Amid non-existent volumes as many US traders are taking an extended holiday weekend, this week’s rally fizzled with global markets and US equity futures drifting into the red ahead of today’s U.S. jobs data which could either boost or temper market expectations about aggressive policy easing by the Federal Reserve.

European bourses suffered with the pan-region STOXX 600 slipping 0.3%, dragged lower by the basic resource and industrial goods & services sectors which both fell more than 1.5%. A sharp drop in China iron ore futures hit miners. Tech shares retreated 0.9% after Samsung’s dour forecast showed the impact of U.S.-China trade war on global chip and smartphone markets, sending Infineon, STMicroelectronics and Siltronic as much as 1.5% lower.

Losses accelerated after the latest German data showed Europe’s largest economy was still stuck in pre-recessionary limbo with industrial orders falling far more than expected in May, and a warning from the economy ministry this sector of Europe’s largest economy was likely to remain weak in the coming months.

“Devastating new orders data just undermined any hopes for an industrial rebound. We are starting to lose our optimism,” said Carsten Brzeski, chief economist at ING Germany. “Combined with the weakest June performance of the labour market since 2002 and disappointing retail sales, today’s new orders wrap up a week to forget for the German economy. The fear factor is back.”

Europe’s losses followed gains in Asia, where MSCI’s index of Asia-Pacific shares ex-Japan was set for its fifth straight weekly rise. S&P futures and Shanghai Composite index both hovered near 3,000-mark in muted post-holiday trade. Asian stocks traded sideways, heading for the fifth week of gains, their longest winning streak since January 2018, as traders assessed India’s federal budget and awaited U.S. payroll data. Consumer staples companies rallied, countering declines in material firms. Markets in the region were mixed, with Australia climbing and India dropping. The Topix gauge closed 0.2% higher, capping its best week since January, as electronics makers offered the biggest boost. The Shanghai Composite Index gained 0.2%, driven by Kweichow Moutai and China Life Insurance. Chinese equities should post gains this quarter despite uncertainty over trade disputes, according to a Bloomberg survey of analysts and fund managers.

The S&P BSE Sensex Index fell 1% as a lack of stimulus from the government in its annual spending plan unveiled Friday and additional tax on high income spooked investors. Meanwhile, jewelers tumbled after the government announced a proposal to raise import tax on gold to 12.5% from 10%. Shares of Indian shadow lenders rose after Finance Minister Nirmala Sitharaman proposed to provide a partial guarantee to state-run banks with exposure to pooled assets of financially-sound non-bank lenders.

A rebound in emerging-market stocks and currencies paused as ahead of the June payrolls report. The MSCI Emerging Markets Index fell on Friday, still heading for its sixth week of gains, the longest winning streak in five months. The currency gauge was little changed for the week, with currencies in Latin America largely outperforming those in eastern Europe and Asia. The risk premium on sovereign dollar bonds narrowed.

“Following the strong performance more recently, markets are looking for what next,” said Trieu Pham, a London-based strategist at ING Bank NV. “U.S. job market data will certainly be closely watched in view of the July 31 Fed meeting. Lastly, a bit of caution as well as the trade truce is holding but the matter is far from resolved.”

