So much for 50bps of rate cuts in July.

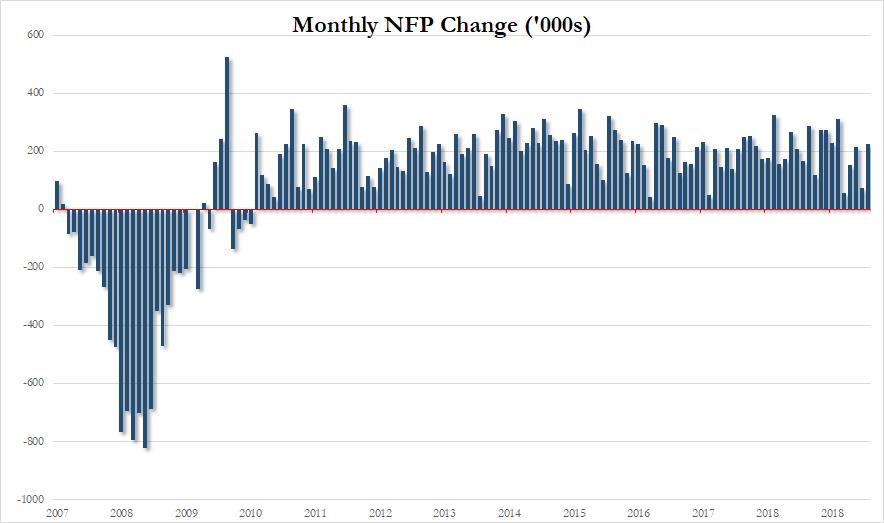

With whisper numbers for the June payrolls well below the 160K consensus (perhaps as the market hoped the case for 2 rate cuts in July would be cemented), moments ago the BLS reported that last month 224K jobs were created, three times greater than the revised 72K jobs in May, and well above the 160K expected and above the highest Wall Street forecast.

This was also the best monthly increase since January, and a number that has made 2 rate cuts at the Fed’s July meeting virtually impossible, and even setting the scene for a Fed that may in fact be “patient” in three weeks, crushing market hopes for an imminent easing cycle.

The change in total nonfarm payroll employment for April was revised down from +224,000 to +216,000, and the change for May was revised down from +75,000 to +72,000. With these revisions, employment gains in April and May combined were 11,000 less than previously reported.

Sure enough, the market implied odds of a July rate cut slumped quickly even as the wage growth number disappointed, as the BLS reported only 0.2% increase in average hourly wages in June, below the 0.3% expected, a number which also missed on a Y/Y bases, increasing 3.1% Y/Y in June, below the 3.2% expected.

There was no rebound in the recent modest drop in the average workweek for all employees, which was unchanged at 34.4 hours in June, same as last month, although in manufacturing, the average workweek edged up 0.1 hour to 40.7 hours, while overtime was unchanged at 3.4 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls held at 33.6 hours.

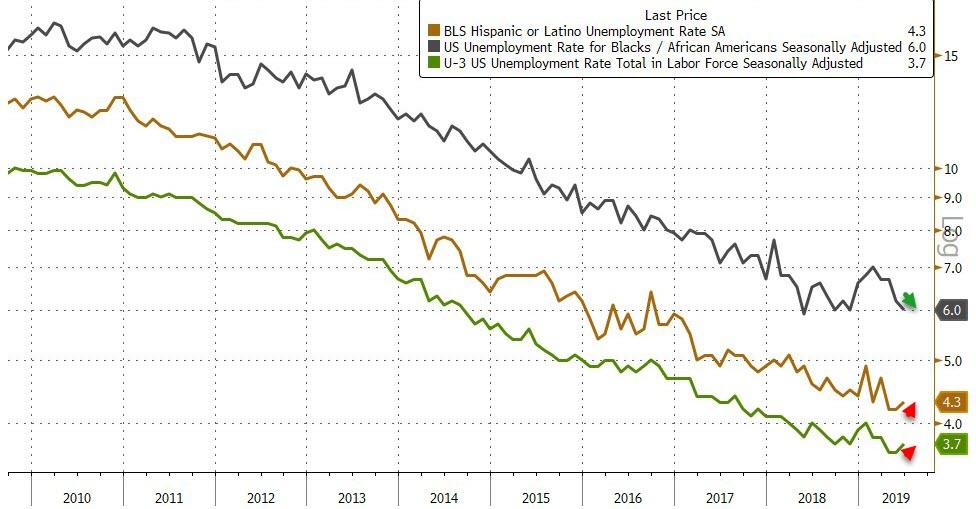

The unemployment rate, which has become a secondary indicator, rose fractionally to 3.7%, from 3.6% in May, and missing the 3.6% expectation, even as the unemployment rate for black dipped back to 6.0%, matching the all time record low offset by a modest increase in the unemployment rate for hispanics..

via ZeroHedge News https://ift.tt/2Yz3AUZ Tyler Durden