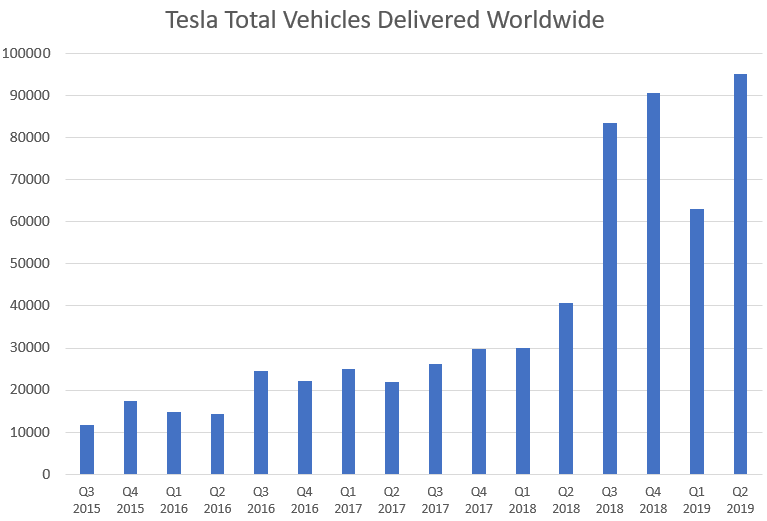

Despite Tesla posting record production and delivery numbers for Q2…

… sell side analysts remain skeptical on the company, heading into its Q2 financials. Both Goldman Sachs and JPM weighed in on Tesla this morning, with Goldman keeping its “sell” rating and $158 target and JPM also maintaining its price target of $200 and keeping its “underperform” rating on the name.

Goldman noted that despite numbers coming in over its estimates, the sustainability of demand remains a key focus. As a result, Goldman still expects a substantial “step down” in demand and deliveries into Q3. Goldman also noted a shift in product mix toward the Model 3, which it thinks could have a negative impact on margin. From the Goldman note:

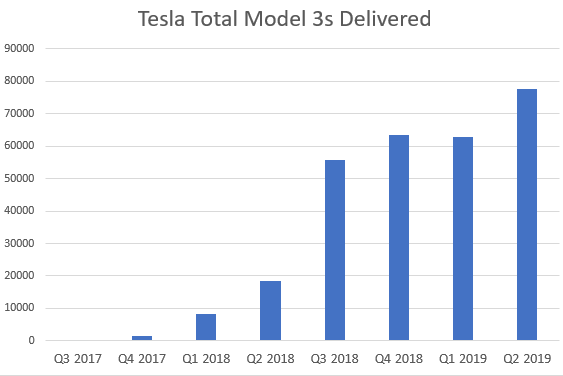

1. Aggregate deliveries for Tesla vehicles in 2Q19 came in 5% above our estimate and over 10% above consensus (both company-compiled and StreetAccount) as Model 3 deliveries surprised to the upside.

2. Further, the company noted positive progress on its logistics and delivery operations (driving some cost efficiencies and working capital improvements) as well as orders that exceeded deliveries for the quarter.

3. This is all positive newsflow in the near-term for TSLA and likely pushes shares higher in trading.

4. However, we continue to focus on the sustainability of demand for the company’s products — particularly as we believe 2Q19 deliveries and order flow was helped by the company’s release of its Standard Model 3 variant, a leasing option, and right-hand drive Model 3s, further, demand in the US was likely aided in 2Q19 by the looming second step in the phase out of US Federal Tax Incentives for TSLA vehicles that began on July 1.

5. As a result, we continue to expect some sequential stepdown in demand and ultimately deliveries as we progress into 3Q19. That said, the near-term focus will be on the full quarterly results that likely come toward the end of the month as the move to offering a lower priced Standard Model 3 variant as well as leasing option could have negative impacts on Model 3 program gross margins and FCF generation.

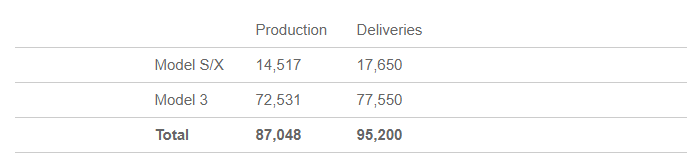

In addition, while the company beat our estimates on absolute units, the mix was more heavily skewed toward the Model 3 (as Model S/X deliveries missed GSe by 17%); this negative mix likely weighs on our Automotive gross margin estimate of 20.6% for 2Q19

JP Morgan was simpler in its approach to summing up its thoughts. It noted that even though it is raising its Q2 2019 estimates (and slightly raising its FY 2019 estimates), that the magnitude of the company’s Q2 loss and its free cash flow number will still be in intense focus. They are also concerned about the stepdown in demand occurring from the diminishing Federal Tax Credit. JPM noted:

We are raising our 2Q19 estimates (and full year 2019 slightly on flow-through) to reflect better than expected 2Q deliveries, but only maintain our 2020 estimates and December 2019 price target of $200 (and underperform).

The magnitude of 2Q loss and amount of FCF generated in the quarter will now be key to watch, particularly as we estimate the firm may have undertaken premium costs to meet delivery targets. The debate will also likely turn to sustainability of demand given that 2Q was, like 4Q18, a pre-buy quarter in the US ahead of another step-down in availability of federal tax credits on July 1.

Recall, we reported yesterday that Tesla posted Q2 numbers of 87,048 vehicles produced and deliveries of approximately 95,200 vehicles. In its release, the company also said it “made significant progress streamlining [its] global logistics and delivery operations at higher volumes, enabling cost efficiencies and improvements to [its] working capital position.”

In addition, the company also offered positive guidance for its Q3, claiming that its backlog had increased:

Orders generated during the quarter exceeded our deliveries, thus we are entering Q3 with an increase in our order backlog. We believe we are well positioned to continue growing total production and deliveries in Q3.

Investors, like the sell side, remain anxious to see how these record numbers are reflected in the company’s Q2 financials.

via ZeroHedge News https://ift.tt/325zoCZ Tyler Durden