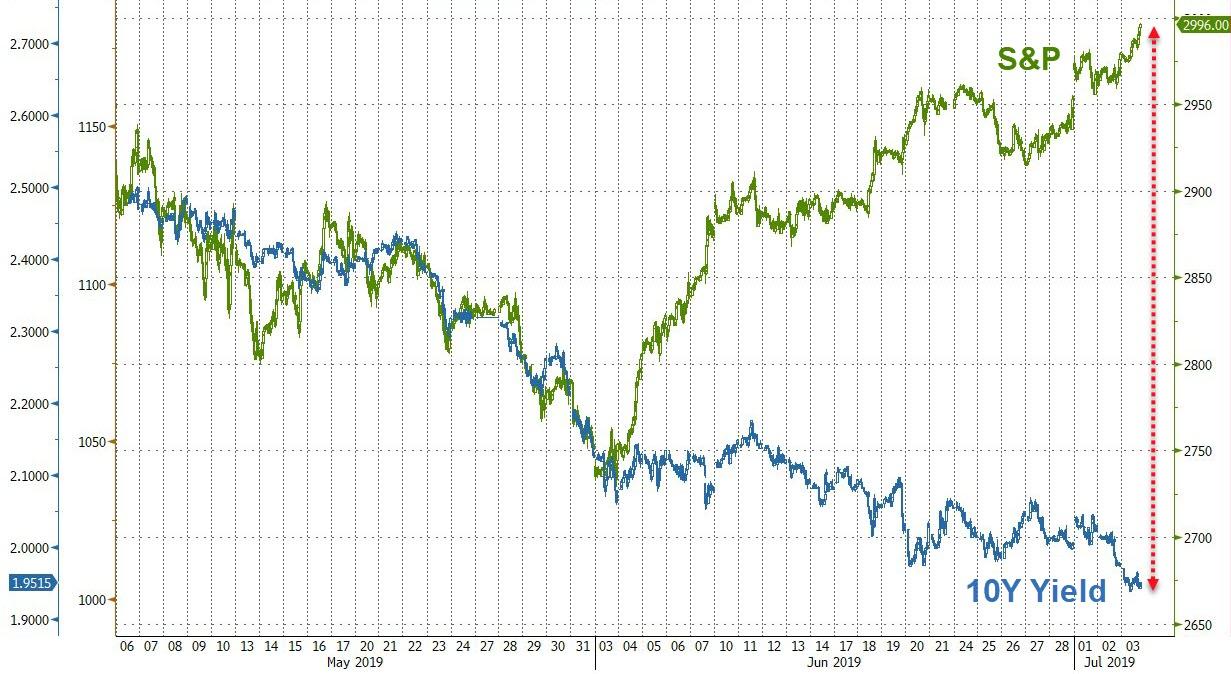

In rates, Treasury futures dipped, lifting the 10-year yield fractionally to 1.958% after hitting the lowest since November 2016 at 1.941%; Aussie curve little changed. JGB futures edge higher, supported by buying in ultra long-end, despite strongest Japanese spending pace in four years. Germany’s 10-year government bund yield, fell to minus 0.4% and breached the European Central Bank’s deposit rate for the first time – a level analysts say acts as a psychological barrier even though shorter-dated German bond yields trade well below it.

World stocks and bonds have rallied at a feverish pace since the start of June on hopes global central banks will keep policy easy to support growth. A ceasefire in the protracted Sino-U.S. trade war has also bolstered sentiment.

All eyes were now on U.S. non-farm payrolls – which we previewed earlier – due later in the day, and which are expected to have jumped by 160,000 in June compared with 75,000 in May.

“This will be the last employment report before the FOMC meeting at the end of this month for which markets are pricing in 33 basis points of cuts as of this morning,” Deutsche Bank’s Craig Nicol wrote in a note to clients. Fed futures are fully pricing in a 25-basis-point cut when the Fed meets on July 30-31. Investors also see a 25% chance of a 50-basis-point reduction.

“What today’s report says about the trends in hiring and income growth could meaningfully impact market expectations so expect there to be just as much focus on hours and wages as the headline payrolls reading.”

In FX, the easing bund yields dragged the euro lower to $1.1273 with the common currency on track for the biggest weekly drop in three weeks. The Bloomberg dollar index beat its Group-of-10 peers amid thin flows ahead of Friday’s U.S. labor data, which could signal whether the Fed will cut interest rates this month; it was on track for a ~1% gain this week. Against the Japanese yen the dollar gained 0.2% to 108.04.

Worries about the health of the global economy also weighed on commodity markets. Oil prices eased with Brent crude futures , the international benchmark for oil prices, off 30 cents at $63.00 per barrel while U.S. crude slipped 85 cents to $56.49. Crude markets shrugging off tensions around Iran and a decision by OPEC and its allies to extend a supply cut deal until next year was an ominous sign to market watchers.

