Authored by Mike Shedlock via MishTalk,

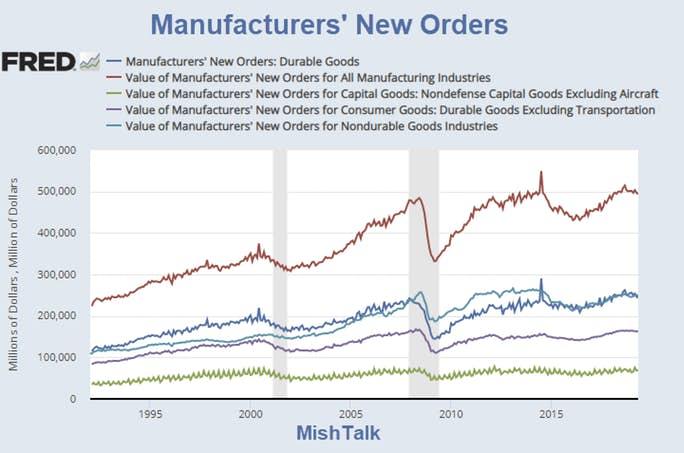

Factory new orders are down year-over-year and barely afloat excluding transportation. Inventories are a concern.

The monthly report on Manufacturers’ Shipments, Inventories and Orders, shows strong signs of a manufacturing sector that has peaked.

New Orders

New orders for manufactured durable goods in May, down three of the last four months, decreased $3.1 billion or 1.3 percent to $243.5 billion, unchanged from the previously published decrease. This followed a 2.8 percent April decrease. Transportation equipment, also down three of the last four months, drove the decrease, $3.8 billion or 4.6 percent to $80.0 billion. New orders for manufactured nondurable goods decreased $0.5 billion or 0.2 percent to $250.1 billion.

Shipments

Shipments of manufactured durable goods in May, up following two consecutive monthly decreases, increased $0.9 billion or 0.3 percent to $254.2 billion, down from the previously published 0.4 percent increase. This followed a 1.6 percent April decrease. Machinery, up four of the last five months, led the increase, $0.3 billion or 1.0 percent to $33.4 billion. Shipments of manufactured nondurable goods, down following three consecutive monthly increases, decreased $0.5 billion or 0.2 percent to $250.1 billion. This followed a 0.4 percent April increase. Petroleum and coal products, also down following three consecutive monthly increases, drove the decrease, $1.3 billion or 2.4 percent to $54.7 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in May, down three of the last four months, decreased $6.3 billion or 0.5 percent to $1,171.1 billion, unchanged from the previously published decrease. This followed a 0.2 percent April decrease. Transportation equipment, also down three of the last four months, led the decrease, $5.7 billion or 0.7 percent to $803.7 billion.

Inventories

Inventories of manufactured durable goods in May, up ten of the last eleven months, increased $2.0 billion or 0.5 percent to $424.6 billion, unchanged from the previously published increase. This followed a 0.4 percent April increase. Transportation equipment, also up ten of the last eleven months, drove the increase, $2.2 billion or 1.6 percent to $138.5 billion. Inventories of manufactured nondurable goods, down two consecutive months, decreased $0.6 billion or 0.2 percent to $269.6 billion. This followed a 0.1 percent April decrease. Petroleum and coal products, down following four consecutive monthly increases, drove the decrease, $0.6 billion or 1.5 percent to $41.3 billion.

Core Capital Goods

Econoday finds some good news in the report: “Now the good news and that’s core capital goods orders (nondefense ex-air) which rose 0.5 percent for a 1 tenth upward revision from the advance reading. The Federal Reserve is focused on questions over the strength of business spending and this result should ease their immediate concerns.”

I used to follow that line item closely, but it is way over-rated.

The theory behind core capital good is that it is a measure of business investment and thus a leading indicator of future production.

Note the line in green in the above chart. Month-to-month fluctuations are totally random, even seasonally adjusted. In the Great Recession, that item did not turn lower until the recession was half over.

Year-Over-Year Chart

Year-Over-Year Numbers

Manufacturers’ Inventories

Inventories to Order Comparison

-

Inventories, are up 10 of the last 11 months to new record highs.

-

Even non-transportation inventories are near the all-time high.

-

Boeing may very well have skewed transportation numbers.

-

But excluding transportation, new orders year-over-year are barely in positive territory at +0.28% growth.

-

Overall, new orders are down 1.16% and durable goods new orders are down 2.75%.

This is not a healthy picture.

via ZeroHedge News https://ift.tt/2Jti2HC Tyler Durden