps lower and Italian yields a whopping 105. Bond analysts were also far too bearish.”

Well, it hasn’t actually been all that difficult to forecast the direction of bonds considering we have been calling for consistently lower rates over the last three years.

The problem with equities at all-time highs, with yields and economic growth declining sharply, is that it has consistently led to terrible outcomes for equities, and not the other way around.

Bloomberg came to the correct conclusion:

“What looks more likely is that equities ultimately succumb to the macro logic that has fueled this year’s bond rally.”

via ZeroHedge News https://ift.tt/2Jj9wuV Tyler Durden