“When bullish signals fail to lift the oil market’s spirits, we should be very concerned this downtrend could run much further than expected,” said Stephen Innes, managing partner at Vanguard Markets.

Bitcoin rebounded from a loss on Thursday, while China iron ore futures racked up sharp losses after hitting a record on Wednesday. China’s most-active September iron ore contract on the Dalian Commodity Exchange fell as much as 4.9% to 838 yuan ($121.89) a tonne.

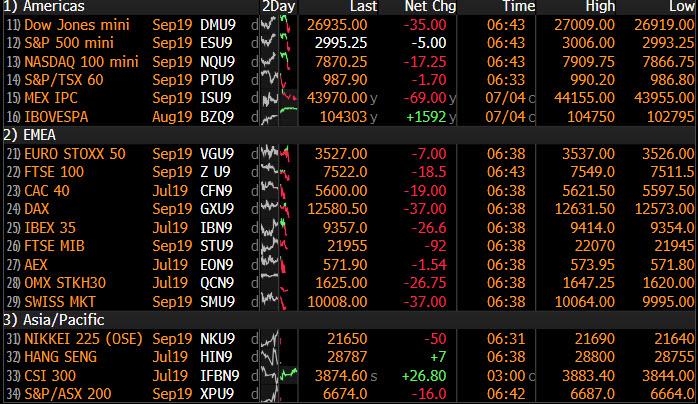

Market Snapshot

- S&P 500 futures down 0.09% to 2,997.50

- STOXX Europe 600 down 0.3% to 391.97

- MXAP down 0.04% to 162.18

- MXAPJ down 0.08% to 532.39

- Nikkei up 0.2% to 21,746.38

- Topix up 0.2% to 1,592.58

- Hang Seng Index down 0.07% to 28,774.83

- Shanghai Composite up 0.2% to 3,011.06

- Sensex down 0.6% to 39,666.60

- Australia S&P/ASX 200 up 0.5% to 6,751.28

- Kospi up 0.09% to 2,110.59

- German 10Y yield rose 0.3 bps to -0.396%

- Euro down 0.2% to $1.1265

- Brent Futures up 0.1% to $63.38/bbl

- Italian 10Y yield rose 9.0 bps to 1.322%

- Spanish 10Y yield rose 0.5 bps to 0.253%

- Brent Futures up 0.1% to $63.38/bbl

- Gold spot down 0.1% to $1,414.14

- U.S. Dollar Index up 0.1% to 96.91

Top Overnight News from Bloomberg

- China continues to stress that the U.S. must remove all the tariffs placed on Chinese goods as a condition for reaching a trade deal. On Friday, an influential blog connected to state media said the talks will “go backward again” without that step, echoing the line from Ministry of Commerce’s weekly briefing on Thursday

- German factory orders slumped in May as trade uncertainty continued to weigh on global manufacturers and drive a slowdown in Europe’s largest economy. The continued gloom is pushing a growing number of economists to predict the ECB will add more monetary stimulus as soon as this month

- Deutsche Bank AG’s job cuts across the U.S. will probably go far beyond equities and interest-rate derivatives trading, which have been marked as major targets, according to people with knowledge of the matter

- Investors are so keen to find a safe home for their cash that they’re paying the German government to take it, and that makes the nation’s reluctance to borrow increasingly puzzling. Yields are now below zero for 85% of German sovereign debt, right out to bonds that don’t mature for another 20 years

- Boris Johnson, the front-runner to replace Theresa May as British prime minister, said delivering Brexit would be key to keeping the U.K. together, just hours after May warned her successor not to put the union at risk with a no-deal Brexit

Asian equity markets were mixed following the non-existent lead from Wall Street where markets were shut due to Independence Day and with the region tentative heading into the key US Non-Farm Payrolls data. ASX 200 (+0.5%) was positive with the index led higher by strength in financials and real estate after APRA effectively relaxed guidance on mortgage lending in which banks will be able to review and set their own minimum rate floor in assessing serviceability, although gains were capped for most the session by weakness in the commodity-related sectors. Elsewhere, Nikkei 225 (+0.2%) was choppy as it failed to find inspiration from the highest growth in Household Spending since 2015, due to a humdrum tone in the currency and the KOSPI (+0.1%) traded cautious amid losses in index heavyweight Samsung Electronics which beat expectations in its preliminary earnings for Q2 but still showed oper. profit slipped by 56% Y/Y. Elsewhere, Hang Seng (U/C) and Shanghai Comp. (+0.2%) were initially subdued after further PBoC inaction resulted to a net weekly liquidity drain of CNY 340bln, while there were also recent mixed comments from China’s MOFCOM which confirmed US-China trade teams are in communication but also suggested that tariffs must be removed for a trade deal to occur. Finally, 10yr JGBs were marginally higher and briefly reclaimed the 154.00 level with mild support seen amid the lacklustre risk tone in Japan and BoJ’s presence in the market for JPY 555bln of JGBs.

Top Asian News

- India to Narrow Budget Gap Target, Sell First Global Bond

- India Sees Economy Rebounding This Year as Growth Risks Balanced

- India to Inject Another $10.2 Billion Into State-Run Banks

- Call Center Nation to Lose Shine on Duterte’s Manila Ecozone Ban

European indices are little changed/modestly into negative territory this morning [Euro Stoxx 50 -0.2%] as bourses lack any firm direction due to the US market holiday and the relatively quiet newsflow ahead of the US Jobs Report later on in the session. Sectors are largely negative, with some underperformance seen in tech names as Samsung Electronics reported earnings last night where Q2 operating profit fell by 56% Y/Y. Separately, mining names are suffering on the pullback in iron ore prices and amidst reports that Chinese regulators are to examine the drivers behind the metal’s recent price surge; as such, Rio Tinto (-2.4%) and Anglo American (-2.6%) are towards the bottom of the Stoxx 600. Elsewhere, at the bottom of the Stoxx 600 are Hexagon (-14.0%) after the Co. stated that they have been impacted due to a China slowdown in July, stemming from the ongoing US-China trade dispute. Finally, Osram Licht (+1.8%) are firmer this morning after confirming that they support the Bain & Carlyle takeover for EUR 35.00 per share.

Top European News

- Brevan Howard Main Hedge Fund Posts Best First Half in a Decade

- German Factory Orders Slump as Europe Economic Slowdown Worsens

- South African Stocks Fall as Iron Ore Producers, Aspen Slump

- Euro Hopeful Croatia Sets Sights on Adoption as Early as 2023

- Saudi Arabia, Kuwait Make Breakthrough in Neutral Zone Oil Talks

In FX, the Dollar is edging higher ahead of US jobs data, albeit not independently or directly as G10 and EM rivals weaken further or retreat in advance of the big release. The DXY has inched back up towards 97.000 and into a marginally firmer range, but may be capped by resistance seen between the big figure and 97.010 awaiting the latest BLS report and return of US markets after yesterday’s market holiday.

- CHF/NZD – The major underperformers, though not by much, as the Franc and Kiwi hover around 0.9875 and 0.6670 respectively vs the Greenback and both still within recent trading parameters awaiting further direction from the aforementioned NFP metrics.

- JPY/EUR/SEK – The Yen has slipped back to around 108.00 from safe-haven highs circa 107.50 earlier this week, but may derive some support from decent option expiry interest at the 108.00 strike (1 bn), or heavy supply said to be stacked from 108.50 if the US labour data is strong. Meanwhile, the single currency is testing key downside technical levels in wake of yet more poor German data, like converged DMAs and a Fib in the 1.1259-62 region, but outpacing the Swedish Krona amidst a sharp slide in Hexagon shares (due to the IT firm flagging weakness in China). Indeed, Eur/Sek has rebounded firmly from sub-10.5000 levels towards 10.5500.

- AUD/CAD/GBP – The Aussie is holding up better than its G10 peers and forming base above 0.7000/1.0500 vs the Usd and Nzd as post-RBA short covering continues, while the Loonie has lost some ground after a trade data-related boost as the focus switches to Canadian jobs data alongside NFP. However, Usd/Cad remains closer to weekly lows between 1.3045-70, and Cable is also nearer the bottom end of a 1.2550-87 range after this week’s bleak UK PMIs and further survey evidence of Brexit uncertainty weighing on the economy (BDO retail activity weak and IoD business morale worse).

In commodities, WTI and Brent futures have lost some ground in early trade, but have recently picked back up with the former just below the USD 57.00/bbl mark whilst the latter is around the USD 63.50/bbl mark. While newsflow remains light, it’s worth keeping in mind that WTI prices did not settle yesterday amid the US Independence Day holiday, thus a divergence in prices is observed. Elsewhere, gold is tentative, as usually the case in the run-up to NFP data with the yellow metal still above the USD 1300/oz level, having traded in a wide weekly 1382-1437 range. Meanwhile, copper prices are heading for the first weekly drop in a month as the red metal is pressured by a sluggish demand outlook and an increase in supplies. Finally, Dalian iron ore futures fell over 7% after China Iron & Steel Association urged the government to maintain order amid rising iron ore prices and wants prices to return to a reasonable level, while it was also reported that China regulators are to examine the drivers for the increase in iron ore prices. China Iron & Steel Association urged the government to maintain order amid rising iron ore prices and wants prices to return to a reasonable level, while it was also reported that China regulators are to examine the drivers for the increase in iron ore prices.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 160,000, prior 75,000

- 8:30am: Change in Private Payrolls, est. 150,000, prior 90,000

- 8:30am: Change in Manufact. Payrolls, est. 3,000, prior 3,000

- 8:30am: Unemployment Rate, est. 3.6%, prior 3.6%

- 8:30am: Average Hourly Earnings MoM, est. 0.3%, prior 0.2%; YoY, est. 3.2%, prior 3.1%

- 8:30am: Average Weekly Hours All Employees, est. 34.4, prior 34.4

- 8:30am: Underemployment Rate, prior 7.1%

DB’s Jim Reid concludes the overnight wrap

It may have lost some steam but no prizes for guessing what happened to core bond yields yesterday. On an unsurprisingly light day for news it was yet another move lower for yields outside of the periphery which was the only real talking point here in Europe however before we get to that let’s look forward as we’ve got a much anticipated US employment report due out this afternoon.

Indeed, this will be the last employment report before the FOMC meeting at the end of this month for which markets are pricing in 33bps of cuts as of this morning. As our economists noted in their preview, what today’s report says about the trends in hiring and income growth could meaningfully impact market expectations so expect there to be just as much focus on hours and wages as the headline payrolls reading.

In terms of expectations both our economists and the consensus peg payrolls at 160k. As a reminder, the May print was a much softer than expected 75k which dragged down the three-month trailing average to 151k. Our colleagues note that from the Fed’s perspective, the year-over-year trend in private employment is more important as this needs to outpace the trend in labor force growth in order to keep downward pressure on the unemployment rate. As Cleveland Fed President Mester reminded us recently, monthly payroll gains in the 75k – 120k range would still be consistent with the underlying trend in overall output growth. As for the rest of the report, the consensus expects the unemployment rate to hold steady at 3.6%, earnings to rise +0.3% mom and hours to hold at 34.4. Our economists also expect earnings to rise +0.3% which should result in a one-tenth increase in the year-over-year rate to +3.2%, however they do expect hours to tick up to 34.5. All that to look forward to at 1.30pm BST.

Back to markets where, as mentioned at the top, it was the move lower for bond yields which got the most attention on an otherwise quiet day. The headline grabber was 10y Bunds falling below the ECB deposit rate for the first time ever. They eventually closed at -0.402% which was -1.3bps on the day and the sixth successive day that yields have dropped. In fact, out of the 45 trading days back to May 3rd, 10y Bund yields have fallen on 32 of those days. The most that we can find over 45 days based on data back to 1991 is 34 days that yields have dropped so this is up there with the most days ever over a 45-day run. Similar maturity yields in France (-2.9bps) and Netherlands (-1.8bps) also nudged lower while Gilts fell -1.5bps. The exception was the periphery where BTPs rose +9.0bps. There wasn’t any specific news and instead it just appeared to be a bit of profit taking following a six-day rally which had seen yields fall -57.6bps. Also tentatively bucking the trend was the EUR 5y5y inflation swap which rose 1.9bps to 1.160%. Meanwhile, equity markets were open however there really wasn’t much to report with the STOXX 600 rising +0.09% in an intraday range of just 0.25%.

Anyway, yesterday’s bond moves mean the Bund curve is now negative at all maturities out to 2040. In fact, we count 49 outstanding Bunds with a maturity of at least 12 months and all but 4 now have a negative yield. That’s around 90% by market value which is fairly staggering. Across Europe we’ve now got negative 2y and 5y yields in 17 different countries. At the 10y maturity we’ve got negative yields in 9 different countries including Switzerland, Germany, Denmark, Netherlands, Austria, Finland, France, Belgium and Sweden. To be fair Slovakia, Ireland, Slovenia and Latvia are within a sneeze of dropping into negative territory too. For 30y bonds it’s still only Switzerland which has a negative yield with Germany (0.194%) and Netherlands (0.204%) the closest after that. If you were also wondering what the longest dated government bond was yielding in Europe, well the Austrian 2117 bond – with 98 years to maturity – is now down to 1.061%. The duration on that is fairly eye watering at 52.7 and at a cash price now of 163.2, the bond is up nearly 47pts this year alone. Anyway, when it was all said and done the global stack of negative yielding debt held at the record high of $13.4tn yesterday.

Of course, JGBs are a big part of the global negative yielding debt stack too with yields negative at all maturities out to 2033. This morning 10y JGBs are little changed at -0.165% and the Treasury market has reopened with 10y yields down a modest -0.7bps to 1.943%. There’s not much movement in equity markets this morning either with the Nikkei flat and Hang Seng (+0.08%), Kospi (-0.04%) and Shanghai Comp (-0.18%) all failing to move with much conviction. That said futures on the S&P 500 have crept over the 3,000 level this morning which suggests we could be in for a record start on Wall Street. Elsewhere, news that British military forces had seized a supertanker near Gibraltar carrying Iranian oil to Syria in violation of sanctions against the country hasn’t caused much of a reaction in the oil market with WTI actually down -1.01% as we go to print.

In other news, the South China Morning Post reported last night that US trade negotiators will be in China next week to restart trade discussions. The report also suggested that China has still not confirmed to the US that it would immediately restart soybean purchases with China wanting clarity on how President Trump would ease sanctions on Huawei. It goes on to say that US officials are still debating between extending a 90-day reprieve on the export ban beyond August 13 or establishing a special approval process for Huawei and that the White House may elaborate in “next couple of days” on conditions for lifting export restrictions.

In other news, while it was a very quiet session yesterday we did hear from one of the ECB Governing Council members. Indeed Rehn told Boersen-Zeitung that “growth in the euro area has slowed significantly recently” and that “we cannot deny that there are doubts among market participants and the public about the ability of the central bank to achieve the price stability target”. He added “we have a number of instruments which are very effective and which, as a package, have even greater effects than isolated”. Perhaps most significant was his reference “if we really want to live up to our mandate, further monetary stimulus is now needed until there is improvement in economic and inflation prospects”. All-in-all the tone leant dovish and followed a similar rhetoric from Lane earlier this week.

As for data, it was very quiet with weak May retail sales numbers for the Euro Area (-0.3% mom vs. +0.3% expected) and a further decline in new car registrations in the UK in June (-4.9% yoy) the only readings of any substance.

Finally, the day ahead will be dominated by the aforementioned June employment report in the US this afternoon. Prior to that the only data due out this morning in Europe is the May factory orders reading in Germany and May trade balance reading in France. Away from that the ECB’s Guindos is due to make comments at a conference in Madrid.

via ZeroHedge News https://ift.tt/2FQTqrm Tyler Durden